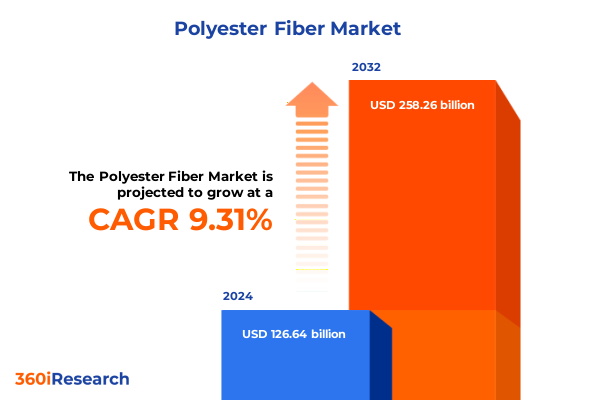

The Polyester Fiber Market size was estimated at USD 138.00 billion in 2025 and expected to reach USD 150.38 billion in 2026, at a CAGR of 9.36% to reach USD 258.26 billion by 2032.

Catalyzing the Future of Textiles: Uncovering the Strategic Role of Polyester Fiber in Material Innovation and Industry Evolution

The polyester fiber market stands at the forefront of material innovation, serving as a cornerstone for a vast array of end-use industries ranging from high-performance apparel to industrial textiles. Over the last several decades, polyester has risen to prominence due to its versatility, strength, and cost efficiency. As global demand continues to accelerate, driven by urbanization, rising disposable incomes, and evolving consumer preferences, the role of polyester fiber in redefining modern manufacturing and sustainability benchmarks has become increasingly significant.

Amid heightened focus on environmental stewardship, the industry is witnessing a paradigm shift toward circularity and resource optimization. Manufacturers are now challenged to balance economic viability with ecological responsibility, prompting collaboration across the value chain-from polymer producers to fabric converters and brand owners. Against this backdrop, technological breakthroughs in recycling, functional finishes, and spinning processes are reshaping the competitive landscape. As market participants explore novel feedstocks and incorporate advanced manufacturing techniques, polyester fiber is poised to sustain its growth trajectory while addressing global sustainability goals.

This executive summary provides an in-depth overview of the emerging trends that are set to influence the polyester fiber market, examines regulatory impacts, and outlines strategic imperatives for stakeholders aiming to thrive amid rapid transformation.

Navigating the Shifting Landscape of Polyester Fiber: From Sustainability Imperatives to Technological Breakthroughs Shaping the Market

In recent years, the polyester fiber industry has transitioned from traditional commodity production to a dynamic ecosystem characterized by sustainability imperatives and technological integration. Leading manufacturers are adopting advanced recycling technologies-such as chemical depolymerization and continuous melt extrusion-to convert post-consumer waste into high-quality polymer feedstock. This shift toward closed-loop systems reflects growing regulatory pressures and consumer demands for eco-friendly products, prompting stakeholders to embed circularity at the core of their operations.

Concurrently, the integration of Industry 4.0 solutions is enhancing process efficiency and product consistency. Smart manufacturing platforms equipped with real-time monitoring and predictive analytics optimize energy consumption and reduce material waste. Digital twins enable rapid prototyping of new fiber formulations, accelerating time-to-market for specialized offerings. Furthermore, innovations in functional finishes-ranging from UV resistance to moisture-wicking and flame retardancy-are expanding end-use applications, from performance apparel to industrial and automotive textiles.

As the landscape evolves, collaborations between chemical companies, textile machinery suppliers, and brand owners are becoming vital. These partnerships foster joint R&D initiatives, ensuring seamless integration of novel materials into existing value chains. The convergence of sustainability, digitalization, and strategic alliances is setting new benchmarks for competitive differentiation in the polyester fiber market.

Assessing the Multifaceted Consequences of 2025 United States Tariffs on Polyester Fiber: Supply Chains, Pricing Dynamics, and Competitive Positioning

The introduction of new tariff measures in 2025 has reshaped the economics of polyester fiber trade within the United States, prompting market players to reevaluate sourcing strategies and cost structures. These levies, aimed at addressing trade imbalances and supporting domestic manufacturing, have triggered adjustments throughout the supply chain. Importers have responded by diversifying procurement from alternative low-cost producers in Southeast Asia, while domestic polymer producers have accelerated capacity expansions to capture a larger share of local demand.

Price volatility has inevitably followed, as increased duties elevated landed costs of imported staple fibers, influencing downstream yarn and fabric converters. Some manufacturers have implemented flexible sourcing agreements, maintaining relationships with suppliers across multiple regions to hedge against tariff fluctuations. Meanwhile, growing interest in nearshoring and reshoring initiatives has underpinned investments in local infrastructure and recycling facilities. These efforts not only mitigate trade-related uncertainties but also align with national sustainability objectives aimed at reducing carbon emissions associated with long-distance transportation.

Amid these shifts, industry participants are focusing on operational agility and supply-chain transparency. By leveraging advanced trade-compliance software and predictive analytics, companies can anticipate tariff adjustments and optimize inventory management. Such measures are critical for preserving margins, fostering resilience, and ensuring that polyester fiber remains a reliable and cost-effective solution for textile manufacturers and end-users across the United States.

Decoding Polyester Fiber Market Segmentation Insights Across Products, Applications, Forms, Functionalities, and Processing Techniques

The polyester fiber market can be dissected through multiple segmentation lenses to reveal nuanced insights across product types, applications, forms, functionalities, and processing methods. From the perspective of product type, drawn textured yarn leads innovation in stretch and elasticity, catering to athleisure and seamless garments, while fully drawn yarn continues to serve robust industrial textiles that require dimensional stability. Partially oriented yarn remains a critical intermediary, combining cost efficiency with sufficient strength for a range of commodity fabrics.

Examining applications illuminates distinctive end-use requirements: automotive interiors demand high-tenacity fibers with excellent abrasion resistance; home textiles prioritize softness and colorfastness; industrial textiles emphasize durability and chemical resistance; and apparel integrates advanced moisture-management and thermal‐regulation properties. Regarding form, filament fiber dominates technical textile markets where continuous strands enhance tensile performance, whereas staple fiber maintains a strong presence in nonwoven productions and spun yarns, offering versatility in blending and processing.

Functional considerations further diversify the landscape. Antibacterial polyester addresses hygiene concerns in medical and hospitality sectors, flame-retardant variants ensure safety compliance for protective apparel, moisture-wicking finishes meet the rigorous demands of sportswear, and UV-resistant fibers protect outdoor furnishings and dyed fabrics. Process innovations also play a defining role: while melt spinning remains the most widely adopted technique for its efficiency and cost-effectiveness, dry spinning excels in producing specialty fibers with solvent-based polymers, and wet spinning facilitates precise control of copolymer structures. Through these segmentation lenses, market participants can identify targeted growth opportunities and tailor product portfolios to evolving customer needs.

This comprehensive research report categorizes the Polyester Fiber market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Function

- Process

- Application

Unveiling Regional Variances in the Global Polyester Fiber Industry: Market Characteristics and Growth Enablers in Key Macro Geographies

Regional dynamics continue to shape the trajectory of the polyester fiber industry, with the Americas, Europe, Middle East & Africa, and Asia-Pacific each exhibiting distinct market drivers and challenges. In the Americas, stringent sustainability regulations and consumer preferences for recycled content have accelerated the adoption of post-consumer resin. U.S. federal incentives for advanced recycling technologies have catalyzed investment in mechanical and chemical recycling capacities, while strong demand from the automotive sector fuels high-performance filament consumption.

Shifting focus to Europe, Middle East & Africa reveals a regulatory environment heavily influenced by the European Union’s circular economy framework and REACH standards. Manufacturers across this region are investing in bio-based polyester variants and advanced recycling partnerships to comply with extended producer responsibility directives. Additionally, the Middle East’s access to cost-advantaged feedstocks supports large‐scale polymer production, positioning the region as a critical exporter to global markets.

In Asia-Pacific, the largest manufacturing hub for polyester fiber, rapid urbanization and expanding textile and apparel industries are driving capacity expansions in China, India, and Southeast Asia. While cost competitiveness remains a hallmark, there is a growing emphasis on technology transfer and digitalization, particularly in Japan and South Korea, where advanced fiber modifications and functional finishes are advancing niche applications. Furthermore, regional collaborations on supply-chain transparency and sustainability certifications are emerging to enhance traceability and consumer confidence.

This comprehensive research report examines key regions that drive the evolution of the Polyester Fiber market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives and Competitive Profiles of Leading Polyester Fiber Manufacturers Driving Technological, Operational, and Sustainability Advances

Leading polyester fiber producers are deploying strategic initiatives to strengthen their competitive positions and align with evolving market demands. Prominent industry players are investing in vertical integration, securing upstream polymer supply while expanding downstream spinning and texturizing capacities. Partnerships with textile machinery companies and chemical innovators facilitate co-development of specialized fibers that meet stringent performance and sustainability criteria.

In recent years, key manufacturers have launched large-scale recycling ventures, utilizing chemical depolymerization processes to produce virgin-quality polymer from post-consumer waste. These projects underscore a collective commitment to resource efficiency and corporate responsibility. Concurrently, research and development efforts are focused on bio‐based polyester that leverages renewable feedstocks, reducing dependence on fossil fuels and carbon emissions.

Operational excellence initiatives, including digital twin simulations and predictive maintenance platforms, are enhancing production uptime and energy consumption. Leading corporations are also forming alliances with fashion brands and technical textile end users to pilot next-generation materials, thereby accelerating commercialization cycles. Through these and other strategic maneuvers, top companies are not only solidifying market share but also setting benchmarks for innovation, performance, and environmental stewardship in the polyester fiber domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyester Fiber market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advansa B.V.

- Alpek, S.A.B. de C.V.

- Billion Industrial Holdings Limited

- China Petroleum & Chemical Corporation

- DAK Americas, LLC

- Far Eastern New Century Corporation

- Hengli Group Co., Ltd.

- Hyosung Corporation

- Indorama Ventures Public Company Limited

- Jiangsu Sanfangxiang Group Co., Ltd.

- Kolon Industries, Inc.

- Lealea Group Co., Ltd.

- M&G Chemicals

- MITsui Chemicals, Inc.

- Nan Ya Plastics Corporation

- PetroVietnam Petrochemical and Textile Fiber Joint Stock Company (PVTEX)

- Reliance Industries Limited

- Rongsheng Petrochemical Group Co., Ltd.

- Shenghong Group Co., Ltd.

- SINOPEC Yizheng Chemical Fibre Co., Ltd.

- Teijin Limited

- Tongkun Group Co., Ltd.

- Toray Industries, Inc.

- Wellman International Limited

- Xinfengming Group Co., Ltd.

- Zhejiang GuXianDao Industrial Fiber Co., Ltd.

- Zhejiang Hengyi Group Co., Ltd.

Actionable Strategic Recommendations for Polyester Fiber Industry Leaders to Capitalize on Technological Innovations and Evolving Market Dynamics

To capitalize on the evolving opportunities within the polyester fiber market, industry leaders should prioritize an integrated sustainability agenda that includes greater use of recycled content and investments in advanced recycling facilities. By embracing state-of-the-art chemical recycling, companies can secure a steady supply of high-purity polymer, enhance brand credibility, and mitigate exposure to raw material price fluctuations.

Moreover, digital transformation should be accelerated to optimize manufacturing processes and reduce operational risks. Deploying interconnected sensors and analytics platforms provides granular insights into production efficiency and energy usage, enabling real-time adjustments and long-term strategic planning. This approach not only drives cost savings but also supports environmental, social, and governance objectives by minimizing waste and carbon footprint.

Collaboration across the value chain remains essential. Forming strategic alliances with end-use brands, technology partners, and regulatory bodies can foster innovation, streamline compliance, and unlock new market segments. Companies are also advised to explore bio-based polyester alternatives, leveraging advancements in biotechnology to create differentiated, eco-friendly products. Finally, conducting targeted pilot programs and market trials will ensure that emerging fiber variants meet performance benchmarks and customer expectations before full-scale rollout.

Outlining a Research Methodology Combining Primary and Secondary Data Techniques to Ensure Comprehensive and Reliable Insights into Polyester Fiber Trends

This analysis is grounded in a comprehensive research framework that combines primary and secondary data collection methodologies. Primary research involved in-depth interviews with executive decision makers from fiber producers, spinning mill operators, machinery suppliers, and brand owners, providing firsthand insights into strategic priorities and market challenges. These qualitative findings were augmented by structured surveys targeting technical and commercial managers to quantify adoption rates of innovative processes and end-use requirements.

Secondary research encompassed the systematic review of industry publications, regulatory filings, patent databases, and sustainability reports to map technological advancements and policy developments. Data from trade associations and government agencies validated trade flows, while scholarly articles offered context on emerging circular economy models. Through iterative data triangulation, inconsistencies were identified and resolved, ensuring robustness and credibility.

Analytical techniques included thematic content analysis to extract key trends, and scenario planning workshops with cross-functional experts to foresee potential market disruptions. Rigorous quality checks, including peer reviews and stakeholder validation sessions, were conducted throughout the research cycle. This multifaceted approach guarantees that the insights presented are authoritative, actionable, and reflective of the current dynamics shaping the polyester fiber sector.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyester Fiber market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyester Fiber Market, by Product Type

- Polyester Fiber Market, by Form

- Polyester Fiber Market, by Function

- Polyester Fiber Market, by Process

- Polyester Fiber Market, by Application

- Polyester Fiber Market, by Region

- Polyester Fiber Market, by Group

- Polyester Fiber Market, by Country

- United States Polyester Fiber Market

- China Polyester Fiber Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Drawing Conclusions on the Transformative Potential of Polyester Fiber and Highlighting Strategic Imperatives for Sustainable Growth and Competitive Advantage

The polyester fiber industry is undergoing a transformative evolution characterized by sustainability imperatives, technological integration, and shifting trade policies. As recycled and bio-based alternatives gain traction, traditional manufacturers are compelled to adapt swiftly, adopting advanced recycling processes and exploring novel feedstocks. Concurrently, digitalization efforts are enhancing operational efficiency, enabling data-driven decision making and predictive maintenance.

Distinct segmentation insights highlight how product type, application, fiber form, functional attributes, and spinning techniques present tailored opportunities for value creation. Regional analysis underscores the importance of aligning strategies with local regulatory frameworks and consumer expectations, whether in the Americas, where recycled content mandates prevail, or in Europe, where circular economy regulations set the pace.

For industry leaders, success hinges on forging strategic alliances, investing in R&D for differentiated fiber functionalities, and leveraging digital solutions to optimize resource utilization. As competitive pressures intensify, organizations that seamlessly integrate sustainability, innovation, and operational excellence will secure a decisive advantage. The imperative for agility, collaboration, and forward-looking investments is clear: those who anticipate and respond to emerging trends will define the future of polyester fiber.

Empowering Decision Makers to Secure Exclusive Insights on the Polyester Fiber Market and Drive Strategic Growth by Engaging with Ketan Rohom

To explore comprehensive insights tailored to your organization’s strategic priorities, connect with Ketan Rohom, Associate Director of Sales & Marketing, who can guide you through the report’s unique findings and facilitate a customized engagement to meet your research objectives. His expertise will help translate the extensive analysis into actionable strategies that enhance competitiveness and drive sustainable growth. Reach out today to secure your copy and gain the competitive intelligence needed to navigate the evolving polyester fiber landscape effectively.

- How big is the Polyester Fiber Market?

- What is the Polyester Fiber Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?