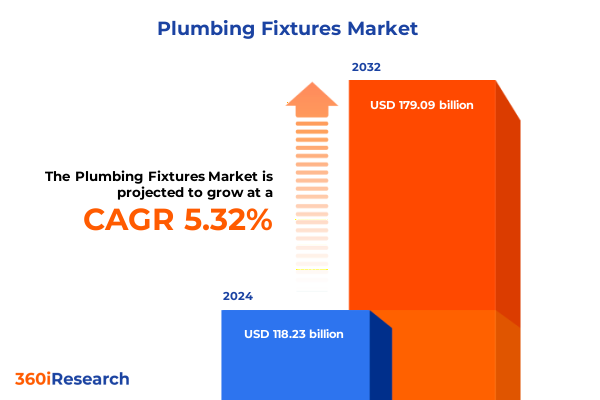

The Plumbing Fixtures Market size was estimated at USD 123.88 billion in 2025 and expected to reach USD 130.21 billion in 2026, at a CAGR of 5.40% to reach USD 179.09 billion by 2032.

Establishing the Foundation for Understanding Critical Dynamics Shaping the Evolving United States Plumbing Fixtures Landscape

In an era defined by rapid technological progress and shifting consumer expectations, the plumbing fixtures sector stands at a pivotal junction. At its core, the market embodies a convergence of traditional craftsmanship and digital innovation, where enduring quality must align with contemporary demands for hygiene, water efficiency, and aesthetic appeal. Industry leaders and stakeholders now find themselves navigating through a labyrinth of regulatory guidelines, supply chain complexities, and sustainability imperatives, all while striving to meet evolving architectural and design trends.

Against this backdrop, a holistic view of the plumbing fixtures landscape reveals dynamic interactions between material science advancements, global trade policies, and digital transformation initiatives. High-performance ceramics and metals coexist alongside lightweight plastics and smart glass solutions, each vying for recognition in residential, commercial, and institutional projects. Furthermore, the proliferation of connected devices is redefining user experiences, as touchless faucets and integrated water monitoring systems become instrumental in both new constructions and renovation projects. As the sector continues to innovate, it must also contend with heightened scrutiny over environmental impact and resource conservation, driving manufacturers to adopt circular economy principles and water-reducing technologies.

This executive summary delivers a concise yet comprehensive exploration of the forces shaping the plumbing fixtures realm, offering decision-makers an essential roadmap. By examining transformative market shifts, regulatory headwinds, segmentation nuances, and actionable industry recommendations, this overview equips stakeholders with the insights needed to seize emerging opportunities and mitigate potential risks.

Navigating the Emergent Technological, Regulatory and Consumer Behavioral Transformations Reshaping United States Plumbing Fixtures Market Dynamics

Recent years have witnessed an unprecedented acceleration of innovation in the plumbing fixtures arena, where digitalization, sustainability, and changing end-user priorities intersect to redefine market expectations. The integration of smart technologies within faucets, showers, and toilets is no longer a futuristic ideal but an established reality, as manufacturers embed sensors, connectivity modules, and data analytics capabilities into everyday fixtures. Such developments have elevated the user experience, enabling precise water flow control, leak detection, and remote management, while also creating new revenue streams through subscription-based maintenance and software upgrades.

Concurrently, tightening environmental regulations and corporate sustainability commitments have prompted a shift toward low-flow fixtures, eco-friendly materials, and closed-loop manufacturing processes. Water conservation targets mandated by federal and state agencies, alongside voluntary green building certifications, have become powerful levers driving product innovation and market differentiation. Companies are responding by leveraging advanced materials such as antimicrobial ceramics and recyclable polymers, aiming to balance performance, cost, and ecological responsibility.

Moreover, consumer behavior is undergoing its own transformation, influenced by heightened health consciousness and a growing appetite for customization. End-users now seek fixtures that not only deliver reliable functionality but also reflect personal style and reinforce hygienic standards. As new-generation homeowners and facility managers embrace digitally enabled, sustainable fixtures, the sector’s competitive paradigm is shifting, emphasizing agility, interoperability, and brand transparency. These tectonic shifts underscore the need for manufacturers to realign their strategies, invest in cross-functional collaboration, and accelerate time to market to capture emerging growth pockets.

Evaluating the Comprehensive Economic and Operational Repercussions of Newly Enacted United States Tariff Policies on Plumbing Fixtures in 2025

The imposition of enhanced tariff measures on imported plumbing fixtures in early 2025 has introduced fresh challenges across the supply chain, impacting everything from raw material sourcing to end-product pricing. As a consequence of these trade policy adjustments, manufacturers reliant on ceramic and metal components originating from specific international markets have encountered elevated input costs and logistical complexities. In addition, distribution networks have faced delays and increased operational expenses, prompting firms to reevaluate their vendor portfolios and reassess freight strategies to preserve margin integrity.

In response, a growing number of organizations have accelerated efforts to localize production and diversify procurement channels. Strategic collaborations with domestic metal foundries and plastic compounders are enabling manufacturers to reduce exposure to tariff fluctuations and optimize inventory cycles. Simultaneously, transparent communication with channel partners has become essential to managing customer expectations regarding lead times and pricing dynamics. While some companies have elected to absorb a portion of the additional costs to maintain competitive positioning, others have opted to implement tiered pricing models, aligning premium smart fixtures with higher margin thresholds.

Despite the immediate cost pressures, the tariff-driven realignment is catalyzing long-term supply chain resilience and fostering investment in automated production capabilities. By leveraging robotics, additive manufacturing, and digital twin simulations, industry participants are enhancing operational flexibility and mitigating the risk of future trade disruptions. As the sector adapts to the cumulative impact of the 2025 tariff environment, these strategic pivots are poised to deliver sustainable benefits, reinforcing the critical importance of agile supply chain frameworks.

Uncovering Nuanced Market Behaviors Through Product, Material, Application, End-Use and Distribution Channel Segmentation Perspectives

A granular analysis of the plumbing fixtures market through the prism of product typologies uncovers diverse trajectories across multiple categories. Traditional Bathtub & Shower ensembles continue to anchor residential renovations, whereas advanced Bidet installations are gaining traction in both high-end hospitality and health care environments. Complementary components such as Drains and Hose Bibs maintain steady demand driven by infrastructural projects, while core staples like Faucets & Taps experience consistent uptake as they evolve to incorporate touchless activation and antimicrobial coatings. Simultaneously, standalone Sinks, Toilets, and Urinals demonstrate enduring relevance, yet their growth patterns diverge based on end-use requirements and regional water management mandates.

Material composition further refines market segmentation, as Ceramic Fixtures retain a dominant position due to their aesthetic versatility and durability. In parallel, Glass Fixtures are carving a niche in luxury applications, celebrated for their seamless integration with contemporary design schemes. The prominence of Metal Fixtures has spurred specialized streams for Brass and Copper, prized for their ornate finishes, while Stainless Steel meets the rigorous demands of institutional and commercial installations. On the other hand, Plastic Fixtures have evolved to encompass high-performance polymers like Acrylic, CPVC, and PVC, each selected based on criteria such as impact resistance, chemical stability, and cost optimization.

Application-oriented insights reveal a bifurcation between New Construction projects and Repair & Remodel initiatives. The former drives large-scale procurement cycles aligned with builders’ specifications, whereas the latter is characterized by shorter lead times and heightened consumer taste sensitivities. Finally, an examination of End-Use contexts distinguishes between commercial settings-with Healthcare Facilities, Hospitality ventures, and Office Spaces generating differentiated requirements-and residential domains focused on comfort, functionality, and design personalization. Distribution channels remain divided between the established Offline Retail landscape, which continues to thrive on hands-on showroom experiences, and the expanding Online Retail ecosystem shaped by digital platforms and direct-to-consumer models.

This comprehensive research report categorizes the Plumbing Fixtures market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Application

- End-Use

- Distribution Channel

Revealing Strategic Regional Variances and Growth Opportunities Across Americas, Europe Middle East Africa and Asia Pacific Plumbing Fixtures Markets

Regional performance in the plumbing fixtures market is defined by unique economic drivers, regulatory landscapes, and consumer priorities across the Americas, the combined Europe, Middle East & Africa expanse, and Asia-Pacific territories. In the Americas, the United States leads with robust residential remodeling activity, underpinned by stable housing markets and preferential financing rates, while Canada and Mexico exhibit increased infrastructure investments targeting water management and sanitation upgrades. This region’s mature distribution networks and advanced manufacturing base enable rapid adoption of smart fixtures and sustainable product lines.

Shifting focus to Europe, Middle East & Africa, regulatory stringency emerges as a paramount factor shaping product compliance and innovation. The European Union’s ambitious water efficiency benchmarks, coupled with Middle Eastern initiatives to address water scarcity through advanced desalination and reuse technologies, propel manufacturers to intensify research on low-flow and high-durability solutions. Meanwhile, emerging African markets present untapped potential, where urbanization and public health imperatives drive demand for reliable, cost-effective fixtures.

Across Asia-Pacific, the market dynamic is twofold: the region serves as a global production hub leveraging economies of scale for exports, and simultaneously represents one of the fastest-growing domestic consumption markets. Rapid urban expansion in China and India fuels an unprecedented wave of residential and commercial construction projects, while Southeast Asian nations prioritize sustainable water infrastructure. Cross-border trade agreements and regional supply chain integration further reinforce Asia-Pacific’s pivotal role in shaping global fixture availability and pricing patterns.

This comprehensive research report examines key regions that drive the evolution of the Plumbing Fixtures market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Competitive Strategies and Innovation Leadership Among Prominent Manufacturers Steering the United States Plumbing Fixtures Domain

The competitive terrain of the plumbing fixtures domain is defined by a spectrum of global and regional players distinguished by their innovation cycles, brand equity, and strategic alliances. Established manufacturers continually expand their product portfolios to integrate smart functionalities, as seen in the introduction of sensor-driven faucets and digitally enhanced shower systems. Leading companies invest heavily in research partnerships to harness emerging materials and surface treatments, thereby prolonging product lifecycles and elevating hygiene standards.

Collaboration between industry incumbents and technology firms has become a hallmark of competitive differentiation. Cross-disciplinary initiatives yield connected fixture platforms that integrate water usage analytics into building management systems, creating value for commercial property developers and facility operators seeking operational efficiencies. At the same time, regional specialists strive to capture niche segments by tailoring designs and materials to local preferences, whether focusing on artisanal finishes or cost-effective modular assemblies.

Mergers and acquisitions activity underscores the pursuit of scale and geographic diversification. By absorbing complementary businesses, leading organizations expedite market entry into high-growth areas and bolster their end-to-end value chain control. Simultaneously, smaller disruptors leverage agile production models and digital-first distribution strategies to carve out market share, compelling larger entities to refine their go-to-market approaches and enhance customer engagement through omnichannel experiences.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plumbing Fixtures market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- American Bath Group, LLC

- Bemis Manufacturing Company

- Cera Sanitaryware Ltd.

- Colston Bath & Spa India Pvt. Ltd.

- Delta Faucet Company

- Duravit Aktiengesellschaft

- Fima Carlo Frattini S.P.A.

- Fortune Brands Home & Security, Inc.

- Geberit AG

- Gerber Plumbing Fixtures, LLC by Globe Union Industrial Corp.

- H & R Johnson (India)

- Hansgrohe SE

- Hindware Home Innovation Limited

- Huida Sanitary Ware Co.,Ltd.

- Jacuzzi Brands, LLC

- Jaquar Group

- Kohler Co.

- LIXIL Corporation

- Masco Corporation

- Pearl Precision Products Pvt. Ltd.

- Roca Sanitario, S.A.

- Spectrum Brands, Inc.

- T&S Brass and Bronze Works, Inc.

- Toto Ltd.

- Xiamen OLT Co., Ltd.

- Zurn Industries, LLC by Zurn Elkay Water Solutions Corporation

Formulating Proactive Strategic Initiatives and Operational Tactics for Industry Leaders to Capitalize on Emerging Plumbing Fixtures Market Trends

Industry leaders seeking to capitalize on emerging opportunities must prioritize supply chain resilience and technological adaptability. Firms should explore nearshoring and regional manufacturing partnerships to insulate operations from future tariff volatility, while strategically allocating investment toward automation solutions that enhance production scalability and reduce lead times. By embracing advanced robotics and digital twin simulations, organizations can anticipate disruptions, optimize workflow efficiencies, and maintain agility in dynamic market conditions.

To meet growing sustainability expectations, manufacturers ought to commit to circular economy principles, extending product lifecycles through design for disassembly and introducing take-back programs for end-of-life fixtures. Collaboration with material innovators can facilitate the adoption of bio-based polymers and recyclable alloys, enabling a competitive advantage by appealing to environmentally conscious consumers and institutional partners. Furthermore, integrating advanced analytics into connected fixtures not only supports water usage monitoring but also opens ancillary revenue streams through predictive maintenance services.

Finally, a nuanced market approach requires segment-specific strategies that align with distinct buyer behaviors. Premium smart fixtures should be marketed through partnerships with high-end designers and digital platforms, while value-driven product lines can leverage traditional wholesale channels to reach cost-sensitive audiences. Regional playbooks must account for localized regulations and infrastructure maturity, ensuring regulatory compliance and maximizing market penetration. By combining these strategic imperatives, organizations can strengthen their market position and drive long-term sustainable growth.

Detailing Rigorous Mixed Methodological Approaches, Data Collection Protocols and Analytical Techniques Underpinning the Market Research Process

This research project synthesizes primary and secondary data sources through a structured, multi-layered methodology designed to ensure robustness and relevance. Primary insights were gathered via in-depth interviews with senior executives, supply chain managers, and product engineers across leading fixture manufacturers and distribution networks. These discussions provided qualitative context on strategic priorities, innovation roadmaps, and operational challenges. Complementing this, a series of quantitative surveys targeted architects, facility managers, and contractors to capture purchasing drivers, channel preferences, and material selection criteria.

Secondary research entailed a comprehensive review of industry publications, regulatory filings, technical white papers, and trade association reports. Government databases on trade flows, customs records, and tariff schedules were also consulted to quantify policy impacts and benchmark import-export dynamics. Data triangulation was performed to validate findings, involving cross-referencing divergent sources and reconciling any discrepancies through follow-up interviews and expert consultations.

Analytical frameworks employed include a combination of SWOT analysis, supply chain mapping, and segmentation validation techniques. Rigorous data cleansing and normalization protocols were applied to ensure consistency across diverse data sets. Advanced tools such as statistical regression and scenario modeling facilitated the exploration of tariff-induced cost variables and adoption rates of smart fixtures. Throughout the process, strict adherence to data integrity and methodological transparency guidelines was maintained, ensuring the credibility and actionable relevance of the research outcomes.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plumbing Fixtures market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plumbing Fixtures Market, by Product Type

- Plumbing Fixtures Market, by Material Type

- Plumbing Fixtures Market, by Application

- Plumbing Fixtures Market, by End-Use

- Plumbing Fixtures Market, by Distribution Channel

- Plumbing Fixtures Market, by Region

- Plumbing Fixtures Market, by Group

- Plumbing Fixtures Market, by Country

- United States Plumbing Fixtures Market

- China Plumbing Fixtures Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesizing Core Findings and Strategic Imperatives to Illuminate the Path Forward Within the United States Plumbing Fixtures Ecosystem

Drawing from the insights uncovered in this executive summary, it becomes evident that the United States plumbing fixtures market is at an inflection point where innovation, regulatory forces, and supply chain dynamics converge. The advancement of smart, connected fixtures, coupled with stringent environmental mandates, is catalyzing a wave of product evolution and strategic realignment among market participants. Meanwhile, the 2025 tariff reshuffle has accelerated efforts to localize production and enhance logistical resilience, setting the stage for a more agile and diversified supply network.

The segmentation analysis highlights distinct growth vectors across product categories, material compositions, application scenarios, and distribution channels, underscoring the importance of tailored strategies that align with end-use demands and regional nuances. Furthermore, competitive benchmarking reveals a landscape shaped by both global giants investing in scale and innovation, as well as nimble challengers leveraging digital channels and localized offerings.

Looking ahead, industry stakeholders are advised to adopt a dual focus on operational robustness and customer-centric innovation, integrating sustainability imperatives with next-generation digital capabilities. By fostering cross-industry collaborations and continuously refining supply chain frameworks, firms can unlock new value propositions and reinforce their market positioning. Ultimately, the capacity to respond decisively to regulatory, technological, and consumer behavior shifts will determine which organizations lead the transformation of the plumbing fixtures ecosystem.

Seize the Opportunity to Acquire Comprehensive Market Intelligence From Associate Director Ketan Rohom to Drive Growth and Strategic Advancement

We invite you to harness the depth and precision of this specialized market research to gain a decisive competitive advantage. Engage directly with Associate Director, Sales & Marketing Ketan Rohom to explore customized intelligence solutions and secure a comprehensive understanding of evolving market forces. By partnering with an expert, you will be empowered to navigate tariff implications, leverage cutting-edge segmentation insights, and implement strategies tailored to your organization’s unique objectives. Don’t miss this opportunity to transform raw data into actionable strategies that propel growth and innovation within the plumbing fixtures sector. Contact Ketan Rohom today to initiate your journey toward market leadership and sustained success.

- How big is the Plumbing Fixtures Market?

- What is the Plumbing Fixtures Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?