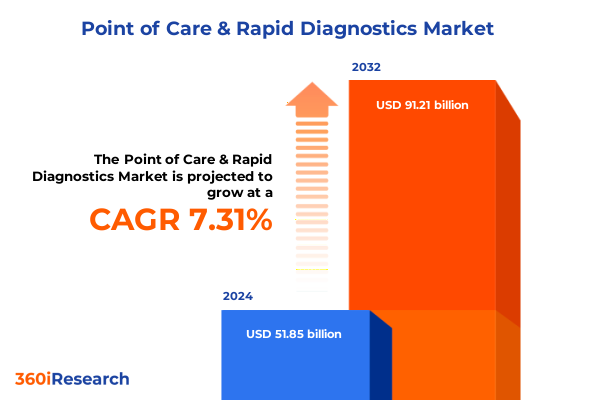

The Point of Care & Rapid Diagnostics Market size was estimated at USD 55.61 billion in 2025 and expected to reach USD 59.96 billion in 2026, at a CAGR of 7.32% to reach USD 91.21 billion by 2032.

Unveiling the Critical Emergence of Point of Care and Rapid Diagnostics as a Cornerstone of Decentralized Healthcare Delivery

As healthcare delivery continues its shift towards more patient-centric models, point of care and rapid diagnostics have emerged as indispensable components of modern clinical practice. Driven by the imperatives to accelerate diagnosis, reduce hospital stays, and optimize resource utilization, these technologies offer immediate insights at or near the patient’s bedside. Recent advances in microfluidic platforms have enabled compact, portable devices to perform complex biochemical analyses on minimal sample volumes, transforming routine clinical workflows and extending diagnostic reach into ambulatory, home, and remote settings. The growing imperative to decentralize testing-strengthened by pandemic preparedness initiatives, increasing prevalence of chronic diseases, and demand for value-based care-has placed point of care diagnostics at the forefront of healthcare system priorities.

Moreover, the integration of digital technologies and biosensors with artificial intelligence and cloud connectivity is reshaping diagnostic accuracy and accessibility. AI-enabled biosensors can analyze data streams from finger-stick blood samples, saliva, or sweat, providing real-time alerts and predictive analytics that preempt critical events. This convergence of miniaturized assay chemistry, advanced data interpretation, and automated workflows is not only improving detection of infectious agents and cardiac markers but also supporting chronic disease monitoring, such as glycemic management and coagulation testing, outside the central laboratory environment. Consequently, point of care diagnostics are becoming integral to proactive patient management, offering clinicians and care teams unprecedented agility and precision.

Revolutionizing Patient Outcomes Through Converging Technologies and Innovative Platforms Shaping the Future of Point of Care Testing

The dynamics driving point of care and rapid diagnostics are marked by a confluence of technological breakthroughs and evolving care models. Among the most significant shifts is the refinement of microfluidic lab-on-a-chip platforms, which now perform multiplexed assays for molecular diagnostics, immunoassays, and cell analysis within a single disposable cartridge. These devices harness automated fluid handling and biosensor integration to deliver high-throughput results without compromising sensitivity, thereby enabling on-demand testing in emergency departments, ambulatory settings, and field operations. The adoption of digital microfluidics-where droplets are manipulated by precise electrical fields-further enhances assay customization, minimizes reagent consumption, and supports rapid assay development for emerging pathogens.

In parallel, the convergence of artificial intelligence, machine learning, and wearable connectivity is ushering in a new era of proactive diagnostics. AI algorithms, trained on vast datasets, are embedded into point of care platforms to automate image analysis, pattern recognition, and predictive modeling, thereby reducing human error and enabling real-time decision support. Wearable microfluidic sensors, now capable of continuous monitoring for metabolites and biomarkers, stream data to cloud-based analytics engines that can trigger clinical interventions before symptomatic onset occurs. These transformative shifts are redefining the interface between diagnostics and digital health, bridging the gap between in vitro testing and personalized medicine.

Assessing the Cumulative Repercussions of United States Tariff Policy Changes on Rapid Diagnostic Supply Chains and Cost Structures in 2025

Recent updates to United States trade policy have introduced a complex layer of cost pressures and supply chain considerations for the point of care diagnostics sector. Under the Section 301 framework, tariffs on imported medical devices and consumables originating from mainland China have been incrementally raised-ranging from 25% on facemasks and respirators to 100% on syringes and needles-while Canadian and Mexican imports face a 25% duty on non-USMCA goods. This escalation compounds the universal 10% tariff applied to most goods since April 2025, resulting in cumulative duties that in some cases exceed 145%. The immediate effect has been an uptick in unit costs for test kits, reagents, and instrument components, prompting manufacturers and laboratories to reassess procurement strategies and consider nearshoring alternatives.

Industry stakeholders have been vocal about the ramifications of these measures. Leading manufacturers and trade associations warn that elevated tariffs threaten to inflate healthcare expenditures and risk shortages of critical diagnostics at the point of care. For instance, disruptions in the supply of disposable cartridges and microfluidic reagents could extend turnaround times and undermine the rapid testing protocols essential for emergency care and infectious disease management. In response, companies such as Danaher are executing regional manufacturing rebalancing, diversifying supplier portfolios, and implementing surcharges to offset duties-measures projected to mitigate a forecasted impact of approximately $350 million on annual profitability. These strategic adaptations underscore the necessity for resilience and agility in an intensifying trade environment.

Decoding Market Dynamics Through Multi-Dimensional Segmentation Insights Spanning Products Technologies Test Types End Users and Distribution Channels

A nuanced understanding of market segmentation reveals distinct growth trajectories and competitive dynamics across the point of care and rapid diagnostics landscape. When products are categorized by type, consumables-including reagents and test kits-drive recurring revenue streams and require ongoing innovation to enhance shelf life, stability, and assay performance. Instruments, encompassing analyzers and readers, serve as the technological backbone, where investments in throughput, connectivity, and miniaturization influence adoption rates across clinical and non-clinical settings. Software and services-including data management platforms and customer support-provide the ecosystem that integrates decentralized testing into broader health information systems and ensures compliance with regulatory standards.

From a technology standpoint, clinical chemistry and hematology assays remain foundational, while immunoassays and molecular diagnostics are expanding rapidly due to their high sensitivity and ability to detect emerging pathogens. Test types focusing on cardiac markers and coagulation are established within acute care, whereas glucose monitoring, infectious diseases, and pregnancy and fertility testing illustrate how rapid diagnostics are permeating both chronic disease management and preventive health. End users range from ambulatory care centers and clinics-where rapid decision making is paramount-to diagnostic laboratories and home care settings that benefit from remote monitoring and telehealth models. Hospitals continue to deploy POC solutions for critical care pathways, leveraging integration with electronic health records to support clinical workflows. Meanwhile, applications such as cardiac care, coagulation testing, diabetes management, infectious disease diagnostics, oncology, and pregnancy testing reflect the expanding clinical scope of rapid diagnostics. Finally, distribution channels through direct sales, distributors, e-commerce platforms, and online retail define how products reach diverse end users globally, emphasizing the importance of omnichannel strategies and supply chain transparency.

This comprehensive research report categorizes the Point of Care & Rapid Diagnostics market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Technology

- Test Type

- End User

- Application

- Distribution Channel

Examining Regional Market Drivers and Barriers Influencing Point of Care and Rapid Diagnostics Across Americas EMEA and Asia-Pacific

The point of care and rapid diagnostics market exhibits marked variations across geographies, influenced by regulatory frameworks, healthcare infrastructure, and economic dynamics. In the Americas, North America leads adoption, driven by favorable reimbursement policies, high healthcare spending, and robust digital health initiatives that accelerate integration of POC testing into clinical practice. The United States, in particular, benefits from decentralized testing pilot programs and strong government support for rural health networks, positioning it as a focal point for product launches and clinical validation studies.

In Europe, the Middle East, and Africa, heterogeneous regulatory landscapes present both opportunities and challenges. While the European Union’s In Vitro Diagnostic Regulation establishes high standards for safety and performance, it also streamlines market access across member states, encouraging multinationals to invest in regional manufacturing hubs and collaborative research efforts. Healthcare systems in the Middle East are increasingly funding digital labs and telehealth platforms to expand diagnostic reach, while Africa’s growing emphasis on infectious disease surveillance and community-based testing underscores the need for cost-effective, portable POC solutions.

Asia-Pacific stands out for its rapid uptake of innovative diagnostic technologies, propelled by large patient populations, growing healthcare investments, and policy initiatives to expand rural healthcare access. Governments in China and India are incentivizing local production and adoption of rapid diagnostic devices, while countries such as Australia and Japan are integrating POC testing into emergency response frameworks and chronic disease management protocols. This regional diversity underscores the need for tailored market strategies and flexible business models.

This comprehensive research report examines key regions that drive the evolution of the Point of Care & Rapid Diagnostics market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players and Their Strategic Maneuvers Accelerating Innovation Collaboration and Supply Chain Resilience in Rapid Diagnostics

Leading industry participants are leveraging strategic investments, partnerships, and innovation pipelines to capitalize on the expanding point of care and rapid diagnostics market. Abbott Laboratories-despite a 7.2% decline in its diagnostics division driven by reduced COVID-19 testing volumes and pricing pressures in China-reported strong profitability in its broader portfolio, investing $500 million in new facilities to bolster domestic manufacturing and mitigate tariff impacts. Similarly, Danaher has committed to regionalizing its production network and implementing cost-offset measures to preserve earnings, reflecting a proactive stance toward trade-related headwinds.

Thermo Fisher Scientific and Roche are enhancing their microfluidic qPCR and immunoassay platforms with AI-driven analytics to improve diagnostic accuracy and enable remote consultations, while Standard BioTools (formerly Fluidigm) continues to push the envelope in single-cell analysis and high-throughput multiplexed detection. Becton, Dickinson and Company (BD) has integrated machine learning algorithms into its biosensor offerings to automate data interpretation and reduce time-to-result. Collectively, these companies are forging collaborations with academic institutions, technology vendors, and healthcare systems to accelerate product validation, navigate regulatory pathways, and expand global distribution networks.

This comprehensive research report delivers an in-depth overview of the principal market players in the Point of Care & Rapid Diagnostics market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abaxis, Inc.

- Abbott Laboratories

- AccuBioTech Co., Ltd.

- Becton, Dickinson and Company

- bioMérieux SA

- Boditech Med Inc.

- Chembio Diagnostics, Inc.

- Danaher Corporation

- Eiken Chemical Co., Ltd.

- ELITechGroup SAS

- F. Hoffmann-La Roche Ltd.

- Meridian Bioscience, Inc.

- OraSure Technologies, Inc.

- QuidelOrtho Corporation

- Sekisui Diagnostics, LLC

- Siemens Healthineers AG

- Sysmex Corporation

- Thermo Fisher Scientific Inc.

- Trinity Biotech plc

Implementing Strategic Roadmaps for Industry Leaders to Enhance Agility Optimize Operations and Capitalize on Emerging Opportunities in Point of Care Testing

To thrive in the dynamic POC and rapid diagnostics environment, industry leaders must pursue strategies that balance innovation with operational resilience. Diversifying manufacturing footprints by establishing regional production hubs in duty-free or low-tariff jurisdictions can insulate supply chains from geopolitical volatility and reduce lead times. Simultaneously, forging strategic alliances with digital health providers and cloud analytics vendors can unlock new revenue streams and enhance data interoperability, enabling providers to deliver comprehensive diagnostic services within value-based care models. Investing in advanced R&D, particularly in microfluidics, AI-driven biosensors, and next-generation sequencing assays, ensures readiness to address emerging public health threats and chronic disease burdens.

Proactive engagement with policymakers and trade associations is essential to advocate for tariff exemptions and regulatory pathways that support timely market access. Industry associations can work collaboratively to highlight the clinical importance of rapid diagnostics and secure relief for critical consumables such as reagents, cartridges, and biosensor materials. Additionally, implementing dynamic pricing models and flexible sales agreements with distributors and healthcare systems can absorb cost pressures while preserving market access. It is imperative for executives to maintain a forward-looking posture by continuously monitoring legislative developments, supply chain disruptions, and technological advances, thereby positioning their organizations to capitalize on emerging opportunities while safeguarding operational continuity.

Outlining a Robust Research Methodology Integrating Qualitative and Quantitative Approaches to Deliver Rigorous Insights Into Rapid Diagnostics Market Trends

Our research methodology integrates a blend of qualitative and quantitative techniques to ensure robust, unbiased insights into the point of care and rapid diagnostics market. Secondary data sources-including academic journals, regulatory filings, industry reports, and financial statements-provide the foundational context for market trends, technological advancements, and competitive landscapes. We conducted in-depth interviews with key opinion leaders, including laboratory directors, clinicians, regulatory experts, and procurement managers, to validate findings and capture first-hand perspectives on emerging challenges and unmet needs.

Quantitative analysis involved rigorous data triangulation, leveraging proprietary proprietary databases to cross-verify product adoption rates, pricing structures, and supply chain metrics. Segmentation and scenario modeling were employed to assess the impact of variables such as tariff changes, reimbursement policies, and technology penetration on market dynamics. Throughout the process, our methodology adhered to industry best practices and ethical standards, ensuring that conclusions are transparent, replicable, and actionable for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Point of Care & Rapid Diagnostics market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Point of Care & Rapid Diagnostics Market, by Product Type

- Point of Care & Rapid Diagnostics Market, by Technology

- Point of Care & Rapid Diagnostics Market, by Test Type

- Point of Care & Rapid Diagnostics Market, by End User

- Point of Care & Rapid Diagnostics Market, by Application

- Point of Care & Rapid Diagnostics Market, by Distribution Channel

- Point of Care & Rapid Diagnostics Market, by Region

- Point of Care & Rapid Diagnostics Market, by Group

- Point of Care & Rapid Diagnostics Market, by Country

- United States Point of Care & Rapid Diagnostics Market

- China Point of Care & Rapid Diagnostics Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Reinforce the Critical Role of Point of Care Diagnostics in Modern Healthcare Ecosystems

In synthesizing the key findings, it is clear that point of care and rapid diagnostics stand at an inflection point driven by converging technological, regulatory, and market forces. The maturation of microfluidic and AI-powered platforms is facilitating more accessible, accurate, and timely diagnostics, while evolving trade policies underscore the urgency for supply chain diversification and localized manufacturing. Regional nuances-from North America’s robust digital health ecosystems to Asia-Pacific’s aggressive localization mandates-highlight the importance of adaptive market strategies and stakeholder engagement.

As healthcare systems embrace value-based care and proactive disease management, rapid diagnostics will play an increasingly pivotal role in patient pathways, public health surveillance, and personalized medicine initiatives. Leaders must harness these insights to craft resilient operational models, forge strategic partnerships, and advocate for policy frameworks that sustain innovation and patient access. By aligning product development roadmaps with emerging clinical needs and regulatory trends, organizations can reinforce the critical role of point of care diagnostics in contemporary healthcare ecosystems.

Secure Your Competitive Advantage by Engaging with Our Expert Analysis and Tailored Solutions—Connect Directly with Ketan Rohom to Acquire the Full Report

To secure a competitive edge in the rapidly evolving point of care and rapid diagnostics landscape, engage with our comprehensive market intelligence and strategic recommendations. Our in-depth analysis encompasses technological innovations, supply chain dynamics, regulatory impacts, and regional market drivers, offering you the actionable insights needed to inform product development, market entry strategies, and partnership opportunities. Reach out directly to Ketan Rohom, Associate Director of Sales & Marketing, to discuss how our tailored solutions can support your organization’s objectives and to obtain the full market research report.

- How big is the Point of Care & Rapid Diagnostics Market?

- What is the Point of Care & Rapid Diagnostics Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?