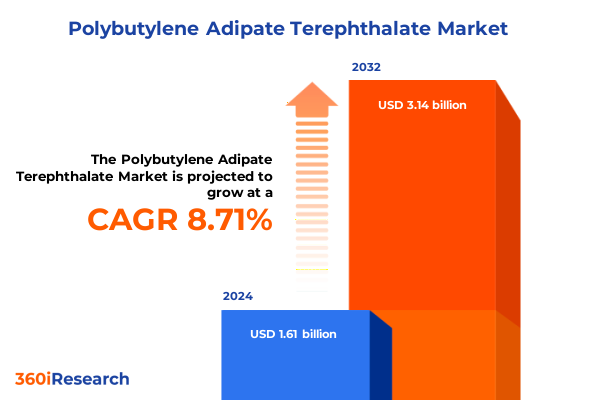

The Polybutylene Adipate Terephthalate Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.88 billion in 2026, at a CAGR of 8.79% to reach USD 3.14 billion by 2032.

Unveiling the Evolving Landscape of Polybutylene Adipate Terephthalate as a Biodegradable Polymer Shaping Sustainable Markets and Regulatory Dynamics in 2025

Polybutylene adipate terephthalate (PBAT) has emerged as a pivotal biodegradable copolyester in response to mounting environmental concerns and stringent regulatory frameworks worldwide. As a random copolymer of adipic acid, 1,4-butanediol, and terephthalic acid, PBAT offers flexibility and resilience comparable to low-density polyethylene, making it a viable alternative in applications ranging from packaging films to agricultural mulches. The urgency for sustainable materials has accelerated its adoption, driven by both consumer demand and policy measures aimed at reducing plastic waste.

In the face of evolving global sustainability mandates, PBAT producers are leveraging innovation to optimize blend formulations and processing techniques, addressing performance gaps and cost imperatives. By integrating advanced additives and refining copolymerization methods, manufacturers are achieving enhanced thermal and mechanical properties required for diverse end uses. Simultaneously, the alignment of circular economy principles with industrial composting standards is reshaping supply chain strategies, as stakeholders seek to ensure compliance with regional biodegradability criteria.

As the market transitions toward eco-friendly alternatives, understanding the underlying forces shaping PBAT’s role in the plastics ecosystem is critical. This introduction sets the stage for a comprehensive examination of transformative market shifts, regulatory impacts, segmentation insights, regional nuances, leading players, and strategic imperatives that define PBAT’s trajectory in 2025 and beyond.

How Sustainable Imperatives and Technological Innovations Are Redefining Polybutylene Adipate Terephthalate Applications and Competitive Dynamics Globally

The PBAT market is undergoing transformative shifts fueled by escalating sustainability targets and regulatory milestones. Legislation such as California’s mandate for recyclable or compostable packaging by 2032 and the EU’s Corporate Sustainability Reporting Directive have created new imperatives for material transparency and end-of-life accountability. In response, companies are enhancing polymer formulations to meet rigorous compostability standards, while expanding industrial and home composting certifications to align with diverse regional requirements.

Technological innovation is another key driver reshaping PBAT’s competitive landscape. Manufacturers are refining polymerization processes, adopting twin-screw reactive extrusion, and integrating renewable feedstocks to reduce carbon footprints and stabilize costs. Breakthrough blending techniques, such as combining PBAT with PLA or starch-based polymers, have unlocked applications in high-barrier food packaging and temperature-resilient agricultural films.

Simultaneously, cross-industry collaborations between bioplastic producers, academic institutions, and brand owners are accelerating R&D, fostering marine-degradable formulations and enzyme-assisted degradation pathways. These cooperative efforts not only enhance material performance but also facilitate regulatory harmonization and standardization, mitigating fragmentation across global markets.

Evaluating the Cumulative Impact of New United States Tariffs on PBAT Imports in 2025 and Their Strategic Implications for Domestic Supply Chains

In early 2025, the United States implemented a 7.5% duty on imported PBAT resin under HS Code 3907.99, a measure intended to protect domestic producers and encourage local feedstock integration. This tariff, coupled with duties on related monomers like adipic acid, has directly impacted import-dependent supply chains, compelling manufacturers to re-evaluate sourcing strategies and cost structures.

Consequently, several resin producers have pivoted toward vertically integrated models, forging partnerships with regional biorefineries to secure monomer supply under long-term off-take agreements. This strategic realignment has reduced exposure to tariff volatility and transportation disruptions, while enhancing resilience against future trade policy shifts. At the same time, downstream brand owners are optimizing resin formulations and leveraging hybrid blends to mitigate raw material cost inflation, without compromising on biodegradability or performance standards.

While these tariffs introduced short-term pricing pressures, they have catalyzed capacity expansions within North America, stimulating investment in local adipic acid and 1,4-butanediol production. The net effect is a more robust domestic supply network capable of adapting to policy fluctuations and sustaining growth in sustainable polymer adoption.

In-Depth Analysis of Polybutylene Adipate Terephthalate Market Segmentation by Application, End-Use Industry, Form, and Grade Revealing Niche Opportunities

Analyzing market segmentation reveals nuanced growth trajectories and competitive dynamics across PBAT’s diverse application landscape. In blown film and injection molding segments, innovation is driven by demand for both bottles and automotive components, where performance requirements necessitate specific copolymer ratios. Extrusion coating and filament production are likewise influenced by evolving consumer preferences for compostable paper coatings and biodegradable fibers.

End-use industries further differentiate market behavior. In agriculture, demand centers around mulch films and seed coatings that decompose without harming soil health. Consumer goods applications such as homeware and single-use cutlery leverage PBAT’s flexibility and safety profile. Packaging, perhaps the largest end user, balances rigid containers and flexible films, each requiring tailored PBAT grades to meet mechanical and barrier property requirements.

Form variations-granules, pellets, and powder-offer processing versatility for diverse downstream technologies. Powder forms cater to intricate compounding processes, while granules and pellets streamline melt extrusion for film and fiber applications. Grade classifications, spanning high molecular weight, specialty, and standard, underpin product differentiation. Specialty grades with antimicrobial, flame-retardant, and UV-resistant attributes address niche safety and regulatory demands, enabling PBAT to penetrate sectors beyond traditional packaging.

This comprehensive research report categorizes the Polybutylene Adipate Terephthalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Grade

- Distribution Channel

- Application

Uncovering Regional Dynamics in the Polybutylene Adipate Terephthalate Market across Americas, Europe Middle East Africa and AsiaPacific for Strategic Growth

Regional dynamics significantly influence PBAT market development and adoption patterns. In the Americas, regulatory frameworks such as the U.S. Plastic Waste Reduction Law and Canada’s single-use plastics ban have accelerated demand for certified compostable materials. Producers in North America have responded by expanding capacity and securing tax credits under programs like USDA BioPreferred, which recognizes PBAT blends with renewable content as eligible for federal procurement mandates.

Europe, Middle East & Africa (EMEA) exhibit a dual force of stringent EU directives mandating recyclability and industrial composting, alongside emerging market opportunities within EMEA’s growing manufacturing hubs. The EU’s Packaging and Packaging Waste Directive revisions and Fertilising Products Regulation have created avenues for PBAT-coated agricultural products, enhancing adoption in both developed and developing economies within the region.

Asia-Pacific remains the fastest-growing region for PBAT, driven by national policies in China and India aimed at reducing plastic waste and subsidizing biodegradable imports. Major producers in China have ramped up domestic output, spurred by tariff incentives and investment in bio-based feedstock projects under national green transformation strategies. This expansion supports local demand for agricultural films, food packaging, and consumer goods applications.

This comprehensive research report examines key regions that drive the evolution of the Polybutylene Adipate Terephthalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Polybutylene Adipate Terephthalate Producers and Innovators Shaping Competitive Trends through Capacity Sustainability and Technological Leadership

The PBAT market is anchored by a cadre of global chemical leaders and specialized bioplastics innovators. BASF, under its ecoflex and ecovio trademarks, pioneered commercial PBAT production and continues to lead capacity expansions with certified compostable grades tailored for film, packaging, and agricultural markets. Novamont, with its Origo-Bi and Mater-Bi blends, integrates PBAT with starch to enhance marine biodegradability, catering to segments requiring heightened environmental performance.

In Asia, China’s Kingfa Sci. & Tech. deploys state-supported feedstock partnerships and graphene-enhanced formulations to address heat resistance challenges in beverage packaging. JinHui Zhaolong’s Ecoworld brand and Eastman Chemical’s Eastar Bio series diversify supply sources, supplying high-quality PBAT to multinational packaging and consumer goods enterprises.

Additional notable players include Zhejiang Biodegradable Advanced Material Co. Ltd and Jiangsu Torise Biomaterials in China, which are scaling capacity to meet regional demand. These companies leverage vertical integration, process optimization, and targeted R&D investments to differentiate their offerings and navigate evolving regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polybutylene Adipate Terephthalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Anhui Jumei Biotechnology Co., Ltd.

- BASF SE

- Chang Chun Group

- Clariant AG

- Eastman Chemical Company

- Evonik Industries AG

- FKuR Kunststoff GmbH

- Go Yen Chemical Industrial Co., Ltd

- Hengli Group

- Henkel AG & Co. KGaA

- JCU CORPORATION

- Junyuan Petroleum Group

- K.D. Feddersen Holding Gmb

- Kingfa Sci. & Tech. Co.

- Merck KGaA

- Mitsubishi Chemical Corporation

- Mitsui Plastics, Inc.

- Novamont S.p.A.

- Perstorp Holding AB

- PPG Industries, Inc.

- PycnoPlast BV

- Sipol S.p.a.

- SK Geo Centric Co., Ltd.

- SKC Co., Ltd.

- Solvay S.A.

- Swicofil AG

- T.EN Zimmer GmbH

- The Dow Chemical Company

- Toray Industries, Inc.

- Welinks Group (Zhangjiagang) Co., Ltd

- Xinjiang Blue Ridge Tunhe Sci.&Tech. Co., Ltd.

Strategic Recommendations for Industry Leaders to Navigate PBAT Market Challenges through Supply Chain Optimization Innovation Partnerships and Regulatory Engagement

To capitalize on emerging opportunities and mitigate market challenges, industry leaders should strengthen feedstock partnerships with biorefineries to ensure secure access to adipic acid and 1,4-butanediol. Establishing long-term procurement contracts can hedge against tariff volatility and price fluctuations. Concurrently, investing in process innovations such as twin-screw reactive extrusion and enzyme-assisted degradation can enhance product performance, enabling PBAT to penetrate high-barrier packaging and marine-degradable applications.

Engaging proactively with regulatory bodies and participating in standards committees will facilitate alignment on compostability and biodegradability criteria, reducing market fragmentation. Companies should also explore collaborative R&D consortiums, pooling resources to address infrastructure gaps in industrial composting and recycling. Finally, adopting digital traceability solutions, such as blockchain-enabled QR codes, can improve transparency, bolster consumer confidence, and support compliance with emerging sustainability reporting mandates.

Comprehensive Research Methodology Detailing Data Collection Market Analysis Techniques and Validation Processes Underpinning the PBAT Executive Summary Findings

This executive summary is underpinned by a robust research methodology combining primary and secondary data. Primary research involved structured interviews with leading PBAT producers, brand owners, and regulatory experts to gather firsthand insights on market dynamics, supply chain adaptations, and technology trends. Secondary research encompassed an extensive review of academic publications, industry reports, regulatory databases, and credible news sources to validate market developments and policy impacts.

Data triangulation techniques were employed to cross-verify findings, ensuring consistency between quantitative trade data, tariff schedules, and corporate press releases. Market segmentation was analyzed through a framework categorizing applications, end-use industries, forms, and grades, as provided by industry stakeholders. Regional insights were derived from policy analysis, import-export statistics, and localized market intelligence.

Quality assurance processes included peer review by subject matter experts and iterative validation rounds, ensuring the findings reflect the latest market conditions and regulatory environments. This methodology ensures that the strategic insights and recommendations presented herein are both actionable and aligned with industry best practices.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polybutylene Adipate Terephthalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polybutylene Adipate Terephthalate Market, by Form

- Polybutylene Adipate Terephthalate Market, by Grade

- Polybutylene Adipate Terephthalate Market, by Distribution Channel

- Polybutylene Adipate Terephthalate Market, by Application

- Polybutylene Adipate Terephthalate Market, by Region

- Polybutylene Adipate Terephthalate Market, by Group

- Polybutylene Adipate Terephthalate Market, by Country

- United States Polybutylene Adipate Terephthalate Market

- China Polybutylene Adipate Terephthalate Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Drawing Comprehensive Conclusions on PBAT Market Trends Regulatory Impacts and Strategic Imperatives for Stakeholders Seeking Sustainable Plastic Solutions

In summary, PBAT has solidified its role as a versatile, biodegradable alternative to conventional polymers, underpinned by regulatory accelerators, technological advancements, and strategic industry collaborations. The 2025 U.S. tariff regime has prompted supply chain realignment and capacity expansions, reinforcing domestic production resilience. Market segmentation analysis reveals targeted growth drivers across applications, end-use industries, product forms, and specialty grades, highlighting opportunities for differentiated positioning.

Regional dynamics underscore the importance of localized regulatory frameworks and infrastructure readiness, from composting mandates in EMEA to subsidy-driven expansions in Asia-Pacific. Leading companies such as BASF, Novamont, Kingfa, and JinHui demonstrate the impact of vertical integration, feedstock innovation, and sustainability certifications in shaping competitive leadership.

By implementing the strategic recommendations outlined-ranging from feedstock partnerships and process innovations to regulatory engagement and traceability solutions-stakeholders can navigate market uncertainties and capitalize on PBAT’s expanding role in sustainable material portfolios. This holistic perspective equips decision-makers to drive growth, foster resilience, and advance circular economy objectives across the PBAT value chain.

Connect with Ketan Rohom to Access the Complete PBAT Market Research Report and Gain Strategic Insights for Sustainable Polymer Investments

Ready to elevate your strategic decision-making with in-depth analysis on polybutylene adipate terephthalate market dynamics? Connect with Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive PBAT market research report. Harness data-driven insights, expert guidance, and actionable intelligence to drive your sustainable polymer initiatives forward. Reach out today to discuss tailored research solutions designed to meet your organization’s unique requirements and gain a competitive edge in the evolving biodegradable plastics landscape.

- How big is the Polybutylene Adipate Terephthalate Market?

- What is the Polybutylene Adipate Terephthalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?