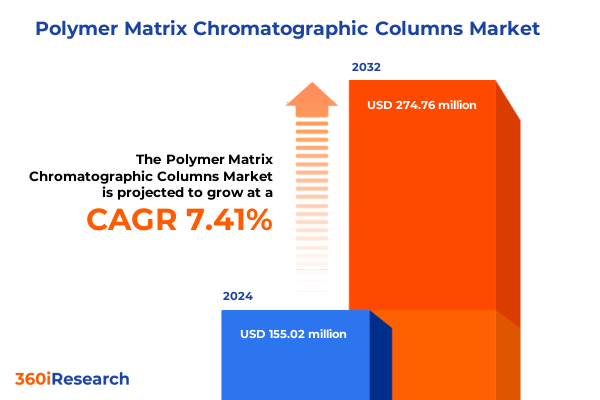

The Polymer Matrix Chromatographic Columns Market size was estimated at USD 164.82 million in 2025 and expected to reach USD 177.76 million in 2026, at a CAGR of 7.57% to reach USD 274.76 million by 2032.

Redefining Analytical Excellence through Advanced Polymer Matrix Chromatographic Columns Shaping Tomorrow’s Laboratory Workflows with Enhanced Precision

The escalating demand for highly reproducible and robust separation technologies has positioned polymer matrix chromatographic columns at the forefront of modern analytical workflows. Unlike conventional silica-based media, polymeric matrices exhibit exceptional chemical and mechanical stability, enabling seamless performance under extreme pH conditions and prolonged operational cycles. As laboratories across pharmaceutical, biotech, environmental, and food and beverage sectors pursue higher throughput and heightened sensitivity, polymer columns have emerged as a cornerstone of innovation, offering versatile stationary phase chemistries that address complex separation challenges with precision and resilience.

Amid intensifying regulatory scrutiny and the imperative to minimize downtime, these advanced columns deliver consistent batch-to-batch performance, reducing maintenance cycles and operational overhead. Moreover, their compatibility with emerging high-pressure liquid chromatography platforms, including ultrahigh-pressure systems, underscores a broader shift toward fast, high-resolution separations. Consequently, industry stakeholders are realigning their strategies to leverage polymer-based solutions, driving investment in novel particle designs, temperature-stable polymer backbones, and surface chemistries that cater to specialized applications such as protein purification and chiral resolution. By anchoring analytical excellence in a polymeric framework, laboratories are redefining productivity benchmarks while ensuring compliance with evolving quality standards.

Unveiling the Revolutionary Technological and Regulatory Transitions Reshaping the Polymer Matrix Chromatographic Column Landscape in Modern Laboratories

Over the past few years, the convergence of technological breakthroughs and regulatory evolution has fundamentally reshaped the polymer matrix chromatographic column arena. On the technological front, the refinement of polymer synthesis techniques has yielded ultra-uniform particle sizes below three microns, paving the way for ultrahigh-pressure liquid chromatography systems that deliver unparalleled peak capacity and speed. Concurrently, the introduction of novel polymer backbones, such as polymethacrylate and polysaccharide derivatives, has expanded the application spectrum to include challenging biomolecule separations and chiral analyses. These innovations are complemented by digital integration, where embedded column sensors and real-time diagnostics enhance method development and lifecycle monitoring, enabling predictive maintenance and reducing unplanned downtime.

In parallel, stringent environmental and safety regulations have prompted a pivot toward green chromatography practices, driving the adoption of polymer columns capable of withstanding bio-based or low-toxicity solvents without performance degradation. Additionally, quality control mandates in pharmaceutical manufacturing now demand rigorous traceability, spurring vendors to embed unique identifiers and data-rich labeling directly onto column housings. These regulatory shifts, when combined with growing emphasis on reproducibility and data integrity, have accelerated the replacement of legacy silica columns with polymeric alternatives across both established and emerging markets. As a result, stakeholders are witnessing a paradigm shift that not only boosts analytical throughput but also aligns with sustainability and regulatory imperatives.

Assessing the Far-Reaching Consequences of 2025 United States Tariff Adjustments on Polymer Matrix Chromatographic Column Supply Chains and Cost Models

The introduction of additional United States tariffs on imported chromatography consumables in early 2025 has triggered a series of cascading challenges throughout global supply chains. Companies heavily reliant on polymer matrix columns manufactured in tariff-impacted regions have experienced cost escalations that erode profit margins and complicate budgeting for routine laboratory operations. In response, many end users have sought to diversify their sourcing strategies, forging partnerships with domestic producers or nearshoring to allied markets in an effort to mitigate lead-time volatility and currency fluctuations. This realignment, however, requires significant capital investment in new vendor qualification processes and validation protocols, extending the time to implement alternative supply solutions.

Furthermore, the higher landed cost of key consumables has led some laboratories to rationalize their column inventories, prioritizing multipurpose polymer variants while deferring adoption of specialized phases. As a result, innovation cycles have slowed for niche applications, and smaller customer segments face longer procurement timelines. Simultaneously, vendors are absorbing a portion of the tariff burden through margin compression, leveraging scale efficiencies and renegotiating raw material contracts to preserve competitiveness. Over time, this has shifted the cost structure for both suppliers and end users, prompting a broader reassessment of vertical integration, regional manufacturing footprints, and strategic stockpiling. Ultimately, the 2025 tariff measures have underscored the importance of resilient supply networks and agile procurement strategies in safeguarding uninterrupted chromatographic operations.

Decoding Critical Segmentation Dimensions to Illuminate Diverse Applications and Technological Nuances within Polymer Matrix Chromatographic Columns

A nuanced understanding of market segmentation reveals how diverse operational needs shape column selection and end-user investment decisions. When considering mode, reversed phase continues to dominate due to its broad applicability in small-molecule analysis, while ion exchange retains a strong foothold in bioprocessing contexts that demand selective separation of charged biomolecules. Normal phase columns are increasingly leveraged for specialty applications, and size exclusion media remain indispensable for molecular weight distribution studies. Affinity-based polymer formats are carving out a critical niche in covalent capture techniques, especially for high-value protein targets.

Particle size also plays a pivotal role in performance optimization. Columns in the three to five micron range strike a balance between resolution and pressure demands, with the three to four micron subrange preferred for routine high-precision analyses and the four to five micron zone favored in cost-sensitive quality control workflows. Below three micron particles, especially those in the one to two micron tier, are driving the fastest separations and highest efficiencies under ultrahigh-pressure conditions, whereas two to three micron media offer a practical compromise for laboratories upgrading existing HPLC platforms.

Column format further differentiates application use cases. Analytical columns remain the backbone of routine separation tasks, while preparative formats support scale-up processes in drug development and biopharmaceutical manufacturing. Semi-preparative designs bridge the gap between analytical and preparative scales, enabling rapid method transfer and process validation. The choice of stationary phase material influences selectivity: polyacrylamide media excel in biomolecule separations thanks to their hydrophilic character, polymethacrylate backbones deliver robust performance for acidic and basic small molecules, and polysaccharide coatings unlock chirality-focused analyses.

End-user segmentation highlights the distinct requirements of each customer cluster. Academic and research institutions prioritize experimental flexibility and method exploration, leading them to adopt a wide array of polymer chemistries. Contract research organizations focus on throughput and reproducibility to meet client timelines. Environmental testing labs emphasize ruggedness and chemical resistance to tackle complex matrices. Food and beverage quality control drives demand for cost-effective yet reliable columns, whereas pharmaceutical and biotech companies invest heavily in specialized phases that comply with stringent regulatory standards.

Pressure rating underscores infrastructure considerations, with traditional HPLC columns retaining a strong installed base in established labs, even as ultrahigh-pressure systems gain traction among performance-focused end users. Finally, column dimension defines sensitivity and scale requirements: capillary and nano bore formats cater to trace-level and proteomics applications, narrow bore columns deliver enhanced sensitivity for targeted assays, and standard bore sizes continue to serve general-purpose analyses in high-volume testing environments.

This comprehensive research report categorizes the Polymer Matrix Chromatographic Columns market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Mode

- Column Format

- Stationary Phase Material

- End User

- Pressure Rating

Exploring Regional Dynamics across Americas, EMEA, and Asia-Pacific to Uncover Strategic Opportunities in Polymer Matrix Chromatography Markets

Regional market dynamics reveal significant variations in adoption, innovation and strategic priorities across the Americas, Europe, the Middle East and Africa, and the Asia-Pacific region. In the Americas, the presence of major biopharmaceutical hubs and leading academic research centers drives continuous demand for advanced polymer columns with tailored chemistries, particularly in the northeastern corridor of the United States and biotech clusters in California. Continuous investments in contract development and manufacturing organizations further support the transition to high-throughput platforms, with a growing emphasis on end-to-end process integration.

Meanwhile, Europe, the Middle East and Africa demonstrate a dual focus on sustainability and compliance. Stringent environmental regulations in the European Union have prompted laboratories to adopt greener solvents and polymer media that tolerate a broader range of bio-based eluents. In addition, the region’s diverse regulatory regimes, from EU pharmacopoeia standards to Gulf Cooperation Council requirements, necessitate versatile column portfolios capable of meeting heterogeneous validation guidelines. Germany and the United Kingdom stand out for their strong life sciences activity, whereas emerging markets in Africa are progressively investing in infrastructure upgrades, leading to an uptick in demand for durable, low-maintenance polymer formats.

Asia-Pacific is experiencing the most accelerated growth trajectory, driven by expanding pharmaceutical and environmental testing sectors in China, India and Southeast Asia. Government initiatives to bolster domestic manufacturing have led to an increase in local polymer column production, with cost-competitive offerings emerging alongside established global brands. Additionally, research institutes in Japan and South Korea continue to pioneer novel polymer chemistries, fostering collaborations with multinational corporations to co-develop next-generation stationary phases. As laboratories in the region upgrade their analytical capabilities, the emphasis on high-pressure systems and specialized applications such as metabolomics and advanced proteomics continues to rise.

This comprehensive research report examines key regions that drive the evolution of the Polymer Matrix Chromatographic Columns market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Vanguard Corporations Driving Innovation and Competitive Excellence in the Polymer Matrix Chromatographic Column Industry Ecosystem

Leading corporations are actively shaping the competitive landscape through targeted product development, strategic partnerships and selective acquisitions. Global life science majors have expanded their polymer column portfolios by introducing hydrophilic interaction polymer matrices and specialty phases designed for ultra-fast separations, while intermediate-scale players are capitalizing on niche segments such as chiral and biomolecule-specific columns. Consolidation among vendors has accelerated, driven by the need to achieve scale efficiencies and broaden geographic reach, particularly in emerging markets where local manufacturing and distribution partnerships can be decisive.

Simultaneously, technology-focused entrants are differentiating themselves through digital and services-led offerings. They integrate column performance monitoring, data analytics platforms and application support to create a value-added ecosystem that extends beyond the physical product. Some have established regional application laboratories, enabling direct collaboration with end users on method development and validation, thereby reducing time to market for novel assays. Others are forging alliances with instrument manufacturers to deliver optimized column-instrument kits, simplifying procurement and facilitating method standardization.

In addition, a wave of research collaborations between academic institutions and industry players is underpinning the next generation of polymer chemistries. These partnerships are yielding advanced monomer designs and sustainable manufacturing processes, resulting in biodegradable polymer backbones and lower solvent consumption. As the competitive dynamics evolve, companies that effectively combine chemical innovation with digital services, global supply resilience, and targeted end-user support are emerging as the benchmarks for excellence in polymer matrix chromatographic column provision.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polymer Matrix Chromatographic Columns market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilent Technologies Inc.

- ANPEL Laboratory Technologies (Shanghai) Inc.

- BIA Separations d.o.o.

- DIKMA Technologies Inc.

- Gilson, Inc.

- Izon Science Limited

- JASCO Corporation

- Malvern Panalytical Ltd

- Merck KGaA

- National Analytical Corporation

- Orochem Technologies, Inc.

- PerkinElmer, Inc.

- Phenomenex Inc.

- Polymer Characterization, S.A.

- Resonac Corporation

- Sartorius AG

- Shimadzu Corporation

- Thermo Fisher Scientific Inc.

- Tosoh Corporation

- Waters Corporation

Implementing Strategic Roadmaps and Tactical Initiatives to Capitalize on Emerging Trends within Polymer Matrix Chromatographic Column Operations

To seize emerging growth opportunities, organizations should prioritize the development of advanced polymer chemistries that cater specifically to biopharmaceutical and chiral analysis applications. Establishing in-region manufacturing hubs will mitigate the impact of trade barriers and accelerate time to delivery, while fostering strategic partnerships with leading instrument vendors will streamline method validation for end users. In addition, investing in digital infrastructure for real-time column performance monitoring and predictive maintenance can significantly reduce unplanned downtime and enhance laboratory productivity.

Moreover, companies must expand their application support services, including dedicated regional labs and on-demand training modules, to differentiate themselves in a crowded marketplace. Aligning product portfolios with green chemistry principles will satisfy regulatory and sustainability mandates, creating a compelling value proposition for environmental and food testing laboratories. Furthermore, a focused effort to optimize particle size distributions for ultrahigh-pressure systems, combined with selective marketing of sub-two micron media, can capture demand from high-performance users.

Finally, diversifying end-user engagement through strategic collaborations with contract research organizations and academic centers will broaden market reach and stimulate adoption among early-career researchers. By combining chemical innovation, localized supply chain resilience, and an enhanced service ecosystem, industry leaders can unlock new revenue streams and solidify their position in the evolving polymer matrix chromatographic column landscape.

Employing Robust Mixed-Method Research Approaches to Validate Critical Insights into Polymer Matrix Chromatographic Column Market Dynamics

The insights presented are the result of a rigorous mixed-method research approach that integrated both qualitative and quantitative data sources to ensure robustness and validity. Primary research included in-depth interviews with senior executives, R&D directors, and end-user laboratory managers, providing firsthand perspectives on technological priorities, procurement challenges, and evolving regulatory requirements. These expert discussions were complemented by structured surveys targeting a cross-section of analytical laboratories across multiple geographies, capturing nuanced adoption patterns and performance expectations.

Secondary research involved a thorough review of industry literature, peer-reviewed journals, patent filings, and regulatory documents to map historical trends and emerging innovations in polymer chemistries and column manufacturing. Competitive intelligence was gathered through product catalog analysis, financial filings, and global supply chain mapping to identify key players, strategic partnerships and market entry strategies. Data triangulation techniques were employed to reconcile discrepancies between primary and secondary sources, ensuring consistency and reliability of findings. Finally, all insights were subjected to peer review by technical experts prior to synthesis, guaranteeing accuracy and actionable relevance.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polymer Matrix Chromatographic Columns market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polymer Matrix Chromatographic Columns Market, by Mode

- Polymer Matrix Chromatographic Columns Market, by Column Format

- Polymer Matrix Chromatographic Columns Market, by Stationary Phase Material

- Polymer Matrix Chromatographic Columns Market, by End User

- Polymer Matrix Chromatographic Columns Market, by Pressure Rating

- Polymer Matrix Chromatographic Columns Market, by Region

- Polymer Matrix Chromatographic Columns Market, by Group

- Polymer Matrix Chromatographic Columns Market, by Country

- United States Polymer Matrix Chromatographic Columns Market

- China Polymer Matrix Chromatographic Columns Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 954 ]

Summarizing Core Findings and Strategic Imperatives to Propel the Polymer Matrix Chromatographic Column Industry Forward in an Evolving Analytical Environment

In summary, polymer matrix chromatographic columns are redefining the standards of analytical separations by offering unmatched durability, pH stability and compatibility with high-pressure platforms. Technological advancements in particle engineering and polymer chemistries, coupled with regulatory imperatives around sustainability and data integrity, have catalyzed a significant shift away from traditional media. Simultaneously, the 2025 United States tariff adjustments have underscored the importance of supply chain diversification and regional manufacturing resilience, while segmentation insights have highlighted tailored solutions for a wide array of application needs.

Regional analysis has further illuminated distinct strategic priorities, from the innovation-driven hubs of the Americas and Europe to the rapid infrastructure build-out in Asia-Pacific. Key industry players are responding through integrated product-service offerings, digital monitoring tools and collaborative research initiatives that collectively define the competitive frontier. By adopting the actionable recommendations outlined-ranging from polymer chemistry innovation and digital transformation to in-region production strategies-companies can mitigate risks, enhance operational efficiency and capture growth in the dynamic chromatography landscape. With these core findings and strategic imperatives in hand, decision-makers are well equipped to navigate the evolving market environment and position their organizations for sustained success.

Unlock Exclusive Access to Comprehensive Polymer Matrix Chromatographic Column Market Insights and Strategic Consultation Delivered by Ketan Rohom Today

Ready to elevate your strategic decision-making and gain unparalleled clarity on polymer matrix chromatographic column applications across diverse industries, reach out to Ketan Rohom for personalized insights, exclusive briefings on emerging trends, and tailored recommendations that align with your growth objectives in today’s dynamic analytical environment

- How big is the Polymer Matrix Chromatographic Columns Market?

- What is the Polymer Matrix Chromatographic Columns Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?