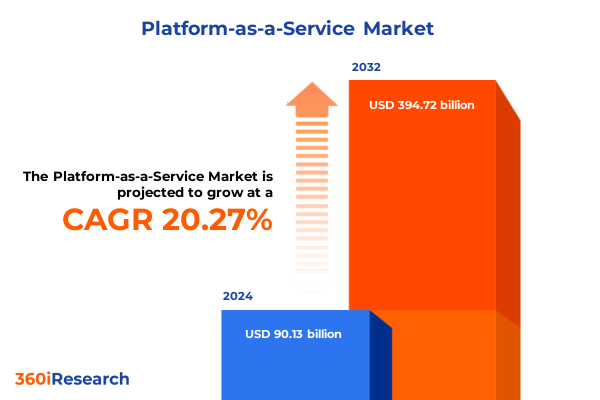

The Platform-as-a-Service Market size was estimated at USD 107.84 billion in 2025 and expected to reach USD 129.03 billion in 2026, at a CAGR of 20.36% to reach USD 394.72 billion by 2032.

Discover How Platform-as-a-Service Is Redefining Enterprise Agility and Driving Next-Generation Application Development and Operations Demands

In an era where digital transformation dictates the pace of competition, Platform-as-a-Service emerges as a linchpin for enterprises seeking to accelerate innovation and streamline application delivery. This executive summary provides a concise yet comprehensive overview of the PaaS landscape, spotlighting pivotal market dynamics, structural shifts, and strategic considerations. By distilling key insights into technological evolutions and tariff impacts, it equips decision-makers with the knowledge to navigate complexities and identify growth levers.

The objective of this document is to articulate the multifaceted forces reshaping PaaS adoption, from rapid container orchestration to the proliferation of low-code frameworks that democratize development. Additionally, it examines how global trade policies are influencing infrastructure costs and service economics. With an emphasis on segmentation by service type, deployment model, organization size, and vertical applications, the analysis illuminates the threads connecting market drivers and end-user demands.

Formatted to guide senior executives and strategists, this summary transitions seamlessly between high-level observations and actionable recommendations. It underscores the importance of aligning technology investments with evolving customer expectations, while also highlighting regional nuances that define market opportunities. Ultimately, this introduction sets the stage for a deeper exploration of PaaS’s transformative potential and its role as a catalyst for enterprise agility and digital innovation.

Uncover the Key Technological and Operational Paradigm Changes Reshaping PaaS Architectures from Containerization to AI-Driven Service Management

The PaaS environment is experiencing transformative shifts driven by the convergence of container-based architectures, event-driven design patterns, and emerging artificial intelligence capabilities. Organizations are embracing container-based development as the default paradigm for application portability and scalability, while low-code platforms bridge the gap between citizen developers and IT, fostering a culture of rapid prototyping. Simultaneously, event-driven architectures enable real-time responsiveness, and microservices management frameworks provide the orchestration required for granular service governance.

Furthermore, integration and orchestration services, including API management and workflow automation, are maturing into strategic assets that unify disparate systems and data sources. These capabilities reduce time to market, enhance interoperability, and bolster security through centralized policy enforcement. As enterprises navigate increasingly complex technology stacks, PaaS offerings that seamlessly integrate middleware services with orchestration tools are gaining traction.

Moreover, the infusion of AI-driven service management is accelerating predictive maintenance of platform components, optimizing resource allocation, and automating operational tasks. This shift toward intelligent operations not only enhances reliability and performance but also extends the value proposition of PaaS from mere deployment infrastructure to a proactive enabler of business outcomes. In this dynamic landscape, vendors that deliver cohesive, end-to-end platforms while anticipating future integration requirements will lead the next wave of cloud innovation.

Analyze the Far-Reaching Consequences of United States Tariff Policies in 2025 on Platform Infrastructure Costs and Cloud Service Economics

The United States’ tariff adjustments in 2025 have imposed a layered impact on the cost structure of platform infrastructure, particularly affecting hardware-dependent services and data center expansions. Increased duties on server components and networking equipment have driven select providers to renegotiate supplier contracts and pursue alternative sourcing strategies to mitigate margin erosion. Simultaneously, these levies have accelerated the shift toward software-defined infrastructure, where operators rely more heavily on virtualized resources and cloud-native services to insulate themselves from hardware price volatility.

In response to this environment, leading PaaS vendors have expanded partnerships with domestic OEMs and diversified their supply chains across Asia-Pacific hubs less affected by punitive measures. These strategic realignments preserve service availability and performance while balancing the elevated costs associated with hardware procurement. Additionally, some providers have introduced localized pricing adjustments or flexible billing constructs, allowing customers in tariff-impacted regions to adopt pay-as-you-go models that correlate service expenses with actual consumption.

Looking ahead, the cumulative effect of such trade policies extends beyond immediate cost spikes. Enterprises are re-evaluating their disaster recovery plans, considering edge-based deployments to reduce reliance on large centralized data centers, and rearchitecting applications to optimize for distributed environments. Consequently, the PaaS market is witnessing an uptick in demand for platforms that offer granular control over resource localization, hybrid connectivity, and tariff-aware capacity planning.

Gain Critical Insights into Platform-as-a-Service Market Segments Driving Adoption, Including Service Models, Deployment Strategies, Organizational Profiles, and Industry Verticals

Delving into service types reveals that application development and lifecycle management solutions dominate when enterprises prioritize rapid deployment and iterative testing. These offerings, which span both container-based development and low-code development frameworks, empower organizations to shorten development cycles and democratize coding tasks. Conversely, application infrastructure and middleware capabilities, driven by event-driven architecture and microservices management, are critical for firms aiming to deconstruct monoliths and embrace modular service constructs.

Integration and orchestration services further enrich the PaaS proposition through API management and workflow automation, ensuring that new applications coexist harmoniously with legacy systems. When evaluating deployment models, hybrid cloud solutions consistently attract organizations seeking a balance between on-premises control and cloud scalability, while private cloud remains a strong choice for data-sensitive workloads and compliance-driven sectors. Public cloud deployments, on the other hand, appeal to those prioritizing rapid capacity elasticity and global reach.

Organizational size also influences platform preferences, as large enterprises often leverage feature-rich suites that include advanced monitoring and governance, whereas small and medium enterprises look for intuitive interfaces and cost-efficient consumption models. Vertically, banking, financial services, and insurance segments demand robust security and regulatory compliance, healthcare and life sciences require stringent data privacy measures, information technology and telecom focus on high-throughput integration, manufacturing emphasizes IoT connectivity, media and entertainment prioritize content delivery performance, and retail and ecommerce seek seamless omnichannel support.

This comprehensive research report categorizes the Platform-as-a-Service market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Deployment Type

- Organization Size

- Vertical

Explore Regional Variations and Growth Drivers Across the Americas, Europe Middle East and Africa, and Asia-Pacific Cloud Platforms Ecosystems

Across the Americas, robust digital infrastructure investments and a mature regulatory framework foster a fertile environment for Platform-as-a-Service innovations. Enterprises in North America lead in early adoption of hybrid cloud setups, leveraging advanced integration capabilities to support complex, multi-cloud deployments. Latin American markets, while in a growth phase, show increasing interest in low-code solutions to accelerate digital inclusion among small and medium enterprises.

In the Europe, Middle East & Africa region, regulatory compliance and data sovereignty regulations guide PaaS strategies. European Union data protection directives have driven demand for private cloud offerings and localized data center expansions, whereas Middle Eastern organizations are investing in edge computing solutions to optimize connectivity across dispersed geographies. African markets, though in nascent stages, present opportunities through public cloud trials and partnerships with global hyperscalers to build digital service capacity.

Asia-Pacific showcases diverse adoption curves: developed markets like Japan and Australia have fully embraced container management and AI-driven operations, while emerging economies in Southeast Asia prioritize cost-effective public cloud services to support the rapid digitization of government services and ecommerce platforms. China’s regulated cloud ecosystem also inspires innovation in self-hosted PaaS instances, setting a precedent for customized solutions that respect local data regulations.

This comprehensive research report examines key regions that drive the evolution of the Platform-as-a-Service market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Understand the Strategic Positioning and Innovation Trajectories of Leading Platform-as-a-Service Providers Shaping the Industry Landscape

Leading PaaS providers are pursuing differentiated strategies to capture market share and extend platform capabilities. Major hyperscale vendors continue to enhance integrated developer services by embedding AI-powered code suggestions, automated testing suites, and scalable microservices frameworks that align with large enterprise existing investments. They also invest in global data center footprints to alleviate latency issues and comply with regional data residency requirements.

Systems integrators and specialized middleware vendors differentiate by offering industry-tailored templates and managed services designed for vertical use cases such as banking compliance, healthcare interoperability, and manufacturing IoT orchestration. Their go-to-market approach emphasizes deep domain expertise and end-to-end support, encompassing architecture design, deployment, and continuous optimization.

Open-source ecosystems and independent software vendors are coalescing around universal PaaS standards, contributing to extensible frameworks that reduce vendor lock-in. Through collaborative governance bodies and community-driven innovation, they deliver interoperability across container runtimes, service meshes, and orchestration layers. This consortium-driven model appeals to organizations seeking flexibility and long-term control over their application stack.

This comprehensive research report delivers an in-depth overview of the principal market players in the Platform-as-a-Service market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alibaba Cloud

- Amazon Web Services, Inc.

- Cloud Foundry Foundation

- DigitalOcean, LLC

- Dokku, Inc.

- Engine Yard, Inc.

- Google LLC

- IBM Corporation

- Mendix B.V.

- Microsoft Corporation

- MongoDB, Inc.

- Netlify, Inc.

- Oracle Corporation

- Rackspace Technology, Inc.

- Red Hat, Inc.

- Salesforce.com, Inc.

- SAP SE

- Tencent Holdings Limited

- Vercel, Inc.

- VMware, Inc.

Implement Data-Driven Practices to Strengthen Platform Resilience, Drive Innovation and Secure Competitive Edge in a Rapidly Changing Cloud Environment

To navigate the evolving PaaS landscape effectively, industry leaders should prioritize data-driven decision-making by establishing continuous feedback loops between operational metrics and development processes. By integrating telemetry and logging data into automated workflows, organizations can rapidly identify performance bottlenecks and adjust platform configurations to maintain optimal uptime.

It is essential to architect platforms with hybrid connectivity in mind, blending on-premises resources with cloud-native services to accommodate regulatory constraints and data residency requirements. Employing a modular microservices approach not only enhances resilience but also streamlines the rollout of new features across distributed environments. In parallel, adopting AI-enabled service management tools can automate routine maintenance, freeing technical teams to focus on strategic initiatives.

Collaboration with ecosystem partners remains critical. Engaging with hardware vendors to co-develop software-defined infrastructure solutions can mitigate tariff-related cost pressures, while working alongside systems integrators ensures successful implementation of complex deployments. Finally, investing in developer enablement through low-code platforms and comprehensive documentation fosters a culture of innovation and accelerates time to market.

Detail the Mixed-Method Research Approach Integrating Primary Expert Interviews and Secondary Data Analysis to Validate Platform-as-a-Service Insights

This study employs a dual-pronged research methodology, combining qualitative insights from in-depth interviews with senior technology executives and quantitative analysis of secondary data sources. Primary interviews probed platform adoption drivers, integration challenges, and tariff impact mitigation strategies, ensuring real-world perspectives inform the findings. Secondary data encompassed regulatory filings, industry white papers, and publicly available performance benchmarks to triangulate and validate primary inputs.

Data collection adhered to rigorous standards, with interview candidates selected based on their direct involvement in PaaS strategy and implementation across a range of organization sizes and verticals. Transcripts were coded thematically to extract recurring patterns, while statistical techniques gauged the prevalence of specific technology preferences and deployment models. This mixed-methods approach guarantees that conclusions reflect both nuanced leadership viewpoints and objective market indicators.

Throughout the research process, continuous data validation checkpoints were instituted to reconcile discrepancies and update analysis based on emerging trends. These validation steps encompassed peer reviews among research analysts and cross-functional workshops, ensuring that the study’s strategic insights remain accurate, relevant, and aligned with evolving industry dynamics.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Platform-as-a-Service market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Platform-as-a-Service Market, by Service Type

- Platform-as-a-Service Market, by Deployment Type

- Platform-as-a-Service Market, by Organization Size

- Platform-as-a-Service Market, by Vertical

- Platform-as-a-Service Market, by Region

- Platform-as-a-Service Market, by Group

- Platform-as-a-Service Market, by Country

- United States Platform-as-a-Service Market

- China Platform-as-a-Service Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Summarize the Essential Findings and Strategic Implications of Platform-as-a-Service Trends to Inform Decision-Making and Future Technology Investments

The analysis reveals that the PaaS market is undergoing a rapid evolution, guided by containerization, low-code innovations, and AI-driven operational intelligence. Service segmentation underscores the importance of integrated development environments, middleware flexibility, and orchestrated workflows, while deployment preferences highlight a prevailing appetite for hybrid architectures. Organizational complexity dictates that large enterprises gravitate toward feature-rich platforms, whereas smaller firms favor cost-efficient, user-friendly solutions. Vertically, compliance and specialized functionality continue to drive differentiated demand curves across industries.

Regionally, mature markets in North America and Europe prioritize regulatory compliance and high-performance integration, while emerging regions in Latin America, Africa, and parts of Asia focus on accessibility and cost-effectiveness. Tariff dynamics in 2025 have injected an additional layer of strategic consideration, prompting vendors and end users to reassess supply chains and embrace software-defined alternatives. Competitive positioning now hinges on the ability to deliver secure, scalable, and intelligent platforms that adapt to evolving regulatory landscapes and geopolitical shifts.

In sum, decision-makers must adopt a holistic view of PaaS, balancing technological innovation with pragmatic considerations around cost structures, localization, and ecosystem partnerships. By aligning investment priorities with these core insights, organizations can harness PaaS’s full potential as a catalyst for digital transformation and sustained business growth.

Take Action Today by Connecting with Ketan Rohom to Access Platform-as-a-Service Research and Unlock Critical Market Insights for Accelerated Business Growth

Elevating business strategy begins with leveraging the right market intelligence, and engaging with Ketan Rohom offers exactly that opportunity. As a seasoned Associate Director of Sales & Marketing, he can guide you through the nuances of this comprehensive Platform-as-a-Service research, ensuring that you access tailored insights aligned with your organization’s goals. By collaborating directly, you gain expedited access to in-depth analyses of service models, deployment scenarios, and industry vertical dynamics that underpin strategic cloud decisions.

Reaching out to Ketan Rohom unlocks a partnership that extends beyond mere data acquisition. He provides consultative expertise, helping you interpret findings on tariffs, regional adoption patterns, and competitive positioning to inform product roadmaps, technology investments, and partnership strategies. Steering discussions with a dedicated expert means you can translate market intelligence into actionable roadmaps that drive revenue, streamline operations, and enhance customer experiences.

Initiate contact today to transform high-level observations into targeted initiatives that resonate across your enterprise. Ketan Rohom is ready to facilitate custom briefings, demographic deep dives, and one-on-one consultations to ensure your team capitalizes on the latest trends in Platform-as-a-Service. Don’t miss the chance to harness definitive market research and secure the intelligence that sharpens your competitive edge and propels growth.

- How big is the Platform-as-a-Service Market?

- What is the Platform-as-a-Service Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?