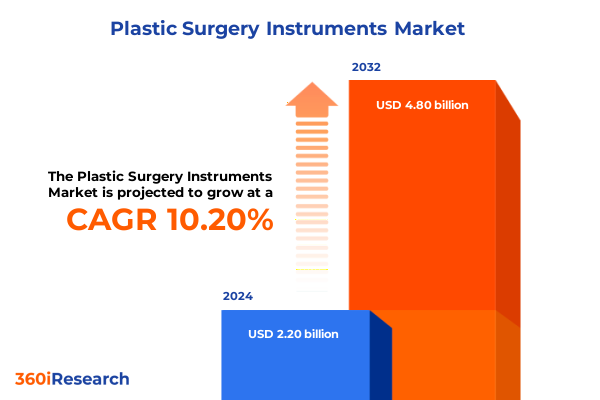

The Plastic Surgery Instruments Market size was estimated at USD 2.43 billion in 2025 and expected to reach USD 2.68 billion in 2026, at a CAGR of 10.18% to reach USD 4.80 billion by 2032.

Understanding the Evolving Plastic Surgery Instruments Market Amid Technological Advancements Clinical Demands and Growing Patient Preference Trends

Plastic surgery has rapidly evolved into a discipline that merges art, engineering and clinical science with patient-centric care. The instruments essential to these procedures have similarly undergone a transformation, driven by an interplay of technological breakthroughs and intensifying aesthetic expectations. Surgeons today demand precision-engineered tools that deliver enhanced ergonomics and consistent performance, reducing procedure times and improving patient outcomes. Concurrently, patients seek minimally invasive options with shorter recovery windows, prompting instrument developers to incorporate innovations such as micro drills and advanced endoscopic systems. As a result, the landscape of surgical instrumentation is defined by an urgent drive towards devices that are not only reliable but also adaptable to a broad range of procedural variations.

Moreover, regulatory rigor and heightened quality standards have reshaped the manufacturing ethos, emphasizing traceability and compliance at every production stage. From material selection to sterilization protocols, instrument designers must navigate an intricate web of certification processes that prioritize patient safety. This regulatory backdrop coexists with intensifying competition, where both established surgical device companies and emerging niche firms invest heavily in research and development. The convergence of these factors underscores the need for strategic clarity and operational agility among industry stakeholders, setting the stage for the transformative shifts that follow.

Beyond technological and regulatory drivers, demographic shifts and the rise of social media have fueled market growth in unexpected ways. An aging population in many regions is driving demand for reconstructive procedures, while social platforms have amplified patient awareness of aesthetic options. This heightened visibility has not only expanded the patient base but also heightened expectations for precision, safety and outcomes. In response, instrument manufacturers are incorporating patient insights into product design, ensuring that the next generation of devices meets both clinical standards and evolving patient aspirations

Examining the Major Technological and Procedural Transformations Redefining Plastic Surgery Instrumentation and Surgical Outcomes

The plastic surgery instrument sector has entered a phase marked by rapid convergence of digital technologies and precision mechanics. One significant transformation is the integration of robotic-assisted systems, which allow surgeons to perform intricate tasks with submillimeter accuracy. These platforms are complemented by advanced imaging technologies, providing real-time guidance and enhancing the fidelity of instrument maneuvers. As a result, procedures that once relied solely on manual dexterity have become more reproducible and less taxing for both patients and practitioners.

Equally disruptive is the rise of smart instruments embedded with sensors that capture data on force, angle and tissue interaction. By analyzing this data, surgical teams can refine techniques, standardize training and minimize the risk of complications. This data-driven approach aligns with the broader trend of personalized medicine, enabling tailored procedural plans that adapt to each patient’s unique anatomy. In tandem, manufacturers are experimenting with novel materials-such as high-performance polymers and bioactive coatings-that enhance instrument longevity and biocompatibility. These materials reduce the risk of adverse reactions and facilitate smoother post-operative recovery.

Regulatory bodies have also stepped up, introducing frameworks that encourage sustainability throughout an instrument’s lifecycle. Instruments designed for reuse now undergo rigorous lifecycle assessments to ensure they meet both safety and environmental standards. This shift has prompted developers to adopt eco-friendly manufacturing processes and explore biodegradable packaging. Taken together, these advancements are reshaping the plastic surgery landscape, shifting the focus from purely mechanical devices to integrated systems that bridge the physical and digital domains, all while adhering to evolving regulatory and environmental criteria.

Assessing the Comprehensive Effects of the 2025 United States Tariff Adjustments on Plastic Surgery Instrument Sourcing and Supply Dynamics

The implementation of tariff adjustments in 2025 has introduced notable shifts in the procurement strategies of plastic surgery instrument providers. Historically reliant on a global network of low-cost manufacturing hubs, many companies now face increased landed costs for imported drill systems, endoscopes and specialized forceps. This realignment has incentivized a reevaluation of supplier relationships and prompted a surge in discussions around nearshoring and domestic production. In turn, some domestic manufacturers have accelerated capacity expansions to capture a growing share of procurement budgets, leveraging reduced logistical complexity and improved agility.

At the same time, end users have become more cost conscious, seeking to balance instrument performance with total cost of ownership considerations. Hospitals and ambulatory surgical centers are exploring rental and leasing models to offset upfront capital expenditures, while clinics have negotiated bundled agreements that include maintenance and training services. Distributors, too, have adapted by enhancing value-added offerings such as inventory management solutions and just-in-time delivery to help mitigate the impact of higher import duties.

Looking beyond immediate cost implications, stakeholders are engaged in multilateral discussions aimed at harmonizing tariff regimes with allied trading partners. Free trade agreements under negotiation could pave the way for reduced duties on critical surgical components, easing supply chain pressures in the long term. Meanwhile, manufacturers are diversifying their sourcing strategies, striking a balance between imported subassemblies and locally produced finished goods to optimize resilience and cost efficiency without compromising on technological sophistication.

Uncovering Critical Segmentation Insights across Instrument Types Applications End Users Materials and Sales Channels Driving Strategic Decision Making

A nuanced understanding of instrument type segmentation reveals how differentiated design and functionality address specific clinical requirements. Drill systems are no longer monolithic, as macro drills handle bone sculpting in reconstructive procedures while micro drills enable delicate work in facial contouring. Endoscopic solutions span arthroscopes for joint exploration, laparoscopes for minimally invasive abdominal procedures and nasal endoscopes that facilitate precise intranasal work. The diversity of forceps, from dressing forceps for surface wound care to hemostatic forceps that control bleeding and tissue forceps designed for gentle manipulation, underscores the breadth of clinical applications. Retractors have evolved into handheld instruments for quick access adjustments alongside self-retaining variants that free surgical teams to multitask. Scalpels are differentiated into disposable options that minimize cross-contamination risks and reusable counterparts valued for their cost efficiency, while scissors range from ultra-thin micro scissors used in intricate tasks to robust operating scissors that deliver clean severing in a range of procedures.

When observing application segmentation, distinct trends emerge within the domains of burn treatment, cosmetic enhancements and reconstructive surgery. Skin graft and wound debridement tools cater to the burn segment, with specialized instruments engineered for meticulous tissue handling. Cosmetic applications bifurcate into facial procedures, where precision and minimal scarring are paramount, and body enhancements where durability and ergonomics take precedence. In the reconstructive realm, congenital repair often demands custom miniaturized instruments to navigate complex anatomical variations, whereas trauma repair utilizes robust, versatile devices capable of managing unpredictable tissue conditions.

End user segmentation further nuances the narrative. Ambulatory surgical centers, whether daycare facilities focused on same-day procedures or outpatient units balancing high throughput, require streamlined instrument sets that reduce setup time. General clinics seek multipurpose tools that accommodate diverse case profiles, while specialty clinics invest in advanced, procedure-specific assemblies. Hospitals-both government-funded institutions prioritizing cost control and private hospitals offering high-end services-illustrate how procurement strategies align with broader operational goals.

Material segmentation illuminates the trade-offs between plastic variants prized for their cost effectiveness and corrosion resistance, stainless steel instruments known for their durability and high tensile strength, and titanium devices that deliver superior biocompatibility and lightweight performance. The choice of material invariably affects sterilization protocols, instrument longevity and tactile feedback during procedures.

Finally, sales channel segmentation highlights the evolving pathways through which instruments reach end users. Direct sales arrangements allow for deep customization and technical training, whereas distributor networks provide broad reach and consolidated ordering. Online sales, encompassing both B2B e-commerce platforms designed for large-scale orders and B2C channels that serve individual practitioners or smaller practices, have gained momentum by offering convenience and transparent pricing structures.

Collectively, these segmentation insights provide a robust framework for stakeholders seeking to align product portfolios with the nuanced demands of each clinical segment, streamline procurement workflows and ultimately enhance the delivery of care.

This comprehensive research report categorizes the Plastic Surgery Instruments market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Instrument Type

- Material

- Sales Channel

- Application

- End User

Highlighting Distinct Regional Perspectives on Plastic Surgery Instruments across the Americas Europe Middle East Africa and Asia Pacific Markets

Regional dynamics significantly influence preferences for plastic surgery instrumentation, driven by factors such as regulatory environments, healthcare infrastructure and cultural aesthetics. In the Americas, a robust network of ambulatory surgical centers and private clinics supports high volumes of cosmetic procedures, fostering demand for cutting-edge endoscopes and smart instrument systems that boost operational efficiency. The emphasis on outpatient care in North America has also accelerated the adoption of portable drill systems and disposable scalpels that align with stringent sterilization standards.

Conversely, Europe, the Middle East and Africa represent a mosaic of regulatory regimes and economic landscapes. Leading Western European nations prioritize integrated systems that combine advanced imaging with ergonomic instrument design, while emerging markets within the region exhibit growing interest in cost-effective, reusable instruments that offer quality at scale. The Middle East has witnessed a surge in medical tourism, prompting healthcare providers to invest in deluxe procedural offerings and high-end instrument sets. In Africa, resource constraints have driven the innovation of modular instrument platforms that can be serviced locally and adapted to a variety of surgical contexts.

The Asia Pacific region stands out for its rapid technological advancements and manufacturing capabilities. Countries with established medical device industries have accelerated production of titanium and stainless steel instruments, leveraging economies of scale. Simultaneously, rising disposable income and increasing healthcare expenditure in emerging economies have spurred demand for both reconstructive and cosmetic tools, particularly in urban centers where patient preferences lean toward minimally invasive solutions. Collaborative ventures between regional original equipment manufacturers and global technology partners are driving the development of next-generation instruments, while digital procurement platforms streamline order fulfillment and enhance transparency across supply chains. This dynamic interplay of regional drivers highlights the importance of tailoring product strategies to align with localized needs, ensuring that innovation and accessibility go hand in hand.

This comprehensive research report examines key regions that drive the evolution of the Plastic Surgery Instruments market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Elaborating on Strategic Moves and Innovative Portfolios of Leading Manufacturers in the Plastic Surgery Instrument Sector

Market leaders have bolstered their positions by pursuing cross-disciplinary collaborations and targeted acquisitions, enabling them to expand their instrument portfolios and accelerate time to market. By forging partnerships with surgical robotics firms, several established device providers have introduced hybrid systems that seamlessly integrate mechanical precision with cutting-edge software analytics. These alliances have yielded instruments equipped with haptic feedback mechanisms that enhance tactile control during intricate procedures, reinforcing the importance of user-centric design.

In addition to strategic partnerships, prominent manufacturers have diversified their offerings by investing in specialized R&D centers dedicated to biomaterials and microfabrication techniques. These facilities focus on refining polymer blends for disposable scalpels and optimizing titanium coating processes for endoscopes, resulting in instruments that deliver both enhanced durability and superior biocompatibility. Product launches in recent years have included modular drill heads that adapt to multiple handpieces and sensor-equipped forceps that provide real-time indicators of tissue tension.

Forward-thinking companies have also pursued acquisitions of innovative startups specializing in additive manufacturing and sensor integration. These strategic investments have expanded in-house capabilities, allowing larger firms to rapidly prototype custom instrument geometries and integrate embedded analytics. Furthermore, service models have evolved to include comprehensive training programs and digital support platforms, offering virtual reality simulations and interactive tutorials that accelerate the learning curve for new instruments, while predictive maintenance tools forecast calibration needs and minimize instrument downtime. By aligning product innovation with service excellence, leading players ensure that end users derive maximum value from their investments and maintain high standards of surgical care.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plastic Surgery Instruments market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Anthony Products Co.

- Anthony Products, Inc.

- Arthrex, Inc.

- B. Braun Melsungen AG

- Blink Medical Ltd.

- BMT Medizintechnik GmbH

- Bolton Surgical Ltd.

- Boston Scientific Corporation

- ConMed Corporation

- Integra LifeSciences Holdings Corporation

- Johnson & Johnson Services, Inc.

- KARL STORZ SE & Co. KG

- KLS Martin Group

- Marina Medical Instruments Inc.

- Medtronic plc

- MicroAire Surgical Instruments, LLC

- MSI Precision Instruments

- Novo Surgical Inc.

- Olympus Corporation

- Sklar Surgical Instruments

- Smith & Nephew plc

- Stryker Corporation

- Surgicon Pvt. Ltd.

- Surgipro Inc.

- Surtex Instruments Ltd.

- Teleflex Incorporated

- Zimmer Biomet Holdings, Inc.

Presenting Actionable Strategies to Capitalize on Emerging Opportunities and Mitigate Challenges in the Plastic Surgery Instruments Industry Landscape

Industry leaders can gain a competitive edge by diversifying their manufacturing footprint to balance tariff-induced cost pressures with the efficiencies of localized production. Establishing partnerships with regional manufacturers can reduce lead times and streamline regulatory approvals, while localized quality control frameworks ensure consistent instrument performance. At the same time, investing in flexible manufacturing systems that accommodate both disposable and reusable instrument lines will allow companies to respond swiftly to shifting end user preferences.

Moreover, instrument providers should deepen their engagement with end users by co-developing bespoke solutions that address specific procedural needs. Collaborative innovation workshops and continuous feedback loops can accelerate product refinement and foster long-term loyalty among surgical teams. In parallel, enhancing digital engagement through e-commerce platforms and remote training services will strengthen customer relationships and open new channels for recurring revenue.

To further mitigate supply chain vulnerabilities, companies should adopt risk management protocols that include multi-sourcing strategies and inventory buffering for critical components. Embracing predictive analytics for demand forecasting will allow procurement teams to anticipate fluctuations in order volumes and optimize stock levels accordingly. Additionally, exploring additive manufacturing for rapid prototyping and deploying digital twin simulations can streamline instrument design cycles and reduce time to clinic. By combining operational resilience with customer-centric innovation, industry leaders can navigate the evolving landscape with confidence and position themselves for sustained growth.

Detailing a Robust Mixed Methodology Framework Combining Qualitative and Quantitative Approaches for Comprehensive Market Analysis

The research methodology underpinning this executive summary draws upon an integrated approach that balances primary insights with secondary data validation. In-depth interviews were conducted with surgeons, procurement specialists and product managers to glean qualitative perspectives on instrument performance, usability and market dynamics. These conversations provided rich anecdotal evidence that illuminated current pain points, emerging technology preferences and decision-making criteria within diverse clinical settings.

Complementing these insights, quantitative data was collected through a systematic review of publicly available regulatory filings, patent registries and product catalogs. This information was triangulated with aggregated procurement data from healthcare institutions to identify usage patterns across instrument types, applications and materials. Furthermore, an online survey of original equipment manufacturers and surgical centers was deployed to capture broader perspectives on emerging trends and purchasing behaviors, while rigorous data cleansing protocols ensured accuracy and consistency across multiple sources.

To ensure analytical rigor, findings were subjected to cross-validation workshops involving industry experts and key opinion leaders. This validation process not only strengthened the accuracy of the results but also integrated forward-looking trends related to digital health integration and sustainability considerations. By melding qualitative narratives with quantitative metrics and leveraging mixed-method techniques, the research framework delivers a comprehensive and balanced perspective on the plastic surgery instruments ecosystem.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plastic Surgery Instruments market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plastic Surgery Instruments Market, by Instrument Type

- Plastic Surgery Instruments Market, by Material

- Plastic Surgery Instruments Market, by Sales Channel

- Plastic Surgery Instruments Market, by Application

- Plastic Surgery Instruments Market, by End User

- Plastic Surgery Instruments Market, by Region

- Plastic Surgery Instruments Market, by Group

- Plastic Surgery Instruments Market, by Country

- United States Plastic Surgery Instruments Market

- China Plastic Surgery Instruments Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 3021 ]

Synthesizing Core Insights and Strategic Implications to Inform Future Directions in the Plastic Surgery Instruments Arena

In sum, the plastic surgery instruments sector is characterized by rapid innovation, evolving regulatory landscapes and dynamic supply chain considerations. Technological advancements such as robotics, sensor-enabled devices and advanced materials are redefining the very essence of surgical instrumentation, while geopolitical factors like tariff adjustments are reshaping procurement strategies. A nuanced segmentation analysis unveils the diverse requirements of surgeons, clinics and large hospitals, highlighting the importance of tailored offerings that align with clinical workflows and budgetary constraints.

Looking ahead, successful stakeholders will be those who embrace collaborative innovation, leverage data-driven insights and maintain operational agility. As sustainability becomes a central tenet of product development, instrument providers must integrate eco-friendly materials and circular lifecycle practices. The emergence of digital ecosystems-combining augmented reality training, predictive maintenance platforms and remote service support-will further differentiate leading innovators. By balancing global scale with regional responsiveness and integrating digital solutions into traditional service models, companies can navigate complex challenges and deliver exceptional value. Ultimately, this convergence of precision engineering, clinical expertise and strategic foresight will drive the next wave of growth in the plastic surgery instruments arena, setting new benchmarks for excellence and patient care.

Engage Directly with Ketan Rohom for Exclusive Insights and Access to the Full Plastic Surgery Instruments Market Research Report Today

To explore the full breadth of strategic intelligence, proprietary data and in-depth analysis that underpins these insights, reach out to Ketan Rohom (Associate Director, Sales & Marketing). Discover how tailored instrument strategies can transform your offerings, optimize procurement processes and drive clinical excellence. Connect now to unlock expert guidance, detailed segmentation breakdowns and actionable recommendations designed to propel your organization forward. Availability is limited, so schedule a consultation today to secure your competitive advantage in the rapidly evolving plastic surgery instruments landscape

- How big is the Plastic Surgery Instruments Market?

- What is the Plastic Surgery Instruments Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?