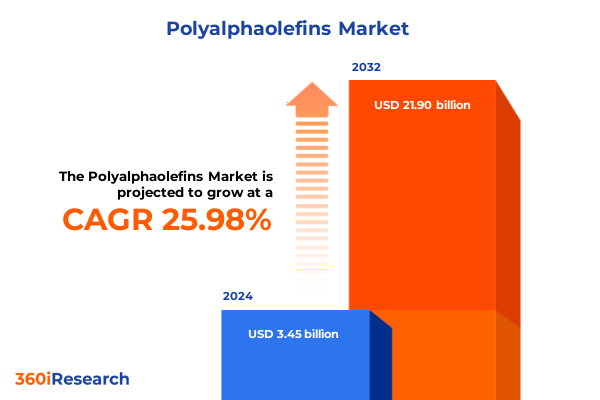

The Polyalphaolefins Market size was estimated at USD 4.30 billion in 2025 and expected to reach USD 5.37 billion in 2026, at a CAGR of 26.15% to reach USD 21.90 billion by 2032.

Understanding the Rising Importance of Polyalphaolefins as High-Performance Synthetic Base Oils in Modern Lubricant Applications

Polyalphaolefins are engineered base oils synthesized through advanced chemical processes that deliver unmatched thermal stability, oxidation resistance, and low-temperature fluidity, setting the standard for high-performance lubricants in demanding applications.

These synthetic fluids boast a high viscosity index and extremely low pour points, enabling reliable performance under extreme temperature variations and heavy-load conditions. As a result, they have become a cornerstone in industries where equipment longevity and maintenance intervals are critical, from precision automotive engines to rugged industrial gearboxes.

Moreover, the adoption of polyalphaolefins has accelerated in conjunction with the electrification of mobility technologies and the intensifying focus on environmental sustainability. New formulations tailored for electric vehicle thermal management systems and next-generation industrial machinery underscore the versatility of these base oils, as they continue to support stringent emissions standards and extended service cycles.

Navigating a New Era of Polyalphaolefin Innovation Driven by Sustainability, Electrification, and Supply Chain Digitalization in the Lubricants Sector

The polyalphaolefin market is undergoing a profound transformation driven by sustainability mandates, technological innovation, and evolving customer expectations. A key trend is the emergence of bio-based synthetic lubricants that integrate renewable feedstocks, aligning with circular economy imperatives and reducing lifecycle carbon footprints. Recent advancements in re-refining technologies have enabled the production of recycled base oils that rival virgin grades in purity and performance, creating new pathways for material recovery and waste minimization.

At the same time, the electrification of transportation and industrial powertrains has spurred the development of specialized PAO formulations engineered to meet the unique thermal and dielectric requirements of battery cooling loops, electric motors, and high-speed gear systems. These innovations are redefining performance benchmarks, as formulators collaborate with OEMs to deliver fluids that optimize energy efficiency and thermal management in next-generation platforms.

Simultaneously, supply chain digitalization and strategic partnerships are reshaping how companies bring these advanced fluids to market. Analytics-driven production planning, real-time monitoring of feedstock availability, and collaborative R&D alliances are fostering greater agility and responsiveness, ensuring that polyalphaolefin producers can adapt swiftly to market shifts and regulatory changes.

Examining the Cumulative Effects of 2025 United States Tariffs on Polyalphaolefin Feedstocks Supply Chains, Costs, and Industry Realignment

Throughout 2025, the cumulative impact of new United States tariffs has reverberated across polyalphaolefin supply chains, reshaping cost structures and prompting industry realignment. The imposition of 25 percent levies on imports from Canada and Mexico alongside substantial reciprocal duties on certain Chinese petrochemical feedstocks has driven up the price of key inputs, compelling producers and downstream buyers to reassess procurement strategies.

In response, many PAO manufacturers have pivoted to domestic ethane-derived feedstocks to mitigate exposure to import duties, leveraging North American shale gas advantages. This strategic shift has bolstered resilience against tariff volatility but also introduced new operational complexities, as plants recalibrate cracking configurations and logistics networks to accommodate alternative raw materials.

Downstream, increased feedstock costs have rippled through lubricant formulators, prompting tighter inventory management and the expansion of distributed warehousing to balance service levels with cost control. At the same time, longer-term effects include heightened interest in near-shoring high-value blending operations and exploring bilateral trade agreements that could offer partial relief from ongoing tariff escalations.

Uncovering Critical Segmentation Insights Across Applications, Product Types, End Use Industries, and Diverse Sales Channels for Polyalphaolefins

Polyalphaolefin applications span automotive, consumer, and industrial lubricant segments, each with distinct performance requirements and growth dynamics. In the automotive arena, PAO base oils are integral to brake fluids, high-temperature engine oils formulated for turbocharged powertrains, and specialized transmission fluids designed to optimize gear shift smoothness and thermal stability. The consumer sector leverages PAOs in cosmetic formulations and personal care lubricants, where purity and skin-friendly properties are paramount. Industrial uses encompass a wide spectrum, from compressor oils that ensure efficient gas compression to gear oils and hydraulic fluids that safeguard heavy machinery, and from metalworking fluids that enhance tool life to turbine oils that maintain reliability in power generation equipment.

Viscosity grades are another critical segmentation layer, with low-viscosity PAO 4 cSt and PAO 6 cSt options prized for rapid cold-start performance and thin-film lubrication, while PAO 8 cSt and PAO 10 cSt grades deliver enhanced load-bearing capacity and shear stability for high-stress applications. End use industries further differentiate market needs: the automotive sector demands solutions that support higher engine outputs and longer service intervals, industrial machinery emphasizes prolonged equipment uptime and contamination control, and power generation places a premium on oxidative stability and extended drain intervals. Finally, sales channels split between direct sales models-where producers engage directly with OEMs and large end users to co-develop tailored formulations-and distributor networks that provide extensive reach to smaller formulators and aftermarket service providers.

This comprehensive research report categorizes the Polyalphaolefins market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End Use Industry

- Sales Channel

Evaluating Polyalphaolefin Market Dynamics and Regional Drivers in the Americas, Europe Middle East & Africa, and Asia-Pacific Landscape

Regional dynamics play a pivotal role in shaping polyalphaolefin demand and strategic priorities. In the Americas, North American producers benefit from abundant shale gas feedstocks, enabling competitive PAO production costs and supporting a robust downstream lubricants industry focused on automotive and heavy-duty truck markets. Latin American markets, although smaller in scale, are experiencing steady uptake as infrastructure investment and vehicle sales gradually recover.

Europe, the Middle East, and Africa present a diverse landscape shaped by stringent environmental regulations and growing emphasis on reduced carbon intensity. European formulators are increasingly incorporating bio-based PAO blends to meet circular economy targets, while Middle Eastern producers leverage integrated refining complexes to secure feedstock supplies. In Africa, nascent industrialization and expanding power generation projects are driving incremental growth in turbine oils and hydraulic fluids.

Asia-Pacific remains the largest and most dynamic region, fueled by rapid industrial expansion and escalating vehicle ownership in markets such as China and India. Regional PAO capacity has expanded markedly to serve booming demand from industrial machinery, wind-power turbine oils, and the burgeoning electric vehicle segment. At the same time, the Asia-Pacific supply chain continues to navigate shifting trade policies and efforts to localize production, reinforcing its strategic importance in the global PAO ecosystem.

This comprehensive research report examines key regions that drive the evolution of the Polyalphaolefins market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Polyalphaolefin Industry Players and Strategic Moves Shaping the Competitive Landscape in Advanced Lubricant Solutions

The competitive landscape of the polyalphaolefin market is characterized by a blend of global integrated majors and specialized base oil producers. Shell has taken a leadership position by launching a line of carbon-neutral PAOs, underscoring its commitment to sustainability and lifecycle emissions reduction. Fuchs has strategically expanded production capacity in China, targeting the Asia-Pacific industrial lubricant segment and strengthening regional supply resilience. ExxonMobil has differentiated itself through the introduction of EV-focused synthetic fluids, designed to meet the stringent thermal and dielectric requirements of battery cooling and electric drive systems.

TotalEnergies has ventured into bio-based PAO formulations for heavy-duty industrial applications, leveraging renewable feedstocks to align with evolving ESG mandates. Valvoline’s successful rollout of high-mileage synthetic blends highlights the strategic value of tailored product lines addressing specific vehicle age cohorts, reinforcing its aftermarket presence. Meanwhile, regional players and emerging entrants continue to carve niche positions through localized manufacturing, rapid customer service models, and targeted R&D partnerships, ensuring that innovation and flexibility remain key differentiators in a market marked by evolving end use requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyalphaolefins market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Addinol GmbH

- BASF SE

- Behran Oil Company

- Calumet Specialty Products Partners, L.P.

- Chemtura Corporation

- Chevron Phillips Chemical Company LLC

- China Petroleum & Chemical Corporation

- Croda International Plc

- DuPont de Nemours, Inc.

- Exxon Mobil Corporation

- Fuchs SE

- Huntsman Corporation

- Idemitsu Kosan Co., Ltd.

- INEOS Group Holdings S.A.

- Jiangsu Subin New Materials Co., Ltd.

- JX Nippon Oil & Energy Corporation

- Lanxess AG

- Mitsui Chemicals, Inc.

- NACO Corporation

- NacoSynthetics Corporation

- Neste Oyj

- PetroChina Company Limited

- Petro‑Canada Lubricants Inc.

- Royal Dutch Shell plc

- Shanghai Fox Chemical Technology Co., Ltd.

- Sinopec Corporation

- SK Lubricants Co., Ltd.

- Suncor Energy Inc.

- The Lubrizol Corporation

- TotalEnergies SE

Actionable Strategic Recommendations for Industry Leaders to Drive Innovation, Mitigate Risks, and Capitalize on Emerging Polyalphaolefin Opportunities

To thrive amid shifting market dynamics, industry leaders should prioritize the development of next-generation PAO formulations that address both performance and sustainability objectives. Investing in R&D for bio-based and re-refined base oils can unlock new market segments and pre-empt regulatory pressures, while collaborations with OEMs and research institutions accelerate the commercialization of these eco-friendly solutions.

Supply chain resilience must be bolstered through diversified feedstock sourcing, including the strategic build-out of domestic ethane and naphtha equivalents, as well as the establishment of multiple logistics corridors to mitigate tariff-driven disruptions. Moreover, companies should embrace digital transformation initiatives that integrate AI-driven demand forecasting, predictive maintenance analytics, and real-time inventory optimization to drive operational efficiency and customer satisfaction.

Finally, forging strategic partnerships and alliances-whether through joint ventures in target regions or co-development agreements with additive specialists-will enable producers to offer holistic lubricant systems. This approach not only enhances value propositions but also cements long-term relationships with major OEMs and end users, positioning companies to capture emerging opportunities in electrification, renewable energy, and advanced industrial ecosystems.

Rigorous Research Methodology Combining Primary Interviews, Secondary Data Sources, and Advanced Analytical Techniques to Ensure Insights Accuracy

This research employs a hybrid methodology combining extensive secondary research and targeted primary outreach. Secondary data was gathered from industry publications, trade associations, regulatory databases, and technical white papers to map supply chain structures, policy landscapes, and technology developments. Key sources included public filings, proprietary news services, and specialized digital archives.

Simultaneously, primary insights were obtained through structured interviews with senior executives, technical experts, and procurement leaders across the PAO value chain. These conversations provided firsthand perspectives on emerging challenges, strategic priorities, and innovation roadmaps. Data points were triangulated against multiple sources to ensure consistency and reliability.

Analytical techniques such as competitive benchmarking, segmentation analysis, and scenario modeling were applied to distill actionable conclusions. Quality control measures included peer reviews by domain specialists and cross-validation against publicly available performance indicators. This rigorous approach ensures that the insights presented herein are both comprehensive and robust, empowering stakeholders with clarity in a complex market environment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyalphaolefins market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyalphaolefins Market, by Product Type

- Polyalphaolefins Market, by Application

- Polyalphaolefins Market, by End Use Industry

- Polyalphaolefins Market, by Sales Channel

- Polyalphaolefins Market, by Region

- Polyalphaolefins Market, by Group

- Polyalphaolefins Market, by Country

- United States Polyalphaolefins Market

- China Polyalphaolefins Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Conclusion Emphasizing Key Takeaways on Polyalphaolefin Market Evolution, Tariff Impacts, Segmentation Opportunities, and Regional Growth Drivers

The polyalphaolefin market in 2025 stands at the intersection of advanced performance demands, evolving regulatory frameworks, and dynamic trade environments. High stability, extended drain capabilities, and adaptability to electrified platforms underscore the material’s critical role in modern lubrication systems. Tariff-induced supply chain realignments have accelerated feedstock diversification and near-shoring initiatives, reshaping global production footprints.

Segmentation insights reveal a multifaceted landscape where application-specific formulations, viscosity gradations, and sales channel strategies converge to meet nuanced customer requirements. Regional analysis highlights the competitive edge afforded by North America’s feedstock advantages, EMEA’s regulatory leadership, and Asia-Pacific’s scale-driven growth.

As industry players refine their strategies, the imperative to innovate sustainably, enhance operational resilience, and foster strategic partnerships will drive success. By integrating advanced analytics with a clear understanding of market segmentation and regional dynamics, stakeholders can navigate uncertainties and position themselves for sustained growth in the evolving polyalphaolefin sector.

Drive Your Business Forward with Expert Polyalphaolefin Market Insights by Connecting with Ketan Rohom to Access the Comprehensive Research Report Today

For decision-makers aiming to deepen their understanding of the polyalphaolefin landscape and unlock actionable intelligence, our comprehensive market research report provides unrivaled depth and strategic clarity. Backed by rigorous analysis and exclusive industry interviews, this report distills complex market dynamics into clear implications for your business, whether you are navigating tariff disruptions, optimizing product portfolios, or exploring regional growth frontiers.

Connect with Ketan Rohom, Associate Director of Sales & Marketing, to gain direct access to this indispensable resource and empower your organization with the insights needed to outpace competitors, seize emerging opportunities, and chart a confident course forward in the polyalphaolefin sector.

Contact Ketan today to secure your copy of the definitive polyalphaolefin market research report and begin transforming data into decisive action.

- How big is the Polyalphaolefins Market?

- What is the Polyalphaolefins Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?