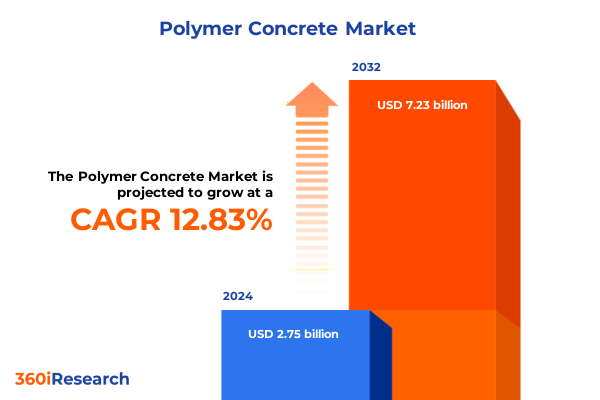

The Polymer Concrete Market size was estimated at USD 3.11 billion in 2025 and expected to reach USD 3.42 billion in 2026, at a CAGR of 12.80% to reach USD 7.23 billion by 2032.

Unlocking the Potential of Polymer Concrete Through Comprehensive Analysis of Material Innovations Market Dynamics and Sustainable Infrastructure Demands

Polymer concrete has emerged as a transformative material within modern construction and infrastructure projects, offering enhanced mechanical performance and accelerated curing times compared to traditional cement‐based composites. By integrating advanced resin systems with high‐strength aggregates, polymer concrete provides superior resistance to chemical attack, abrasion, and freeze–thaw cycles. These attributes have driven increasing adoption across applications where longevity and reliability are paramount. Recent strides in resin chemistry have broadened the scope of viable applications, enabling formulations tailored for rapid turnaround in precast production or for high‐performance overlays in industrial settings. As public and private stakeholders intensify their focus on resilient infrastructure and sustainable building practices, the unique properties of polymer concrete position it as a leading solution for next‐generation projects.

Within this evolving landscape, decision makers require a holistic understanding of material innovations, market drivers, and competitive dynamics to effectively navigate project requirements and procurement strategies. This executive summary provides a concise yet comprehensive overview of the critical trends shaping polymer concrete, the implications of recent policy shifts, and the segmentation patterns that influence demand. Readers will gain insight into regulatory developments, supply chain considerations, and regional growth differentials that collectively inform strategic planning. By distilling complex data into actionable intelligence, this report equips stakeholders with the context and clarity needed to capitalize on emerging opportunities in the polymer concrete arena.

Charting Transformative Shifts in Polymer Concrete Applications Driven by Technological Advancements Environmental Imperatives and Industry Collaboration

Over the past several years, polymer concrete has undergone a profound transformation driven by converging trends in material science, environmental stewardship, and digital integration. Advances in resin formulations now deliver a balance of toughness and flexibility that was previously unattainable, enabling novel applications such as 3D‐printed formwork and ultra‐thin overlays with micro‐tolerance precision. Concurrently, growing regulatory emphasis on carbon reduction and wastewater management has incentivized the adoption of low‐emission curing agents and bio‐based polymer blends, fostering innovation across resin suppliers and end‐users alike. As a result, collaboration between chemical manufacturers, equipment providers, and construction firms has become increasingly strategic, with integrated pilot programs accelerating time‐to‐market for breakthrough technologies.

At the same time, digitalization has introduced new efficiencies in quality control and project coordination. Remote monitoring of curing kinetics, combined with AI‐driven predictive maintenance, allows contractors to optimize resource allocation and minimize downtime. This shift toward data‐centric workflows is further supported by modular manufacturing platforms that standardize production processes and ensure consistent batch quality across geographically dispersed facilities. Taken together, these transformative shifts are redefining expectations around performance, sustainability, and project delivery, setting the stage for polymer concrete’s next growth chapter.

Assessing the Cumulative Impact of 2025 United States Tariffs on Raw Materials Supply Chains Industry Costs and Competitive Dynamics in Polymer Concrete

In 2025, the United States implemented new tariff schedules on key raw materials used in polymer concrete production, including select epoxy prepolymer components and specialty polyester resins. These duties, introduced under broader Section 301 measures, have led to an uptick in input costs for domestic producers reliant on imports from Asia and Europe. The cumulative impact has been most pronounced for manufacturers of bisphenol‐based vinyl ester systems and orthophthalic polyester grades, where supply chain bottlenecks have translated into material shortages and project scheduling delays.

Producers have responded by diversifying procurement channels and accelerating qualification of alternative resin suppliers. In some cases, forward contracts and hedging strategies have been employed to lock in competitive pricing, while collaborative ventures with domestic resin processors are creating more localized production capacity. Despite these mitigation efforts, the tariffs have prompted a realignment of supply chain relationships and spurred regional sourcing strategies that favor North American and Middle Eastern resin manufacturers. Moving forward, companies that proactively manage tariff exposure and cultivate robust supplier partnerships will be best positioned to absorb cost fluctuations and maintain project timelines without sacrificing performance or pricing competitiveness.

Revealing Key Segmentation Insights Illuminating Resin Type Application and End Use Interdependencies Shaping Polymer Concrete Market Opportunities

A granular examination of polymer concrete reveals three primary segmentation dimensions-resin type, application, and end use-whose interdependencies drive market dynamics and innovation trajectories. Within resin type, epoxy systems deliver exceptional adhesion and chemical resistance, while polyester formulations, encompassing isophthalic and orthophthalic variants, balance cost efficiency and mechanical strength. Vinyl ester resins, available in bisphenol and novolac chemistries, further differentiate performance profiles by combining high durability with moderate viscosity for complex molds. This nuanced resin landscape influences product development cycles and informs targeted R&D investments.

Application segmentation underscores the versatility of polymer concrete across distinct use cases, from flooring systems deployed in commercial spaces where decorative and industrial floors demand both aesthetics and resilience, to precast products engineered for rapid onsite assembly, and specialized primers and sealers that extend substrate lifespan. Repair and rehabilitation projects represent an additional growth avenue, leveraging fast‐set chemistries to minimize downtime in critical infrastructure. End use classification into commercial, industrial, and residential sectors highlights divergent adoption drivers: commercial developers prioritize aesthetics and maintenance, industrial operators seek chemical resilience and load‐bearing capacity, and residential customers emphasize rapid installation and cost control. Collectively, these segmentation insights illuminate emergent opportunities where tailored formulations and service models can unlock new value propositions.

This comprehensive research report categorizes the Polymer Concrete market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resin Type

- Application

- End Use

Extracting Fundamental Regional Perspectives on Polymer Concrete Adoption Market Drivers and Growth Levers Across the Americas EMEA and Asia Pacific

Regional dynamics vary significantly across the Americas, Europe, Middle East & Africa, and Asia-Pacific, reflecting distinct regulatory, economic, and infrastructure imperatives. In the Americas, aging transportation networks and expanding industrial parks have driven demand for high‐performance overlays and precast elements that accelerate maintenance cycles and minimize traffic disruptions. Sustainability mandates in Canada and the United States are catalyzing adoption of low‐VOC resins and recycled aggregate blends, reinforcing the region’s leadership in green construction practices.

Across Europe, Middle East & Africa, government initiatives targeting infrastructure resilience and oil & gas facility upgrades are stimulating demand for chemical‐resistant polymer concrete solutions. Stringent environmental regulations in the European Union have also accelerated uptake of bio‐based resin technologies, while rapid urbanization in Middle Eastern markets is fueling high‐volume precast deployments. In the Asia-Pacific, robust construction activity in Southeast Asia and infrastructure modernization programs in Australia and Japan are propelling investment in polymer concrete for marine and heavy‐industrial applications. Local supply chains continue to strengthen through joint ventures, ensuring faster material delivery and better cost structures for multinational contractors.

This comprehensive research report examines key regions that drive the evolution of the Polymer Concrete market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Key Corporate Players Propelling Innovation Market Reach and Strategic Alliances in the Polymer Concrete Industry Landscape

Leading industry players are deploying strategic initiatives to consolidate market positions and advance polymer concrete capabilities. Global resin manufacturers have intensified investment in next‐generation chemistries that offer enhanced environmental profiles, forging partnerships with application specialists to co‐develop turnkey solutions. Equipment providers are integrating digital monitoring and rapid mixing technologies to complement resin innovations and differentiate their offerings. At the same time, select contractors and precast fabricators have expanded vertically through acquisitions, securing in‐house access to specialized resin formulations and quality control laboratories.

Strategic alliances between technology startups and established multinationals are also emerging, blending entrepreneurial agility with scale advantages to accelerate commercial launch of disruptive products. Furthermore, joint research consortia sponsored by industry associations are facilitating pre‐competitive collaboration on standardization efforts and performance benchmarking. This collective strategy matrix-comprising proprietary R&D, partnership ecosystems, and strategic M&A-underscores the imperative for integrated approaches that align product innovation with end‐user demands and distribution capabilities.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polymer Concrete market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acciona S.A.

- ACO Ahlmann SE & Co. KG

- Arizona Polymer Flooring Inc.

- BASF SE

- Chryso SA

- Dudick Inc.

- Forté Composites Inc.

- Fosroc International Limited

- GCP Applied Technologies Inc.

- Heidelberg Cement AG

- Interplastic Corporation

- Lafarge Holcim Ltd

- LATICRETE International, Inc.

- Mapei S.p.A.

- Pidilite Industries Limited

- RPM International Inc.

- Sika AG

- TPP Manufacturing Sdn. Bhd.

- ULMA Architectural Solutions

- Wacker Chemie AG

Formulating Actionable Strategic Recommendations to Propel Leadership Competitive Advantage and Market Expansion in Polymer Concrete Sector

To capture growth opportunities and safeguard margins, industry leaders should prioritize a multipronged strategy centered on sustainable innovation, supply chain resilience, and customer-centric service. First, allocating R&D resources toward bio-based and low-emission resin systems will meet tightening regulatory standards while reinforcing brand leadership. Second, establishing dual-sourcing frameworks and cultivating emerging resin suppliers in under-served regions can mitigate tariff volatility and ensure consistent raw material availability. Third, integrating digital process controls and remote analytics into batch production and onsite application workflows will enhance quality assurance and reduce project risk. Additionally, firms should co-create value with end users by developing modular precast solutions and rapid-cure formulations that directly address project timelines and budget constraints. Finally, proactive engagement with policy makers and standards organizations will position companies at the forefront of evolving safety and environmental requirements, unlocking first-mover advantages in new market segments.

Detailing Robust Research Methodology Combining Primary Field Insights Secondary Data Triangulation and Quantitative Analytical Rigor for Reliable Findings

This report synthesizes insights derived from a rigorous research framework combining primary and secondary data sources. Primary research included in-depth interviews with senior R&D executives, project managers, and procurement leads across resin manufacturers, precast fabricators, and major contracting firms, complemented by onsite visits to mixing facilities and application trials. Secondary research encompassed technical papers, trade association publications, government regulatory filings, and academic case studies, which provided foundational data on material performance, environmental standards, and regional market drivers.

Data were triangulated through a multi-stage validation process, employing quantitative models to analyze historical trends and forecast scenario impacts. Key findings were subjected to peer review by an external advisory panel composed of industry veterans and academic experts, ensuring methodological rigor and impartial interpretation. This blend of qualitative insights and quantitative analytics yields a comprehensive, reliable perspective on polymer concrete, enabling stakeholders to make decisions with confidence in the accuracy and relevance of the information presented.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polymer Concrete market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polymer Concrete Market, by Resin Type

- Polymer Concrete Market, by Application

- Polymer Concrete Market, by End Use

- Polymer Concrete Market, by Region

- Polymer Concrete Market, by Group

- Polymer Concrete Market, by Country

- United States Polymer Concrete Market

- China Polymer Concrete Market

- Competitive Landscape

- List of Figures [Total: 15]

- List of Tables [Total: 1113 ]

Concluding Strategic Insights Emphasizing Critical Takeaways Industry Implications and Future Prospects of Polymer Concrete in Evolving Construction Ecosystems

In conclusion, polymer concrete stands at the nexus of performance innovation and sustainability imperatives, offering a compelling alternative to conventional construction materials. The ongoing evolution of resin chemistries, coupled with digitalization and strategic industry collaboration, has broadened the application spectrum and enhanced project efficiencies. While recent tariff measures have introduced supply chain challenges, they have also spurred adaptive strategies that reinforce domestic sourcing and collaborative ventures.

Segment analysis highlights the critical interplay between resin type, application, and end use, revealing targeted growth pockets in commercial flooring, precast elements, and rapid-repair applications. Regional insights underscore the importance of tailored market approaches to address distinct regulatory landscapes and infrastructure priorities. With key players investing in integrated innovation and alliances, the competitive environment is primed for continued expansion. By following the strategic recommendations outlined herein, stakeholders can navigate complexities, harness emerging opportunities, and secure a leading position in the dynamic polymer concrete market.

Engaging Expert Guidance and Access to Empower Decisions in Polymer Concrete Market through Consultation with Associate Director of Sales & Marketing

To gain a competitive edge and make informed investment decisions in the polymer concrete market, industry leaders are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing. This personalized consultation will provide an opportunity to explore customized insights based on project specifications, regional dynamics, and material preferences. Participants will receive in‐depth guidance on emerging resin technologies, optimal application strategies, and regulatory considerations that specifically address their organizational goals while mitigating supply chain disruptions. By leveraging direct access to a senior expert, stakeholders can validate strategic priorities, refine product development roadmaps, and secure early intelligence on upcoming industry shifts to ensure sustained growth. Reach out today to arrange a focused session that transforms market intelligence into actionable strategies and unlocks new avenues for margin expansion and operational efficiency.

- How big is the Polymer Concrete Market?

- What is the Polymer Concrete Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?