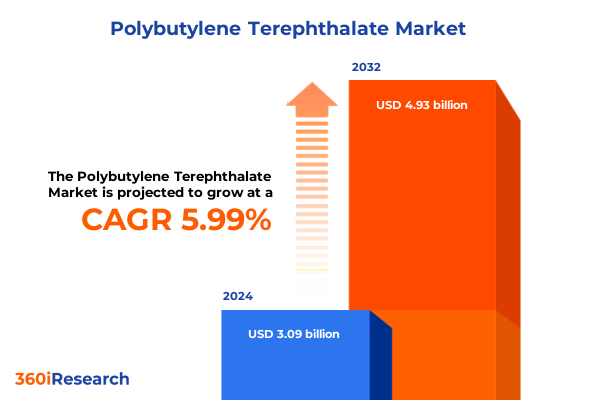

The Polybutylene Terephthalate Market size was estimated at USD 3.25 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 6.12% to reach USD 4.93 billion by 2032.

Exploring the Evolutionary Journey of Polybutylene Terephthalate from Niche Engineering Polymer to Mainstream Industrial Essential

The evolution of polybutylene terephthalate has been shaped by a complex interplay of material science innovations and shifting marketplace demands. As a semi-crystalline thermoplastic engineering polymer, it has gained prominence for its robust mechanical properties and ease of processing. Initially embraced in niche applications requiring dimensional stability and chemical resistance, PBT has progressively expanded into mainstream markets where durability and precision are paramount.

Over time, continuous improvements in catalyst systems, polymerization techniques, and additive packages have enhanced the material’s performance envelope. These advancements have elevated PBT’s viability across multiple forms-ranging from melt-processed pellets to finely milled powders-each engineered to address specific application requirements. As a result, manufacturers can tailor formulations to deliver targeted properties, be it enhanced stiffness through mineral reinforcements or heightened fatigue resistance via specialized glass fiber blends.

The introduction of closed-loop recycling initiatives and reprocessed resin streams has further diversified the material’s lifecycle profile. Whereas virgin PBT predominated earlier market phases, regenerative strategies have begun to take root, offering environmentally conscious alternatives without compromising critical performance metrics. These cumulative developments have set the stage for a dynamic, next-generation polymer landscape that promises both technical excellence and sustainable alignment.

Navigating the Confluence of Digital Manufacturing, Circular Economy Principles, and Supply Chain Regionalization in the PBT Industry

Recent years have seen transformative shifts in the polybutylene terephthalate ecosystem, driven by the convergence of digital manufacturing, sustainability mandates, and geopolitical reconfiguration. Digital twins and simulation-driven process optimization have ushered in a new era of efficiency, enabling molders and extrusion specialists to predict performance outcomes with unprecedented accuracy. Consequently, lead times have been compressed while scrap rates and energy consumption have been systematically reduced.

Simultaneously, the industry is increasingly guided by circular economy principles, with cradle-to-cradle frameworks reshaping raw material sourcing and end-of-life pathways. The rising popularity of reprocessed PBT resins reflects growing stakeholder pressure to minimize environmental impact, particularly in highly regulated regions where carbon attribution and material traceability are paramount. As a result, companies are forging partnerships across the value chain to enhance resin recovery, purification, and reintegration into high-performance applications.

Moreover, the global realignment of supply chains has prompted manufacturers to reconsider traditional offshore production models. Regionalization strategies, backed by nearshoring incentives and tariff mitigation efforts, are redefining how and where PBT compounds are produced. These strategic shifts not only reduce logistical risk but also align with broader industrial policies aimed at securing critical materials through localized, resilient networks. Together, these forces are catalyzing a fundamental reshaping of the PBT landscape.

Assessing the Far-Reaching Effects of 2025 United States Tariff Policies on Domestic Polybutylene Terephthalate Supply Chain Strategies

The cumulative impact of United States tariffs in 2025 has introduced a pronounced recalibration across the polybutylene terephthalate supply chain. Initially imposed to protect domestic resin producers, tariff structures have incrementally driven up landed costs for imported PBT, compelling end-users to reassess vendor strategies. In response, several automotive and electronics manufacturers have accelerated qualification of alternative resin suppliers within the Americas, prioritizing North American and Latin American compound producers to mitigate exposure to tariff volatility.

This recalibration has not only affected procurement frameworks but has also incentivized additional investment in local compounding capabilities. By establishing new production capacities closer to key end-use markets, resin formulators can effectively bypass the escalating duties, optimize inventory management, and improve service responsiveness. The tariff environment has therefore acted as a catalyst for nearshoring trends, fostering a more distributed network of PBT feedstock hubs designed to ensure continuity amidst shifting trade policies.

As these dynamics settle into a new operational norm, stakeholders are placing greater emphasis on cost-to-performance analyses to validate the economic rationale of domestically sourced versus imported compounds. This heightened scrutiny has underscored the strategic importance of agility and supply chain visibility, prompting both resin producers and end-users to upgrade digital procurement platforms and embrace predictive sourcing models. Ultimately, the tariff-driven realignment of 2025 continues to leave an indelible mark on how polybutylene terephthalate flows through North American markets.

Unveiling PBT’s Multifaceted Market Segmentation Spanning Resin Type, Form, Reinforcement, Processing Technology, and Industry Applications

A nuanced understanding of polybutylene terephthalate market segmentation reveals the distinct roles played by resin type, physical form, reinforcement strategy, processing technology, and end use industry. Within resin type segmentation, the landscape is divided between reprocessed grades and virgin formulations, with each segment addressing divergent sustainability and performance criteria. Reprocessed PBT has gained traction in applications where eco-credentials are prioritized, while virgin resin remains the choice for critical high-load components.

Turning to physical form, PBT pellets dominate large-scale melt processing operations, offering ease of handling and consistent feed rates. Conversely, powdered variants enable specialized techniques such as rotational molding and selective laser sintering, catering to bespoke geometries and minimal-waste scenarios. Reinforcement strategies further refine mechanical attributes, where glass fiber integration delivers elevated modulus and fatigue strength, mineral fillers impart hardness and dimensional control, and non-reinforced blends serve in applications demanding high elongation and surface finish.

Processing technology exerts its own influence on compound selection, as blow molding optimizes hollow-part creation, extrusion molding excels in continuous profiles, and injection molding remains the gold standard for complex, high-volume precision parts. Finally, end use industry segmentation captures a spectrum of demand drivers: in automotive, exterior, interior, and under-the-hood components call for tailored combinations of thermal stability and impact resistance; consumer goods draw on PBT’s resilience in appliances and consumer electronics; electrical and electronics applications rely on robust performance in connectors, housings, and switches; while industrial use spans pipe fittings and power tools, where toughness and chemical resistance are critical.

This comprehensive research report categorizes the Polybutylene Terephthalate market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Form

- Reinforcement

- Processing Technology

- End Use Industry

Examining Regional Demand Dynamics and Strategic Drivers Shaping the PBT Market across the Americas, EMEA, and Asia-Pacific

A closer examination of geographic performance illustrates that the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibit unique demand patterns and strategic priorities. In the Americas, the convergence of automotive OEM investments and infrastructure modernization has sustained robust PBT consumption, with nearshoring expansions further amplifying regional manufacturing footprints. This dynamic environment has fostered partnerships between resin producers and tier-one suppliers to co-develop application-specific compounds for North American assembly lines.

Meanwhile, the Europe, Middle East & Africa region is shaped by stringent regulatory frameworks and advanced electrification initiatives. As Europe accelerates its shift toward electric vehicles, PBT’s role in high-voltage connectors and battery housings has become increasingly prominent, stimulating innovation in flame-retardant and high-dielectric formulations. In the Middle East, large-scale industrial projects continue to drive demand in piping and power distribution systems, where material reliability under harsh environmental conditions remains paramount.

In Asia-Pacific, rapid urbanization and consumer electronics proliferation underpin sustained PBT growth. Manufacturers across China, Japan, South Korea, and Southeast Asian nations are ramping up capacity for high-performance resins, while government incentives for domestic chemical production support ongoing capacity expansions. This region’s emphasis on cost-competitive manufacturing has also led to wide adoption of reprocessed resin grades and streamlined processing technologies, reflecting a balance between affordability and technical capability.

This comprehensive research report examines key regions that drive the evolution of the Polybutylene Terephthalate market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Competitive Strategies of Leading Resin Producers and Specialty Compounders Driving Innovation in Performance and Sustainability

The competitive landscape for polybutylene terephthalate is defined by a group of leading chemical companies and specialty compounders that continue to advance material performance and market reach. Global players have leveraged integrated petrochemical platforms to secure feedstock advantages, while smaller, nimble firms focus on niche applications and rapid innovation cycles. Collaboration between resin producers and OEMs has become increasingly common, enabling co-engineered solutions that meet precise end-use requirements.

Recent strategic partnerships have centered on the development of high-temperature resistant grades and improved flame-retardant PBT formulations for electrical and automotive sectors. Furthermore, investment in digital customer engagement platforms has allowed companies to offer value-added services such as virtual compound selection tools and dynamic application simulations. These digital interfaces not only expedite material qualification but also foster deeper customer loyalty through ongoing performance tracking and iterative compound optimization.

As sustainability considerations intensify, major players are expanding their recycled resin portfolios and targeting significant carbon footprint reductions through green chemistry initiatives. This competitive drive toward more sustainable PBT grades is reshaping product roadmaps and compelling end-users to factor environmental metrics into supplier evaluations. In this landscape, firms that can marry technical excellence with robust sustainability credentials are poised to capture the most lucrative growth opportunities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polybutylene Terephthalate market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Celanese Corporation

- DIC Corporation

- LANXESS AG

- LyondellBasell Industries N.V.

- Mitsubishi Engineering-Plastics Corporation

- Saudi Basic Industries Corporation

- Shinkong Synthetic Fibers Corporation

- SK Global Chemical Co., Ltd.

- Sumitomo Chemical Co., Ltd.

- Teijin Limited

- Toray Industries, Inc.

Driving Competitive Advantage through Supply Chain Resilience, Digital Transformation, Sustainability, and Customer Co-Development

Industry leaders seeking to solidify their position in the polybutylene terephthalate market should pursue several strategic imperatives. First, strengthening supply chain resilience through dual sourcing and regional manufacturing partnerships can minimize exposure to geopolitical disruptions and tariff fluctuations. By cultivating relationships with both established and emerging compound suppliers in key regions, companies can ensure flexibility in procurement and optimize logistics.

Second, investing in digital transformation initiatives-particularly those that integrate predictive analytics and real-time quality monitoring-will enhance operational efficiency and reduce time to market. Implementing advanced process control systems across key extrusion and injection molding lines can further drive consistency in finished part performance and reduce waste.

Third, aligning product innovation with sustainability objectives is essential. Leaders should prioritize the development of recycled and bio-based PBT grades that meet or exceed virgin resin performance metrics. Collaborating with downstream OEMs to establish closed-loop recycling programs can reinforce brand reputation and deliver tangible environmental benefits.

Finally, deepening application co-development partnerships with customers will differentiate offerings. By offering customized compound solutions, prototyping support, and lifecycle performance data, firms can embed themselves within customer workflows and become indispensable collaborators, rather than mere suppliers.

Employing a Hybrid Research Framework Integrating Primary Interviews, Secondary Data Analysis, and Trade Flow Examination to Ensure Robustness

The research methodology underpinning this analysis combines a multi-pronged approach that synthesizes primary interviews, secondary literature review, and market trend triangulation. Primary insights were gathered through in-depth discussions with resin producers, compounders, manufacturers, and end-users across diverse industries, ensuring a comprehensive understanding of current performance requirements and procurement strategies.

Secondary research included a thorough examination of industry publications, regulatory filings, patents, and corporate sustainability reports to validate emerging material innovations and sustainability commitments. Additionally, trade data and customs records were analyzed to quantify the impact of tariff measures and supply chain realignments, offering a robust foundation for understanding trade flow dynamics.

Quantitative data points were cross-verified through comparison with industry association statistics and technical performance benchmarks derived from standardized testing protocols. This triangulation process ensured the credibility of the segmentation insights and regional breakdowns presented herein. Qualitative assessments were further enriched by site visits to compounding facilities, molding shops, and automotive assembly plants, where process improvements and material performance were directly observed.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polybutylene Terephthalate market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polybutylene Terephthalate Market, by Resin Type

- Polybutylene Terephthalate Market, by Form

- Polybutylene Terephthalate Market, by Reinforcement

- Polybutylene Terephthalate Market, by Processing Technology

- Polybutylene Terephthalate Market, by End Use Industry

- Polybutylene Terephthalate Market, by Region

- Polybutylene Terephthalate Market, by Group

- Polybutylene Terephthalate Market, by Country

- United States Polybutylene Terephthalate Market

- China Polybutylene Terephthalate Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1590 ]

Synthesizing Core Strengths, Emerging Trends, and Strategic Imperatives Shaping the Future of the Polybutylene Terephthalate Sector

The landscape of polybutylene terephthalate is marked by rapid technological advances, evolving regulatory pressures, and shifting geopolitical paradigms. From the maturation of recycled resin streams to the advent of digital manufacturing controls, every facet of the industry is in flux. Yet, core material strengths-such as mechanical robustness, chemical resistance, and process versatility-continue to underpin PBT’s value proposition across automotive, electrical, consumer goods, and industrial applications.

As supply chains become more distributed and nearshoring gains prominence, agility in procurement and manufacturing will be critical for sustaining competitive positioning. Likewise, the imperative to demonstrate environmental stewardship through recycled and bio-based material solutions will shape future compound development roadmaps. Industry leaders that can skillfully navigate tariff headwinds, leverage digital transformation, and co-innovate with end-users will emerge as the primary architects of the next growth phase.

Looking ahead, the integration of PBT formulations into emerging sectors such as renewable energy systems, advanced robotics, and high-performance consumer electronics suggests an expanding application environment. Stakeholders must remain vigilant in monitoring technical breakthroughs and policy shifts, ensuring that their strategies remain aligned with both market demands and broader sustainability goals.

Unlock Tailored Insights and Strategic Advantages by Connecting Directly with Ketan Rohom for Advanced Polymer Market Intelligence

Engaging industry leaders in the high-stakes polymer market begins with a tailored invitation that underscores the strategic value of in-depth research and expert guidance. Elevate your competitive edge by connecting directly with Ketan Rohom, an accomplished Associate Director of Sales & Marketing known for his comprehensive understanding of advanced polymer markets. This is your opportunity to secure bespoke insights and actionable intelligence, crafted specifically to inform critical business decisions and long-term strategies.

In today’s dynamic landscape, timely access to robust market research is essential for capitalizing on emerging trends and mitigating risk. By partnering with Ketan Rohom, you will gain exclusive guidance on leveraging the latest data, refining product portfolios, and navigating regulatory and geopolitical challenges. Whether you require detailed segmentation analyses, regional performance breakdowns, or comprehensive tariff impact assessments, this call to action provides a direct line to the expertise needed to drive growth.

Initiate the conversation now to explore customizable reporting options, discuss volume licensing plans, and outline the best pathways to integrate research findings into your organization’s operational framework. Embark on a journey toward market leadership by taking the next decisive step: reach out to Ketan Rohom today to unlock the full potential of your polybutylene terephthalate strategy and ensure your business remains ahead of the curve.

- How big is the Polybutylene Terephthalate Market?

- What is the Polybutylene Terephthalate Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?