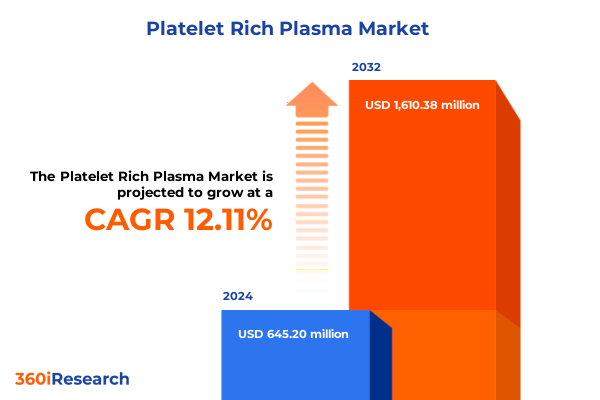

The Platelet Rich Plasma Market size was estimated at USD 721.85 million in 2025 and expected to reach USD 808.33 million in 2026, at a CAGR of 12.14% to reach USD 1,610.38 million by 2032.

Platelet-rich plasma enters a pivotal adoption phase as clinical standardization, device automation, and care-setting economics converge to redefine value

Platelet-rich plasma has evolved from an exploratory adjunct to a structured, protocol-driven tool across orthopedics and sports medicine, dermatology and cosmetic surgery, dentistry, ophthalmology, and wound care. The convergence of refined preparation systems, clearer regulatory parameters, and maturing clinical workflows has reduced variability in outcomes and improved the predictability of practice-level economics. As a result, decision-makers now evaluate PRP alongside other orthobiologics and advanced wound therapies through standardized criteria such as preparation time, leukocyte content control, consumables cost, and care-setting fit.

Clinicians, for their part, are increasingly focused on the biological fidelity of the final product and on workflow efficiency at the point of care. Systems offering adjustable platelet concentration and tunable leukocyte levels, while maintaining closed processing to safeguard sterility, are gaining traction in both hospital-based and ambulatory environments. Simultaneously, administrative teams are aligning procurement with reimbursement mechanics and regulatory status to minimize financial risk while sustaining the ability to scale procedures across multiple specialties.

Against this backdrop, stakeholders should view PRP less as a monolithic therapy and more as a configurable platform. Differences in plasma type, device automation, disposables mix, and treatment protocols meaningfully influence clinical performance and the supply chain. The market’s center of gravity is therefore shifting toward solutions that deliver reproducible biologics, streamlined operations, and documentation that supports compliance and coding accuracy.

Automation, regulatory clarity, and reimbursement alignment are transforming PRP from operator-dependent adjunct into a reproducible, scalable clinical platform

Three structural changes are reshaping the PRP landscape. First, there is a decisive push toward automation and closed-system processing to reduce operator dependence and batch-to-batch variability. Systems capable of customizing platelet concentration and leukocyte profiles through automated sensing and single-button workflows are increasingly favored because they compress preparation time and improve reproducibility at scale. This trend is evident in platforms that allow clinicians to adjust formulations on demand while maintaining a sterile, closed pathway from draw to delivery, a capability highlighted by leading device families in widespread orthopedic use. Such systems not only refine biologic output but also simplify training and credentialing for expanding multidisciplinary teams. Examples in the market describe automation and adjustable leukocyte control as core differentiators for reproducible PRP preparation, underscoring how engineering advances are now central to clinical quality assurance rather than peripheral feature sets.

Second, regulatory clarity for devices intended to prepare PRP has improved procurement confidence. Multiple devices are cleared through the premarket notification pathway under the hematology classification for platelet and plasma separators intended for bone graft handling, which informs how hospitals and clinics document intended use and align labeling with procedure notes. Recent clearances illustrate the ongoing cadence of reviews and the continued reliance on this regulatory pathway, reinforcing the importance of indications wording for coding and marketing claims. This shift is helping purchasers distinguish between claims supported by device clearance and those that fall outside labeled indications, thereby mitigating compliance risk during audits.

Third, reimbursement developments in wound care are helping standardize economic models in the United States. The establishment of a national payment approach for autologous PRP used to treat chronic diabetic wounds via a specific HCPCS code has replaced contractor pricing variability and created clearer expectations for physician offices starting January 2025. While coverage parameters and documentation requirements still demand rigor, the move toward national pricing reduces uncertainty that previously hindered broader adoption in community settings and multidisciplinary wound centers.

Taken together, these shifts-automation for consistency, regulatory clarity for compliant marketing and procurement, and reimbursement predictability in defined indications-are reinforcing each other. They are pushing the market toward platforms that combine configurable biology with turnkey operations and credible economic narratives for providers, payers, and patients alike.

The 2025 cumulative tariff environment reshapes PRP consumables economics and sourcing strategies, demanding proactive hedging and supplier diversification

United States tariff actions in 2024–2025 have materially altered the cost basis for PRP workflows that depend on disposable medical components. In 2024, Section 301 adjustments raised tariffs on select Chinese medical items, including syringes and needles, to 50 percent, with additional modifications scheduled in later years for other categories such as rubber medical gloves. Because PRP preparation and administration rely on a steady supply of syringes, needles, anticoagulants, and sterile disposables, these changes have a cumulative effect on per-procedure consumables costs for providers sourcing from impacted supply chains.

In 2025, the trade environment was further complicated by the opening of national security investigations under Section 232 that specifically examined medical devices alongside other industrial products. While these probes have not uniformly translated into immediate tariffs, they introduce scenario risk into purchasing and vendor strategy decisions, particularly for institutions with multi-year contracts or those scaling ambulatory service lines. Whether or not downstream PRP systems and accessories ultimately face additional duties, the investigations themselves prompt contingency planning for alternative suppliers, tariff engineering, and bonded warehouse strategies to limit cost shocks.

The net effect in 2025 is a blended economic signal: certain PRP-adjacent disposables already face higher landed costs due to Section 301 adjustments, while device capital and accessory lines may encounter prospective risk pending outcomes of ongoing inquiries. Providers are responding by tightening vendor qualification processes, prioritizing sourcing diversity beyond single-country dependencies, and renegotiating framework agreements to include tariff pass-through clauses and inventory buffers. Manufacturers, for their part, are accelerating dual-sourcing of molded plastics, glass collection tubes, and sterile pack assembly in non-impacted geographies to preserve service-level agreements and minimize list price volatility.

For decision-makers, the immediate action is less about predicting every tariff outcome and more about operational resilience. Mapping product bills-of-materials to tariff exposure, identifying eligible exclusions, and engaging distributors on substitution protocols can insulate high-volume specialties from disruptions. Where feasible, aligning formularies to systems with broader domestic or allied sourcing footprints can stabilize per-case costs without sacrificing biologic performance. Policy monitoring should remain continuous, since both enforcement timelines and product scope under these trade authorities can evolve with short notice.

Segmentation insights reveal purposeful choices across plasma type, device architecture, origin, applications, end users, and channels that shape clinical outcomes

Plasma type selection is increasingly deliberate as clinicians differentiate between leukocyte-rich and leukocyte-poor preparations to match tissue biology and inflammation profiles. Leukocyte-rich PRP is being applied where immunomodulatory activity and catabolic signaling may be beneficial in short bursts, particularly in certain orthopedic indications under close protocol control. By contrast, pure platelet-rich plasma with minimal leukocytes is favored where dampening post-procedural inflammation and preserving matrix integrity are priorities, such as aesthetic dermatology and delicate soft-tissue applications. The ability to dial leukocytes up or down through device settings or kit selection is therefore becoming a defining criterion in purchasing decisions for multispecialty practices. Evidence of platforms enabling adjustable leukocyte concentration and higher platelet enrichment further supports the move toward tailored formulations within consistent, closed workflows.

Product type considerations now extend beyond a simple choice between centrifuges and disposables. Kits designed for rapid preparation support office-based procedures, while preparation devices and integrated systems offer automation, sensor feedback, and predefined protocols suitable for higher-volume hospital and ambulatory centers. Accessories and consumables-from anticoagulant solutions to specialized collection tubes-have moved to the foreground due to tariff exposure and supply continuity concerns. In selection committees, the winning configurations increasingly pair a robust, capital-efficient processing platform with standardized, readily sourced disposables that balance biologic fidelity, safety, and cost control.

Origin is another strategic axis, with autologous PRP dominating procedural use because it aligns with regulatory expectations for minimal manipulation and lowers immunogenic risk. Allogeneic and homologous approaches are mostly explored in research contexts or narrowly defined clinical pathways, with barriers including donor screening, processing controls, and labeling complexity. As trial activity expands, research institutes continue to shape how these origins could eventually complement autologous workflows in highly specific indications.

Application patterns are coalescing. In orthopedics and sports medicine, reproducible concentration and reliable leukocyte modulation underpin use in tendon and joint-related procedures, while perioperative mixing with graft materials leverages labeled device indications that align with surgical workflows. Cosmetic surgery and dermatology emphasize low-inflammatory profiles for facial rejuvenation and scalp applications, where patient experience and downtime are paramount. Neurosurgery and ophthalmology remain selective adopters, prioritizing sterility and finely tuned formulations in sensitive tissues. General surgery and wound care have gained new momentum as reimbursement clarity for diabetic chronic wounds in the United States has improved, creating a more stable environment for integrating PRP protocols into outpatient wound management. Dental practices value predictable fibrin scaffolding and easy chairside preparation, supporting ridge preservation, implant adjuncts, and soft-tissue procedures.

End-user dynamics follow predictable lines. Hospitals and clinics seek integrated systems that standardize training across departments and align with sterile processing policies, while ambulatory surgical centers prioritize speed, footprint, and rapid turnover. Specialty clinics, particularly in dermatology and sports medicine, look for configurations that minimize patient chair time and consumables complexity. Research institutes, conversely, demand systems with flexible parameters and detailed data outputs to support protocol variation and publication needs.

Finally, distribution channel strategies have bifurcated. Offline channels remain dominant for capital equipment and clinical training bundles, where in-person demonstrations and credentialing are decisive. Meanwhile, online channels have grown in importance for replenishing consumables and accessories, aided by e-commerce platforms offering traceable lot control and subscription replenishment that ease inventory management. Providers increasingly blend both approaches, procuring systems through negotiated contracts and maintaining resilient, multi-vendor e-commerce pipelines for day-to-day supplies.

This comprehensive research report categorizes the Platelet Rich Plasma market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Plasma Type

- Product Type

- Origin

- Application

- End User

- Distribution Channel

Regional adoption patterns show the Americas driven by reimbursement clarity, EMEA shaped by procurement policy, and Asia-Pacific energized by aesthetics

Regional dynamics reflect different combinations of policy, practice patterns, and industrial capabilities. In the Americas, the United States continues to anchor adoption through high procedure volumes in orthopedics, dermatology, and dentistry, supported by an expanding base of FDA-cleared preparation systems. The introduction of a national payment approach for autologous PRP in the treatment of chronic diabetic wounds beginning in January 2025 reduces prior variability in physician-office economics and is expected to reinforce protocol adoption in outpatient wound care networks. Canada and Latin American markets, notably Brazil and Mexico, exhibit steady uptake in private clinics, where aesthetic and sports medicine demand leads and public reimbursement remains more limited. Vendor strategies across the region emphasize turnkey systems, credentialing support, and documentation frameworks that align with local coding rules.

Across Europe, the Middle East, and Africa, regulatory heterogeneity defines the operating environment. The European Union’s risk-based device framework and ongoing trade positioning, including restrictions applied to certain Chinese medical device bidders in public procurements, shape sourcing decisions for hospitals and public tenders. This policy posture, coupled with MDR compliance timelines and notified body capacity constraints, encourages buyers to prioritize vendors with strong documentation, postmarket surveillance data, and stable supply chains within the bloc or allied countries. In the Middle East, private-sector centers continue to adopt PRP for orthopedic and aesthetic indications, aided by investments in elective care. In Africa, access remains uneven, with growth concentrated in urban private clinics that can support capital equipment and sterile disposables.

Asia-Pacific remains one of the most dynamic arenas. Mature aesthetic markets in South Korea, Japan, and Australia are expanding training-led adoption in dermatology, while orthopedics and dentistry sustain a broad base of procedures. China continues to advance domestic device manufacturing and clinical use in private hospitals and specialty clinics, though international trade frictions and procurement rules in other regions are reshaping export prospects. India’s large private care landscape is adopting PRP across dermatology and sports medicine in metropolitan centers, with demand for cost-sensitive kits and compact preparation devices. Throughout the region, distributors differentiate by pairing equipment with education and by ensuring reliable availability of sterile consumables in markets sensitive to import lead times and policy changes.

This comprehensive research report examines key regions that drive the evolution of the Platelet Rich Plasma market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Companies differentiate on biologic precision, automation, and supply resilience while aligning claims to labeled indications and perioperative workflows

Competitive positioning in PRP centers on three vectors: biologic control, workflow automation, and supply reliability. Companies that demonstrate tunable platelet concentration and leukocyte content within a closed, repeatable process are setting the clinical standard in orthopedics and sports medicine. For instance, device platforms highlighting multi-sensor automation and adjustable leukocyte profiles underscore how hardware and software now co-produce biologic quality. These capabilities are frequently paired with education assets and application calculators that simplify protocol selection during cases.

Firms emphasizing streamlined preparation in compact form factors are addressing the needs of ambulatory and office-based practices. Systems that offer single-spin simplicity, small blood draw volumes, and tight control of red blood cell carryover have found a durable niche in dermatology and multi-specialty clinics. Recent brand consolidations and rebranding efforts have aimed to unify product portfolios under singular, easily credentialed systems, signaling a maturation of go-to-market strategies in the aesthetics segment.

Orthopedic leaders maintain broad portfolios that include double-syringe systems for quick preparation, higher-volume buffy coat approaches, and fully automated platforms designed for reproducibility. Published materials describe double-spin regimens and high-fold platelet enrichment, with options to customize formulations for case-specific needs. In parallel, established medtech firms continue to market platelet concentration systems positioned for mixing with autograft or allograft bone, aligning closely with cleared indications and perioperative workflows. These strategies cater to hospital value-analysis committees that weigh device claims against labeling and evidence.

Specialized manufacturers focus on supraphysiologic concentration and neutrophil control, promoting rapid preparation and closed processing while highlighting cellular characterization. Their messaging stresses predictable biologic deliverables and minimal inflammatory byproducts, themes that resonate with clinicians seeking consistency across operators and sites. Meanwhile, companies dedicated to standardized tubes and procedure kits emphasize pharmaceutical-grade materials, anticoagulant choice, and gel separators to produce leukocyte-poor plasma with repeatable composition.

Finally, diversified device companies supply PRP procedure packs and accessories that complement centrifuge platforms and support compliance with labeled use, especially when PRP is used to improve handling characteristics of bone grafts in surgical settings. This accessory ecosystem helps institutions standardize across specialties while preserving vendor flexibility, particularly important in a tariff-sensitive supply environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Platelet Rich Plasma market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- APEX Biologix, LLC

- Arthrex, Inc.

- Celling Biosciences, Inc.

- Croma-Pharma GmbH

- Dr PRP USA, LLC

- EmCyte Corporation

- Exactech, Inc.

- Factor Medical, Inc.

- Glofinn Group

- Isto Biologics, LLC

- Johnson & Johnson Services, Inc.

- Juventix Regenerative Medical, LLC

- PRP Concepts, Inc.

- Regen Lab SA

- Rocky Mountain Biologicals, Inc.

- Shandong Weigao Group

- Stryker Corporation

- Terumo Corporation

- ThermoGenesis Holdings, Inc.

- Tricell Biologics Pvt Ltd

- Ycellbio Medical Co., Ltd.

- Zimmer Biomet Holdings, Inc.

Operationalize PRP success through biologic standardization, reimbursement readiness, supply hedging, cross-specialty governance, and outcomes dashboards

Senior leaders should first anchor their strategies in biologic fidelity and reproducibility. Standardize on systems that allow precise control over platelet concentration and leukocyte content within closed, automated workflows, and document these parameters within clinical protocols. By doing so, your organization reduces operator variability, strengthens quality assurance, and creates a robust foundation for comparative outcomes analyses across specialties.

Next, operationalize reimbursement gains where they exist. For chronic diabetic wounds, align site-of-care protocols, supply chains, and documentation with the national payment framework now in place in the United States. Embed coding guardrails in electronic health records, ensure that device labeling matches the documented indication, and audit early to surface any gaps. Where coverage remains limited, sequence PRP as part of value-based bundles or clinical pathways that emphasize functional outcomes and reduced downstream utilization.

Third, hedge trade and supply risks proactively. Map each PRP bill-of-materials to tariff exposure, qualify non-impacted alternates for syringes and needles, and negotiate framework agreements that include pass-through language and safety stock commitments. Evaluate distributors on their ability to provide traceable lot control and rapid substitution. For capital procurement, favor platforms with broad accessory compatibility to avoid single-source constraints.

Fourth, align clinical governance and education. Create cross-specialty credentialing that standardizes blood draw, centrifugation parameters, activation protocols, and documentation, then embed those steps into checklists and tray cards. Appoint a PRP stewardship lead to monitor emerging evidence, labeling updates, and payer policies, ensuring the playbook evolves with practice and regulation.

Finally, build outcome dashboards that link biologic parameters to patient-reported outcomes and procedure-level costs. By correlating leukocyte profile, platelet fold-increase, and anticoagulant selection with recovery metrics and adverse-event rates, your teams can iterate toward indication-specific best practices that are defensible to payers and persuasive to clinicians.

Methodology integrates clinician and procurement insights with device clearances, tariff policy, and reimbursement updates to inform actionable conclusions

This analysis synthesizes multiple evidence streams to ensure accuracy and practical relevance for decision-makers. Primary research included structured conversations with clinicians using PRP across orthopedics, dermatology, dentistry, and wound care, as well as discussions with procurement leaders and distributors regarding device selection criteria, training, and logistics. These interactions helped prioritize variables such as preparation time, leukocyte control, anticoagulant choice, and the balance between capital expenditure and consumables spend.

Secondary research encompassed a detailed review of device labeling and regulatory status, including premarket notifications and device identifiers associated with platelet and plasma separators cleared for bone graft handling. This pathway, reflected in recent clearances, provides a reference point for intended uses that are typically cited in perioperative mixing and for understanding the scope of claims used in marketing materials. Company materials were examined to understand functional differentiation around automation, concentration ranges, and closed-system sterility.

Policy and reimbursement assessment integrated public notices and expert analyses. United States tariff actions were tracked through official announcements and legal summaries to contextualize their effect on core PRP disposables, while Medicare coverage and payment developments for chronic diabetic wounds were reviewed using the national coverage determination and commentary on the 2025 physician fee schedule final rule. These sources provided clarity on where financial predictability is increasing and where trade-related costs may rise, enabling a balanced view of near-term risks and opportunities.

Analytical synthesis followed a triangulation approach. Findings from interviews guided the weighting of secondary evidence, and both were stress-tested against operational considerations such as supply chain resilience and training demands. The resulting insights are designed to be actionable for executives responsible for strategy, portfolio management, procurement, and clinical governance, without engaging in market sizing or share estimation to preserve focus on operational and clinical decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Platelet Rich Plasma market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Platelet Rich Plasma Market, by Plasma Type

- Platelet Rich Plasma Market, by Product Type

- Platelet Rich Plasma Market, by Origin

- Platelet Rich Plasma Market, by Application

- Platelet Rich Plasma Market, by End User

- Platelet Rich Plasma Market, by Distribution Channel

- Platelet Rich Plasma Market, by Region

- Platelet Rich Plasma Market, by Group

- Platelet Rich Plasma Market, by Country

- United States Platelet Rich Plasma Market

- China Platelet Rich Plasma Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

PRP’s scalable era favors organizations that marry biologic precision with policy awareness, supply resilience, and rigorous clinical governance for impact

Platelet-rich plasma is entering a practical, scalable era defined by biologic precision, device automation, and clearer economic footing in defined indications. The most competitive solutions now combine tunable leukocyte and platelet profiles with closed-system reliability and streamlined preparation, enabling multidisciplinary teams to deliver reproducible outcomes in both hospital and ambulatory settings. At the same time, labeling discipline and documentation integrity remain essential, particularly as organizations expand from perioperative bone-graft handling into broader applications supported by emerging evidence and protocol governance.

External forces will continue to shape adoption. United States tariff dynamics are elevating the importance of sourcing diversification for syringes, needles, and sterile disposables, while reimbursement developments in chronic diabetic wounds are creating steadier economics for outpatient wound care programs. In Europe, procurement policies and MDR compliance realities are reinforcing a premium on documentation and reliable in-bloc supply chains. Across Asia-Pacific, aesthetics-led demand and expanding clinical education are accelerating uptake, with distributors differentiating through training and stock reliability.

Executives who synchronize clinical, operational, and policy perspectives will be best positioned to harness PRP’s potential. By standardizing biologic parameters, hedging supply risks, aligning with coverage rules, and instrumenting outcomes, organizations can convert PRP from a promising adjunct into a dependable pillar of regenerative and perioperative care. The trajectory is clear: disciplined execution will separate those who dabble from those who lead.

Accelerate confident investments in platelet-rich plasma by engaging directly with Ketan Rohom to secure the full report and align strategic execution

The promise of platelet-rich plasma is no longer a future bet but a present-day lever for clinical quality, patient experience, and service-line differentiation. If you are ready to translate this momentum into practical growth, connect with Ketan Rohom, Associate Director, Sales & Marketing, to purchase the comprehensive market research report that informed this executive summary.

Through this report, your team will gain structured analysis of technology choices, clinical adoption pathways, regulatory crosswinds, reimbursement updates, vendor benchmarking, and purchase criteria used by leading providers. Whether you are refining product roadmaps, redesigning procurement strategies, or preparing investor communications, these insights are built to be immediately actionable.

Take the next step today. Engage with Ketan Rohom to secure your copy, align stakeholders with a single source of truth, and accelerate decisions that keep you ahead of competitors and policy shifts alike.

- How big is the Platelet Rich Plasma Market?

- What is the Platelet Rich Plasma Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?