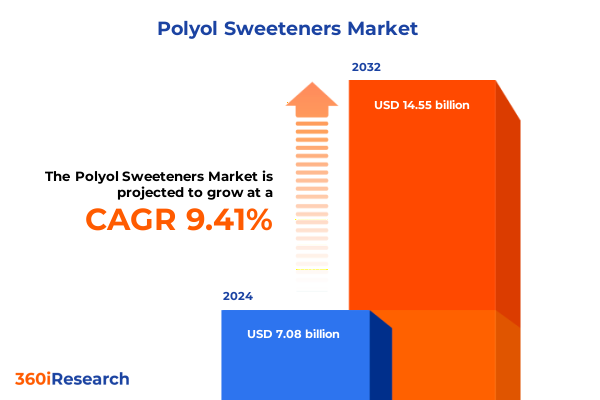

The Polyol Sweeteners Market size was estimated at USD 7.67 billion in 2025 and expected to reach USD 8.31 billion in 2026, at a CAGR of 9.57% to reach USD 14.55 billion by 2032.

Charting the Evolving Landscape of Polyol Sweeteners with Emerging Health Drivers Production Innovations and Regulatory Influences

Polyol sweeteners have emerged as a pivotal category of sugar substitutes that offer reduced caloric intake without compromising on taste or functionality. The distinct chemical structure of polyols such as erythritol, maltitol, and sorbitol underpins their application across diverse industries, from sugar‐free confectionery and low‐calorie beverages to pharmaceutical formulations where taste masking is essential. As consumer awareness of metabolic health intensifies and regulations around sugar content become more stringent, polyols have transitioned from niche ingredients to mainstream sweetening solutions. Moreover, innovations in production technologies have driven improvements in yield and purity, further accelerating their adoption.

In parallel, shifting consumer preferences toward clean labels and natural ingredients have reinforced the attractiveness of certain polyol variants that can be marketed with minimal processing. Regulatory bodies in key markets have begun to establish guidelines for labeling and permissible daily intake, shaping how manufacturers formulate products and communicate benefits to end users. Within this dynamic context, stakeholders-from ingredient suppliers and formulators to food service operators and retailers-must navigate an ecosystem defined by technological breakthroughs, evolving dietary trends, and regulatory oversight.

Against this backdrop, this executive summary lays out the fundamental drivers and structural characteristics of the global polyol sweeteners market, setting the stage for an in‐depth exploration of transformative shifts, tariff impacts, segmentation insights, and strategic imperatives that will guide decision makers toward sustainable growth.

Unveiling the Transformational Forces Reshaping the Polyol Sweeteners Sector Including Sustainability Mandates Regulatory Overhauls and Technological Innovations

The polyol sweeteners market is experiencing a wave of transformative shifts driven by a convergence of consumer health consciousness, technological advances in bio‐production, and heightened regulatory scrutiny. First and foremost, consumer demand for reduced‐sugar and sugar‐free alternatives has surged, propelled by rising concerns over obesity, diabetes, and cardiovascular health. As a result, product developers are increasingly incorporating high‐purity erythritol and novel sugar alcohol blends to achieve taste profiles that closely mimic sucrose without the glycemic impact.

Concurrently, biotechnological innovations-such as enzymatic conversion processes and microbial fermentation-have enhanced the efficiency and sustainability of polyol production. These breakthroughs not only lower manufacturing costs but also reduce environmental footprints by minimizing water and energy consumption. In turn, sustainability commitments by major food and beverage corporations are reinforcing investment in greener production pathways for polyols.

On the regulatory front, tighter labeling requirements in jurisdictions like the European Union and North America are compelling manufacturers to provide clear nutritional disclosures and adhere to permissible daily intake limits. This increased transparency is reshaping competitive dynamics, as companies with robust quality assurance and traceability systems gain consumer trust. Moreover, strategic partnerships between ingredient suppliers and end‐user companies are becoming more prevalent, reflecting a broader shift toward integrated value chains that can rapidly adapt to evolving market demands and compliance standards.

Assessing the Cumulative Impact of 2025 United States Tariffs on Polyol Sweeteners Supply Chains Pricing Structures and Competitive Dynamics

In 2025, a series of United States tariff adjustments significantly affected the import economics of polyol sweeteners, reshaping supply chains and competitive landscapes. Tariffs on certain sugar alcohols sourced from major producing regions increased by five to ten percentage points in response to trade policy measures aimed at protecting domestic ingredient manufacturers. Consequently, companies that historically relied on cost‐effective imports faced elevated landed costs, prompting a strategic reevaluation of sourcing and pricing strategies.

The immediate effect of these tariff hikes was an increase in raw material costs across multiple polyol categories, particularly for erythritol and xylitol, where a substantial share of global production originates from Europe and Asia. Some formulators responded by passing through a portion of the additional expense to end‐product prices, while others engaged in long‐term supply agreements to lock in more favorable terms. At the same time, domestic producers of sorbitol and maltitol intensified capacity expansions to capitalize on the protective tariff environment.

Over the longer term, the tariffs have spurred increased investment in localized production and backward integration strategies among leading players. These moves are designed to mitigate exposure to import levies and enhance supply chain resilience. Furthermore, negotiation efforts at both governmental and industry association levels aim to secure tariff relief or adjustments, potentially shaping a more balanced competitive dynamic in the latter part of the decade. Overall, the 2025 tariff changes have served as a catalyst for supply diversification and strategic realignment within the polyol sweeteners industry.

Extracting Comprehensive Market Insights from Diverse Product Type Application Form and Distribution Channel Segmentation to Inform Strategic Decisions

Diving into the market’s structure reveals nuanced opportunities and challenges across multiple segmentation dimensions that inform strategic positioning. When viewed through the lens of product type, erythritol leads in consumer acceptance for sugar-free applications, while isomalt and maltitol find strong demand in confectionery where textural attributes are paramount. Mannitol and sorbitol remain staples for pharmaceutical and personal care formulations, with xylitol’s oral health benefits underpinning its prevalence in dental products.

Equally important is the breakdown by application, where food and beverage applications dominate due to the breadth of demand in bakery, beverages, confectionery, and dairy products. Confectionery manufacturers especially prize maltitol and isomalt for their mouthfeel and low hygroscopicity. Beyond food, the animal feed sector employs sorbitol as an energy source, while cosmetics and oral care segments harness the humectant and flavor properties of various polyols. In pharmaceuticals, the diversity of oral, parenteral, and topical formulations underscores the critical role of maltitol and mannitol as diluents and stabilizers.

Form-based dynamics further influence supply and distribution strategies. Granular polyols are favored by retail channels and specialty stores for ease of handling, while liquid variants suit beverage formulators seeking rapid dissolution. Powdered formats, with their fine particle size, cater to high‐precision dosing in pharmaceuticals and advanced skincare applications. Finally, distribution channels shape reach and customer engagement, as supermarkets and hypermarkets drive high‐volume retail sales, online retail offers direct-to-consumer personalization, and convenience stores ensure accessibility in quick‐service contexts. Specialty stores continue to serve niche segments with high-performance product demands.

This comprehensive research report categorizes the Polyol Sweeteners market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Application

- Distribution Channel

Highlighting Evolving Regional Dynamics and Growth Opportunities across Americas Europe Middle East Africa and Asia Pacific in the Polyol Sweeteners Arena

Regionally, the Americas exhibit strong momentum driven by robust health and wellness trends that elevate demand for sugar alternatives. North America, in particular, leads in adoption of clean-label formulations and innovation in low-calorie beverages and confectionery, bolstered by favorable regulatory frameworks and consumer awareness campaigns. In Latin America, a growing middle class and rising disposable incomes are accelerating uptake, although price sensitivity remains a critical factor influencing ingredient selection.

Across Europe, Middle East, and Africa, regulatory alignment within the European Union around nutrient profiling and sugar reduction initiatives continues to drive formulators toward polyol integration. Western European markets prioritize sustainability certifications and traceability, while Eastern Europe shows potential for growth as retail penetration deepens. In the Middle East, burgeoning food service sectors and shifts toward Western-style confectionery present openings, albeit tempered by economic volatility. African markets remain at an earlier stage of polyol adoption but are poised for expansion as health awareness rises.

The Asia-Pacific region represents a dynamic frontier, anchored by significant production capabilities in China and emerging demand in Southeast Asia and Oceania. Domestic manufacturing hubs in China supply global markets, while countries such as Japan and South Korea emphasize product innovation in personal care and pharmaceuticals. Meanwhile, Australia and New Zealand demonstrate growing appetite for naturals-focused formulations in food and beverage applications. Each subregion’s unique regulatory landscape and consumer priorities underscore the importance of tailored market entry and growth strategies.

This comprehensive research report examines key regions that drive the evolution of the Polyol Sweeteners market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Industry Leaders Their Strategic Investments Innovation Collaborations and Competitive Positioning in the Polyol Sweeteners Sector

A handful of industry leaders are defining competitive contours through strategic investments, technological differentiation, and collaborative alliances. One of the foremost multinational ingredient suppliers has prioritized expansion of fermentation-based production capacity, leveraging proprietary yeast strains to achieve higher erythritol yields with lower resource inputs. Concurrently, a major European processing conglomerate has focused on backward integration into raw material procurement to secure stable feedstock supplies and mitigate input cost volatility.

Meanwhile, an organization renowned for its specialty chemicals portfolio has directed significant R&D funding toward next-generation polyol blends that optimize sweetness profiles while maintaining superior functional performance. Alliances between key players are also on the rise, particularly joint ventures aimed at co-developing customized solutions for high-growth end-use segments like plant-based dairy alternatives and sugar-reduced beverages. These collaborations underscore a broader industry trend toward value chain integration and end-market alignment.

Additionally, emerging regional players are carving niche positions by emphasizing localized production and targeted product formulations that cater to specific dietary guidelines and cultural taste preferences. In the pharmaceutical arena, certain specialized companies have garnered recognition for offering pharmaceutical-grade mannitol and maltitol with stringent quality certifications. Collectively, these strategic maneuvers are shaping a highly competitive environment where innovation, scale, and agility determine market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyol Sweeteners market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Archer-Daniels-Midland Company

- B Food Science Co., Ltd.

- Cargill, Incorporated

- Ecogreen Oleochemicals Pte. Ltd.

- Foodchem International Corporation

- Gulshan Polyols Limited

- Hylen Co., Ltd.

- Ingredion Incorporated

- International Flavors & Fragrances Inc.

- Jungbunzlauer Suisse AG

- Lonza Group AG

- Merck KGaA

- Mitsubishi Gas Chemical Company, Inc.

- Roquette Frères

- Shandong Sanyuan Biotechnology Co., Ltd.

- Südzucker Group

Delivering Forward-Looking Strategic Recommendations to Strengthen Supply Chains Drive Sustainable Innovation and Enhance Competitive Resilience

To capitalize on the evolving polyol sweeteners landscape and build resilient, future-proof operations, industry leaders should pursue several targeted actions. First, enhancing supply chain resilience through strategic sourcing diversification and nearshoring of production can mitigate the risks introduced by tariff volatility and geopolitical uncertainties. Establishing flexible procurement arrangements with multiple suppliers ensures continuity of supply and cost stability.

Second, investing in sustainable production technologies-such as fermentation optimization and energy-efficient crystallization processes-enables companies to align with consumer demands for environmentally responsible ingredients while achieving operational cost savings. Concurrently, embedding circular economy principles through byproduct valorization and waste minimization strengthens corporate sustainability profiles and opens new revenue streams.

Third, forging deeper partnerships with end-users and co-innovation platforms accelerates product development cycles and fosters tailored solutions for key growth segments in food and beverage, personal care, and pharmaceuticals. By collaborating closely on formulation challenges, ingredient specialists can deliver differentiated offerings that meet stringent performance and labeling requirements.

Finally, strengthening regulatory intelligence capabilities is critical to anticipate and navigate shifting compliance landscapes. Proactive engagement with policy makers, participation in industry associations, and adoption of digital monitoring tools will ensure timely adaptation to evolving standards and certification frameworks. Collectively, these recommendations will empower leaders to maintain competitive advantage and drive sustainable market share growth.

Articulating the Multi-Phase Research Methodology Employing Primary Interviews Secondary Databases Analytical Frameworks and Rigorous Validation Processes

The research methodology underpinning this report combines rigorous primary and secondary research to ensure comprehensive and reliable insights. Secondary data sources include publicly available regulatory documents, company annual reports, patent databases, and industry white papers, forming the foundational landscape of market definitions and prevailing trends. These data are supplemented by proprietary databases that track trade flows, production volumes, and patent filings across geographies.

Primary research efforts involved in-depth interviews with senior executives from leading ingredient suppliers, formulators, and end-user companies, as well as consultations with academic experts and regulatory authorities. These qualitative insights provided nuanced understanding of innovation priorities, sourcing strategies, and regional market entry considerations. In addition, surveys of technical and commercial personnel in the food and beverage, personal care, and pharmaceutical sectors quantified preferences for specific polyol attributes.

Data triangulation was achieved through cross-validation of insights from multiple sources, ensuring consistency and minimizing informational biases. Analytical frameworks such as Porter’s Five Forces and value chain mapping guided the assessment of competitive dynamics, while scenario analysis evaluated the potential impact of tariff changes and regulatory shifts. Quality checks, including peer review by independent industry consultants, further bolstered the credibility and robustness of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyol Sweeteners market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyol Sweeteners Market, by Product Type

- Polyol Sweeteners Market, by Form

- Polyol Sweeteners Market, by Application

- Polyol Sweeteners Market, by Distribution Channel

- Polyol Sweeteners Market, by Region

- Polyol Sweeteners Market, by Group

- Polyol Sweeteners Market, by Country

- United States Polyol Sweeteners Market

- China Polyol Sweeteners Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1272 ]

Synthesizing Strategic Findings and Critical Takeaways to Guide Decision Makers Through the Complex Polyol Sweeteners Market Evolution

The global polyol sweeteners market stands at a strategic inflection point defined by shifting consumer preferences, innovative production technologies, and evolving regulatory landscapes. As demand for reduced-sugar and clean-label products continues to intensify, the ability of industry participants to navigate tariff uncertainties, optimize segment-specific strategies, and forge collaborative partnerships will determine their success.

Key takeaways include the critical importance of supply chain diversification to mitigate cost pressures, the value of investing in sustainable production methods to meet environmental and operational imperatives, and the need to tailor offerings across product types and applications to capture high-growth segments. Regionally, North America and Europe present mature but evolving markets driven by health mandates, while Asia-Pacific and emerging regions offer significant growth potential underpinned by rising incomes and urbanization.

Ultimately, the most successful players will be those who combine technological agility with strategic market intelligence, leveraging data-driven insights to preempt regulatory changes and consumer trends. By aligning innovation pipelines with end-market demands and reinforcing ecosystem partnerships, companies can secure long-term competitive advantage in a dynamic polyol sweeteners landscape.

Engage with Ketan Rohom Associate Director Sales Marketing to Unlock In-Depth Polyol Sweeteners Insights and Drive Strategic Growth Through Customized Research Solutions

To secure a comprehensive deep‐dive into the global polyol sweeteners market and obtain tailored strategic insights that empower your organization to stay ahead of evolving industry dynamics, reach out to Ketan Rohom, Associate Director of Sales & Marketing. Ketan brings extensive expertise in market intelligence and consultative support, ensuring you receive a customized research solution aligned with your specific needs. Engage with Ketan today to discuss how this report can address your unique challenges, unlock competitive advantage, and drive sustainable growth through data‐driven decision making.

Contacting Ketan provides direct access to:

Comprehensive briefings on the latest market developments and regulatory shifts Customized segmentation analysis aligned with your target applications and channels One-on-one consultations to translate research findings into actionable strategies Flexible licensing models and tailored deliverables to match your organizational objectives

Don’t miss the opportunity to transform insights into impact. Connect with Ketan Rohom now to purchase the full market research report and equip your team with the knowledge and tools to successfully navigate the future of polyol sweeteners.

- How big is the Polyol Sweeteners Market?

- What is the Polyol Sweeteners Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?