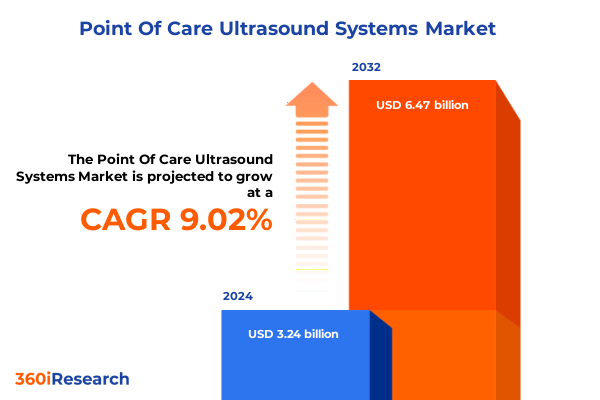

The Point Of Care Ultrasound Systems Market size was estimated at USD 3.51 billion in 2025 and expected to reach USD 3.82 billion in 2026, at a CAGR of 9.10% to reach USD 6.47 billion by 2032.

Emerging Point-of-Care Ultrasound Systems are Reshaping Bedside Diagnostics with Portability, Precision Imaging and Real-Time Clinical Decision Support

Point-of-care ultrasound systems have transcended their traditional role as hospital-confined imaging consoles to emerge as indispensable tools at the patient’s bedside. Modern point-of-care devices combine compact form factors, high-resolution imaging capabilities, and wireless connectivity, enabling clinicians to perform diagnostic examinations in emergency rooms, intensive care units, ambulances, and remote clinics without the delays associated with centralized imaging infrastructure. The proliferation of handheld and cart-based systems underscores a fundamental shift toward decentralized diagnostic workflows, where rapid, real-time insights directly inform clinical decisions and facilitate early intervention.

This evolution is driven by ongoing technological advancements in transducer design, semiconductor-based beamforming, and integrated software platforms that streamline image acquisition and interpretation. Artificial intelligence (AI) algorithms now augment ultrasound imaging by automating measurements, predicting anatomical landmarks, and offering decision support, which collectively reduce operator dependency and accelerate diagnostic throughput. As a result, healthcare providers across specialties-from emergency medicine to obstetrics-are embracing point-of-care ultrasound as a means to enhance patient safety, optimize resource utilization, and reduce reliance on more invasive or time-consuming modalities.

Looking ahead, the convergence of miniaturization, AI-enabled image analytics, and cloud-based interoperability is set to expand adoption even further. Training and integration initiatives are empowering non-specialist clinicians to leverage ultrasound for routine assessments, while tele-ultrasound services supported by 5G networks facilitate remote consultation and expert guidance in underserved regions. Together, these trends position point-of-care ultrasound as a cornerstone of modern, decentralized healthcare delivery.

AI-Enabled Analytics, Miniaturization Breakthroughs and Telehealth Integrations are Reconfiguring the Clinical Delivery of Point-of-Care Ultrasound Systems

The point-of-care ultrasound landscape is undergoing transformative shifts fueled by breakthroughs in AI-powered analytics, advanced visualization technologies, and seamless telehealth integrations. AI-enabled software now offers real-time tissue segmentation, automated anomaly detection, and predictive modeling directly on handheld and trolley-mounted devices. This innovation streamlines workflows by eliminating manual image optimization steps, allowing clinicians to focus on patient assessment and treatment planning rather than technical adjustments. Consequently, point-of-care ultrasound is evolving from a purely imaging modality into an intelligent diagnostic assistant that enhances consistency, reduces variability, and broadens the user base beyond traditional sonographers.

Simultaneously, miniaturization efforts have yielded ultra-compact form factors that rival smartphone dimensions, yet deliver high-definition imaging through microelectromechanical systems (MEMS) transducers and on-chip beamforming. Wireless connectivity and battery-powered operation liberate ultrasound from fixed workstations, enabling continuous monitoring in emergency response vehicles, field clinics, and home care environments. These portable solutions integrate with cloud repositories, bridging gap between disparate care settings and facilitating multidisciplinary collaboration through instantaneous image sharing.

Moreover, the regulatory and reimbursement frameworks are adapting to support these innovations. Accelerated pathways for software-driven medical devices and evolving billing codes for point-of-care imaging services are lowering barriers to market entry and incentivizing adoption. As digital ultrasound solutions increasingly embed within electronic health records and enterprise imaging networks, the traditional boundary between radiology departments and point-of-care settings is dissolving, heralding a new era of distributed diagnostic capabilities.

Escalating Section 301 Tariffs and Retaliatory Duties are Reshaping US Supply Chains and Cost Structures for Point-of-Care Ultrasound Equipment in 2025

In 2025, the implementation of additional Section 301 tariffs on medical devices originating from China and the imposition of a sweeping 10% duty on all Chinese imports have materially affected supply chains and cost structures for point-of-care ultrasound equipment in the United States. The USTR’s final notice, effective September 27, 2024, introduced new duty rates of up to 100% on consumable supplies and incremental increases for device components, with a 25% tariff on certain surgical gloves and a 50% tariff on disposable masks entering on January 1, 2025. Beyond consumables, broader medical devices such as diagnostic ultrasound probes are also subject to heightened scrutiny and potential duty reclassifications.

This escalation has led to immediate pricing pressures for U.S. healthcare providers, prompting prominent industry players to revise their cost projections. Johnson & Johnson’s medical technology division, for instance, anticipates approximately $400 million in 2025 expenses attributable to tariff-related costs, driven primarily by levies on Chinese imports and reciprocal duties. Simultaneously, companies such as GE HealthCare have experienced share price volatility linked to these developments, with a reported near-13% stock decline following China’s retaliatory measures and an investigation into CT tube imports.

In response, ultrasound system OEMs and component suppliers are accelerating supply chain diversification strategies. According to GlobalData, the tariff environment is expediting shifts toward regional manufacturing hubs in Europe, North America, and Southeast Asia, as companies seek to mitigate cost escalation and inventory risk. While these adjustments may stabilize long-term procurement, transitional challenges include qualification of new suppliers, validation of manufacturing processes, and regulatory re-certification-factors that collectively prolong time-to-market and strain working capital.

Comprehensive Segmentation Insights Illuminate Demand Variations Across Modalities, Applications, Portability Options and End-User Configurations

A closer examination of market segmentation reveals distinct demand profiles shaped by device classification and user requirements. Diagnostic ultrasound systems dominate clinical adoption due to their versatility across imaging applications, while therapeutic ultrasound devices are gaining traction in procedural guidance and targeted interventions. Portability further stratifies the market into cart/trolley-based platforms that offer extensive modality options and handheld/portable systems prized for rapid deployment and ease of use at the bedside. These dynamics underscore the dual imperative of comprehensive functionality and nimble form factors within point-of-care environments.

Technological segmentation delineates the roles of 2-D imaging as a foundational modality, 3-D/4-D imaging-encompassing real-time and volumetric rendering-for complex anatomical visualization, and Doppler techniques for vascular assessment. Concurrently, display modes ranging from A-mode and B-mode to Duplex and M-mode cater to specialized workflows in emergency medicine, cardiology, and musculoskeletal evaluation. Each imaging configuration addresses unique clinical needs, balancing spatial resolution, penetration depth, and hemodynamic insights.

Clinical applications extend across cardiology (with dedicated adult and pediatric probes), emergency medicine for acute illness, poisoning, and trauma assessment, and gastroenterology focusing on gallbladder, liver, and pancreas evaluation. Musculoskeletal uses encompass orthopedic and sports medicine scenarios, while obstetrics/gynecology segments emphasize fetal monitoring and pregnancy management. Urology applications target bladder assessment and prostate examination. End-user segmentation includes ambulatory surgical centers; diagnostic centers differentiated into imaging and radiology units; home care settings enabled by compact handheld devices; and hospitals & clinics, which remain primary deployment venues for advanced point-of-care systems.

This comprehensive research report categorizes the Point Of Care Ultrasound Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Portability

- Technology

- Display Mode

- Application

- End-User

Regional Market Dynamics Vary Significantly Across the Americas, EMEA and Asia-Pacific Driven by Regulatory, Economic and Healthcare Ecosystem Differences

Regional dynamics in the point-of-care ultrasound market are shaped by diverse regulatory frameworks, healthcare infrastructure maturation, and economic drivers. In the Americas, widespread reimbursement for point-of-care imaging, robust telehealth initiatives, and significant hospital system investments have established North America as a leading adopter. The United States benefits from early code assignment for POCUS procedures and strong venture capital inflows fueling start-ups, while Latin American markets in Brazil and Mexico are seeing accelerated deployment through public health programs, such as Brazil’s SUS integrating AI-assisted tele-ultrasound to reduce urban-rural care disparities.

Within Europe, Middle East & Africa, regulatory harmonization under CE marking across the European Economic Area streamlines product entry, yet reimbursement pathways remain fragmented across national health systems. Investments in remote diagnostics, particularly in Gulf Cooperation Council countries, are propelling the uptake of portable ultrasound in ambulatory and community-based settings. Conversely, in parts of sub-Saharan Africa, donor-funded deployments underscore the importance of AI-guided training modules to compensate for scarcity of trained sonographers, as demonstrated by initiatives like M-SCAN Africa.

Asia-Pacific is characterized by rapid market expansion tied to government healthcare modernization, rising chronic disease prevalence, and growing demand for non-invasive diagnostics. China’s domestic manufacturers now command a significant share of regional unit shipments, leveraging cost-effective solutions, while India and Southeast Asian nations emphasize rural health programs that deploy mobile ultrasound units in community clinics. Ongoing infrastructure investments and digital health policies are expected to sustain this growth trajectory.

This comprehensive research report examines key regions that drive the evolution of the Point Of Care Ultrasound Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Point-of-Care Ultrasound Providers Deploy Strategic Alliances, Innovative R&D and Diversified Portfolios to Strengthen Their Market Positions

Market leadership in point-of-care ultrasound is concentrated among legacy medical imaging giants, disruptive digital health entrants, and regional champions. GE HealthCare leverages its global service network, broad portfolio of transducers, and recent introduction of the Invenia Automated Breast Ultrasound Premium system to anchor its position in both diagnostic and women’s health applications. Philips supports its Flash Ultrasound System 5100 POC with enterprise integration capabilities, facilitating seamless workflow orchestration in cardiology and emergency medicine.

Siemens Healthineers has forged strategic partnerships-such as its long-term agreement with Tower Health-focused on deploying precision imaging modalities across hospital networks and community sites. Butterfly Network continues to democratize access with its semiconductor-based handheld devices, exemplified by the Butterfly iQ+ and the recently FDA-cleared Butterfly iQ3, which combine military-grade durability, AI-guided needle visualization, and whole-body presets in a single probe.

Emerging competitors such as Mindray and Edan are consolidating market share in Asia-Pacific through competitively priced solutions and targeted channel expansion, while specialized entrants like Exo and Mendaera advance AI-powered software tools that detect pleural effusions and guide robotic interventions. These varied strategies-ranging from product innovation to localized manufacturing and digital service offerings-highlight the multifaceted competitive landscape in point-of-care ultrasound.

This comprehensive research report delivers an in-depth overview of the principal market players in the Point Of Care Ultrasound Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BPL MEDICAL TECHNOLOGIES PRIVATE LIMITED

- Butterfly Network, Inc.

- Canon Medical Systems Corporation

- Chison Medical Imaging Co., Ltd.

- Clarius Ultrasound Inc.

- EchoNous Inc.

- EDAN Instruments, Inc.

- Esaote S.p.A.

- Exo Imaging Corp.

- eZono AG

- FUJIFILM Corporation

- General Electric Company

- Konica Minolta Healthcare Americas, Inc.

- Koninklijke Philips N.V.

- Mindray Medical International Ltd.

- Natus Medical Incorporated

- Planmed Oy

- Samsung Electronics Co., Ltd

- Siemens Healthineers AG

- Sonoscape Medical Corp.

- Telemed Ltd.

- ZONARE Medical Systems

Proactive Strategic Investments and Operational Tactics Will Empower Industry Stakeholders to Capitalize on Emerging Point-of-Care Ultrasound Opportunities

To capitalize on the evolving point-of-care ultrasound landscape, industry participants must adopt a holistic approach that harmonizes technological innovation with operational excellence. First, investing in AI-driven software platforms that integrate seamlessly with existing clinical workflows will enhance diagnostic confidence and reduce training barriers. By deploying cloud-based analytics and remote monitoring tools, organizations can extend the reach of specialist expertise to peripheral care settings and optimize resource allocation in real time.

Second, diversifying supply chain footprints through strategic partnerships with contract manufacturers and regional production hubs will mitigate tariff and logistics risks. Establishing dual sourcing arrangements for critical components, coupled with rigorous supplier qualification processes, can ensure continuity of supply while preserving product quality and regulatory compliance. Additionally, collaborating with payers to secure dedicated reimbursement pathways for point-of-care ultrasound services will drive sustainable adoption, particularly in value-based care models where rapid, bedside diagnostics can reduce total cost of care.

Finally, strengthening user engagement through comprehensive training programs and intuitive user interfaces will foster clinician confidence and accelerate time-to-competency. Simulation-based curricula, AI-augmented guidance modules, and peer-to-peer learning networks can embed ultrasound proficiency across multidisciplinary teams. By aligning product roadmaps with end-user feedback and clinical outcome metrics, leaders can refine value propositions and differentiate their offerings in a competitive market.

Robust Triangulation of Primary Interviews, Regulatory Filings and Secondary Data Underpins the Rigorous Point-of-Care Ultrasound Market Analysis Methodology

The research methodology underpinning this market study employs a rigorous triangulation of primary and secondary sources to ensure accuracy and depth. Primary insights were garnered through in-depth interviews with key stakeholders, including OEM executives, clinical end-users, and industry analysts. These qualitative discussions provided first-hand perspectives on technological adoption, regulatory challenges, and competitive dynamics. Secondary research encompassed a review of regulatory filings, patent databases, thought leadership publications, and corporate financial disclosures to corroborate and enrich the collected data.

Quantitative data collection involved analysis of global shipment statistics, clinical utilization rates, and device installation metrics obtained from proprietary and subscription-based databases. The combination of top-down and bottom-up approaches allowed for cross-validation of market segmentation parameters, ensuring consistency across type, technology, application, and end-user categories. Emerging trend identification was guided by patent filing patterns, venture capital investment flows, and academic research outputs, providing a forward-looking view of innovation trajectories.

To maintain methodological transparency, all assumptions and data sources are explicitly documented, and a sensitivity analysis evaluates the impact of variable factors such as tariff changes, reimbursement revisions, and regulatory approvals. This comprehensive framework delivers a robust foundation for strategic decision-making and fosters stakeholder confidence in the study’s conclusions.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Point Of Care Ultrasound Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Point Of Care Ultrasound Systems Market, by Type

- Point Of Care Ultrasound Systems Market, by Portability

- Point Of Care Ultrasound Systems Market, by Technology

- Point Of Care Ultrasound Systems Market, by Display Mode

- Point Of Care Ultrasound Systems Market, by Application

- Point Of Care Ultrasound Systems Market, by End-User

- Point Of Care Ultrasound Systems Market, by Region

- Point Of Care Ultrasound Systems Market, by Group

- Point Of Care Ultrasound Systems Market, by Country

- United States Point Of Care Ultrasound Systems Market

- China Point Of Care Ultrasound Systems Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Consolidated Conclusions Highlight the Current State of Point-of-Care Ultrasound Adoption and Anticipated Evolution in Clinical Practice

This executive summary synthesizes critical insights into the current state and future direction of the point-of-care ultrasound market. Technological advances-spanning AI-enabled imaging, handheld device miniaturization, and integrated connectivity-are driving the transition toward decentralized diagnostics that deliver rapid, cost-effective care across diverse clinical environments. Regulatory adaptations and emerging reimbursement models are further enabling this shift, while escalating tariff pressures underscore the need for resilient supply chain strategies.

Key segmentation analyses reveal that demand varies significantly by device type, imaging modality, clinical application, and end-user setting, necessitating tailored go-to-market approaches and product configurations. Regional dynamics emphasize the prominence of North America in early adoption, the collaborative regulatory landscape of EMEA, and the rapid growth momentum in Asia-Pacific fueled by infrastructure expansion and cost-competitive local manufacturing.

Competitive intelligence highlights the strategic imperatives pursued by leading players-from legacy imaging giants to innovative digital health start-ups-that are investing in R&D, forging alliances, and expanding service offerings to capture evolving market opportunities. To navigate this complex ecosystem, stakeholders must embrace a balanced strategy of technological differentiation, operational agility, and stakeholder engagement. This study provides the insights required to inform those strategic decisions, ensuring sustainable growth and clinical impact in the dynamic point-of-care ultrasound arena.

Immediate Next Steps and Contact Instructions to Secure Your Point-of-Care Ultrasound Market Research Report with Associate Director of Sales & Marketing

To acquire the comprehensive market research report on Point-of-Care Ultrasound Systems and gain deeper visibility into emerging opportunities, key trends, and strategic imperatives, please reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan will guide you through the available research packages, customizable solutions, and exclusive add-ons designed to align with your decision-making requirements. Engaging directly with Ketan ensures you receive prompt access to detailed data tables, expert commentary, and ongoing support for implementation of findings within your organization. Connect today to secure your copy of the report and leverage the insights that will empower your strategic roadmap in the evolving point-of-care ultrasound landscape

- How big is the Point Of Care Ultrasound Systems Market?

- What is the Point Of Care Ultrasound Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?