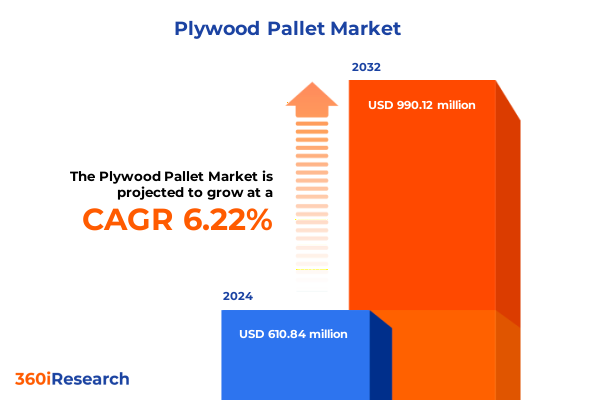

The Plywood Pallet Market size was estimated at USD 646.42 million in 2025 and expected to reach USD 688.97 million in 2026, at a CAGR of 6.28% to reach USD 990.12 million by 2032.

How Plywood Pallets Are Redefining Modern Logistics in an Era of E-Commerce Growth, Supply Chain Complexity, and Sustainable Packaging Imperatives

Plywood pallets have emerged as a cornerstone of modern logistics, combining the structural advantages of engineered wood with the flexibility required by today’s dynamic supply chains. As e-commerce continues to redefine the pace and scale of goods movement, these pallets are instrumental in supporting the seamless transition of products from manufacturing sites to distribution centers and ultimately to end consumers. Chinese logistics operators, for instance, have significantly increased their U.S. warehousing footprint, accounting for 20% of new lease activity in major hubs such as Southern California and Savannah, underscoring the global interplay that drives demand for reliable, standardized pallet solutions.

Meanwhile, heightened environmental awareness among consumers and regulators is reshaping packaging expectations. Shoppers in North America are actively opting out of purchases due to concerns over non-eco-friendly plastic packaging, prompting brands and logistics providers alike to explore sustainable alternatives. This shift has placed plywood-sourced from certified responsibly managed forests-at the forefront of sustainable packaging, offering a biodegradable and recyclable option that aligns with stringent recyclability mandates set to take effect by 2032 in states like California.

In tandem with these drivers, technological integration is rapidly redefining pallet capabilities. The deployment of sensors, RFID tags, and GPS modules enables real-time visibility into location, condition, and utilization metrics, empowering decision-makers with actionable data and supporting predictive maintenance strategies. As a result, plywood pallets are no longer passive transporters but active digital assets within a connected supply network.

Against this backdrop, understanding the interplay of supply chain acceleration, sustainability imperatives, and digital transformation is essential for stakeholders seeking to optimize procurement, manufacturing, and distribution strategies. This report delves into these critical factors to equip leaders with a comprehensive perspective on the evolving plywood pallet ecosystem.

Unlocking the Future of Plywood Pallets Through Digitalization, Circular Economy Practices, Engineered Wood Innovations, and Nearshoring Trends

The landscape of plywood pallets is undergoing profound transformation driven by a confluence of technological, regulatory, and economic shifts. First and foremost, the digitalization of pallet operations through the integration of Internet of Things (IoT) devices and smart tracking capabilities has moved pallets from static inventory to live data sources. By embedding RFID tags, BLE beacons, and telematics sensors, manufacturers and end users are unlocking unprecedented levels of transparency in transit, enabling dynamic allocation of resources and minimizing the risk of loss or damage.

Simultaneously, circular economy principles are reshaping how pallets are designed, used, and recirculated. The European Union’s Packaging and Packaging Waste Regulation mandates that transport packaging achieve a 40% reuse rate by 2030 and 70% by 2040, compelling logistics providers to invest in durable, modular pallet designs that can withstand multiple life cycles and be refurbished with minimal material waste. This regulatory impetus is fostering innovation in returnable plastic containers and wooden pallet pooling programs that maximize utilization while reducing environmental impact.

Innovation in engineered wood products (EWPs) is another catalyst of change. Advanced materials such as cross-laminated timber (CLT) and laminated veneer lumber (LVL) deliver superior strength-to-weight ratios, enabling pallets to carry heavier loads with reduced biomass consumption. These composites also open avenues for incorporating timber by-products and secondary wood fibers, driving resource efficiency and contributing to carbon sequestration efforts in wood-based supply chains.

Finally, global supply chain realignments and near-shoring initiatives are influencing pallet sourcing strategies. With logistics volatility and geopolitical tensions prompting companies to localize manufacturing closer to end markets, demand patterns for pallets are shifting from traditional offshore procurement to regional manufacturing hubs. Investments in domestic production capacity, coupled with the expansion of cross-border trade under agreements like USMCA, are recalibrating the balance between cost optimization and resilience in pallet supply networks.

Together, these trends underscore a transformative period in the plywood pallet sector, where innovation, sustainability, and strategic sourcing converge to define competitive advantage.

Analyzing the Layered Impact of United States Tariff Policies on Plywood Pallet Trade Dynamics, Cost Structures, and Sourcing Decisions

The current tariff environment in the United States presents a layered and evolving challenge for plywood pallet stakeholders, shaping import costs, sourcing decisions, and competitive dynamics. Under the Harmonized Tariff Schedule of the U.S. (HTSUS), wooden pallets classified as HTS 4415.20.80.00 face a general Most-Favored-Nation (MFN) duty rate of 10.7% on non-preferential imports, directly impacting landed costs for companies sourcing pallets from markets without reciprocal trade agreements.

However, regional trade accords such as the United States–Mexico–Canada Agreement (USMCA) provide preferential treatment for qualifying imports. Effective March 7, 2025, goods originating in Canada and Mexico that meet USMCA rules of origin are exempt from additional emergency tariffs, preserving duty-free access for cross-border pallet flows and reinforcing integrated North American supply networks.

In contrast, imports from China are subject to additional Section 301 tariffs of 25% ad valorem on products classified under Chapter 44, which includes plywood and related wood packaging. This escalated duty, introduced in response to trade imbalances and intellectual property concerns, compounds the baseline MFN rate and has led many logistics managers to reassess reliance on Chinese sources, favoring regional suppliers or domestic production to mitigate cost volatility.

Furthermore, certain hardwood plywood products imported from China remain under anti-dumping and countervailing duty orders instituted in January 2018. These orders levy anti-dumping duties as high as 183.36% ad valorem and countervailing duties ranging from 22.98% to 194.90%, targeting unfairly subsidized or underpriced imports. While finished wood pallets typically benefit from packaging exceptions and are generally excluded from these punitive measures, the underlying sheet materials may incur significant charges before assembly, affecting overall pallet economics.

Collectively, these layers of duties-MFN tariffs, emergency tariffs, Section 301 surcharges, and AD/CVD orders-have heightened the complexity of international procurement strategies. As a result, many organizations are doubling down on local manufacturing, diversifying supplier portfolios, and exploring tariff classification strategies to optimize import structures. Understanding these tariff nuances is essential for accurately modeling total cost of ownership and maintaining resilient supply chains in an era of trade uncertainty.

Deciphering Key Market Segmentation for Plywood Pallets by Product Composition, Structural Configuration, Usage Environment, and Distribution Models

A nuanced understanding of market segmentation illuminates how plywood pallets can be tailored to diverse operational requirements and customer preferences. By examining product type, notable distinctions emerge between hardwood and softwood variants. Hardwood pallets deliver exceptional load-bearing capacity and durability, making them the choice for heavy machinery and industrial shipments. In contrast, softwood pallets offer a lighter, more cost-effective solution suited to high-volume, short-haul applications where weight minimization drives efficiency.

Structural configuration through ply count further refines performance characteristics. Entry-level 3-ply pallets serve well in standardized domestic distribution, balancing minimal material use with sufficient rigidity. Five-ply constructions occupy the middle ground, blending weight savings with robust strength for retail and retail-to-home delivery. When maximum load stability is paramount, 7-ply pallets provide top-tier resilience, especially in export shipments and specialized industries requiring rigorous handling protocols.

Application-driven segmentation underscores the importance of environmental factors and handling modes. Pallets designed for air freight must adhere to strict weight and dimensional constraints, whereas rail and road shipment pallets prioritize impact resistance and stackability. Sea-bound pallets are engineered for moisture resistance and protective surface treatments. Beyond modal distinctions, exhibition pallets emphasize aesthetic finish for brand showcasing, and retail setting pallets often incorporate custom print or logo embossing. Specialty types such as refrigerated storage and high-bay warehouse pallets demand advanced surface treatments and engineered core materials to withstand temperature cycles and mechanical stress.

End-use segmentation reveals granular demand profiles across vertical industries. Automotive clients differentiate between aftermarket and original equipment manufacturing, requiring specialized certifications and traceability for just-in-time supply models. Category-driven sectors like beverages, dairy, and processed foods impose stringent hygiene standards and regulatory compliance, favoring pallets treated against contaminants. Electronics and pharmaceutical segments demand static dissipative finishes and precision tolerances to safeguard sensitive cargos.

Surface treatment options range from natural finishes, prized for their cost efficiency and circularity, to coated solutions including galvanized, painted, and varnished variants that extend service life and enable brand differentiation. Meanwhile, distribution channels encompass direct-to-manufacturer custom orders, distributor networks segmented into retail and wholesale models, and online retailer platforms via manufacturer websites or digital marketplaces, each shaping order volumes, lead times, and customization scope.

Together, these six segmentation axes form the strategic blueprint for product development and market positioning, enabling stakeholders to align plywood pallet offerings with exacting operational demands and value propositions.

This comprehensive research report categorizes the Plywood Pallet market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Ply Count

- Surface Treatment

- Distribution Channel

- Application

- End User

Comparative Regional Perspectives on Plywood Pallet Markets Spanning the Americas, Europe Middle East & Africa, and Asia-Pacific Dynamics

The Americas region presents a mature pallet landscape characterized by deep integration of supply chains across the United States, Canada, and Mexico. Under the USMCA framework, qualifying plywood pallets move duty-free, reinforcing cross-border manufacturing synergies and just-in-time distribution models. At the same time, Latin American markets demonstrate rapid urbanization and rising e-commerce penetration, though regulatory and infrastructure disparities can create fragmentation in pallet pooling and recycling programs.

In Europe, Middle East & Africa (EMEA), stringent environmental regulations such as the Packaging and Packaging Waste Regulation drive adoption of reusable and recyclable pallet solutions. The PPWR’s 40% reuse mandate by 2030 has catalyzed investments in pallet refurbishment networks and circuit pooling systems. Middle Eastern logistics hubs leverage infrastructure expansions to support regional trade corridors, while African markets exhibit growth potential despite logistical constraints, with pallet providers partnering on localized repair and recirculation schemes.

Asia-Pacific is dominated by high-capacity manufacturing nodes in China, Southeast Asia, and India. China continues to command substantial share in plywood production, though recent Section 301 tariffs have stimulated domestic pallet production ventures in neighboring countries. India’s growing industrial output is fostering investments in precision-engineered pallets, while Japan and South Korea prioritize high-quality EWPs. Regional trade agreements like the Regional Comprehensive Economic Partnership (RCEP) have lowered non-tariff barriers, facilitating the flow of plywood pallet components across member countries. In markets such as Australia and New Zealand, environmental stewardship has elevated demand for biodegradable and sustainably sourced pallet materials, aligning with national carbon reduction targets.

This comprehensive research report examines key regions that drive the evolution of the Plywood Pallet market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry-Leading Manufacturers and Service Providers Driving Innovation, Sustainability, and Efficiency in the Plywood Pallet Sector

Leading stakeholders in the plywood pallet ecosystem are deploying a variety of strategic initiatives to strengthen market positions. Major pallet pooling firms are integrating advanced tracking solutions into their fleets, exemplified by the imminent launch of ultra-light smart pallets equipped with Bluetooth Low Energy, GPS, and QR code functionality, which promise to enhance shipment visibility and reduce carbon emissions in cold-chain logistics.

Simultaneously, engineered wood product specialists are advancing manufacturing capabilities through automation. Robotic assembly lines and machine vision systems are being adopted to ensure consistent quality, accelerate throughput, and minimize labor costs. These investments are particularly pronounced among medium-sized producers seeking to differentiate on lead time and customization flexibility.

Sustainability credentials are becoming a key point of differentiation. Several prominent plywood manufacturers have secured Forest Stewardship Council and Sustainable Forestry Initiative certifications, underscoring commitments to responsible sourcing. Partnerships with logistics providers are focusing on closed-loop models, wherein pallets are repaired, reconditioned, and redeployed through dedicated refurbishment centers to prolong service life and reduce waste.

Additionally, smaller niche players are carving out market share by offering bespoke pallet designs tailored to specific end-user requirements, such as static-dissipative finishes for electronics or moisture-barrier laminates for refrigerated storage. By coupling material science expertise with agile production techniques, these firms are capitalizing on rising demand for specialized pallet solutions within high-value verticals.

This comprehensive research report delivers an in-depth overview of the principal market players in the Plywood Pallet market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Austral Plywoods Pty Ltd

- Boise Cascade Company

- Brambles Limited

- Century Plyboards (India) Ltd.

- Eksons Corporation Berhad

- Georgia-Pacific LLC

- Kamps Pallets, Inc.

- Latvijas Finieris AS

- Litco International Inc.

- Loscam International Holdings Co. Ltd.

- Metsäliitto Cooperative

- Millwood, Inc.

- NEFAB Group

- PalletOne, Inc.

- PECO Pallet, Inc.

- PotlatchDeltic Corporation

- SVEZA Forest Ltd.

- UFP Industries, Inc.

- UPM-Kymmene Oyj

- Weyerhaeuser Company

Strategic Imperatives and Actionable Recommendations for Industry Leaders to Capitalize on Shifting Tariffs, Sustainability Mandates, and Technological Advances

To thrive amidst evolving tariffs, sustainability mandates, and technological disruption, industry leaders should prioritize several strategic imperatives. First, advancing digital capabilities by embedding IoT sensors and data analytics platforms into pallet fleets will deliver actionable insights on utilization, condition, and life cycle costs, enabling proactive maintenance and operational agility.

Second, embracing circular economy frameworks through pallet pooling, refurbishment networks, and material recycling will not only comply with regulatory reuse mandates but also generate long-term cost savings and brand differentiation in increasingly eco-conscious markets.

Third, diversifying supply chains by establishing regional manufacturing hubs and developing multi-sourcing strategies will mitigate the impact of tariff fluctuations and trade policy uncertainties, ensuring resilient cargo flows.

Finally, collaborating with regulatory bodies and standardization entities to shape policy frameworks around sustainable packaging and pallet recycling will position organizations as trusted partners in advancing industry-wide environmental and safety objectives.

Comprehensive Research Methodology Integrating Primary Interviews, Secondary Data Sources, and Rigorous Analytical Frameworks for Enhanced Market Intelligence

This research integrates a multifaceted approach combining primary and secondary methodologies to deliver robust, actionable insights. Primary research was conducted through in-depth interviews with senior executives, operations managers, and supply chain experts across leading pallet manufacturers, logistics service providers, and industrial end users. These qualitative engagements enriched the analysis with real-world perspectives on emerging trends and strategic priorities.

Secondary research encompassed a comprehensive review of publicly accessible resources, including the U.S. Harmonized Tariff Schedule, federal trade announcements, industry association publications, and thought leadership reports. Proprietary customs data and trade flow statistics were leveraged to quantify import-export patterns and tariff impacts.

Data triangulation methodologies were employed to reconcile findings from diverse sources, ensuring consistency and reliability of conclusions. Quantitative analysis models were supplemented by scenario planning and sensitivity testing to evaluate the effects of policy changes and macroeconomic variables. The final deliverable underwent rigorous validation through peer review by subject matter experts to guarantee methodological integrity and practical relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Plywood Pallet market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Plywood Pallet Market, by Product Type

- Plywood Pallet Market, by Ply Count

- Plywood Pallet Market, by Surface Treatment

- Plywood Pallet Market, by Distribution Channel

- Plywood Pallet Market, by Application

- Plywood Pallet Market, by End User

- Plywood Pallet Market, by Region

- Plywood Pallet Market, by Group

- Plywood Pallet Market, by Country

- United States Plywood Pallet Market

- China Plywood Pallet Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Conclusive Insights on the Strategic Trajectory of the Plywood Pallet Market Amidst Evolving Trade Landscapes and Sustainability Drivers

In conclusion, the plywood pallet market is at a strategic inflection point shaped by the interplay of e-commerce acceleration, sustainability imperatives, digital transformation, and trade policy dynamics. Organizations that proactively embrace smart pallet technologies, circular economy practices, and diversified sourcing models will gain decisive advantage in cost control, regulatory compliance, and supply chain resilience. As tariffs and environmental regulations continue to evolve, maintaining real-time visibility and adaptability across procurement, manufacturing, and distribution processes will be critical. By aligning segmented product offerings with regional market demands and forging collaborative partnerships across the value chain, industry participants can capitalize on growth opportunities and navigate uncertainties with confidence.

Engage with Ketan Rohom to Secure Your Plywood Pallet Market Research Report Tailored to Your Strategic Needs and Growth Objectives

For tailored guidance on leveraging these insights to drive operational excellence and competitive advantage, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan can provide detailed pricing, answer questions about the report’s scope, and outline how the research can align with your organization’s strategic priorities. Secure your comprehensive Plywood Pallet Market Research Report today to stay ahead in a rapidly evolving landscape.

- How big is the Plywood Pallet Market?

- What is the Plywood Pallet Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?