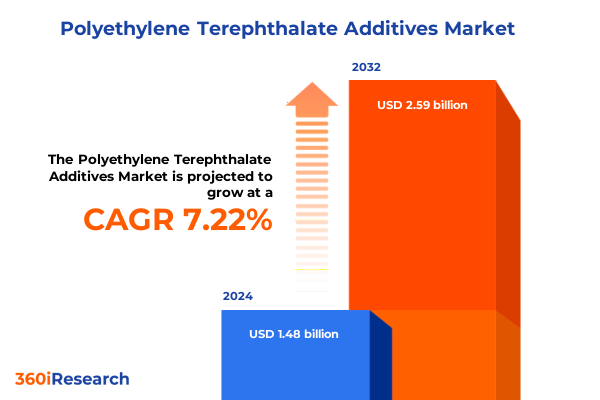

The Polyethylene Terephthalate Additives Market size was estimated at USD 1.56 billion in 2025 and expected to reach USD 1.65 billion in 2026, at a CAGR of 7.50% to reach USD 2.59 billion by 2032.

Unlocking the Fundamentals of Polyethylene Terephthalate Additives to Understand Their Essential Role and Emerging Importance in Modern Polymer Applications

The polyethylene terephthalate additives market has emerged as a critical segment within polymer chemistry, with its applications influencing performance across a broad array of end-use industries. In recent years, advancements in additive technology have not only addressed fundamental challenges like thermal stability, color consistency, and mechanical strength but have also driven transformative shifts toward sustainability and circularity. As global demand for lightweight and recyclable materials intensifies, these additives play an essential role in meeting rigorous regulatory requirements while enhancing the functionality and lifespan of PET-based products.

Moreover, innovation in additive composition continues to unlock novel properties that expand application potential. For instance, breakthroughs in nucleating agent technology have optimized crystallization kinetics, resulting in faster cycle times and improved optical clarity for packaging films. Likewise, the integration of advanced UV stabilizers has significantly extended the service life of outdoor PET components. At the same time, additive manufacturers are increasingly leveraging digital formulation tools and predictive modeling to tailor performance attributes at the molecular level, ensuring that PET additives align with precise processing conditions and end-use demands.

Consequently, an understanding of the core drivers behind PET additive development-from performance enhancement to regulatory compliance and environmental stewardship-is essential for stakeholders seeking to maintain competitiveness. As the market continues to evolve under the influence of shifting consumer preferences, policy frameworks, and technological capabilities, establishing a robust foundational grasp of PET additive fundamentals remains the first step toward strategic differentiation and long-term value creation.

Tracing the Evolution of PET Additive Innovations and Market Dynamics That Are Transforming Performance, Sustainability, and Efficiency in Polymer Manufacturing

The landscape of PET additives has undergone remarkable transformation, driven by converging forces of sustainability mandates, supply chain resilience concerns, and escalating performance requirements. Initially focused on simple stabilization and coloring functions, additive chemistries have expanded to incorporate multi-functional solutions that simultaneously address durability, recyclability, and regulatory compliance. Innovations such as bio-based plasticizers and halogen-free flame retardants illustrate how the market has pivoted toward greener alternatives without compromising performance.

Furthermore, the adoption of Industry 4.0 practices has accelerated this evolution by enabling real-time monitoring of additives’ impact on processing parameters. Artificial intelligence and machine learning platforms are now employed to predict how novel additive blends will behave under varying extrusion and injection molding conditions. This data-driven approach has not only reduced development cycles but also facilitated rapid customization based on specific customer requirements.

In addition, the global shift toward a circular economy has spurred extensive research into additive formulations that enhance recyclate quality. Developments in compatibilizers and chain-extending additives are transforming post-consumer PET streams into near-virgin equivalents, thereby addressing critical concerns about material downcycling. Collaborative partnerships between resin producers, additive developers, and end users have become commonplace, marking a more integrated value chain where sustainability and innovation coalesce.

As a result, the PET additives landscape today is defined by its agility and responsiveness to external pressures. Stakeholders who align their strategies with these transformative shifts-leveraging advanced chemistries, data-enabled development, and circularity-focused collaborations-are best positioned to lead in an increasingly competitive and sustainability-driven market.

Analyzing the Ripple Effects of 2025 U.S. Tariff Policies on Domestic PET Additives Supply Chains, Costs, and Strategic Responses by Industry Stakeholders

In 2025, the imposition of new U.S. tariffs on imported PET additives has reshaped cost structures and strategic priorities across the industry. These measures, intended to incentivize domestic production and protect critical supply chains, have led to immediate adjustments in procurement practices. Companies that had historically relied on competitively priced foreign suppliers for antioxidants, colorants, flame retardants, and other key additives were required to reevaluate their sourcing strategies under the new duty regime, which has increased landed costs and influenced margin profiles.

Consequently, several domestic and regional suppliers have ramped up their production capabilities to capture market share, investing in capacity expansions and enhancing logistical frameworks. This shift has fostered greater supply chain resilience, reducing reliance on cross-border shipments while mitigating the risk of future policy fluctuations. Nonetheless, the transition has not been without challenges; manufacturers have navigated tighter inventory conditions and temporary disruptions as supply networks calibrate to new trade parameters.

Moreover, the tariff-induced cost pressure has heightened interest in additive formulations that deliver multifunctional benefits-thereby offsetting higher raw material expenses through downstream savings in processing efficiency and product performance. For instance, nucleating agents that reduce cycle times or UV stabilizer blends that extend service life are being prioritized for their total cost-of-ownership advantages. In turn, R&D teams are accelerating product innovation to meet this demand for high-value, cost-effective additive solutions.

Looking ahead, the cumulative impact of 2025 tariffs is expected to reinforce a more diversified supplier ecosystem and stimulate domestic innovation. Companies that proactively adapt by forging strategic alliances and advancing in-country manufacturing will emerge with a competitive edge, while those that fail to adjust may face prolonged cost burdens and supply volatility.

Deep Dive into Diverse PET Additive Segmentation Revealing Critical Type, Application, Form, and End-Use Insights Driving Tailored Solutions and Market Differentiation

A deep-dive examination of market segmentation unveils nuanced insights that shape tailored product development and commercialization strategies. When analyzing by type, the spectrum of antioxidant solutions is categorized into primary and secondary variants, each addressing distinct thermal stability challenges in PET processing. Concurrently, dye and pigment colorants allow formulators to balance aesthetic requirements with UV resistance, while mineral and polymer fillers are selected based on cost-performance optimization and mechanical reinforcement objectives. Flame retardants further bifurcate into halogenated and non-halogenated chemistries, compelling manufacturers to navigate evolving environmental regulations. Nucleating agents in inorganic or organic form refine crystallization kinetics, enhancing clarity and throughput. Plasticizers range from phthalate to non-phthalate options, influencing flexibility and regulatory compliance. Finally, UV stabilizers encompassing absorbers and hindered amine light stabilizers guard against photodegradation and color fade.

Turning to application-based segmentation, bottles-spanning carbonated beverage, PET water, and other packaging variants-demand additives that ensure barrier performance, aesthetic clarity, and processing efficiency. Engineering plastics, whether reinforced or unreinforced, call for stabilization packages that support complex molding geometries and structural integrity. Fiber applications, both in textile and industrial arenas, rely on specialized additive blends to impart tensile strength, dye affinity, and abrasion resistance. Film and sheet products, including BOPET film and thermoformed sheet formats, leverage nucleating and slip agent combinations to optimize surface properties and processing speeds.

In terms of additive form, micro-pellet and standard granule offerings deliver consistent melt profiles and feeding precision, whereas coarse and fine powders cater to specialty processes such as high-shear compounding and surface coating applications. Finally, end-use industries spanning automotive interiors and exteriors, consumer electronics and housewares, beverage, food and pharmaceutical packaging, and apparel and home textiles, each impose unique performance criteria. These targeted segmentation insights empower stakeholders to develop differentiated formulations that align precisely with functional requirements and value propositions.

This comprehensive research report categorizes the Polyethylene Terephthalate Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Form

- Application

- End-Use Industry

Comparative Analysis of Americas, EMEA, and Asia-Pacific Regional Trends Highlighting Shifting Demand Patterns, Regulatory Landscapes, and Strategic Growth Hotspots

Regional dynamics for PET additives reveal distinct drivers and challenges across the Americas, EMEA, and Asia-Pacific markets. Within the Americas, regulatory frameworks and consumer demand in North America emphasize recyclability and food-grade compliance, prompting local manufacturers to prioritize compatibilizers and barrier-enhancing additives. Latin American markets, while smaller in scale, are experiencing gradual modernization of packaging infrastructure, driving increased uptake of multi-functional additive blends that support emerging beverage and food industries.

In the Europe, Middle East & Africa region, stringent environmental regulations and ambitious circularity targets have accelerated the adoption of bio-based and halogen-free formulations. The European Union’s Single-Use Plastics Directive and extended producer responsibility schemes place a premium on additives that facilitate material recovery and recyclate quality. Meanwhile, Middle Eastern manufacturing hubs focus on high-performance engineering plastics, leveraging advanced flame retardants and stabilizers to meet safety standards in construction and electronics. Sub-Saharan African markets, still in early stages of polymer adoption, present opportunities for value-driven additive solutions that address cost sensitivity and infrastructure variability.

Asia-Pacific stands out as a growth engine for PET additives, powered by expanding packaging sectors in China and Southeast Asia and burgeoning automotive and electronics industries in Japan and South Korea. Additive suppliers in the region are investing heavily in research centers and production facilities to serve local demand efficiently, often collaborating with global partners to introduce next-generation chemistries. At the same time, Asia-Pacific regulators are tightening restrictions on certain phthalate plasticizers and halogenated flame retardants, incentivizing the shift toward greener additive alternatives.

This comprehensive research report examines key regions that drive the evolution of the Polyethylene Terephthalate Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading PET Additive Manufacturers and Innovators Unveiling Their Strategic Portfolios, Collaborative Ventures, and Innovation Roadmaps Shaping Industry Leadership

The competitive landscape of PET additives is characterized by a combination of global chemical giants, specialized innovators, and vertically integrated resin producers. Leading multinational corporations distinguish themselves through expansive R&D infrastructures, enabling the development of proprietary multifunctional additives that address evolving performance and sustainability requirements. These industry frontrunners often engage in cross-sector partnerships to co-develop bespoke formulations tailored to end-user processes and regulatory mandates.

Simultaneously, mid-sized specialty companies have carved niches by focusing on high-value segments such as bio-based plasticizers, halogen-free flame retardants, and compatibilizers for recycled PET. Their agility and targeted expertise allow rapid response to emerging trends, while strategic alliances with resin manufacturers and processors expand their market reach. Meanwhile, resin producers with in-house additive capabilities leverage integrated supply chains to offer bundled solutions that simplify procurement and ensure material compatibility.

Emerging players from innovation hubs are also reshaping the competitive equation, introducing advanced digital formulation platforms and AI-driven predictive modeling to accelerate additive development. These technology-centric entrants frequently collaborate with academic institutions and testing laboratories to validate performance under real-world processing conditions. Together, this diverse array of participants drives continuous innovation and competitive differentiation, ensuring that customers have access to a broad spectrum of additive solutions optimized for their specific application requirements.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyethylene Terephthalate Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- ADEKA Corporation

- Arkema S.A.

- Avient Corporation

- Baerlocher GmbH

- BASF SE

- Clariant AG

- Eastman Chemical Company

- Evonik Industries AG

- ExxonMobil Chemical Company

- Kaneka Corporation

- LANXESS AG

- Mitsubishi Chemical Group Corporation

- Mitsui & Co. Plastics Ltd.

- SABIC

- SABO S.p.A.

- Solvay S.A.

- Songwon Industrial Co., Ltd.

- The Dow Chemical Company

Strategic Imperatives for Industry Leaders to Capitalize on PET Additive Opportunities Through Innovation, Circular Economy Practices, and Diversified Supply Chain Strategies

Industry leaders should prioritize the integration of sustainable additive chemistries into their core portfolios to meet both regulatory imperatives and consumer expectations. By focusing investment on bio-based and halogen-free solutions, organizations can differentiate their offerings while aligning with global circular economy goals. Furthermore, embedding digital formulation and predictive modeling capabilities within R&D processes will accelerate time to market and enhance customization for end users.

Moreover, forging strategic alliances across the value chain-from resin producers to converters and brand owners-will be critical for co-developing high-performance additive systems that address complex processing and regulatory challenges. Close collaboration with recyclers and waste management stakeholders can also unlock new opportunities for compatibilizers and chain modifiers that improve recyclate quality. Equally important is the diversification of supply sources to mitigate geopolitical and tariff-related risks, whether through regional manufacturing expansions or alternative feedstock strategies.

In addition, companies must invest in robust application testing infrastructure, enabling rapid validation of additive performance under diverse processing conditions. By providing technical support and training for converters and end users, additive suppliers can deepen customer relationships and foster brand loyalty. Finally, continuous market intelligence gathering and scenario planning will help organizations anticipate regulatory shifts and emerging performance requirements, ensuring that product roadmaps remain aligned with evolving market dynamics.

Rigorous Research Methodology Outlining Comprehensive Primary and Secondary Approaches, Data Validation Techniques, and Analytical Frameworks Ensuring Report Credibility

This report is underpinned by a rigorous research methodology that combines primary and secondary data collection to deliver credible and actionable insights. The primary research component involved structured interviews and surveys with key stakeholders, including additive manufacturers, resin producers, converters, and brand owners. These engagements yielded first-hand perspectives on emerging trends, formulation challenges, and strategic priorities across various end-use segments.

Secondary research sources encompassed industry publications, regulatory databases, patent filings, and technical white papers. This secondary intelligence provided context on historical market evolution, competitive positioning, and the impact of regulatory frameworks. Data triangulation techniques were applied to reconcile information from multiple sources, ensuring consistency and mitigating bias.

Analytical frameworks such as SWOT and Porter’s Five Forces were employed to evaluate competitive dynamics, while scenario analysis assessed potential outcomes of regulatory and tariff changes. Additive formulation performance data and processing metrics were validated through collaboration with independent testing laboratories. The integration of quantitative and qualitative insights, supported by an expert advisory panel, ensures that the report’s findings are robust, objective, and actionable for decision makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyethylene Terephthalate Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyethylene Terephthalate Additives Market, by Type

- Polyethylene Terephthalate Additives Market, by Form

- Polyethylene Terephthalate Additives Market, by Application

- Polyethylene Terephthalate Additives Market, by End-Use Industry

- Polyethylene Terephthalate Additives Market, by Region

- Polyethylene Terephthalate Additives Market, by Group

- Polyethylene Terephthalate Additives Market, by Country

- United States Polyethylene Terephthalate Additives Market

- China Polyethylene Terephthalate Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 2862 ]

Synthesizing Key Findings on PET Additive Trends, Challenges, and Opportunities While Emphasizing the Imperative for Innovation and Strategic Agility in Evolving Markets

In conclusion, the PET additives market is poised at a critical juncture, shaped by sustainability imperatives, regulatory complexities, and technological breakthroughs. The shift toward multi-functional, eco-friendly formulations reflects a broader industry move to reconcile performance demands with environmental stewardship. Meanwhile, the 2025 U.S. tariffs have catalyzed greater supply chain diversification and domestic innovation, underscoring the importance of strategic agility in procurement and manufacturing.

Key segmentation insights reveal that a nuanced understanding of type, application, form, and end-use requirements enables more precise product positioning and value delivery. Regional analysis highlights that while North America and EMEA prioritize recyclability and regulatory compliance, Asia-Pacific’s dynamic growth is driving robust demand for both standard and advanced additive solutions. Competitive profiling indicates that a balance of global R&D prowess, niche specialization, and digital innovation defines market leadership.

As the landscape continues to evolve, stakeholders who embrace sustainable chemistries, invest in collaborative partnerships, and leverage data-driven R&D will secure a competitive advantage. Ultimately, success in the PET additives sector will hinge on the ability to anticipate change, innovate continually, and align product development with the interwoven demands of performance, cost efficiency, and environmental responsibility.

Secure Exclusive PET Additives Market Insights Today by Connecting with Ketan Rohom, Associate Director, Sales & Marketing, to Access the Comprehensive Research Report

To secure your copy of the comprehensive market research report on Polyethylene Terephthalate Additives, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. By engaging with Ketan Rohom, you will gain personalized guidance on report features, customized data packages, and exclusive advisory sessions to ensure that the insights align precisely with your strategic objectives. Connect today to unlock the full value of actionable intelligence, in-depth industry analysis, and forward-looking trends that will empower your organization to excel in the evolving PET additives landscape.

- How big is the Polyethylene Terephthalate Additives Market?

- What is the Polyethylene Terephthalate Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?