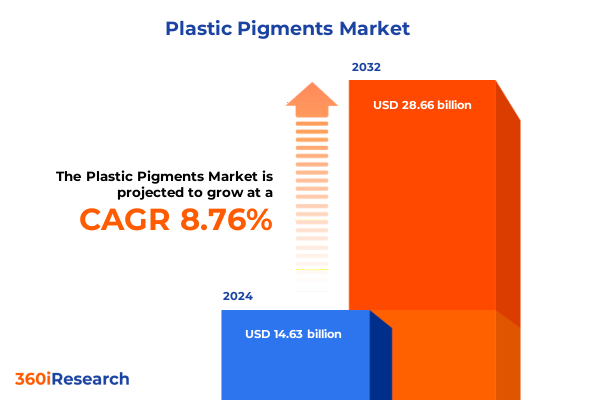

The Plastic Pigments Market size was estimated at USD 14.63 billion in 2024 and expected to reach USD 15.88 billion in 2025, at a CAGR of 8.76% to reach USD 28.66 billion by 2032.

Setting the Stage for the Plastic Pigments Landscape with Emerging Dynamics, Regulatory Pressures, and Strategic Imperatives for Stakeholders

The plastic pigments market operates at the intersection of material science innovation and global economic dynamics. With polymers constituting the backbone of countless applications from automotive components to consumer electronics housings, pigments play an essential role in imparting color, functionality, and performance characteristics to plastic products. An informed understanding of the plastic pigments landscape enables decision makers to navigate the complexities of raw material sourcing, regulatory compliance, and evolving customer desires for vibrant, durable, and sustainable coloration. As industries accelerate toward digital manufacturing and green chemistry paradigms, pigment suppliers and end users alike face a dynamic ecosystem defined by technological advances, shifting regulatory mandates, and intensifying competitive pressures.

Against this backdrop, stakeholders must recognize the multifaceted drivers that shape demand for pigment portfolios. Rising environmental concerns have spurred a wave of legislation targeting volatile organic compounds and heavy metal content, influencing both inorganic pigment formulations and emerging organic alternatives. Simultaneously, end use sectors such as automotive and consumer goods are demanding performance pigments that enable not only aesthetic appeal but also functional properties like UV resistance, heat stability, and antimicrobial action in healthcare applications. At the same time, form factors ranging from finely milled powders to ready-to-use dispersions are redefining how processors integrate pigments into extrusion, injection molding, and thermoforming operations.

Transitioning from traditional supply chain models, companies are adopting digital tools for color matching, real-time quality analytics, and predictive maintenance to deliver faster development cycles and tighter tolerances. As global players adjust to these forces, they must also contend with raw material availability fluctuations and logistical disruptions. The convergence of sustainability goals, customer-centric innovation, and lean operational practices is creating strategic imperatives for pigment manufacturers, plastic compounders, and brand owners seeking to differentiate their offerings and future-proof their portfolios.

Navigating Transformative Market Shifts Driven by Sustainability, Technological Innovation, and Evolving Customer Preferences in Plastic Pigments

In recent years, sustainability has become a central theme in the plastic pigments sector, driving a transformation that extends well beyond simple color aesthetics. Manufacturers and end users are increasingly prioritizing low-carbon manufacturing processes, solvent-free pigment dispersions, and the integration of bio-based feedstocks to reduce environmental footprints. This shift toward greener chemistries is reshaping research and development pipelines, prompting a new generation of pigment technologies characterized by improved lightfastness, recyclability, and minimal environmental impact. Concurrently, regulatory frameworks worldwide are tightening restrictions on heavy metals and hazardous additives, compelling suppliers to innovate replacements for legacy inorganic pigments without sacrificing performance.

Technological innovation also plays a pivotal role in redefining market contours. Digital color formulation tools and spectroscopy-based quality control systems have accelerated development timelines, enabling rapid prototyping of unique hues and special effects. Advances in nanotechnology and microencapsulation are empowering pigment manufacturers to tailor release profiles for antimicrobial or UV-blocking functionalities in healthcare and outdoor applications. Meanwhile, end use industries such as electrical and electronics are demanding pigments with enhanced conductivity or insulating properties for printed circuit boards, connectors, and control panels. Taken together, these transformative forces underscore the sector’s dynamic evolution, where sustainability, digitalization, and material science converge to unlock new performance frontiers.

As customer preferences grow more sophisticated, brands across automotive, consumer goods, and packaging sectors are seeking differentiated color solutions that align with premium aesthetics and experiential interactions. The advent of 3D printing and additive manufacturing amplifies this demand, as designers leverage custom pigments to achieve intricate finishes and multi-colored structures. Reflecting this trend, supply chain models are shifting toward just-in-time delivery, agile inventory management, and closer collaboration among pigment formulators, plastic compounders, and brand designers. These developments collectively highlight a sector in flux, where innovation and sustainability drive market redefinition and strategic recalibration.

Analyzing the Cumulative Effect of 2025 United States Tariff Adjustments on Supply Chains, Cost Structures, and Competitive Positioning in Plastic Pigments

The introduction of a new tranche of United States tariffs in early 2025 has precipitated a series of strategic recalibrations among plastic pigment suppliers and downstream processors. These duties, applied across select imported pigment categories, have effectively altered the cost basis for both inorganic materials such as titanium dioxide and zinc oxide and organic chemistries including phthalocyanine and quinacridone. Suppliers have responded by reassessing their geographic sourcing strategies, with some investing in domestic production capacity or seeking preferential trade agreements to mitigate the impact of heightened import levies. As a result, supply chains that once prioritized price arbitrage across regions are being reengineered to optimize duty structures and minimize total landed costs.

Cost pass-through has become a delicate balancing act, particularly for blow molding and extrusion operations that rely on pigment concentrates purchased on thin margins. While some leading manufacturers have absorbed a portion of the tariff impositions to preserve customer relationships, many have implemented targeted price adjustments across their pigment portfolios. This has driven plastic compounders to explore alternative colorants, including locally produced iron oxides and chrome oxides, as well as advanced organic dispersions developed to emulate premium imported hues. At the same time, end use industries such as automotive and construction have begun to reevaluate long-term supply agreements, seeking greater flexibility in contract terms and volume commitments to hedge against future trade policy volatility.

As competitive positioning shifts, collaboration between pigment producers and plastic processors has become more critical than ever. Joint innovation programs aimed at optimizing pigment loadings, enhancing dispersion stability, and reducing cycle times are helping to offset increased raw material expenses. Furthermore, companies are engaging in scenario planning to anticipate potential tariff escalations or expansions to additional pigment chemistries. Through these collaborative efforts and strategic adjustments, stakeholders are striving to maintain profitability, uphold quality standards, and secure reliable pigment supply chains in an era defined by evolving trade dynamics.

Uncovering Critical Segmentation Insights by Pigment Type, Form, End Use Industry, and Processing Method to Inform Strategic Decision Making

Insights drawn from segmentation by pigment type reveal divergent trajectories for inorganic and organic colorants. Inorganic pigments such as chrome oxides, iron oxides, titanium dioxide, and zinc oxide continue to underpin high-volume applications where durability, opacity, and cost efficiency are primary considerations. Conversely, organic chemistries including azo, diketopyrrolopyrrole, phthalocyanine, and quinacridone are gaining traction in premium segments that demand vibrant chromatic intensity, fine particle dispersions, and tailored functional properties. The interplay between these two categories is catalyzing new product offerings, as formulators blend inorganic and organic solutions to achieve hybrid performance characteristics in specialized plastic applications.

Form-based segmentation underscores the importance of delivery systems that align with processing requirements. Powder pigments remain ubiquitous in extrusion and injection molding due to their flexibility and long shelf life. Paste concentrates, with calibrated pigment loadings and rheological modifiers, streamline color metering for rotational molding and thermoforming, reducing on-site mixing errors and downtime. Dispersion systems, particularly those engineered for high-shear processes, are becoming essential for advanced applications where uniformity and particle surface treatment directly impact aesthetic quality and mechanical integrity. As processors evaluate these form factors, they weigh not only cost and convenience but also the environmental footprint associated with solvent usage and energy consumption during pigment incorporation.

End use industry segmentation highlights differentiated demand drivers across sectors. Automotive OEMs require pigments that deliver consistent batch-to-batch color matching, UV stability, and scratch resistance for exterior trim components. Construction applications emphasize weatherability, fire retardance, and low-emission profiles in pipe, siding, and roofing materials. Consumer goods and packaging sectors prioritize safety compliance, tactile finishes, and high-definition printing capabilities, while the electrical and electronics industry seeks insulating or conductive pigment formulations for connectors and housings. Healthcare applications add further complexity, mandating antimicrobial activity and sterilizability. Understanding how pigment selection aligns with these industry-specific performance criteria is crucial for market participants seeking targeted growth strategies. Finally, process segmentation across blow molding, extrusion, injection molding, rotational molding, and thermoforming offers insight into operational constraints, equipment compatibility, and cycle time optimization that inform pigment selection and supplier partnerships.

This comprehensive research report categorizes the Plastic Pigments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Pigment Type

- Physical Form

- Polymer Type

- Color Family

- Application Process

- End Use Industry

Exploring Regional Nuances across Americas, Europe Middle East & Africa, and Asia-Pacific Highlighting Demand Drivers and Growth Potential in Plastic Pigments

Regional dynamics in the plastic pigments domain reveal a tapestry of demand patterns and competitive landscapes. In the Americas, robust industrial manufacturing and a resurgence in automotive production continue to drive demand for high-performance inorganic pigments such as titanium dioxide and iron oxides. At the same time, sustainability mandates at the federal and state levels are incentivizing local production of low-emission dispersion systems, leading to increased investment in North American pigment manufacturing capacity and downstream compounding facilities.

In Europe, Middle East & Africa, stringent environmental regulations and a dynamic construction market are shaping pigment preferences. The region’s focus on circular economy principles encourages the adoption of recycled resin-based pigment dispersions and eco-efficient production techniques. Regulatory frameworks targeting heavy metals and persistent organic pollutants have accelerated the phasing out of legacy formulations, prompting formulators to introduce alternative inorganic chemistries like zinc oxide and phthalocyanine-based dispersions. Emerging markets in the Middle East and Africa are simultaneously exhibiting growing appetite for cost-effective iron oxide variants and temperature-stable organic pigments suited for infrastructure projects.

Asia-Pacific continues to lead in manufacturing scale and capacity, supported by an extensive automotive supply chain, rapidly expanding consumer electronics sector, and burgeoning healthcare market. Demand for specialized pigments that meet demanding UV resistance, antimicrobial functionality, and precise color matching is intensifying, particularly in high-growth markets such as China, India, and Southeast Asia. Local producers are investing heavily in research centers and pilot-scale facilities to develop tailored pigment offerings, while international players leverage strategic partnerships and joint ventures to tap into regional distribution networks and optimize cost structures.

This comprehensive research report examines key regions that drive the evolution of the Plastic Pigments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Competitive Strategies that Shape Innovation, Collaboration, and Market Expansion within the Plastic Pigments Arena

The competitive landscape of the plastic pigments sector is defined by a mix of global chemical conglomerates, specialized performance pigment innovators, and agile regional producers. Leading companies leverage extensive research and development infrastructure to pioneer next-generation pigment technologies, from nano-engineered dispersions to smart colorants with responsive properties. These industry frontrunners frequently engage in collaborative research initiatives with academic institutions, driving breakthroughs in low-emission manufacturing, bio-based pigment precursors, and digital color management tools.

Meanwhile, niche players and regional entrants focus on high-value application segments, offering customized pigment solutions for sectors such as electrical and electronics or healthcare. Their agility enables rapid prototyping of new formulations, shortening time-to-market for specialty offerings. To enhance competitive positioning, these companies forge partnerships with plastic compounders and brand owners, co-developing pigments that align precisely with customer specifications around color consistency, functional performance, and regulatory compliance.

Across the board, strategic alliances and mergers are reshuffling market shares, with larger firms acquiring smaller innovators to expand their product portfolios and geographic reach. Investment in state-of-the-art manufacturing lines allows companies to optimize particle size distribution, reduce waste, and implement closed-loop solvent recovery systems. As a result, market leaders are consolidating their positions by delivering comprehensive pigment solutions-encompassing inorganic and organic chemistries, multiple form factors, and tailored services-that address the full spectrum of plastic processing requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Pigments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ABC Chemicals Pvt. Ltd.

- Alliance Organics LLP

- ALTANA AG

- Atul Ltd

- BASF SE

- Cabot Corporation

- Chemours Company

- Chemworld International, Ltd. Inc.

- Clariant AG

- CrownPigment

- DCL Corporation

- DIC Corporation

- Ferro Corporation by Vibrantz Technologies

- Huntsman International LLC

- KRONOS Worldwide Inc.

- Lanxess AG

- LB Group

- Mazda Colours Ltd.

- Navpad Pigments Pvt. Ltd.

- Neo V Chem

- OXERRA

- Primex Plastics Corporation

- Qualitron Chemicals

- Solvay S.A.

- Stockmeier Group

- Sudarshan Chemical Industries Limited

- Tronox Holdings plc

- Venator Materials PLC

Delivering Actionable Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Navigate Regulatory Complexities

To succeed amid evolving market conditions, industry leaders should intensify investment in sustainable pigment development by prioritizing low-carbon feedstocks, solvent-free dispersion technologies, and circular economy–aligned manufacturing processes. Embedding eco-efficiency metrics in product development lifecycles will not only meet stricter environmental regulations but also resonate with end users who increasingly valorize green credentials. In parallel, companies can establish cross-functional teams that bridge color science, materials engineering, and regulatory compliance, accelerating the translation of laboratory innovations into commercially viable pigment offerings.

Diversifying supply chains represents another critical step in mitigating trade-related disruptions, as recent tariff adjustments have demonstrated. Establishing dual-sourcing arrangements, strategic partnerships with domestic producers, and regional distribution hubs will afford companies greater control over cost structures and logistical risks. At the same time, adopting digital color formulation tools and advanced analytics can optimize pigment loadings, streamline quality control, and reduce material waste across extrusion, injection molding, and thermoforming processes.

Enhanced collaboration with end use industries will further unlock new growth opportunities. Joint development programs with automotive OEMs, healthcare equipment manufacturers, and consumer electronics brands can yield bespoke pigment solutions that address precise performance requirements. By co-innovating from early design stages, pigment suppliers can secure long-term supply agreements and position themselves as indispensable partners in product differentiation. Ultimately, these strategic initiatives will empower companies to navigate regulatory complexities, capitalize on emerging trends, and reinforce competitive advantage in the dynamic plastic pigments market.

Outlining a Comprehensive Research Methodology Combining Primary Expert Interviews and Secondary Source Validation to Ensure Thorough Market Insight

The research methodology underpinning this analysis integrates a deliberate fusion of primary and secondary techniques to ensure both depth and rigor. Primary research was conducted through structured interviews with pigment formulators, plastic compounders, and brand procurement specialists, capturing first-hand perspectives on evolving customer requirements, process challenges, and emerging innovation priorities. These insights were complemented by secondary source validation, encompassing peer-reviewed journals, industry association white papers, and regulatory filings related to chemical compliance and environmental standards.

Quantitative analysis was performed on a curated dataset of patent filings, trade statistics, and corporate disclosures, enabling trend identification across pigment types, form factors, end use segments, and regional markets. Data triangulation was applied to reconcile divergences between public information and expert inputs, ensuring that strategic conclusions rest on a balanced foundation of evidence. In parallel, supply chain mapping exercises were conducted to visualize raw material flows, duty impacts, and logistics pathways, offering actionable intelligence on cost optimization and risk mitigation.

Throughout the research process, rigorous quality checks were applied via cross-functional review panels comprising color scientists, process engineers, and market strategists. This collaborative evaluation refined key assumptions, validated methodological approaches, and enhanced the overall reliability of the findings. The outcome is a robust analytical framework that delivers a comprehensive understanding of the plastic pigments landscape, equipping stakeholders with the insight required to make informed strategic decisions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Pigments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Pigments Market, by Pigment Type

- Plastic Pigments Market, by Physical Form

- Plastic Pigments Market, by Polymer Type

- Plastic Pigments Market, by Color Family

- Plastic Pigments Market, by Application Process

- Plastic Pigments Market, by End Use Industry

- Plastic Pigments Market, by Region

- Plastic Pigments Market, by Group

- Plastic Pigments Market, by Country

- United States Plastic Pigments Market

- China Plastic Pigments Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2544 ]

Drawing Strategic Conclusions on Market Trajectory, Key Opportunities, and Imperatives for Stakeholders in the Evolving Plastic Pigments Sector

In sum, the plastic pigments sector is experiencing a period of dynamic transformation, driven by sustainability imperatives, technological innovation, and shifting regulatory landscapes. The interplay between inorganic and organic pigment chemistries, coupled with evolving form factor preferences and application-specific requirements, underscores the complexity of strategic decision making for suppliers and end users alike. Regional dynamics-from the regulatory rigor of Europe, Middle East & Africa to the scale-driven growth of Asia-Pacific and the revitalized industrial base in the Americas-further highlight the need for nuanced market approaches.

As competitive pressures intensify, companies that align their R&D programs with emerging functionality demands, diversify their supply chains to weather trade fluctuations, and collaborate closely with end use industries will be best positioned to capture value. The insights presented here provide a solid foundation for stakeholders seeking to navigate the plastic pigments landscape with confidence, pinpoint growth levers, and forge resilient strategies for long-term success.

Engage with Ketan Rohom to Acquire Comprehensive Market Intelligence and Strategic Insights on Plastic Pigments That Drive Growth and Competitive Advantage

To explore the comprehensive findings and gain the granular details that underpin these insights, engage with Ketan Rohom, Associate Director of Sales & Marketing, to secure the full market research report on plastic pigments. Connect with Ketan to discuss how this in-depth analysis can be tailored to your strategic objectives, unlocking value across supply chains, product innovation pipelines, and regulatory compliance frameworks. By partnering directly, you ensure that your organization obtains the actionable intelligence and strategic foresight needed to capitalize on market shifts, enhance competitive positioning, and accelerate sustainable growth in the plastic pigments sector. Take the next step toward informed decision making and contact Ketan Rohom to purchase the definitive industry report today

- How big is the Plastic Pigments Market?

- What is the Plastic Pigments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?