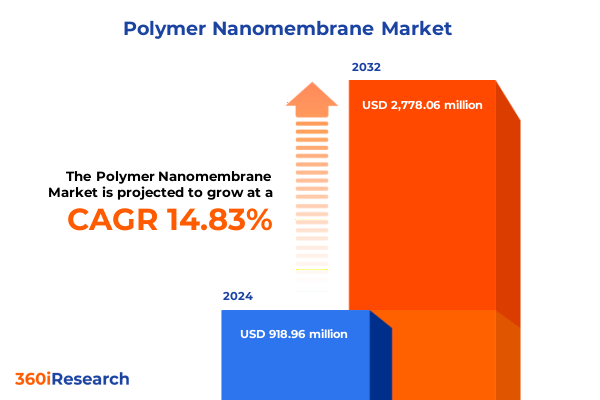

The Polymer Nanomembrane Market size was estimated at USD 1.04 billion in 2025 and expected to reach USD 1.19 billion in 2026, at a CAGR of 14.95% to reach USD 2.77 billion by 2032.

Discover the fundamental innovation drivers and transformative potential fueling the development of polymer nanomembrane technologies across application sectors

Polymer nanomembranes are ultrathin, selectively permeable barriers engineered at the nanoscale to achieve precise molecular separation, filtration, and sieving. Leveraging advances in polymer chemistry, recent innovations have enabled the fabrication of membranes with highly controlled pore sizes, enhanced mechanical strength, and tailored surface functionalities. These developments have accelerated the pursuit of next-generation separation solutions capable of meeting increasingly stringent performance demands.

In practice, polymer nanomembranes now underpin critical processes in water treatment, energy conversion, biotechnology, and advanced manufacturing. Their ability to deliver high selectivity while minimizing energy consumption has made them especially attractive for desalination, industrial effluent treatment, gas separation, and biomedical applications such as drug delivery and tissue scaffolding. As global priorities shift toward sustainable resource management and regulatory compliance intensifies, nanomembrane solutions are gaining prominence as enablers of efficient, low-carbon operations.

Research efforts are converging on hybrid membrane architectures that integrate nanoparticles, stimuli-responsive polymers, and multilayer assemblies. By combining diverse material attributes at the nanoscale, these novel constructs aim to overcome longstanding challenges related to fouling, chemical stability, and flux decline. Consequently, decision-makers must stay informed about emerging breakthroughs, intellectual property advancements, and evolving performance benchmarks.

Looking ahead, successful commercialization will hinge on reconciling laboratory-scale innovations with scalable manufacturing, cost containment, and robust quality control. Integration with digital monitoring and predictive maintenance platforms will further ensure reliability under real-world conditions. This foundational overview sets the stage for exploring transformative shifts, policy impacts, and strategic imperatives in the polymer nanomembrane domain.

Highlight the paradigm shifts redefining the polymer nanomembrane landscape through breakthroughs in material science manufacturing and application integration

Over the past few years, polymer nanomembrane technology has undergone paradigm-defining shifts driven by breakthroughs in material science and process engineering. Researchers have exploited advanced polymer synthesis techniques to create novel block copolymers, zwitterionic surfaces, and amphiphilic architectures that confer unprecedented levels of selectivity and fouling resistance. These material innovations have been complemented by new fabrication approaches-such as electrospinning coupled with precision embossing and interfacial polymerization at curved interfaces-that yield highly uniform nanoscale features.

Simultaneously, integration of inorganic nanofillers like metal-organic frameworks and graphene derivatives is reshaping the performance envelope of composite membranes. By strategically embedding nanoparticles, developers can tailor transport pathways to facilitate rapid flux while maintaining molecular discrimination. As a result, separation efficiencies for water desalination, gas purification, and pharmaceutical fractionation have reached benchmarks previously considered unattainable.

In parallel, advances in process intensification-such as continuous roll-to-roll manufacturing and additive assembly-are forging pathways for cost-effective scale-up. These manufacturing innovations reduce defect rates and enable more consistent membrane performance across large surface areas. As a consequence, the technology is transitioning from niche laboratory constructs to mainstream industrial solutions.

Taken together, these transformative shifts underline a clear trajectory: the convergence of smarter polymer chemistries, hybrid material systems, and agile manufacturing is redefining the scope and scalability of polymer nanomembrane applications. Stakeholders must adapt to this dynamic environment by aligning R&D investments with emerging technical standards and end-user requirements.

Examine the ramifications of the 2025 United States tariff measures on polymer nanomembrane supply chains including cost dynamics and strategic responses

In 2025, the United States implemented targeted tariff measures affecting a range of imported polymer nanomembrane precursors and finished products. These import duties, calibrated to protect domestic capacity and stimulate local manufacturing, have altered cost structures across the value chain. Suppliers face elevated raw material expenses for specialty monomers, while membrane fabricators must manage increased overheads associated with imported additives and ancillary components.

Consequently, many end users are encountering higher procurement costs for polymer nanomembrane modules. Faced with this new cost environment, companies are reevaluating supply bases, accelerating qualification of domestic suppliers, and exploring strategic alliances to insulate against further tariff volatility. In response, certain membrane producers have repatriated portions of their production lines to the United States, leveraging tax incentives and local incentives to offset tariff burdens.

Meanwhile, downstream integrators in sectors such as water treatment and energy have begun to reassess total cost of ownership, factoring in maintenance, replacement cycles, and potential disruption risks linked to import restrictions. Procurement teams are negotiating long-term commitments to secure price stability, while R&D groups are intensifying efforts to develop alternative feedstocks and recyclable polymer matrices that reduce import dependency.

Overall, the 2025 tariff landscape has prompted a strategic realignment in polymer nanomembrane supply chains. Organizations capable of agile sourcing and responsive manufacturing now enjoy a competitive edge, underlining the importance of supply chain agility in today’s geopolitical climate.

Illuminate the segmentation dimensions of polymer nanomembrane markets across technology types materials manufacturing applications and end user domains

A granular examination of polymer nanomembrane markets reveals distinct trajectories across multiple segmentation axes. When viewed through the lens of technology type, forward osmosis membranes are gaining traction where low-energy separations are valued, while reverse osmosis solutions remain the workhorse for desalination and high-pressure filtration. Microfiltration and ultrafiltration platforms continue to serve critical roles in particle removal and sterilization, with nanofiltration bridging the gap by enabling selective ion retention for industrial water reuse.

Material composition introduces another layer of differentiation: ceramic supports offer exceptional thermal and chemical resilience for harsh industrial environments, whereas pure polymeric matrices deliver lower capital costs and greater flexibility in pore architecture. Composite configurations merge benefits of both, providing a balance of stability and performance that suits emerging applications in energy conversion and gas separation.

Manufacturing approaches further delineate market segments. Electrospinning yields fibrous membranes advantageous in biomedical scaffolding, while interfacial polymerization enables thin-film composite membranes favored in water purification. Phase inversion methods underpin many commercial polymeric membranes, and track etching continues to serve specialized high-precision applications, such as microreactors and analytical devices.

Finally, application-based segmentation underscores the expansive utility of polymer nanomembranes. In biomedical arenas, drug delivery, tissue engineering, and wound dressing harness biocompatible constructs. Energy applications encompass battery separators, fuel cell membranes, and hydrogen purification layers. Gas separation units facilitate CO₂ capture and air separation, and water treatment spans desalination, drinking water purification, industrial effluent treatment, and wastewater remediation. End users range from healthcare providers and pharmaceutical developers to heavy-duty industrial operators and academic research institutions, each applying tailored membrane solutions to meet sector-specific demands.

This comprehensive research report categorizes the Polymer Nanomembrane market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Technology Type

- Material

- Manufacturing Process

- Application

- End User

Uncover the regional dynamics influencing polymer nanomembrane adoption and innovation across the Americas Europe Middle East & Africa and Asia Pacific markets

Regional dynamics are shaping how polymer nanomembrane technologies evolve and diffuse across the globe. In the Americas, established desalination markets in the southwestern United States and Chile drive demand for reverse osmosis membranes, while nascent investments in wastewater recycling initiatives spur interest in forward osmosis and ultrafiltration platforms. Local incentives for infrastructure modernization are fueling collaborations between technology developers and municipal authorities, positioning North America and South America as innovation corridors for large-scale water treatment solutions.

Over in Europe, Middle East & Africa, the regulatory emphasis on circular economy principles is accelerating adoption of recyclable polymer matrices and energy-efficient membrane operations. European Union directives targeting water reuse have prompted research partnerships focused on advanced ceramic-polymer composites. Simultaneously, Middle Eastern oil-and-gas operators are exploring gas separation membranes to enhance natural gas upgrading and reduce flaring, whereas African mining sectors are piloting membrane-based effluent treatments to comply with tightening environmental standards.

Asia Pacific remains the fastest-growing arena, underpinned by robust demand from electronics manufacturing hubs in Taiwan and South Korea and large-scale desalination projects in Australia. Investments in fuel cell and hydrogen ecosystems in Japan and China are catalyzing interest in polymer-based proton exchange membranes. Additionally, India’s expanding healthcare infrastructure is creating opportunities for biomedical nanomembranes in drug delivery and tissue scaffolding applications.

Collectively, these regional insights emphasize the need for tailored strategies that align product portfolios with local regulations, incentive structures, and end-user priorities. Cross-border partnerships and regional manufacturing footprints will be critical to capturing the diverse growth trajectories across these major markets.

This comprehensive research report examines key regions that drive the evolution of the Polymer Nanomembrane market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Reveal the strategic positioning and collaborations shaping competitive advantage in the polymer nanomembrane sector through innovation and partnerships

The competitive landscape of polymer nanomembranes is defined by a cohort of established chemical manufacturers, specialized membrane producers, and emerging technology developers. Leading polymer suppliers are leveraging their R&D capabilities to formulate high-performance copolymers and surface-modified resins, while vertically integrated membrane fabricators focus on end-to-end production efficiencies and quality assurance. Notably, strategic alliances between polymer innovators and water treatment equipment vendors are becoming more prevalent, enabling seamless integration of membrane modules with turnkey systems.

Several prominent companies are pursuing open-innovation models, engaging with academic institutes and national laboratories to accelerate the development of next-generation membrane chemistries. Joint ventures aimed at scaling novel fabrication methods, such as 3D-structured membrane reactors, are yielding pilot-scale demonstrations that validate commercial viability. In parallel, contract research organizations are offering customized membrane design services, creating niche value propositions for clients in pharmaceutical and energy sectors.

At the same time, market entrants specializing in functional coatings and nanocomposite additives are differentiating through intellectual property portfolios targeting anti-fouling and self-healing membrane surfaces. These developments are intensifying patent-based competition, prompting incumbents to bolster their patent fences and licensing strategies.

Overall, the strategic positioning of key players is shifting toward collaborative ecosystems characterized by co-development agreements, shared pilot facilities, and joint commercialization roadmaps. Firms that can align technical expertise with market access channels will capture the greatest share of emerging opportunities in polymer nanomembranes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polymer Nanomembrane market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Alfa Laval AB

- Asahi Kasei Corporation

- DuPont de Nemours, Inc.

- Evonik Industries AG

- GEA Group Aktiengesellschaft

- Hydranautics

- Koch Separation Solutions

- LG Chem, Ltd.

- Merck KGaA

- Nitto Denko Corporation

- Pall Corporation

- Pentair PLC

- Saudi Basic Industries Corporation

- SUEZ S.A.

- Sumitomo Chemical Co., Ltd.

- Toray Industries, Inc.

- Toyobo Co., Ltd.

- Veolia Environnement S.A.

- Vontron Technology Co., Ltd.

Offer actionable recommendations enabling industry leaders to enhance polymer nanomembrane development deployment and market positioning amid regulatory shifts

Industry leaders must adopt a multi-pronged approach to capitalize on the evolving polymer nanomembrane landscape. First, accelerating the development and deployment of hybrid membrane constructs can unlock performance enhancements in selectivity and throughput. By partnering with academic and national research entities, companies can de-risk novel material platforms and shorten the path to market validation.

Second, strengthening supply chain resilience through diversified sourcing of monomers, fillers, and ancillary chemicals is essential to mitigate geopolitical uncertainties. Businesses should evaluate near-shoring manufacturing options, leverage free trade zones, and explore off-take agreements with local producers to secure critical inputs at predictable cost structures.

Third, integrating digital monitoring and predictive maintenance capabilities into membrane modules will translate into reduced downtime and extended service life. Adopting advanced analytics platforms and remote sensing technologies enables real-time performance tracking, allowing end users to proactively address fouling or degradation before it impacts process continuity.

Finally, engaging with regulatory bodies to influence emerging standards related to recyclability, life cycle assessments, and environmental footprints will create a more favorable policy environment. By participating in industry consortia and standard-setting committees, stakeholders can help shape the rules that govern future membrane applications while ensuring compatibility with sustainability goals.

Explain the research methodology utilized to deliver analysis on polymer nanomembrane trends including data sources expert interviews and validation

This report is underpinned by a structured research methodology designed to ensure depth, accuracy, and relevance. The process began with extensive secondary research, encompassing peer-reviewed journals, patent databases, technical conference proceedings, and publicly available government regulations. These sources provided a foundational understanding of material innovations, manufacturing techniques, and evolving application requirements.

Complementing the secondary phase, the study incorporated primary research through in-depth interviews with industry experts, including membrane scientists, process engineers, and procurement leaders. These expert dialogs offered firsthand insights into technical challenges, adoption barriers, and emerging use cases that extend beyond published literature.

Data triangulation and validation were achieved by cross-referencing quantitative findings with project case studies, pilot plant reports, and select site visits. This multi-layered approach ensured that analytical outputs reflect both theoretical potential and practical feasibility.

Finally, an iterative review cycle involving peer benchmarking and stakeholder workshops refined the key themes, segmentation logic, and strategic imperatives. This rigorous methodology delivers a balanced, evidence-based perspective on polymer nanomembrane trends, tailored for decision-makers seeking actionable intelligence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polymer Nanomembrane market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polymer Nanomembrane Market, by Technology Type

- Polymer Nanomembrane Market, by Material

- Polymer Nanomembrane Market, by Manufacturing Process

- Polymer Nanomembrane Market, by Application

- Polymer Nanomembrane Market, by End User

- Polymer Nanomembrane Market, by Region

- Polymer Nanomembrane Market, by Group

- Polymer Nanomembrane Market, by Country

- United States Polymer Nanomembrane Market

- China Polymer Nanomembrane Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1431 ]

Synthesize insights from this executive summary to underscore the strategic vision guiding polymer nanomembrane advancements and industrial opportunities

Bringing together the insights from each section, this executive summary highlights the dynamic interplay of technological innovation, policy environments, and market strategies that define the polymer nanomembrane sector. The convergence of advanced polymer chemistries, hybrid architectures, and agile manufacturing is driving new performance frontiers, while regional regulatory and incentive landscapes are shaping adoption patterns worldwide.

Tariff actions in key markets have underscored the importance of supply chain agility and cost management, prompting firms to reassess sourcing strategies and localize production. Detailed segmentation analysis reveals that differentiation across technology type, material composition, manufacturing method, application focus, and end-user need will be critical to securing competitive advantage.

Leading companies are forging collaborative ecosystem models, combining internal R&D with external partnerships to accelerate time to market. As the industry matures, stakeholders who embrace digital integration, sustainability imperatives, and proactive regulatory engagement will be best positioned to capitalize on emerging opportunities.

This synthesis underscores a clear strategic vision: polymer nanomembranes will play an increasingly vital role in addressing global challenges in water scarcity, energy transition, and healthcare innovation. Readers are encouraged to delve deeper into the full report to explore tailored insights and chart a course for success.

Connect with Ketan Rohom to gain guidance on acquiring the comprehensive polymer nanomembrane market research report and elevate your strategic insights

We invite you to connect directly with Ketan Rohom, Associate Director of Sales & Marketing, to explore how our in-depth report can be tailored to your strategic imperatives. By engaging in a personalized consultation, you will gain clarity on the methodologies, exclusive data, and expert insights that underpin this comprehensive study. Ketan will guide you through the process of acquiring the report swiftly, discuss value-added custom research options, and ensure you have the resources needed to enhance your decision-making. Elevate your understanding of the polymer nanomembrane arena and secure a competitive edge-reach out today to unlock the full potential of this essential market intelligence

- How big is the Polymer Nanomembrane Market?

- What is the Polymer Nanomembrane Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?