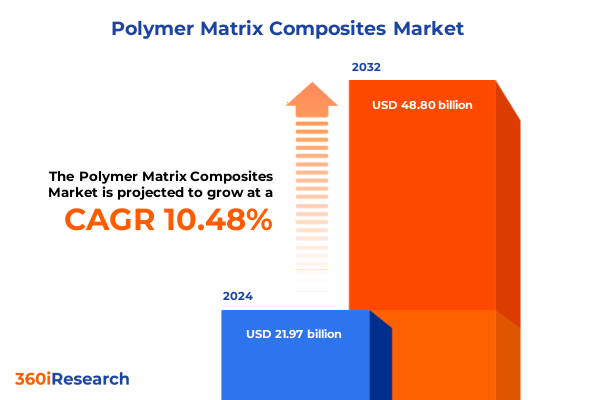

The Polymer Matrix Composites Market size was estimated at USD 24.26 billion in 2025 and expected to reach USD 26.66 billion in 2026, at a CAGR of 10.49% to reach USD 48.80 billion by 2032.

Unearthing the Core Dynamics of Polymer Matrix Composites: Material Innovations, Application Breakthroughs, and Market Potentials

Polymer matrix composites have emerged as a cornerstone for innovation across high-performance industries due to their superior strength-to-weight ratios, design flexibility, and durability. These materials integrate reinforcing fibers within polymer binders to create structures that outperform traditional metals and pure polymers in applications ranging from aerospace frames to automotive components. As global demand intensifies for lightweight solutions, polymer composites offer a pathway to reduce energy consumption, extend service life, and enable novel design architectures.

Recent advancements in fiber engineering and resin formulations have accelerated the adoption of composite materials. The convergence of nanotechnology, surface treatment chemistries, and synergistic hybrid fiber assemblies has expanded the performance envelope of these materials, unlocking new possibilities in impact resistance, thermal stability, and environmental resilience. In parallel, manufacturing methods have evolved to support greater throughput, tighter tolerances, and more complex geometries than ever before.

This executive summary distills the critical drivers shaping the polymer matrix composites ecosystem, examines the regulatory and trade considerations affecting production and trade flows, and delivers segmentation and regional insights to guide strategic priorities. By synthesizing the latest technological trends and market dynamics, decision makers will gain the context needed to navigate shifting landscapes and position their organizations for sustainable growth.

Mapping the Transformative Technological, Regulatory, and Demand Shifts Reshaping the Polymer Matrix Composites Ecosystem in Today’s Industry

The polymer matrix composites landscape is undergoing profound transformation driven by converging advances in materials science, evolving regulatory frameworks, and changing end customer requirements. On the technological front, the integration of additive manufacturing techniques with high-performance composite inks has enabled the production of geometries once considered impossible, driving rapid prototyping cycles and tailored product customization. Simultaneously, innovations in bio-based and recyclable resin systems are responding to intensifying sustainability mandates, catalyzing a shift away from conventional thermosetting chemistries toward thermoplastic solutions that offer recyclability and lower processing energy.

Regulatory influences have also altered the market landscape. Stricter emissions standards in automotive and aviation sectors are compelling OEMs to prioritize lightweight construction, accelerating composite adoption to reduce carbon footprints. In parallel, emerging environmental regulations in Europe and North America are imposing lifecycle assessments and end-of-life disposal requirements, which compel manufacturers to re-engineer supply chains and invest in takeback or recycling programs.

Moreover, demand patterns are realigning across industries. The push for electrification in mobility sectors requires materials that can withstand high voltages and temperatures while maintaining structural integrity, increasing interest in carbon fiber-reinforced composites. Infrastructure renewal and renewable energy projects are generating new avenues for glass fiber composites that combine cost-efficiency with corrosion resistance. As a result, market participants must adapt product portfolios and innovation roadmaps to stay ahead of these synchronized shifts in technology, policy, and end-user expectations.

Assessing the Effects of U.S. Tariff Adjustments in 2025 on Supply Chains, Cost Structures, and Market Positioning for Polymer Matrix Composites

In 2025, adjustments to United States tariffs on composite raw materials have introduced a new set of complexities for manufacturers and end users alike. Heightened duties on certain imported fibers and resins have put upward pressure on input costs, compelling procurement teams to re-evaluate sourcing strategies. Organizations that previously relied on established international suppliers are now exploring nearshoring opportunities and alternative fiber grades to maintain cost efficiency without sacrificing quality.

The supply chain ramifications extend beyond raw materials to include tooling, ancillary chemicals, and specialized additives. Increased lead times for imported fabrication equipment have disrupted production schedules, forcing manufacturers to invest in buffer inventories and contingency logistics. For vertically integrated players, the tariff environment has underscored the value of localized production footprints, prompting accelerated expansion of domestic capacity and cross-border partnerships.

Competitive positioning has also shifted as domestic and regional producers leverage their proximity to end-use markets to offer more agile delivery and responsive collaboration in product development. While some multinational suppliers have absorbed tariff impacts through margin adjustments, others have strategically relocated portions of their processing operations to tariff-exempt jurisdictions. As a result, organizations across the value chain must continuously monitor trade policy updates and cultivate supplier diversity to mitigate tariff-induced volatility.

Unearthing Actionable Insights from Segmentation by Matrix Material, Fiber Type, End Use Industry, and Manufacturing Process in Composite Markets

Actionable intelligence emerges when examining how the polymer matrix composites market segments according to material matrices, fiber reinforcements, application sectors, and production techniques. Based on matrix material, thermoplastic polymers are gaining traction for their recyclability and rapid cycle times, particularly in industries that demand frequent part iterations, whereas thermosetting polymers continue to dominate high-temperature applications and structural components. Based on fiber type, aramid and carbon fibers are commanding premium positions for their exceptional strength and stiffness properties, glass fibers find broad adoption where cost-effectiveness and corrosion resistance are paramount, and natural fibers are carving out niche applications in sustainable and consumer-facing products.

Based on end use industry, aerospace and defense players lead in advanced composite utilization for structural weight reduction and fatigue resistance, automotive manufacturers prioritize composites to meet fuel efficiency and emissions targets, and construction companies benefit from composite panels that resist moisture and seismic forces. Marine applications leverage tailored composite laminates for hull integrity, while sports and leisure brands innovate with lightweight gear that enhances performance. Wind energy developers continue to deploy glass and carbon fiber blades to achieve longer spans and improved power generation.

Based on manufacturing process, compression molding and injection molding enable high-volume production with consistent quality, filament winding excels in producing cylindrical structures such as pressure vessels, pultrusion and resin transfer molding support continuous profiles and complex shapes, and hand layup remains a flexible approach for low-volume or highly customized components. By linking these segmentation dimensions, stakeholders can pinpoint growth pockets, optimize product roadmaps, and align manufacturing footprints with evolving market requirements.

This comprehensive research report categorizes the Polymer Matrix Composites market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Matrix Material

- Fiber Type

- End Use Industry

- Manufacturing Process

Highlighting Regional Dynamics and Growth Drivers Across Americas, Europe Middle East And Africa, and Asia Pacific in the Polymer Matrix Composites Industry

Regional dynamics play a pivotal role in shaping strategic priorities across the polymer matrix composites sector. In the Americas, investments in electric vehicle platforms and aerospace modernization continue to fuel demand for carbon fiber composites, while domestic resin producers explore bio-based alternatives to meet regulatory and consumer sustainability goals. North American manufacturers leverage a robust research infrastructure to accelerate material qualification cycles, with cross-industry collaborations driving next-generation resin chemistries.

Across Europe, the Middle East and Africa, stringent carbon reduction commitments and circular economy directives have created fertile ground for thermoplastic composite adoption and recycling initiatives. European Union funding programs support pilot projects that integrate composite waste streams into new material feeds, and partnerships between energy producers and composite fabricators are advancing wind turbine blade recycling. In the Middle East, expanding aerospace MRO hubs and luxury automotive production centers are anchoring new composite manufacturing facilities, while African research institutes explore locally sourced natural fibers for cost-competitive composites.

The Asia-Pacific region exhibits heterogeneity, with advanced economies prioritizing automation and Industry 4.0 integration within composite fabrication, and emerging markets driving volume growth through infrastructure and transportation projects. Chinese shipyards continue to scale glass fiber hull production, Japanese suppliers push the boundaries of carbon nanotube-reinforced polymers for electronic applications, and Australian innovators leverage pultrusion to produce modular construction elements for remote installations. Understanding these regional contrasts enables companies to align go-to-market tactics with localized demand drivers and regulatory landscapes.

This comprehensive research report examines key regions that drive the evolution of the Polymer Matrix Composites market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players Shaping Innovation, Production Capacity, and Strategic Collaborations in the Polymer Matrix Composites Sector

Leading organizations in the polymer matrix composites sphere are distinguished by their integrated innovation pipelines, comprehensive manufacturing footprints, and strategic alliances that accelerate technology commercialization. Global fiber suppliers have expanded production lines to include hybrid reinforcements-combining carbon, glass, and specialty fibers-to satisfy multi-property requirements in demanding applications. Resin producers are unveiling novel bio-based thermosets and high-performance thermoplastics formulated for faster curing and reduced environmental impact.

Key players are also forging joint ventures with OEMs and research institutions to co-develop tailored composite solutions. These partnerships accelerate material validation and shorten design-to-production timelines, especially in sectors such as aerospace and defense where qualification standards are rigorous. Concurrently, some manufacturers are acquiring automation specialists to integrate robotics and digital process controls into their layup and molding operations, achieving higher throughput and improved quality consistency.

On the service side, providers of testing, certification, and end-of-life management are broadening their offerings to encompass the full composite lifecycle. This holistic approach addresses customer demand for turnkey solutions that minimize risk and maximize value extraction. By monitoring these strategic maneuvers, industry participants can anticipate next-generation materials and identify cooperative pathways that fortify competitive positioning

This comprehensive research report delivers an in-depth overview of the principal market players in the Polymer Matrix Composites market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Applied Poleramic, Inc.

- Arkema S.A.

- Avient Corporation

- Axiom Materials, Inc.

- BASF SE

- Celanese Corporation

- GKN Aerospace Services Limited

- Gurit Holding AG

- Hexcel Corporation

- Huntsman Corporation

- Kordsa Teknik Tekstil AS

- Mitsubishi Chemical Group Corporation

- Owens Corning

- SABIC (Saudi Basic Industries Corporation)

- SGL Carbon SE

- Solvay S.A. (now includes Syensqo)

- Teijin Limited

- Toray Industries, Inc.

- TPI Composites

Formulating Actionable Strategies to Enhance Supply Resilience, Innovation Roadmaps, and Sustainability Practices for Composite Material Manufacturers

To thrive amid evolving material technologies and shifting trade landscapes, industry leaders must deploy targeted strategies that span innovation, supply resilience, and sustainability. First, prioritizing diversification of fiber and resin sources will reduce exposure to regional tariff fluctuations and supply disruptions. Cultivating partnerships with alternative suppliers and exploring nearshoring or onshore production can foster greater control over lead times and cost structures while maintaining quality standards.

Next, investing in advanced manufacturing automation and digital process monitoring will enhance production flexibility and yield consistency. By integrating in-line sensors, data analytics, and closed-loop controls, composite fabricators can optimize cure cycles and identify process deviations in real time. These capabilities not only improve throughput but also support traceability and compliance with stringent industry regulations.

Furthermore, embedding sustainability into product development and end-of-life strategies will align corporate objectives with evolving environmental mandates. Initiatives such as resin recycling programs, design for disassembly, and incorporation of bio-based feedstocks not only enhance brand reputation but also mitigate lifecycle carbon footprints. Finally, fostering co-innovation ecosystems with OEMs, research consortia, and standards bodies will ensure that emerging material advancements are swiftly validated and integrated into critical applications. By executing these actionable recommendations, organizations will strengthen their competitive advantages and achieve resilient, future-ready operations.

Illustrating the Rigorous Research Methodology Employed to Ensure Data Integrity, Market Insight Accuracy, and Comprehensive Composite Material Analysis

The findings presented in this executive summary are underpinned by a robust and transparent research methodology designed to ensure the highest standards of data integrity and market insight accuracy. The process began with comprehensive secondary research, drawing from industry publications, technical white papers, patent databases, and regulatory filings to establish a foundational understanding of material innovations, regional policies, and competitive dynamics.

This initial phase was complemented by primary research, which included in-depth interviews with engineers, procurement specialists, and senior executives across the value chain. These expert consultations provided nuanced perspectives on emerging fiber technologies, manufacturing challenges, and direct impacts of tariff adjustments. All insights were triangulated against public disclosures and trade data to validate consistency and reliability.

Segment-specific analyses were conducted by mapping material, fiber, application, and process dimensions to real-world product portfolios and project pipelines. Regional insights incorporated macroeconomic indicators and policy frameworks to identify localized growth drivers. Throughout the research cycle, quality assurance protocols-such as peer reviews, data cross-checks, and methodological audits-were applied to eliminate bias and confirm the robustness of conclusions. This rigorous approach delivers actionable intelligence that supports strategic decision making in polymer matrix composites.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polymer Matrix Composites market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polymer Matrix Composites Market, by Matrix Material

- Polymer Matrix Composites Market, by Fiber Type

- Polymer Matrix Composites Market, by End Use Industry

- Polymer Matrix Composites Market, by Manufacturing Process

- Polymer Matrix Composites Market, by Region

- Polymer Matrix Composites Market, by Group

- Polymer Matrix Composites Market, by Country

- United States Polymer Matrix Composites Market

- China Polymer Matrix Composites Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Synthesis Highlighting Key Learnings, Strategic Imperatives, and the Path Forward for Stakeholders in Polymer Composite Advancements

The synthesis of technological trajectories, trade developments, segmentation insights, and regional dynamics underscores the critical juncture at which the polymer matrix composites industry stands today. Material innovations are expanding performance boundaries, regulatory shifts are redefining supply chain strategies, and evolving end-use demand is creating targeted growth opportunities across sectors. Stakeholders that proactively adapt to these trends will secure competitive advantages and foster sustainable value creation.

Key imperatives for industry participants include diversifying supply networks, accelerating the adoption of automated manufacturing systems, and embedding circular economy principles into product lifecycles. By closely monitoring policy changes-especially those pertaining to trade and environmental compliance-organizations can anticipate disruptions and implement contingency measures well in advance. Simultaneously, aligning R&D investments with the most promising fiber-resin combinations and advanced processing techniques will position companies to lead in next-generation applications.

As market landscapes continue to shift, collaborative partnerships between material producers, OEMs, and regulatory bodies will play an increasingly important role in standardizing performance metrics and certification protocols. This collective approach not only reduces time-to-market for breakthrough products but also enhances customer confidence in composite material adoption. Ultimately, a strategic, data-driven focus will enable stakeholders to navigate complexities and chart a path toward long-term success.

Catalyzing Engagement with Ketan Rohom to Unlock Tailored Insights and Empower Informed Decisions in Polymer Matrix Composites Market Research

Ready to transform your strategic approach with deep, actionable insights on polymer matrix composites? Connect directly with Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch, to tailor the findings of this market research to your organization’s unique needs. By engaging with Ketan, you’ll gain privileged access to expert guidance on navigating supply chain complexities, capitalizing on emerging fiber technologies, and leveraging regional growth dynamics.

Ketan Rohom possesses extensive experience in aligning advanced material intelligence with commercial objectives, empowering decision makers to identify untapped opportunities and mitigate evolving trade risks. He will work closely with your team to customize research deliverables, facilitate strategic workshops, and support implementation roadmaps that drive innovation and sustainable competitive advantage.

Initiate your conversation by scheduling a detailed briefing to explore how our insights can address your most pressing challenges-from optimizing manufacturing processes to evaluating the impact of the latest tariff policies. This partnership ensures you receive not only a comprehensive report but also a consultative approach that translates complex data into clear strategic action.

Don’t let uncertainties in material costs, supply chain disruptions, or regulatory shifts slow your growth. Reach out to Ketan Rohom today to secure your copy of the full market research report and embark on a journey toward more informed, confident decision making in polymer matrix composites.

- How big is the Polymer Matrix Composites Market?

- What is the Polymer Matrix Composites Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?