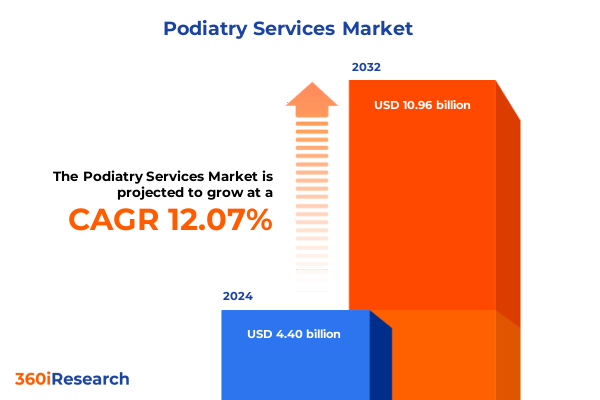

The Podiatry Services Market size was estimated at USD 4.91 billion in 2025 and expected to reach USD 5.48 billion in 2026, at a CAGR of 12.13% to reach USD 10.96 billion by 2032.

Setting a Comprehensive Framework to Explore Critical Drivers, Stakeholder Priorities, and Emerging Trends Shaping the Future of Podiatry Services

In a dynamic healthcare environment characterized by shifting patient needs, regulatory evolution, and technological advancements, understanding the current state of podiatry services has never been more critical. This executive summary provides a clear window into the complexities and nuances of a market where prevention, diagnosis, and treatment modalities are converging to redefine care delivery. Building on an extensive research framework, the analysis unfolds across service types, product categories, and end-user segments to illuminate the strategic levers that stakeholders must navigate.

By setting the stage with foundational context, this introduction positions readers to grasp both macro forces-such as demographic trends and policy changes-and micro dynamics, including provider adoption patterns and patient preferences. The discussion underscores how integrative approaches, from diabetic foot management programs to advanced surgical platforms, are creating pathways for improved outcomes. Ultimately, this section invites decision-makers to engage with a holistic overview that bridges clinical priorities and business considerations, ensuring that subsequent insights resonate with both experts and leaders seeking actionable perspectives.

Charting the Evolution of Podiatry Services Through Digital Health Integration, Advanced Materials, and Collaborative Care Ecosystems

Over the past several years, the podiatry services landscape has undergone transformative shifts driven by advancements in digital health, a growing emphasis on preventive care, and evolving reimbursement models. Telemedicine platforms have expanded access to primary diagnostics, enabling early intervention and reducing downstream complications. Concurrently, artificial intelligence and data analytics have begun to inform risk stratification tools, allowing providers to tailor prevention protocols and diagnostic pathways more efficiently than ever before.

Moreover, the integration of personalized therapeutic footwear and orthotic devices has progressed beyond standard sizing, leveraging materials science innovations to deliver custom-fit solutions with superior patient compliance. In surgical domains, minimally invasive techniques paired with robotic assistance are gaining traction, offering enhanced precision and reduced recovery times. These converging forces are redefining patient journeys from assessment through post-treatment monitoring, establishing a multi-modal continuum of care that aligns clinical efficacy with operational efficiency.

As stakeholders adapt to these paradigm shifts, collaborations among technology developers, healthcare institutions, and payers are becoming pivotal. Such partnerships are catalyzing the development of integrated care ecosystems, where digital triage, remote monitoring, and in-person interventions coalesce. The cumulative effect is an industry trajectory that prioritizes proactive, patient-centered strategies over reactive interventions, signaling a new era of optimized outcomes and cost management.

Analyzing How 2025 Trade Policy Adjustments Are Reshaping Supply Networks and Cost Structures in Podiatry Services

The introduction of United States tariffs in early 2025 has created a ripple effect across the podiatry services supply chain, influencing the availability and pricing of critical components such as specialized footwear, orthotics, and surgical devices. Manufacturers reliant on imported raw materials and finished goods have faced increased costs, with many passing these expenses downstream. As a result, providers are evaluating procurement strategies to mitigate budgetary pressures without compromising quality or delaying patient care.

In response, several domestic producers have accelerated efforts to localize manufacturing, investing in automated fabrication lines for custom orthotic molds and strengthening relationships with regional suppliers. This shift has expanded capacity for onshore production of both off-the-shelf and custom-made bracing solutions, enhancing responsiveness to clinician specifications. Similarly, footwear designers have adjusted material sourcing, substituting certain alloys and polymers to maintain performance while navigating tariff-induced price surges.

These adaptive measures underscore the industry’s resilience, yet they also highlight the importance of strategic agility. Payer negotiations are recalibrating reimbursement schedules to account for new cost structures, and health systems are reassessing vendor agreements to secure more favorable terms. Ultimately, the cumulative impact of 2025 tariffs is accelerating a recalibration of global supply networks, prompting stakeholders to embrace diversified sourcing, flexible contract models, and collaborative partnerships to sustain service continuity and cost-effectiveness.

Uncovering Distinct Opportunities and Clinical Innovations Across Evaluation, Prevention, Device Portfolio, and End-User Applications

Dissecting the podiatry services market through multiple segmentation lenses reveals unique drivers and growth opportunities across service types. When examining service categories, diagnostic offerings are evolving with enhanced imaging modalities and point-of-care testing that streamline early detection of conditions such as neuropathy and vascular insufficiencies. Prevention services are gaining prominence, particularly through multidisciplinary clinics that integrate podiatric assessments with diabetic education programs. Treatment segments continue to diversify, encompassing advanced wound care, pharmacological interventions, and minimally invasive surgical techniques designed to restore function and mobility.

Turning to product type segmentation, the footwear category commands significant attention, with diabetic footwear innovations and therapeutic shoes leveraging breathable fabrics and pressure redistribution technologies. Orthotics and braces have bifurcated into custom-made devices, which employ 3D scanning and printing to match patient anatomy precisely, and off-the-shelf models that prioritize cost efficiency and rapid deployment. Surgical devices further complement treatment pathways, with high-precision fixation systems and next-generation implants enhancing procedural outcomes while reducing complication rates.

Finally, viewing the market through the lens of end users underscores the varied demand patterns across academic and research institutions, home care providers, and hospitals and clinics. Academic centers drive innovation through clinical trials and collaborative studies, contributing to evidence-based standards. Home care services expand access to vulnerable populations, emphasizing continuity of care through remote monitoring and mobile clinics. Hospitals and clinics remain pivotal, serving as high-volume hubs that integrate diagnostics, preventive protocols, and acute treatments under unified care models.

This comprehensive research report categorizes the Podiatry Services market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Service Type

- Podiatry Product Type

- End User

Highlighting Divergent Growth Drivers and Infrastructure Strategies Across Americas, EMEA, and Asia-Pacific Podiatry Markets

Regional dynamics within the podiatry services domain reveal differentiated growth vectors and strategic imperatives based on geographic considerations. In the Americas, rising prevalence of chronic conditions such as diabetes and peripheral arterial disease is fueling demand for comprehensive diabetic foot care programs. North American markets are characterized by robust private and public payer systems, incentivizing preventive care packages that integrate diagnostic and therapeutic workflows. Latin American providers, meanwhile, are leveraging mobile clinics and telehealth platforms to overcome infrastructure constraints and broaden rural outreach.

The Europe, Middle East & Africa region exhibits a diverse regulatory environment, with Western European nations emphasizing strict quality standards and reimbursement frameworks that reward outcome-based care. In the Middle East, investments in state-of-the-art orthopedic centers are driving uptake of advanced surgical and orthotic solutions. Meanwhile, parts of Africa are witnessing the emergence of social enterprise models that deliver basic podiatry services at scale, often paired with community health initiatives to bolster local capacity.

Across Asia-Pacific, demographic shifts, including aging populations in Japan and South Korea and rising healthcare expenditure in China and India, are creating fertile ground for specialized podiatry offerings. Domestic manufacturers are enhancing their portfolios through strategic alliances, positioning regional product lines that address unique anatomical, cultural, and economic factors. Concurrently, digital health adoption-including remote gait analysis and app-based patient engagement-continues to accelerate, reshaping both urban centers and emerging markets.

This comprehensive research report examines key regions that drive the evolution of the Podiatry Services market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling How Leading Market Participants Are Innovating Through Partnerships, Acquisitions, and Outcome-Based Collaborations

Leading companies in the podiatry services ecosystem are distinguishing themselves through a combination of technological innovation and strategic collaborations. Firms specializing in therapeutic footwear have forged partnerships with material science startups to integrate smart-sensing insoles that monitor pressure points and deliver real-time alerts to clinicians. Orthotic and brace manufacturers are aligning with telehealth providers to offer subscription-based maintenance and replacement services, ensuring consistent patient adherence and data continuity.

On the surgical devices front, major medtech players have expanded portfolios by acquiring niche firms with expertise in minimally invasive podiatric procedures. These acquisitions have accelerated the rollout of advanced fixation systems, biologic implants, and navigation-assisted platforms. Concurrently, distributors and service providers are enhancing their value proposition through training programs and digital repositories of best practices, empowering clinicians to adopt new technologies more rapidly.

Furthermore, integrated care networks, including hospital systems and specialty clinics, are collaborating with research institutions to conduct outcome-based studies and share data insights. These alliances not only validate emerging technologies but also inform payer negotiations, leading to reimbursement frameworks that support evidence-based interventions. Collectively, these corporate strategies underscore a shift toward ecosystem-driven models, where shared expertise and aligned incentives fuel sustained innovation and patient-centric care delivery.

This comprehensive research report delivers an in-depth overview of the principal market players in the Podiatry Services market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Apollo Hospitals Enterprise Limited

- Beijing Puhua International Hospital Co., Ltd.

- Cleveland Clinic Foundation

- Foot and Ankle Specialists of the Mid-Atlantic, P.A.

- Fortis Healthcare Limited

- HCA Healthcare, Inc.

- Kaiser Foundation Health Plan, Inc.

- Massachusetts General Hospital Corporation

- Max Healthcare Institute Limited

- Mayo Foundation for Medical Education and Research

- Nuffield Health Enterprises Limited

- Ramsay Health Care Limited

- Schön Klinik SE

- The London Podiatry Centre Limited

- Universal Health Services, Inc.

Implementing Strategic Initiatives to Enhance Digital Integration, Supply Chain Resilience, and Collaborative Innovation

To navigate the evolving podiatry services market, industry leaders should prioritize investing in digital infrastructure that supports remote diagnostics and patient engagement. Building integrated platforms connecting wearable sensors, telemedicine consultations, and electronic health records will streamline workflows, enhance data-driven decision making, and foster patient loyalty through continuous touchpoints. Equally important is the diversification of supply chains by cultivating relationships with multiple regional manufacturers and exploring nearshoring opportunities to mitigate tariff-related disruptions.

In parallel, companies should deepen collaborations with healthcare systems and academic centers to co-develop evidence-based protocols and clinical trials. This approach not only validates product efficacy but also accelerates reimbursement approvals and adoption velocity. Leaders are advised to expand preventive care portfolios by offering comprehensive foot health programs-bundling screenings, therapeutic footwear, and lifestyle coaching-that address patient needs holistically and drive long-term engagement.

Finally, fostering a culture of innovation through cross-functional teams will be instrumental in surfacing novel solutions and improving time-to-market. By integrating insights from clinicians, data scientists, and supply chain experts, organizations can iterate rapidly on product design and service delivery models. Collectively, these actionable steps will position stakeholders to capture emerging opportunities, enhance operational resilience, and deliver superior patient outcomes in a competitive landscape.

Employing a Robust Multi-Source Methodology Combining Secondary Data, Expert Interviews, and Quantitative Validation Techniques

The research methodology underpinning this analysis draws on a rigorous, multi-faceted approach to ensure robust, reliable insights. Initially, exhaustive secondary research was conducted, encompassing peer-reviewed journals, regulatory publications, patent filings, and industry whitepapers to map foundational trends and identify knowledge gaps. This phase established a comprehensive baseline of market definitions, technological advancements, and policy frameworks.

Subsequently, primary research efforts engaged a diverse cohort of stakeholders, including podiatric specialists, product developers, procurement executives, and regulatory officials. Through structured interviews and targeted surveys, qualitative perspectives were captured on unmet needs, adoption barriers, and future priorities. Quantitative validation followed, leveraging anonymized data sets and proprietary databases to confirm thematic findings and quantify emerging patterns without revealing proprietary metrics.

Finally, data triangulation techniques were applied to reconcile insights from multiple sources, ensuring consistency and mitigating bias. Cross-comparison analyses were performed to validate assumptions across geographic regions and segmentation categories. This layered methodology has produced a coherent and nuanced understanding of the podiatry services landscape, grounded in both empirical evidence and expert judgment, offering a robust foundation for strategic decision-making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Podiatry Services market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Podiatry Services Market, by Service Type

- Podiatry Services Market, by Podiatry Product Type

- Podiatry Services Market, by End User

- Podiatry Services Market, by Region

- Podiatry Services Market, by Group

- Podiatry Services Market, by Country

- United States Podiatry Services Market

- China Podiatry Services Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 954 ]

Concluding Reflections on Strategic Imperatives, Collaborative Advances, and Adaptive Resilience in Podiatry Services Market Evolution

As the podiatry services market continues its transformation-from preventive care integration to digital health adoption and tariff-induced supply realignments-stakeholders face a landscape rich with both opportunity and complexity. The convergence of advanced diagnostics, personalized treatment modalities, and outcome-focused collaborations is setting new standards for patient-centric care, while regional and regulatory disparities underscore the importance of localized strategies.

Moving forward, success will hinge on the ability to leverage data-driven insights, foster cross-sector partnerships, and maintain operational flexibility in the face of policy shifts. Organizations that proactively invest in digital infrastructure, diversify their supply chains, and engage in evidence-based alliances will be best positioned to capture value and drive sustainable growth. Ultimately, the insights presented here serve as a strategic compass, guiding leaders toward informed decisions that balance clinical efficacy, cost efficiency, and patient satisfaction in an ever-evolving healthcare paradigm.

Drive Growth and Secure Competitive Advantage with Expert Guidance to Purchase the Definitive Podiatry Services Market Research Report

Ensuring your organization remains at the forefront of the podiatry services industry requires access to data-driven insights, comprehensive market intelligence, and expert analysis. Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy of this definitive market research report. Gain clarity on emerging trends, regulatory impacts, and strategic opportunities that will shape your roadmap for growth and innovation. With personalized consultation, explore tailored solutions that align with your business objectives and drive sustainable value across your service offerings. Don’t miss this opportunity to empower your team with the actionable intelligence needed to make confident, forward-looking decisions in a competitive landscape.

- How big is the Podiatry Services Market?

- What is the Podiatry Services Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?