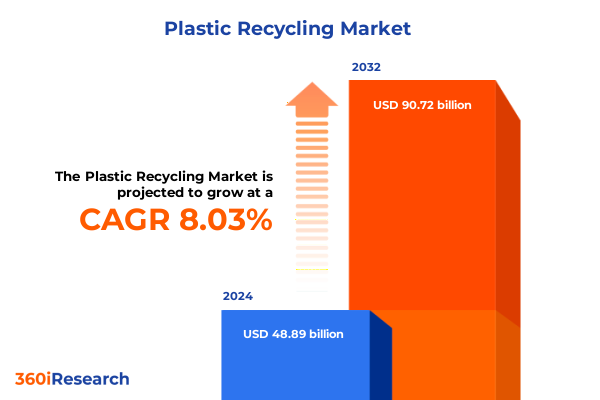

The Plastic Recycling Market size was estimated at USD 52.70 billion in 2025 and expected to reach USD 56.84 billion in 2026, at a CAGR of 8.06% to reach USD 90.72 billion by 2032.

Comprehensive Introduction to Plastic Recycling Dynamics and Critical Considerations Shaping the Current Industry Environment for Strategic Decision Making

Plastic recycling stands at the nexus of environmental responsibility and industrial innovation, serving as a key driver for a sustainable future. Across supply chains, companies are reevaluating material flows and circularity models to reduce reliance on virgin feedstocks. This introductory overview illuminates the convergence of policy imperatives, consumer advocacy, and technological breakthroughs that define today’s recycling initiatives.

From the critical role of public-private partnerships to the rise of extended producer responsibility programs, stakeholders have forged collaborative ecosystems aimed at closing the loop on plastic waste. As regulatory frameworks evolve and brand owners pledge net-zero ambitions, recycling infrastructure has become a strategic priority for manufacturers and municipalities alike. By examining the interplay of these factors, this section lays the foundation for understanding the complex forces propelling plastic recycling toward its next phase of growth.

Identification of Transformative Shifts Reshaping Plastic Recycling Practices from Advanced Technologies to Regulatory and Consumer Behavior Evolutions

Plastic recycling is undergoing a profound transformation as innovations and market shifts redefine established paradigms. Advanced chemical recycling technologies are moving from pilot to commercial scale, offering pathways to depolymerize mixed and contaminated plastics that mechanical processes cannot handle. At the same time, enhancements in sorting and washing techniques are improving the quality of recovered plastics, enabling higher-value applications.

Regulatory landscapes are also shifting, with stricter recycling targets and import-export regulations prompting supply chain realignments. Consumer behavior is evolving in tandem, as sustainability-conscious households and businesses demand transparent recycling credentials. These dynamics, coupled with investment in digital tracking systems and blockchain-enabled traceability, mark a new era in which data-driven optimization will be instrumental. Together, these transformative shifts are redefining what is possible in plastic recycling and setting the stage for sustainable scalability.

Analyzing the Cumulative Impact of United States Tariffs in 2025 on Plastic Recycling Supply Chains Production Costs and Competitive Landscapes

The imposition of new U.S. tariffs in early 2025 has introduced significant complexities for domestic plastic recycling operations. Increased duties on imported recycled resin and related technologies have elevated raw material costs, compelling processors to reassess sourcing strategies. Many recyclers have adapted by onshoring capacity, forming strategic alliances with local resin producers, and investing in in-house recycling lines to mitigate margin erosion.

Moreover, these tariffs have accelerated the consolidation of smaller recycling firms, as mid-sized operators seek economies of scale to absorb additional expenses. While some manufacturers have passed cost increases downstream, others have redirected R&D budgets toward cost-effective process enhancements. Consequently, the landscape has become more competitive, underscoring the need for collaborative procurement models and innovation to navigate tariff-induced headwinds.

Key Segmentation Insights Revealing How Resin Types Applications Technologies and Sources Influence Plastic Recycling Market Dynamics

Understanding market dynamics requires an appreciation of how different resin types, applications, technologies, and sources interact to shape recycling outcomes. Resins such as high density polyethylene deliver robust mechanical properties ideal for rigid packaging, while low density polyethylene appeals to flexible film applications. Polyethylene terephthalate is prized for clear bottle recycling streams, contrasted by polypropylene’s growing role in durable consumer goods. Polystyrene and polyvinyl chloride continue to pose processing challenges but unlock niche opportunities when specialized sorting and cleaning protocols are applied.

Application contexts further influence recycling strategies: packaging remains the largest driver, where both flexible pouches and rigid containers benefit from tailored reclamation systems. In consumer goods, automotive, building and construction, electrical and electronics, and textile segments, varying purity requirements and material blends demand specific treatment routes. From a technology standpoint, mechanical recycling processes such as extrusion, granulation, and washing remain the workhorses, complemented by emergent chemical recycling routes that promise circular monomer regeneration. Finally, the source of material-whether postconsumer bottles and films or postindustrial offcuts-determines feedstock consistency and processing throughput. These segmentation insights reveal the multifaceted nature of market engagement and underscore the importance of targeted strategies.

This comprehensive research report categorizes the Plastic Recycling market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Technology

- Source

- Product Output

- End‑Use

Critical Regional Insights Highlighting Distinct Opportunities and Challenges Facing Plastic Recycling Adoption across Major Global Markets

Regional variations underscore the importance of localized strategies in plastic recycling. In the Americas, established infrastructure and ambitious state-level mandates have fostered advanced collection and sorting systems, yet pockets of rural underinvestment persist. Major urban centers are pioneering deposit return schemes that elevate recycling rates for packaging, while downstream innovations target closed-loop partnerships between manufacturers and waste management firms.

Across Europe, the Middle East, and Africa, the regulatory environment is among the most stringent, with the European Union’s Single-Use Plastics Directive driving rapid expansion of recycling quotas. Emerging economies in the Middle East and Africa face infrastructure gaps, but private-sector investment and cross-border initiatives are catalyzing capacity building. In the Asia-Pacific region, growth in medical-grade recycling and chemical reclamation is outpacing other areas, propelled by robust industrial recyclers and rising export demand. Collectively, these regional insights highlight the need for differentiated, context-aware approaches to policy engagement, technology deployment, and partnership development.

This comprehensive research report examines key regions that drive the evolution of the Plastic Recycling market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Competitive Landscape Insights Emphasizing Leading Industry Players Strategic Priorities and Collaborative Innovations in Plastic Recycling

A handful of leading companies are steering innovation and scaling plastic recycling solutions worldwide. Vertically integrated corporations have leveraged their logistic networks to streamline feedstock supply, while specialized recyclers have attracted capital to expand proprietary purification technologies. Strategic alliances between resin manufacturers, consumer brands, and waste management firms have emerged, aligning circular design initiatives with end-of-life reclamation capabilities.

Collaborative ventures are also proliferating: licensing agreements for solvent-based purification and catalytic depolymerization are extending the reach of chemical recycling. Technology partners are embedding real-time monitoring sensors into sorting lines, unlocking operational efficiencies and quality assurance. Meanwhile, tier-one automotive and electronics OEMs are co-investing in plant expansions that secure consistent, high-quality recycled input. These competitive and cooperative dynamics are establishing new benchmarks for scalability, cost management, and sustainability performance.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Recycling market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Drainage Systems, Inc.

- Alpek S.A.B. de C.V.

- Amcor plc

- Ark Plastics Ltd.

- B & B Plastics Recycling Inc.

- B. Schoenberg & Co., Inc.

- BASF SE

- Biffa Plc

- Borealis GmbH

- Casella Waste Systems, Inc.

- Cleanaway Waste Management Limited

- Covetsro AG by ADNOC

- GFL Environmental Inc.

- Honeywell International Inc.

- Imerys S.A.

- Indorama Ventures Public Company Limited

- Jayplas

- KW Plastics

- Loop Industries, Inc.

- MBA Polymers Inc.

- Montello S.p.A.

- Plastipak Holdings, Inc.

- Reconomy (UK) Ltd

- REMONDIS SE & Co. KG

- Republic Services, Inc.

- Seraphim Plastics LLC

- Shakti Plastic Industries

- SUEZ S.A.

- Teijin Limited

- TOMRA Systems ASA

- Ultra Poly Corporation

- Veolia Environnement S.A.

- Waste Connections, Inc.

- Waste Management, Inc.

Actionable Recommendations for Industry Leaders to Drive Sustainable Growth Operational Efficiency and Market Resilience in Plastic Recycling

To capitalize on evolving market conditions, industry leaders must adopt a multipronged strategy that integrates technological, operational, and stakeholder-focused initiatives. First, accelerating the deployment of advanced sorting algorithms and sensor-based identification can dramatically enhance feedstock purity and reduce downstream processing costs. Embracing digital twins and data analytics platforms will further optimize throughput, energy consumption, and maintenance scheduling.

Simultaneously, forging partnerships across the value chain-from municipal collectors to brand owners-ensures secure feedstock streams and fortifies resilience against tariff fluctuations. Investing in workforce upskilling and community engagement programs can drive recycling participation rates while bolstering corporate social responsibility credentials. Finally, dedicating R&D resources to chemical recycling and closed-loop monomer recovery positions organizations at the vanguard of next-generation circular solutions, unlocking premium revenue streams and reinforcing sustainability leadership.

Robust Research Methodology Detailing Data Sources Analytical Frameworks and Validation Processes Underpinning the Plastic Recycling Market Study

The research underpinning this analysis draws on a rigorous methodology designed to ensure accuracy, relevance, and depth. Primary data collection involved interviews with senior executives across recycling, polymer processing, and end-use segments, complemented by site visits to leading mechanical and chemical recycling facilities. Secondary sources included industry association publications, peer-reviewed journals, and publicly disclosed corporate filings, which were triangulated to validate insights.

Analytical frameworks incorporated qualitative trend mapping, supply chain value chain analysis, and regulatory impact assessment. Segmentation overlays employed defined categories for resin type, application sector, recycling technology, and feedstock source. Regional analyses were calibrated against local policy landscapes, infrastructure maturity, and economic indicators. Throughout, a quality assurance process involving cross-functional expert review and data integrity checks safeguarded the study’s credibility and practical applicability for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Recycling market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Recycling Market, by Resin Type

- Plastic Recycling Market, by Technology

- Plastic Recycling Market, by Source

- Plastic Recycling Market, by Product Output

- Plastic Recycling Market, by End‑Use

- Plastic Recycling Market, by Region

- Plastic Recycling Market, by Group

- Plastic Recycling Market, by Country

- United States Plastic Recycling Market

- China Plastic Recycling Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1113 ]

Conclusive Reflections on Plastic Recycling Evolution Industry Milestones and Imperatives for Advancing Circular Economy Objectives

The evolution of plastic recycling reflects a critical transition toward a regenerative materials economy. Milestones such as scalable chemical depolymerization, harmonized Extended Producer Responsibility schemes, and advanced digital tracking have collectively propelled the industry forward. Yet, persistent challenges-ranging from feedstock heterogeneity to tariff-induced cost pressures-underscore that the journey toward full circularity remains ongoing.

As stakeholders continue to innovate, collaborative models that align policy, technology, and commercial incentives will be essential. Looking ahead, the integration of renewable energy in recycling operations, coupled with new revenue mechanisms for secondary materials, promises to further de-risk investments and solidify recycling as a cornerstone of sustainable manufacturing. This conclusion reinforces that, while significant progress has been made, the path to a truly closed-loop plastics economy will require continued commitment, agility, and partnership.

Compelling Call to Engage with Associate Director of Sales Marketing to Secure Comprehensive Plastic Recycling Market Research Insights

To gain an authoritative view of the plastic recycling market and translate insights into strategic action, contact Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to purchase the comprehensive market research report and empower your organization with data-driven decisions.

- How big is the Plastic Recycling Market?

- What is the Plastic Recycling Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?