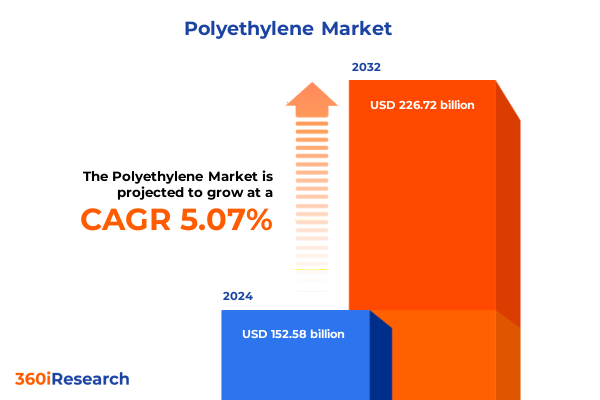

The Polyethylene Market size was estimated at USD 159.97 billion in 2025 and expected to reach USD 167.71 billion in 2026, at a CAGR of 5.10% to reach USD 226.72 billion by 2032.

Navigating the Dynamic Landscape of Polyethylene through Its Core Properties and Evolving Role in Industrial Applications

Polyethylene stands as one of the most versatile polymers in the global materials landscape, underpinning a vast array of industrial applications from packaging to high-performance engineering. Its unique combination of chemical resistance, mechanical strength, and processability has propelled widespread adoption across sectors. Advances in catalyst technology and monomer purity have further enhanced the performance properties of polyethylene, enabling manufacturers to tailor grades for specific end-use requirements. As a result, high-density, linear low-density, and low-density variants each deliver distinct benefits in rigidity, impact resistance, and film clarity, while ultra-high molecular weight polyethylene finds critical use in demanding applications such as medical devices and ballistic protection.

Beyond its intrinsic material properties, polyethylene’s role in enabling efficient manufacturing processes cannot be understated. The polymer’s compatibility with diverse molding and extrusion techniques supports high throughput, cost-effective production, and complex part geometries. Consequently, supply chains worldwide rely on polyethylene resins as foundational building blocks, balancing performance with affordability. In parallel, evolving consumer preferences and stringent regulatory frameworks continue to drive innovation in sustainable polyethylene solutions, reinforcing its strategic importance across global markets.

Unveiling the Pivotal Transformations in Polyethylene Technology Sustainability and Circular Practices Driving Industry Evolution

The global polyethylene industry is undergoing transformative shifts driven by sustainability imperatives and technological breakthroughs. Leading producers have rapidly expanded portfolios of bio-based polyethylene, leveraging renewable feedstocks such as sugarcane ethanol to produce polymer grades chemically identical to conventional resins while reducing carbon footprints and aligning with circular economy goals. Braskem now offers bio-PE certified by ASTM 6866, and DOW Chemical is pioneering bio-based polyolefin elastomers and ionomers to meet demands for sustainable packaging and specialty applications.

Simultaneously, the recycling landscape is evolving, with mechanical and chemical routes converging in integrated facilities. Mechanical recycling retains polymer chains for traditional applications, while advanced chemical methods such as pyrolysis and gasification break down waste streams into monomers for virgin-quality production. Industry alliances are facilitating technology transfer and standardization, exemplified by partnerships deploying proprietary chemical recycling platforms to convert post-consumer PE waste into feedstock suitable for food-grade packaging.

Moreover, digitalization and process intensification are reshaping polyethylene manufacturing. Real-time analytics, predictive maintenance, and advanced control algorithms optimize reactor performance and reduce energy consumption. These data-driven practices, combined with next-generation catalysts, are enabling producers to lower operational costs and adapt quickly to feedstock price volatility. As a result, the industry is better positioned to balance growth with environmental stewardship and resilience against geopolitical disruptions.

Assessing the Comprehensive Impact of 2025 United States Tariff Measures on Polyethylene Trade Flows Production Dynamics and Supply Chains

A landmark policy shift in early 2025 introduced sweeping tariff measures that have reconfigured polyethylene trade flows, production dynamics, and supply-chain strategies in the United States. In April, the administration invoked the International Emergency Economic Powers Act to impose a universal 10% baseline tariff on nearly all imports, with higher reciprocal duties applied to select trading partners. Concurrently, tariffs on steel, aluminum, and automobiles were raised to 25%, and automotive content thresholds under the USMCA were tightened, further reverberating across downstream polyethylene-intensive industries.

Specific actions targeted polyethylene feedstocks and resins from China, with an immediate 20% duty on all Chinese high-density polyethylene imports, compounding existing Section 301 measures and effectively raising average tariff burdens on these grades to around 26.5%. The cancellation of de minimis exemptions removed entry-level thresholds, mandating formal declarations for all shipments and heightening administrative complexity for importers.

In parallel, tariffs on all imports from Canada and Mexico were raised to 25%, though products compliant with USMCA content rules remain exempted. Potash and energy imports from Canada now face a 10% levy, and aluminum and steel from Mexico not covered by USMCA attract 25% duties. These measures have disrupted traditional North American supply chains, prompting resin buyers to explore alternative sources or accelerate domestic capacity utilization.

The immediate impact on polyethylene production is evident in declining operating rates, with analysts warning that domestic plant utilization could fall below 80% without strengthened domestic demand or eased export routes. Export-oriented resin producers are reassessing target volumes for the balance of 2025, seeking to mitigate margin erosion amid elevated feedstock costs and tariff-induced market distortions.

International retaliatory actions have compounded challenges. Brazil preemptively raised duties on imported chemical products, including resins, by up to 50%, leading to canceled U.S. contracts and financing constraints for exporters. Potential EU counter-measures targeting U.S. resin exports risk putting a $1.6 billion trade surplus at stake, threatening competitiveness in a market heavily reliant on Gulf Coast and Middle Eastern feedstocks.

Deciphering Key Market Segmentation Insights to Illuminate Polyethylene Demand Drivers by Product Process Recycling End Use and Application Domains

Polyethylene market dynamics unfold across multiple critical segmentation dimensions, each illuminating unique demand drivers and growth opportunities. Based on product type, polyethylene grades span high-density, linear low-density, low-density, and ultra-high molecular weight resins, enabling applications from rigid pipes to impact-resistant components. Manufacturing process segmentation highlights the strategic roles of blow molding, extrusion, injection molding, and rotational molding in shaping part performance, production throughput, and cost structures.

Recycling process segmentation underscores the industry’s dual focus on mechanical and chemical recycling pathways. Mechanical recycling allows for efficient reintegration of post-consumer scrap into pellet markets, while chemical recycling techniques such as gasification and pyrolysis unlock monomer-level recovery, supporting closed-loop systems and high-value applications. End-user segmentation spans agriculture, automotive, building and construction, consumer goods, electrical and electronics, food and beverage, healthcare and pharmaceuticals, industrial manufacturing, and packaging. Within these verticals, sub-categories such as greenhouse coverings and lay flat tubing in agriculture, upholstery and vehicle components in automotive, insulation and pipes and fittings in construction, housewares, sports equipment, and toys and games in consumer goods, device housings and wires and cables in electronics, and flexible and rigid packaging each reveal nuanced performance requirements and growth imperatives.

Application segmentation further dissects polyethylene utilization into bags and sacks, bottles and containers, films and sheets, and pipes and fittings. This layered view of the market enables stakeholders to tailor product innovation, align manufacturing capabilities, and deploy targeted go-to-market strategies that address evolving performance specifications, regulatory mandates, and sustainability objectives.

This comprehensive research report categorizes the Polyethylene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Recycling Process

- Application

- End User

Highlighting Regional Polyethylene Market Dynamics and Growth Potential Across the Americas Europe Middle East & Africa and Asia-Pacific

Regional dynamics in the polyethylene landscape reflect distinct supply-demand equilibria, investment patterns, and policy frameworks across the Americas, Europe Middle East & Africa, and Asia-Pacific regions. In the Americas, North America serves as the world’s largest producer and consumer, anchored by integrated petrochemical complexes along the U.S. Gulf Coast. Despite the region’s deep feedstock advantages, anticipated 25% tariffs on imports from Canada and Mexico and 10% duties on Chinese shipments have injected volatility into resin pricing and logistics, prompting buyers to diversify sources and accelerate domestic procurement strategies. Latin America exhibits fragmented markets, with Brazil adjusting duties on chemical imports in response to U.S. policies, underscoring interdependencies between trade regulations and production economics.

In Europe Middle East & Africa, high production costs and aging infrastructure have stoked a wave of plant rationalizations, particularly in Western Europe where margin pressures have led to closures and capacity shifts toward the Middle East, which offers advantaged feedstock supplied at scale. Major players are investing in ultra-low-emission crackers and expanding Middle Eastern export hubs to serve European consumption while retaining cost competitiveness. Regulatory incentives and state aid are being deployed to support chemical recycling projects and spur circular-economy initiatives across the region.

Asia-Pacific remains the fastest-growing market, driven by robust demand in China, India, Southeast Asia, and emerging industrial economies. Thailand’s expansion of Braskem’s bio-ethylene production under the “I’m green” brand, aligned with national bio-circular-green economy guidelines, exemplifies regional leadership in sustainable polyethylene manufacturing. Meanwhile, Sinopec and Saudi Aramco’s joint ventures in Saudi Arabia underscore the region’s strategic role in meeting global demand and balancing supply-chain resilience.

This comprehensive research report examines key regions that drive the evolution of the Polyethylene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Polyethylene Industry Players and Their Strategic Initiatives Shaping Market Innovation Capacity and Sustainability

Leading global and regional producers are pursuing diverse strategic initiatives to secure market leadership, drive innovation, and navigate geopolitical complexities. Braskem has distinguished itself through an expanded portfolio of bio-PE grades certified by ASTM 6866, delivering renewable solutions for flexible and rigid packaging and cementing its reputation as a sustainability pioneer. DOW Chemical is advancing bio-based polyolefin elastomers for hot melt adhesives and planning bio-based ionomers for fragrance caps, reflecting an emphasis on high-performance, low-carbon materials that satisfy stringent food and personal care regulations.

Sinopec’s collaboration with Saudi Aramco to expand the Yasref petrochemicals complex in Saudi Arabia, adding a 1.8 million metric ton steam cracker, exemplifies cross-border joint ventures aimed at enhancing integrated value chains and mitigating raw material price swings. In parallel, Sinopec Shanghai Petrochemical’s multibillion-dollar investment to upgrade ethylene refining capacity underscores China’s drive to modernize facilities and elevate product quality.

ExxonMobil’s expansion into Huizhou, commissioning multiple LLDPE lines totalling over 1.2 million tons per year, demonstrates how global majors leverage local partnerships to penetrate high-growth markets and align production footprints with regional demand patterns. These targeted investments, coupled with portfolio synergies in advanced recycling, catalyst innovation, and digitalization, highlight the competitive interplay among established leaders and emerging players shaping the future of polyethylene.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyethylene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpek S.A. de C.V.

- Asahi Kasei Corporation

- BASF SE

- Braskem SA

- Celanese Corporation

- Chevron Phillips Chemical Company LLC

- China Petrochemical Corporation

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- Haldia Petrochemicals Limited

- Hanwha Group

- INEOS AG

- LG Chem Ltd.

- LyondellBasell Industries Holdings B.V.

- Merck KGaA

- Mitsubishi Chemical Corporation

- NOVA Chemicals Corporation

- Reliance Industries Limited

- Saudi Basic Industries Corporation

- SCG Chemicals Public Company Limited

- Shell PLC

- The Dow Chemical Company

- Thermo Fisher Scientific Inc.

- TotalEnergies SE.

- Versalis S.p.A.

Strategic Imperatives and Proactive Measures for Polyethylene Industry Leaders to Capitalize on Emerging Trends and Mitigate Risks

Industry leaders must adopt proactive, forward-looking strategies to thrive amid evolving market conditions and regulatory landscapes. Embracing a circular economy mindset is paramount: companies should accelerate deployment of mechanical and chemical recycling technologies, invest in infrastructure for feedstock diversification, and collaborate across the value chain to secure sustainable waste streams. Establishing mass balance systems and leveraging certification schemes can reinforce traceability and bolster customer confidence in renewable and recycled resin content.

Supply-chain agility will be a key competitive differentiator. Organizations should map critical import dependencies, develop alternative sourcing agreements, and explore regional production hubs that mitigate tariff exposures and logistical constraints. Parallel efforts to optimize capital allocation through high-return debottlenecking projects and modular plant expansions can improve operating rates and reduce lead times.

Innovation remains essential: R&D portfolios must balance incremental improvements in catalyst performance with disruptive breakthroughs in polymer architecture, additive formulations, and digital process controls. Strategic partnerships with technology providers, start-ups, and academic institutions can accelerate commercialization pathways for next-generation materials.

Finally, engagement with policymakers and participation in industry consortia will be crucial to shape supportive regulatory frameworks, secure funding for sustainability initiatives, and ensure equitable trade policies. By aligning strategic planning with emerging industry shifts, polyethylene companies can fortify their resilience, unlock new revenue streams, and maintain leadership in a rapidly transforming marketplace.

Detailing Rigorous Research Approaches and Analytical Frameworks Underpinning the Comprehensive Polyethylene Market Assessment

This research integrates primary and secondary methodologies to deliver a robust and transparent market assessment. Primary research comprised in-depth interviews with key stakeholders, including resin producers, technology licensors, end-use manufacturers, and policy experts. These discussions provided qualitative perspectives on demand drivers, competitive positioning, and regulatory outlooks.

Secondary research leveraged authoritative data sources such as government trade statistics, tariff filings, industry association publications, technical standards, and peer-reviewed journals. Company annual reports, investor presentations, and proprietary deal databases enriched our understanding of strategic investments, capacity expansions, and M&A activities.

Our analytical framework employed both top-down and bottom-up approaches. The top-down analysis evaluated macroeconomic indicators, trade flows, and policy shifts, while the bottom-up analysis aggregated company-level production capacities, operational data, and segment-specific performance metrics. We triangulated findings across multiple sources to validate assumptions and ensure methodological rigor.

Quantitative insights were supplemented by scenario analysis exploring the implications of tariff fluctuations, feedstock price volatility, and adoption rates of sustainable technologies. This comprehensive approach ensures that stakeholders receive actionable intelligence grounded in empirical evidence and strategic foresight.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyethylene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyethylene Market, by Product Type

- Polyethylene Market, by Recycling Process

- Polyethylene Market, by Application

- Polyethylene Market, by End User

- Polyethylene Market, by Region

- Polyethylene Market, by Group

- Polyethylene Market, by Country

- United States Polyethylene Market

- China Polyethylene Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1908 ]

Concluding Perspectives on Polyethylene Market Evolution and Strategic Imperatives for Sustained Competitive Advantage

The polyethylene industry stands at a pivotal juncture, as sustainability imperatives, technological innovations, and trade policy shifts converge to redefine competitive landscapes. Advancements in bio-based production and advanced recycling are reshaping value chains, while digitization and process intensification drive operational excellence. Mitigating the ramifications of 2025 tariff measures requires strategic agility and holistic supply-chain mapping.

Regional dynamics further underscore the importance of tailored strategies: North America’s feedstock advantages must be balanced against new trade barriers, Europe must reconcile aging infrastructure with circular-economy mandates, and Asia-Pacific’s rapid capacity expansion demands alignment with evolving sustainability frameworks.

Leading companies are distinguishing themselves through targeted investments in renewable and circular solutions, integrated joint ventures, and portfolio diversification. However, success will hinge on collaborative ecosystems that unite innovators, policymakers, and end-users in pursuit of resilient, low-carbon polyethylene value chains.

As the industry navigates these transformative shifts, stakeholders equipped with granular segmentation insights, rigorous methodology, and actionable recommendations will be best positioned to capture emerging opportunities and sustain long-term growth.

Engage Directly with Ketan Rohom to Obtain the In-Depth Polyethylene Market Research Report and Elevate Your Strategic Outlook

This comprehensive Polyethylene Market Research Report offers invaluable strategic insights, tailored data, and actionable foresight to empower decision-makers in navigating the complex dynamics of global polyethylene markets. For an in-depth analysis, customized advisory, and executive consultation, please connect with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. Engage now to unlock exclusive access to the full report and refine your strategic initiatives with expert guidance.

- How big is the Polyethylene Market?

- What is the Polyethylene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?