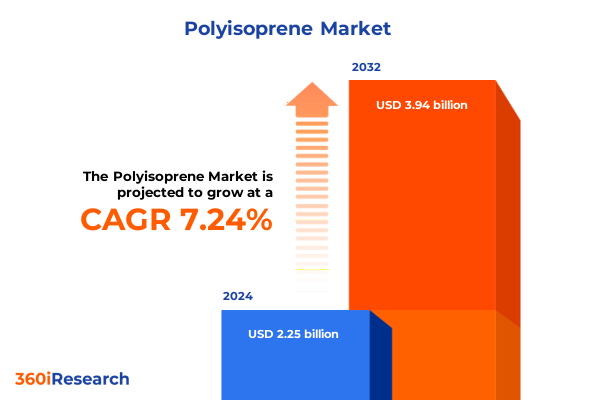

The Polyisoprene Market size was estimated at USD 2.41 billion in 2025 and expected to reach USD 2.58 billion in 2026, at a CAGR of 7.27% to reach USD 3.94 billion by 2032.

Setting the Stage for Polyisoprene Market Dynamics and Strategic Imperatives in a Rapidly Evolving Global Environment

The polyisoprene market stands at a critical inflection point, shaped by a confluence of technological innovations, shifting consumer demands, and evolving regulatory frameworks. As industries ranging from automotive to healthcare intensify their focus on sustainability and performance, polyisoprene has emerged as a material of choice for its unique combination of elasticity, resilience, and biocompatibility. Despite its inherent advantages, market participants face challenges related to raw material availability, production costs, and the integration of greener manufacturing processes. Against this backdrop, a comprehensive understanding of market drivers, constraints, and emerging opportunities has never been more essential.

In this context, stakeholders require a clear, concise overview of the current state of the polyisoprene landscape, as well as forward-looking insights that address competitive pressures and regulatory evolution. This executive summary aims to distill complex market dynamics into actionable intelligence that supports informed decision-making. By outlining transformative shifts, tariff impacts, segmentation nuances, regional trends, corporate strategies, and methodological underpinnings, the following sections provide a structured foundation for industry leaders and investors seeking to advance their position in the polyisoprene arena.

Embracing Sustainable Production and Advanced Polymerization Technologies as Catalysts for Evolution in the Polyisoprene Sector

Recent years have witnessed transformative shifts in the polyisoprene landscape driven by heightened emphasis on sustainable sourcing and advanced polymerization technologies. The widespread adoption of metallocene catalyst systems has enabled manufacturers to produce grades with superior consistency and high-cis content, enhancing material performance in demanding applications such as medical gloves and high-performance tires. Concurrently, emulsion and solution polymerization techniques have evolved, with process optimizations reducing energy consumption and waste generation, allowing suppliers to align with stringent environmental standards.

In parallel, the rise of electric vehicles and stringent emission regulations have accelerated demand for specialized hoses, belts, and vibration-damping components, prompting polyisoprene producers to innovate formulations that maintain elasticity under extreme thermal and mechanical stress. The convergence of digitalization and smart manufacturing has further transformed production ecosystems, fostering real-time monitoring and predictive maintenance that improve yield and product quality. These advances, juxtaposed with growing consumer awareness of eco-friendly materials, are reshaping value chains and compelling both upstream and downstream players to reevaluate sourcing, processing, and product development strategies.

Navigating Tariff-Induced Cost Pressures and Supply Chain Realignments Shaping the United States Polyisoprene Market Landscape

In 2025, the cumulative impact of United States tariffs on polyisoprene imports has introduced a complex layer of cost pressures and supply chain realignment for domestic manufacturers and end users alike. The imposition of additional duties on selected grades has increased landed costs, prompting buyers to diversify sourcing strategies by exploring alternative suppliers in Asia-Pacific and Europe. As a result, regional supply chains have become more pronounced, with companies negotiating long-term contracts and strategic partnerships to secure consistent raw material flows at predictable price points.

Additionally, tariff-related cost fluctuations have catalyzed internal process enhancements aimed at improving production efficiency and reducing waste. Manufacturers have intensified their focus on process automation and lean manufacturing principles to mitigate margin compression. Meanwhile, some industry participants are considering backward integration into polyisoprene resin production to achieve greater control over input costs and to shield themselves from external tariff volatility. Collectively, these developments underscore the multifaceted impact of trade policy on production economics, risk management practices, and the strategic recalibration of global supply networks.

Illuminating Strategic Differentiators Across Application Uses, Material Grades, and Channel Architectures to Drive Targeted Growth

Segmentation analysis reveals nuanced performance dynamics that underpin strategic decision-making across application, product type, production process, grade, and distribution channels. In applications, adhesives and sealants command attention due to the rising demand in construction and packaging industries, with container sealing and pressure-sensitive products benefitting from enhanced adhesion properties. Meanwhile, the footwear segment demonstrates differential growth patterns, where casual and sports footwear leverage comfort-driven formulations, and safety footwear requires formulations that provide superior abrasion resistance. The hoses and belts category underscores the importance of thermal stability and mechanical strength, particularly in automotive and industrial contexts. In the medical gloves space, powder-free variants have gained traction amid heightened infection control protocols, while passenger car tires and off-road tire manufacturers are prioritizing high-cis polyisoprene to balance performance and durability.

From a product type perspective, natural polyisoprene continues to be prized for high-performance and standard-grade applications, with sustainability credentials driving procurement decisions. Synthetic polyisoprene, produced via emulsion or solution polymerization, further segments into general-purpose and high-purity grades, serving diverse markets from consumer goods to precision healthcare devices. Production processes also dictate performance profiles, as anionic polymerization offers precise molecular weight control in both bulk and solution applications, while metallocene polymerization introduces novel emulsion and solution variants that deliver uniformity and enhanced mechanical properties. The grade segmentation differentiates general-purpose from specialty offerings, ensuring that high-performance and customized grades meet the evolving demands of specialized applications. Lastly, distribution channels shape market access, where direct sales enable tailored solutions for large end users, distributors and wholesalers provide broad market coverage, and online channels deliver convenience and expedited procurement for niche buyers.

This comprehensive research report categorizes the Polyisoprene market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- Product Type

- Production Process

- Grade

- Distribution Channel

Dissecting Regional Drivers and Regulatory Forces Propelling Polyisoprene Development Across Major Global Markets

Regional insights expose distinct drivers and challenges that define the polyisoprene market in the Americas, Europe Middle East Africa, and Asia Pacific landscapes. In the Americas, the United States and Brazil lead innovation in sustainable production and biopolymer integration, supported by governmental incentives that foster the development of bio-based feedstocks and green manufacturing protocols. This region grapples with tariff volatility, pushing manufacturers toward localized production to hedge against import costs.

Transitioning to Europe, Middle East, and Africa, stringent environmental regulations have accelerated the adoption of high-purity and low-VOC polyisoprene grades, particularly in medical and automotive applications. EU directives on chemical safety and waste management drive investment in closed-loop production systems and advanced catalyst recovery, while emerging markets in the Middle East and North Africa show promise for infrastructure-driven demand in adhesives and sealants.

Meanwhile, Asia Pacific has emerged as a growth powerhouse, with China and India expanding production capacity through integrated petrochemical complexes, and Japan spearheading high-cis solution polymerization technologies. Infrastructure modernization and rising consumer purchasing power fuel demand for footwear and tire segments, complemented by government policies that incentivize domestic polymer manufacturing and export expansion.

This comprehensive research report examines key regions that drive the evolution of the Polyisoprene market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Showcasing Collaborative Innovation and Integrated Supply Chain Strategies Driving Leadership in Polyisoprene Production

Leading participants in the polyisoprene market are leveraging strategic initiatives to fortify their competitive positions and drive innovation. Key players are investing in research collaborations with academic institutions to refine catalyst formulations and to enhance molecular architecture control, thereby unlocking new performance thresholds in medical and automotive applications. Simultaneously, capacity expansions in Asia Pacific are positioning certain manufacturers to capture growing regional demand, supported by integrated supply chain models that streamline feedstock procurement and resin distribution.

Moreover, alliances between resin producers and downstream converters are becoming increasingly prevalent, enabling co-development of customized polyisoprene grades designed to meet stringent application-specific criteria. To strengthen sustainability credentials, market leaders are implementing blockchain-based traceability systems to verify the origin of natural latex feedstocks and to ensure compliance with environmental and labor standards. In addition, digitalization efforts encompassing process analytics platforms and predictive maintenance tools are enhancing operational resilience and driving step-change improvements in yield and cost efficiency.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyisoprene market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Ansell Limited

- ARLANXEO Luxembourg S.A.

- Asahi Kasei Corporation

- Cariflex Pte. Ltd.

- China Petroleum & Chemical Corporation

- DL Chemical Co., Ltd.

- Exxon Mobil Corporation

- JSR Corporation

- Kuraray Co., Ltd.

- Lion Elastomers LLC

- Mitsui Chemicals, Inc.

- PetroChina Company Limited

- PJSC SIBUR Holding

- Semperit AG Holding

- Shanxi Synthetic Rubber Group Co., Ltd.

- Synthos S.A.

- Top Glove Corporation Berhad

- Versalis S.p.A.

Advancing Resilience and Differentiation Through Integrated Feedstock Strategies and Application-Driven Innovation

Industry leaders should prioritize investments in next-generation polymerization technologies to secure competitive differentiation and operational efficiency. By adopting metallocene catalyst platforms and enhancing process analytics capabilities, organizations can optimize molecular weight distribution and reduce defect rates. Furthermore, strengthening backward integration into feedstock processing will provide insulation from tariff fluctuations and raw material price volatility, while fostering resilience in supply chain configurations.

To maximize market penetration, companies must develop tailored value propositions that align high-purity and specialty grades with the exacting performance requirements of target applications. Engaging in strategic partnerships with end users can expedite product development cycles and facilitate co-created solutions that drive customer loyalty. Simultaneously, environmental stewardship should remain a core pillar of corporate strategy, with emphasis on circular economy principles, closed-loop manufacturing, and the transparent reporting of sustainability metrics. Finally, expanding digital sales channels and forging alliances with logistics providers will accelerate go-to-market execution and ensure seamless delivery in an increasingly digitized procurement ecosystem.

Detailing a Robust Multi-Source Research Approach Integrating Executive Interviews, Trade Analysis, and Technology Surveillance

This market analysis draws upon a rigorous, multi-faceted research methodology designed to ensure comprehensive and objective insights. Primary research was conducted through in-depth interviews with senior executives, process engineers, and regulatory experts across producing and consuming regions, providing real-world perspectives on market trends, technology adoption, and policy impacts. Complementing this, secondary research leveraged peer-reviewed journals, industry white papers, patent filings, and technical standards to validate primary findings and to analyze emerging innovations in polymerization and sustainability practices.

Quantitative data were meticulously curated from customs records, trade databases, and company disclosures to map historical import-export flows and to identify tariff impacts. Qualitative assessments were informed by case studies of production facility upgrades and environmental compliance initiatives. To mitigate bias, data triangulation techniques were employed, cross-referencing multiple sources to verify accuracy and reliability. The integration of these research approaches underpins the robustness of the insights presented, offering stakeholders a transparent view of the polyisoprene market’s evolution and the methodological rigor behind each conclusion.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyisoprene market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyisoprene Market, by Application

- Polyisoprene Market, by Product Type

- Polyisoprene Market, by Production Process

- Polyisoprene Market, by Grade

- Polyisoprene Market, by Distribution Channel

- Polyisoprene Market, by Region

- Polyisoprene Market, by Group

- Polyisoprene Market, by Country

- United States Polyisoprene Market

- China Polyisoprene Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2703 ]

Synthesizing Market Dynamics, Innovation Imperatives, and Strategic Pillars for Future-Proofing Polyisoprene Leadership

The polyisoprene market presents a compelling mix of challenges and opportunities shaped by technological innovation, regulatory evolution, and shifting trade policies. As sustainable production methods and advanced polymerization processes redefine performance benchmarks, stakeholders must navigate complex dynamics related to tariff-induced cost pressures and regional supply chain realignments. Segmentation analysis highlights the critical interplay between application-specific requirements, material grades, and distribution models, while regional insights emphasize the importance of localized strategies that address regulatory and infrastructure variables.

Looking forward, the companies that will thrive are those that harness process efficiency gains, foster collaborative innovation with end users, and reinforce sustainability as a strategic imperative. By leveraging integrated supply chain models, advancing backward integration, and deploying digital tools for operational excellence, industry participants can mitigate risks and capitalize on emerging market niches. Ultimately, a holistic approach that balances innovation with environmental stewardship and customer-centricity will distinguish market leaders in the evolving polyisoprene landscape.

Unlock Actionable Market Intelligence and Strategic Advantages in Polyisoprene by Engaging Directly with Our Associate Director in Sales & Marketing

Engaging with cutting-edge analysis of the polyisoprene market can empower your organization to navigate evolving supply chain dynamics, emerging production technologies, and shifting regulatory landscapes with confidence. With insights tailored to strategic decision-making, this comprehensive report provides a nuanced understanding of segmentation, regional variations, and key competitive strategies that will inform targeted growth initiatives and risk mitigation plans across applications, product types, processes, grades, and channels. To capitalize on the momentum in the polyisoprene industry and secure a competitive advantage, reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch, and take the next step toward unlocking the full potential of your investments in this market

- How big is the Polyisoprene Market?

- What is the Polyisoprene Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?