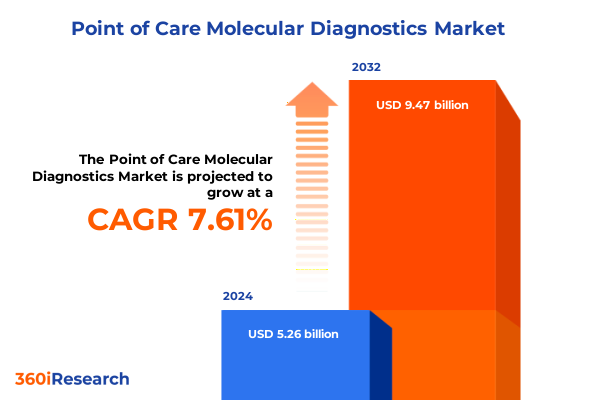

The Point of Care Molecular Diagnostics Market size was estimated at USD 5.64 billion in 2025 and expected to reach USD 6.06 billion in 2026, at a CAGR of 7.66% to reach USD 9.47 billion by 2032.

Exploring the Critical Emergence and Strategic Significance of Point-of-Care Molecular Diagnostics in Transforming Clinical Decision Making Worldwide

The field of point-of-care molecular diagnostics has emerged as a vital component within modern healthcare pathways, offering rapid and accurate detection capabilities that can significantly improve patient outcomes. In recent years, technological advancements in assay sensitivity, miniaturization of instruments, and integration of software analytics have collectively empowered clinicians to make informed decisions at the bedside. This shift toward decentralizing diagnostic testing is not only reshaping operational workflows within hospitals and clinics but also broadening access in home care settings.

Uncovering the Pivotal Technological Advancements and Market Dynamics Reshaping Point-of-Care Molecular Diagnostics Into a New Era of Rapid Testing

The landscape of point-of-care molecular diagnostics is undergoing transformative shifts driven by converging trends in technology, regulation, and patient-centric care. Innovations in microfluidic design and digital connectivity now enable portable and wearable platforms to deliver near-laboratory performance in underserved environments. Meanwhile, stringent regulatory frameworks have sparked an emphasis on robust quality control and faster approval pathways, accelerating the adoption of novel assays for infectious disease and oncology applications.

Moreover, strategic partnerships between diagnostic developers and health systems have catalyzed a move from centralized laboratories toward integrated point-of-care networks. This trend highlights the growing importance of real-time data analytics, where software platforms synthesize molecular results with electronic health records to guide precision medicine initiatives. As these shifts continue, the competitive dynamics within the industry are being redefined by new entrants and alliances eager to capitalize on the demand for faster, more flexible diagnostic solutions.

Analyzing the Strategic Consequences of 2025 United States Tariff Measures on Supply Chains and Operational Costs in Point-of-Care Molecular Diagnostics

In 2025, the imposition of additional United States tariffs on critical raw materials and diagnostic components has posed complex challenges for manufacturers and distributors of point-of-care platforms. These measures have disrupted established supply chains, leading companies to reassess sourcing strategies for reagents and kits. As a result, organizations are investing in nearshoring initiatives, relocating key manufacturing processes closer to domestic markets to mitigate tariff exposure and ensure supply continuity.

Simultaneously, the cost pressures associated with higher import duties have prompted diagnostic developers to optimize instrument designs and reagent formulations. By streamlining workflows and reducing consumable dependencies, companies are striving to balance affordability with performance. These strategic adjustments underscore a broader industry commitment to maintaining access to rapid molecular testing in face of evolving trade policies, ensuring that clinicians and patients can continue to rely on point-of-care solutions without compromising financial sustainability.

Deriving Strategic Insights from Diverse Product Types Formats Applications and End Users to Illuminate Nuanced Demand Drivers in Molecular Diagnostics

A nuanced understanding of market segmentation reveals the diverse drivers shaping demand for point-of-care molecular diagnostics. Instruments, reagents and kits, and software each play distinct roles in the diagnostic ecosystem, with instruments serving as the foundational hardware, reagents and kits providing assay-specific consumables, and software enabling data interpretation and connectivity. The balance among these product types influences procurement decisions across healthcare settings.

The form factor of diagnostic solutions further differentiates market opportunities. Benchtop platforms often anchor central laboratories with high-throughput needs, whereas portable devices empower clinician-led testing in urgent care or rural clinics. Emerging wearable formats represent a frontier in continuous monitoring, offering prospects for real-time disease management. These format-based variations reflect the importance of aligning technological capabilities with end-user workflows.

Applications span cardiology, genetic testing, infectious disease, and oncology, each with layered subsegments. Genetic testing encompasses carrier screening, newborn screening, and prenatal testing, while infectious disease comprises gastrointestinal infections, respiratory infections, sexually transmitted infections, and tropical diseases. Oncology applications are further delineated into liquid biopsy, mutation profiling, and oncogene panels. Together, these application categories guide research investments and define the regulatory pathways for assay approval.

End users such as clinics, diagnostic laboratories, home care settings, and hospitals have unique requirements, from throughput and ease of use to connectivity and cost containment. Recognizing these nuances enables stakeholders to tailor solutions that resonate with specific clinical environments, driving adoption and enhancing patient care outcomes.

This comprehensive research report categorizes the Point of Care Molecular Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Application

- End User

Exploring Distinct Regional Dynamics and Strategic Growth Catalysts Across the Americas Europe Middle East Africa and Asia Pacific for Accelerated Diagnostic Adoption

Regional dynamics exert profound influence on the evolution of point-of-care molecular diagnostics, as varying infrastructure maturity and regulatory frameworks shape adoption patterns. In the Americas, robust private–public partnerships and established healthcare networks have accelerated integration of rapid molecular testing for infectious disease management and personalized oncology workflows. This synergy underscores a regional emphasis on precision medicine and value-based care models.

Across Europe, the Middle East, and Africa, regulatory harmonization efforts and funding initiatives are driving expansion of point-of-care capabilities. In Western Europe, established reimbursement pathways support early adoption, while emerging markets in the Middle East and Africa benefit from targeted investments in decentralizing diagnostic services. These trends highlight the importance of adaptable technologies that can operate reliably in diverse resource settings.

The Asia-Pacific region presents a dynamic blend of market maturity and growth potential. Countries with advanced healthcare infrastructure are prioritizing integration of point-of-care diagnostics into chronic disease management, whereas lower-tier markets are leveraging portable molecular platforms to strengthen infectious disease surveillance. The regional focus on public health preparedness and pandemic response readiness continues to stimulate demand for flexible, user-friendly solutions that can be deployed at scale.

This comprehensive research report examines key regions that drive the evolution of the Point of Care Molecular Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Positioning Collaborative Innovations and Competitive Differentiators Among Leading Global Organizations in Point-of-Care Molecular Diagnostics

Leading companies in point-of-care molecular diagnostics are differentiating through a combination of technological innovation, strategic alliances, and targeted acquisitions. Key industry players have expanded their portfolios by integrating advanced assay chemistries with modular instrument architectures, thereby delivering solutions that accommodate evolving clinical needs. Collaborative ventures between diagnostics firms and software developers are further augmenting value propositions by embedding data analytics and remote monitoring features into next-generation platforms.

Competitive differentiation also emerges through manufacturing optimization, with organizations adopting lean production methodologies to improve margins and accelerate time to market. These improvements are complemented by customer support models designed to streamline implementation and training, reducing barriers to adoption in decentralized settings. As intellectual property landscapes evolve, partnerships with academic institutions and research consortia are enabling early access to emerging biomarkers and assay targets, ensuring that leading companies maintain a robust innovation pipeline.

This comprehensive research report delivers an in-depth overview of the principal market players in the Point of Care Molecular Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbott Laboratories

- ACON LABS INC.

- Becton, Dickinson and Company

- Binx Health, inc.

- Bio-Rad Laboratories, Inc.

- bioMérieux SA

- Cardinal Health, Inc.

- Chembio Diagnostics Inc.

- Co-Diagnostics, Inc.

- Danaher Corporation

- DiaSorin S.p.A

- EKF Diagnostics Holdings

- Exact Sciences Corporation

- FHoffmann-La Roche AG

- Genomadix Inc. by LuminUltra Technologies Ltd.

- Grifols, S.A

- Henry Schein, Inc.

- Hologic, Inc.

- IDEXX Laboratories, Inc.

- Johnson & Johnson Services, Inc.

- Lumos Diagnostics

- Meridian Bioscience, Inc.

- Natera, Inc.

- Novartis AG

- OraSure Technologies, Inc.

- Pfizer, Inc.

- QIAGEN N.V.

- Quidel Corporation

- SD Biosensor

- Sekisui Diagnostics

- SHUWEN BIOTECH CO., LTD

- Siemens Healthineers AG

- Sonic Healthcare Limited

- SYNLAB Group

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

Guiding Strategic Decisions with Actionable Insights and Operational Frameworks to Enhance Competitiveness and Innovation in Point-of-Care Molecular Diagnostics

To maintain a competitive edge, industry leaders should prioritize investments in integrated digital ecosystems that connect point-of-care instruments with cloud-based analytics. This approach not only enhances real-time decision support but also facilitates predictive maintenance and remote quality assurance. In parallel, organizations must cultivate agile supply chain strategies that incorporate regional manufacturing hubs to mitigate geopolitical risks and tariff-related disruptions.

Further, aligning research and development efforts with end-user priorities-such as streamlined workflows in home care or high-throughput testing in hospital laboratories-can accelerate market adoption and foster stronger customer loyalty. Stakeholders should also explore collaborative frameworks with healthcare providers and payers to demonstrate clinical and economic value, thereby securing favorable reimbursement pathways. By adopting these strategic imperatives, companies can position themselves to capitalize on emerging opportunities and navigate evolving regulatory landscapes with confidence.

Detailing the Rigorous Research Methodology Data Sources Validation Procedures and Analytical Frameworks Underpinning the Point-of-Care Molecular Diagnostics Study

This analysis is underpinned by a multifaceted research methodology combining primary and secondary data sources. Primary research encompassed in-depth interviews with industry executives, clinical laboratory directors, and regulatory experts to capture firsthand perspectives on technology adoption and market dynamics. Secondary research involved systematic review of scientific publications, regulatory filings, and proprietary databases to validate trends and extract detailed insights into assay performance and market segmentation.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Point of Care Molecular Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Point of Care Molecular Diagnostics Market, by Product Type

- Point of Care Molecular Diagnostics Market, by Technology

- Point of Care Molecular Diagnostics Market, by Application

- Point of Care Molecular Diagnostics Market, by End User

- Point of Care Molecular Diagnostics Market, by Region

- Point of Care Molecular Diagnostics Market, by Group

- Point of Care Molecular Diagnostics Market, by Country

- United States Point of Care Molecular Diagnostics Market

- China Point of Care Molecular Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings Strategic Implications and Future Outlook to Enable Informed Decision Making in the Point-of-Care Molecular Diagnostics Landscape

In synthesizing the key findings, it is clear that point-of-care molecular diagnostics is transitioning from a niche capability to a cornerstone of modern healthcare delivery. Technological innovations and strategic realignments are driving broader adoption across diverse clinical settings, while regional and regulatory factors continue to shape the competitive landscape. The nuances in product types, formats, applications, and end users underscore the importance of tailored solutions that can adapt to specific healthcare environments.

As market participants navigate the challenges of supply chain disruptions, tariff pressures, and reimbursement complexities, the ability to anticipate and respond to evolving clinical demands will determine long-term success. Ultimately, the integration of advanced molecular diagnostics at the point of care holds the promise of enhancing patient outcomes, optimizing healthcare resource utilization, and enabling data-driven decision making on a global scale.

Engage with Ketan Rohom to Access Comprehensive Point-of-Care Molecular Diagnostics Research and Propel Strategic Growth Opportunities Today

For a deeper exploration of point-of-care molecular diagnostics market trends and to secure customized insights that drive strategic outcomes, we invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing. His expertise in translating complex research into actionable business strategies ensures you receive tailored recommendations aligned with your organizational objectives. By engaging with Ketan Rohom, you will gain prioritized access to proprietary data, in-depth analysis, and comprehensive guidance to bolster your competitive positioning. This collaboration will empower your team with the clarity needed to navigate regulatory shifts, supply chain challenges, and evolving clinical demands. Reach out to Ketan Rohom today to discuss how this report can be customized to your specific use case and to accelerate your decision-making process with confidence and precision.

- How big is the Point of Care Molecular Diagnostics Market?

- What is the Point of Care Molecular Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?