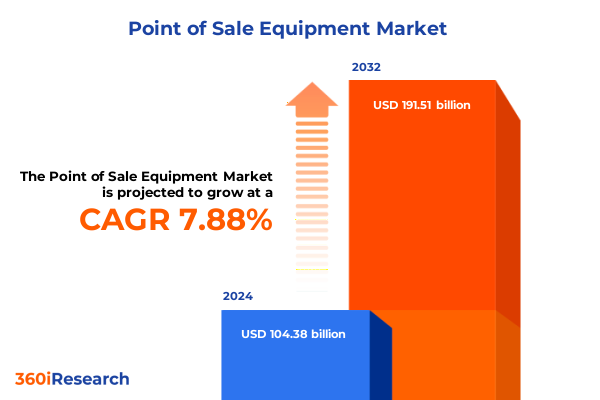

The Point of Sale Equipment Market size was estimated at USD 112.71 billion in 2025 and expected to reach USD 120.59 billion in 2026, at a CAGR of 7.86% to reach USD 191.51 billion by 2032.

Exploring the Strategic Evolution of Point of Sale Equipment in Response to Digital Commerce Demands and Operational Efficiency Imperatives

The modern retail and service landscape demands a reimagining of traditional transaction points, driving a shift toward more agile, data-driven, and customer-centric point of sale solutions. At the same time that consumer expectations for speed, convenience, and personalization have intensified, organizations face mounting pressure to optimize operational workflows and cost structures. This confluence has elevated point of sale equipment from a mere transactional tool to a pivotal component of broader digital commerce strategies.

Against this backdrop, businesses are increasingly adopting multi-functional terminals that integrate payment processing, inventory tracking, and customer engagement features. These advancements enable real-time visibility into sales performance and consumer behaviors, empowering decision-makers to respond swiftly to emerging market dynamics. Simultaneously, the integration of cloud-native architectures has reduced barriers to entry for small and mid-sized businesses, democratizing access to sophisticated POS capabilities once reserved for larger retailers.

As organizations navigate this complex environment, understanding the interplay between hardware evolution, software innovation, and shifting connectivity paradigms is essential. This introduction sets the stage for an in-depth exploration of the transformative forces shaping the point of sale equipment ecosystem, guiding stakeholders toward informed strategies and sustainable competitive advantages.

Uncovering Pivotal Technological and Consumer Behavior Shifts Reshaping the Point of Sale Equipment Ecosystem for Future Resilience

Over the past several years, rapid digitalization and shifting consumer behaviors have catalyzed seismic transformations within the point of sale equipment sphere. Emerging technologies such as cloud-based platforms and advanced analytics are redefining what constitutes a checkout terminal, extending its role to a strategic touchpoint for personalized interactions. In parallel, rising expectations for contactless and mobile payment options have prompted hardware manufacturers to redesign terminals with Near Field Communication (NFC) modules, biometric sensors, and touchscreen interfaces that streamline transactions while enhancing security.

Moreover, the relentless rise of omnichannel retailing has blurred the lines between physical and digital storefronts. Retailers now demand POS systems capable of synchronizing inventory and customer data across brick-and-mortar locations, e-commerce platforms, and mobile applications. This convergence has driven innovation in APIs and middleware solutions that ensure seamless integration with enterprise resource planning and customer relationship management systems. As a result, businesses gain a unified view of the customer journey, enabling targeted promotions, loyalty programs, and real-time merchandising decisions.

Finally, the global shift toward sustainability and environmental responsibility is influencing procurement and product design strategies. Manufacturers are adopting energy-efficient components and recyclable materials while software providers embed analytics to track carbon footprints and minimize waste. Together, these trends underscore a broader imperative: to innovate in ways that simultaneously meet consumer demands, operational goals, and corporate responsibility objectives.

Examining the Cumulative Effects of 2025 United States Tariff Policies on Component Sourcing and Cost Structures within the Point of Sale Equipment Industry

In 2025, the cumulative impact of United States tariff policies has significantly altered the supply chain dynamics for point of sale equipment. Increased duties on imported electronic components and display modules have driven manufacturers to reevaluate sourcing strategies, prompting a shift toward geographically diversified production footprints. As a result, several leading hardware providers have relocated assembly lines to lower-cost jurisdictions in Southeast Asia and Eastern Europe to mitigate cost inflation and maintain competitive price points.

These tariff-induced adjustments have also spurred closer collaboration between OEMs and local distributors, fostering joint inventory buffering programs and just-in-time delivery models. By coordinating more tightly with downstream channel partners, vendors can reduce lead times and manage raw material fluctuations more effectively. This cooperative approach has enhanced resilience against future trade disruptions while preserving margins in an environment of elevated input costs.

Furthermore, the rise in component pricing has accelerated investments in modular and software-defined architectures. Rather than relying on proprietary hardware redesigns for each new payment standard, vendors are embedding programmable modules into universal terminals. This strategic pivot allows rapid updates for compliance and feature enhancements without incurring full hardware replacement cycles, reducing total cost of ownership for end-users in a tariff-uncertain era.

Illuminating Critical Segmentation Dimensions to Reveal Nuanced Market Opportunities and Strategic Pathways in the Point of Sale Equipment Landscape

A nuanced understanding of market segmentation reveals critical pathways to capturing untapped demand and tailoring solutions for diverse customer needs. When considering the offering dimension, it becomes clear that hardware remains the tangible foundation of any POS deployment, yet services and software drive differentiation through ongoing support, analytics capabilities, and feature upgrades. The interplay between durable components and value-added services defines the long-term relationship between vendors and end-users, emphasizing the importance of integrated bundles over standalone device sales.

Connectivity type further refines targeting strategies, with wired terminals retaining a foothold in high-volume retail environments where reliability is paramount. Conversely, wireless connectivity solutions have surged in popularity among mobile merchants and pop-up retailers seeking plug-and-play flexibility. The choice between these two modes directly influences installation complexity, maintenance requirements, and customer experience at the point of transaction.

Distribution channel segmentation highlights the evolving purchasing behaviors of organizations large and small. While traditional offline channels such as direct sales teams and reseller networks remain vital for enterprise clients with bespoke requirements, the online channel continues to grow as small businesses and startups opt for self-serve procurement via e-commerce portals. This dual-channel dynamic necessitates differentiated marketing and support models to align with varying decision-making processes and deployment timelines.

End-user categorization provides a lens for identifying sector-specific value drivers. Education and healthcare institutions prioritize compliance, durability, and accessibility features to serve diverse populations. The hospitality and entertainment sectors seek seamless guest experiences, integrating POS terminals with property management and ticketing systems. Manufacturing and transportation environments demand ruggedized equipment capable of operating in challenging conditions, while retail entities focus on sales analytics, loyalty integrations, and omnichannel orchestration.

This comprehensive research report categorizes the Point of Sale Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Offering

- Connectivity Type

- Distribution Channel

- End-User

Mapping Regional Growth Drivers and Adoption Patterns across Americas, EMEA Markets and Asia-Pacific for Informed Point of Sale Equipment Strategies

Regional landscapes exhibit distinct drivers and adoption patterns that shape the competitive calculus for point of sale equipment suppliers. In the Americas, the convergence of mature retail infrastructure and innovation hubs has accelerated the rollout of next-generation terminals. Early adopters in North America leverage advanced analytics and integrated loyalty platforms to differentiate customer experiences, while Latin American markets are witnessing rapid adoption of mobile POS systems that address the needs of informal merchants and micro-enterprises.

Within Europe, the Middle East and Africa, a broad spectrum of market maturity levels underscores the need for flexible solutions. Western European retailers often require seamless compliance with stringent data protection and payment standards, prompting investments in secure, cloud-native architectures. In contrast, emerging economies in the region are leapfrogging traditional terminals in favor of mobile and tablet-based deployments, driven by infrastructure constraints and the rapid proliferation of smartphone usage.

Asia-Pacific continues to lead global innovation in both hardware and transaction models. Multipurpose smart POS systems that integrate digital payment apps, loyalty wallets, and social commerce platforms are becoming mainstream in key markets like China, Japan and Australia. Meanwhile, regional solution providers are forging partnerships to embed QR code and facial recognition payments, setting new benchmarks for checkout automation and consumer convenience.

This comprehensive research report examines key regions that drive the evolution of the Point of Sale Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Spotlighting Prominent Industry Players Driving Innovation Partnerships and Competitive Differentiation within the Point of Sale Equipment Arena

Prominent players in the point of sale equipment arena are distinguishing themselves through targeted innovation roadmaps and strategic alliances. Established terminal manufacturers are collaborating with software providers to deliver end-to-end ecosystems that encompass payment processing, analytics dashboards, and omnichannel orchestration tools. By integrating third-party apps and developer ecosystems, these vendors are cultivating platforms that extend beyond traditional transaction management into broader operational efficiency use cases.

Meanwhile, cloud-native challengers and fintech entrants are disrupting legacy models with subscription-based offerings that reduce upfront hardware investments. These solutions emphasize continuous software updates, modular feature sets, and scalable licensing structures, resonating with small and mid-sized businesses seeking predictable operating expenses. In turn, traditional incumbents are responding with hybrid pricing schemes and embedded financing options to maintain parity.

Strategic partnerships with telecommunications providers and payment networks have emerged as a critical differentiator. By embedding connectivity services and leveraging network infrastructure, terminal vendors can offer managed service bundles that simplify deployment and enhance security. Such collaborations enable turnkey experiences, particularly in remote or underserved geographies where self-managed installations pose logistical challenges.

This comprehensive research report delivers an in-depth overview of the principal market players in the Point of Sale Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- BBPOS Limited

- Castles Technology Co., Ltd.

- Cisco Systems, Inc.

- Clover Network, Inc.

- Datalogic S.p.A.

- Diebold Nixdorf, Incorporated

- Epson America, Inc.

- Fujitsu Limited

- HP Inc.

- Ingenico Group

- NCR Corporation

- Nexgo Incorporated

- Panasonic Corporation

- PAX Technology Limited

- Posiflex Technology, Inc.

- Samsung Electronics Co., Ltd.

- Sharp Corporation

- Toshiba Tec Corporation

- UIC (USA) Inc.

- Verifone Systems, Inc.

Delivering Practical Strategic Imperatives and Operational Guidelines to Empower Market Leaders in Navigating Complex Point of Sale Equipment Ecosystems

Industry leaders should prioritize investments in adaptive hardware designs and interoperable software frameworks to accommodate evolving payment trends and regulatory shifts. By embracing modular architectures, organizations can future-proof their equipment against emerging standards such as biometric authentication and digital identity verification, minimizing costly hardware refresh cycles. Equally, forging alliances with leading fintech and e-commerce platforms can expand ecosystem footprints and create compelling cross-channel value propositions.

Operationally, vendors and end-users alike must strengthen supply chain resilience by diversifying component sourcing and establishing strategic inventory buffers. Cultivating relationships with regional manufacturing partners and logistics providers can mitigate geopolitical risks and tariff volatility, ensuring continuity of service amidst global trade complexities. Concurrently, adopting data-driven maintenance schedules and remote diagnostics can reduce downtime and enhance total device uptime.

From a go-to-market perspective, tailoring distribution and support strategies across offline and online channels will be crucial. Customizing engagement models to the procurement preferences of enterprise accounts and emerging businesses can drive accelerated adoption, while embedding localized training and technical support resources fosters long-term customer satisfaction. Finally, embedding sustainability metrics into product roadmaps-such as energy-efficient components and end-of-life recycling programs-will resonate with increasingly eco-conscious stakeholders and differentiate offerings in a crowded marketplace.

Outlining Rigorous Multi-Source Data Gathering and Analytical Frameworks Employed to Ensure Comprehensive Insights in Point of Sale Equipment Research

The research underpinning these insights combines extensive primary and secondary data gathering to ensure rigor and depth. Primary research consisted of dozens of in-depth interviews with industry stakeholders, including terminal manufacturers, software developers, distribution partners and end-user executives. These conversations provided qualitative perspectives on emerging needs, procurement challenges and technology roadmaps across diverse sectors.

Simultaneously, secondary research involved systematic reviews of industry publications, regulatory filings, technical specifications and trade association reports. Publicly available procurement databases and patent registries were analyzed to validate competitive positioning and innovation trajectories. Data was triangulated through comparative analysis of company releases, product roadmaps and strategic announcements to ensure consistency and reliability.

Analytical frameworks leveraged in this study include segmentation mapping, scenario planning and value chain analysis. Segmentation mapping illuminated strategic opportunities by aligning product capabilities with end-user requirements, while scenario planning evaluated the resilience of supply chain configurations under varying tariff and geopolitical conditions. Value chain analysis elucidated margin drivers and partnership leverage points, guiding practical recommendations for stakeholders.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Point of Sale Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Point of Sale Equipment Market, by Offering

- Point of Sale Equipment Market, by Connectivity Type

- Point of Sale Equipment Market, by Distribution Channel

- Point of Sale Equipment Market, by End-User

- Point of Sale Equipment Market, by Region

- Point of Sale Equipment Market, by Group

- Point of Sale Equipment Market, by Country

- United States Point of Sale Equipment Market

- China Point of Sale Equipment Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Distilling Core Takeaways for Stakeholders to Leverage Emerging Opportunities and Mitigate Challenges in Point of Sale Equipment Markets

As the point of sale equipment market continues to evolve, stakeholders must remain vigilant in anticipating technological inflection points and shifting customer expectations. The convergence of advanced connectivity, intelligent software modules and sustainable design principles offers an unprecedented opportunity to reshape transaction experiences and operational models. However, navigating these changes demands strategic agility, collaborative ecosystems and a solid understanding of regional nuances and tariff landscapes.

Ultimately, success will favor organizations that balance innovation with pragmatic execution-those that invest in future-ready architectures while maintaining cost discipline and service excellence. By leveraging the segmentation and regional insights outlined herein, market participants can align their product roadmaps, go-to-market strategies and partnership approaches to capture emerging growth pockets and fortify resilience against disruptions.

This body of work synthesizes the core takeaways necessary to guide leadership teams, product managers and channel partners in crafting winning strategies. With a clear view of market dynamics, regulatory shifts and technology inflections, stakeholders are equipped to turn uncertainty into competitive advantage and drive sustainable value creation.

Empower Your Strategic Decisions Today by Securing Exclusive Access to the Comprehensive Point of Sale Equipment Market Research Report

To explore how your organization can harness these comprehensive insights and secure a competitive advantage, we invite you to engage directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch) to acquire the full market research report detailing all crucial data, strategic analyses, and in-depth perspectives on the point of sale equipment market. Connecting with Ketan Rohom ensures personalized guidance on how to leverage our findings for maximum impact and actionable planning across your operations and growth initiatives. Reach out today to transform your strategic decision-making with an authoritative resource designed to inform and accelerate your success.

- How big is the Point of Sale Equipment Market?

- What is the Point of Sale Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?