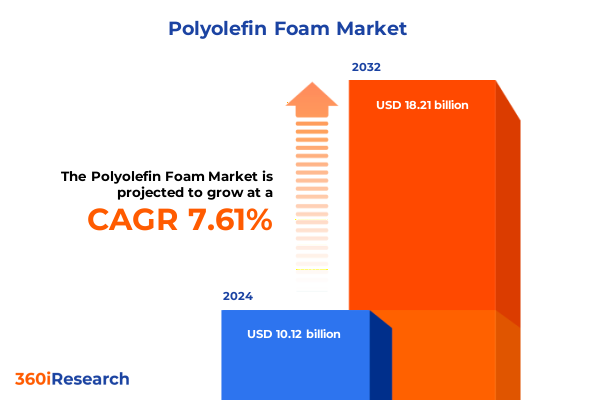

The Polyolefin Foam Market size was estimated at USD 9.12 billion in 2025 and expected to reach USD 9.76 billion in 2026, at a CAGR of 7.95% to reach USD 15.58 billion by 2032.

Unlocking the Potential of Polyolefin Foam: A Comprehensive Overview of Applications, Material Properties, and Market Drivers

Polyolefin foam represents a versatile class of engineered materials characterized by closed-cell structures, exceptional thermal stability, and superior resilience. Widely utilized across diverse industries-from construction to automotive-these foams deliver critical performance benefits such as lightweight cushioning, acoustic dampening, and environmental resistance. As global manufacturers prioritize efficiency and sustainability, polyolefin foam continues to emerge as a material of choice, balancing high performance with cost effectiveness. This executive summary distills key developments, emerging drivers, and strategic considerations shaping the market’s trajectory.

In the context of escalating environmental regulations and evolving customer expectations, the polyolefin foam sector is experiencing a period of rapid transformation. Stakeholders across the value chain are responding to pressures for recyclable content, reduced carbon footprints, and enhanced functional attributes. Meanwhile, shifts in trade policy and manufacturing technology are prompting a reexamination of supply chains and competitive positioning. By synthesizing the latest trends and segment-specific insights, this summary equips decision-makers with a clear, actionable perspective to navigate opportunities and manage risks in the polyolefin foam domain.

Exploring the Major Transformational Forces Shaping Polyolefin Foam Industry Through Innovation, Sustainability, and Regulatory Advancements

The polyolefin foam industry is undergoing radical change driven by an increasing emphasis on sustainability, digital manufacturing, and regulatory realignment. First, material innovation is at the forefront as producers integrate recycled polymers, bio-based additives, and novel crosslinking techniques to elevate performance while minimizing ecological impact. This shift is further amplified by the advent of advanced extrusion processes and green foaming agents that reduce energy consumption and lower greenhouse gas emissions. In parallel, end-users are demanding materials that offer enhanced functionality-ranging from flame retardancy to tailored thermal conductivity-to meet stringent application requirements.

Evaluating the Multifaceted Impact of the 2025 United States Tariff Regime on Polyolefin Foam Supply Chains, Pricing Structures, and Competitiveness

United States tariff measures implemented in early 2025 have exerted pronounced pressure on polyolefin foam producers and downstream users alike. The imposition of increased duties on key raw materials and imported finished foam products has elevated input costs, prompting manufacturers to reconfigure their sourcing strategies. Many have accelerated the search for alternative suppliers outside traditional trade corridors, while others have prioritized domestic capacity expansions to mitigate tariff burden. The cumulative effect has been a realignment of supply chains, with greater emphasis on regional self-reliance and inventory optimization.

In response to elevated duty rates, distributors and fabricators have passed part of the cost increment to end-user segments, which has, in turn, driven innovation toward more efficient foam grades and optimized material utilization. Meanwhile, strategic partnerships and toll-processing arrangements have emerged as viable approaches to share compliance costs and maintain price competitiveness. Collectively, these adaptations underscore the industry’s resilience and highlight the importance of proactive trade management in safeguarding profitability and market access.

Diving Into Segment-Level Dynamics: Product Variations, Forms, Applications, End-Users, Density and Thickness Trends Driving Foam Demand

Insights drawn from product-type segmentation reveal a nuanced balance between polyethylene and polypropylene foams. Within polyethylene foams, crosslinked varieties are increasingly favored for demanding applications requiring high compression set resistance, whereas non-crosslinked grades maintain strong traction where cost and process simplicity take precedence. In the realm of form factor, block foam continues to dominate large-scale structural and thermal insulation applications due to its dimensional stability, while roll form facilitates bespoke conversion in packaging and padding contexts, driving growth in e-commerce and just-in-time fulfillment channels.

Application segmentation highlights differentiated growth dynamics: acoustic insulation is bifurcated between building acoustic boards delivering sound attenuation in commercial spaces and industrial insulation solutions tailored for machinery enclosures; packaging applications range from cushioning and shock-absorbent protective packaging to void-fill solutions that maximize space efficiency; seals and gaskets capitalize on the foam’s resilience to maintain airtight interfaces; and thermal insulation applications split between appliance insulation in refrigeration and heating units and building insulation where energy efficiency mandates are rising. End-user segmentation underscores automotive manufacturers seeking lightweight interior components, construction and building firms deploying foam panels in green building projects, healthcare providers applying biocompatible grades in medical device packaging, packaging specialists optimizing protective solutions for high-value goods, and sports and leisure equipment producers leveraging shock-absorbent foams for safety gear. Finally, density-based preferences skew toward low-density grades in cushioning and acoustic use-cases, medium densities in general packaging and sealing, and high densities for structural support in industrial contexts. Thickness profiles vary accordingly: thin-gauge foams below 2 mm enable high-precision sealing applications, mid-range gauges between 2–5 mm are commonplace in cushioning and insulation, and thicker sections above 5 mm serve as core structural elements in panels and large-format packaging.

This comprehensive research report categorizes the Polyolefin Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Density

- Thickness

- Application

- End User

Analyzing Regional Dynamics Across the Americas, EMEA and Asia-Pacific to Illuminate Market Drivers, Growth Catalysts, and Competitive Landscapes

In the Americas, strong demand from automotive and construction sectors underpins steady uptake of polyolefin foams. North American producers have leveraged near-shoring trends and logistic efficiencies to serve domestic OEMs, while Latin American markets are gaining momentum as infrastructure spending and e-commerce penetration rise. Shifting preferences toward recyclable content and carbon reduction have spurred collaborative programs between resin suppliers and converter partners to develop closed-loop initiatives.

Across Europe, Middle East & Africa, regulatory frameworks focused on building energy efficiency and environmental labeling are pivotal drivers. Manufacturers in Western Europe are investing in next-generation foam chemistries to meet Eurocodes for fire performance and thermal resistance, whereas Middle Eastern markets exhibit growing uptake in acoustic and thermal insulation for commercial developments. African demand remains nascent but promising, particularly in building envelope upgrades and equipment insulation amid electrification efforts.

Asia-Pacific remains the largest growth engine, led by China, India, and Southeast Asia, where rapid industrialization and burgeoning consumer markets have escalated requirements for packaging, automotive interiors, and home appliances. Local capacity expansions, joint ventures with global suppliers, and government incentives for energy-efficient building materials are accelerating market penetration. Meanwhile, stringent environmental policies in key markets such as Japan and South Korea are catalyzing uptake of sustainable foam variants.

This comprehensive research report examines key regions that drive the evolution of the Polyolefin Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Leading Polyolefin Foam Manufacturers: Strategic Initiatives, Innovation Portfolios, and Competitive Positioning in a Rapidly Evolving Market

Leading producers are executing differentiated strategies to secure competitive advantage in an evolving environment. Major global conglomerates have ramped capital expenditure toward capacity expansions and greenfield plants, with a focus on integrating recycled resin streams and proprietary crosslinking technologies. Meanwhile, midsize specialists are forging partnerships with OEMs and regional distributors to deliver application-specific formulations, leveraging agility to respond swiftly to customer requirements. Innovation pipelines emphasize lightweighting, enhanced acoustic damping, and multi-functional foam composites that combine thermal and mechanical performance attributes. Sustainability credentials have become a critical dimension of corporate positioning, prompting several market participants to publish comprehensive environmental product declarations and pursue third-party certifications.

Collaborative ventures between foam suppliers and machinery OEMs are also gaining traction, facilitating co-development of next-generation extrusion and laminating lines. These alliances aim to optimize energy consumption, reduce scrap rates, and enable rapid recipe changes, thereby shortening time-to-market for specialty foam grades. Collectively, these initiatives reflect a strategic alignment around customer-centric innovation, operational excellence, and environmental stewardship.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyolefin Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Armacell International S.A.

- BASF SE

- Borealis AG

- Dow Inc.

- Exxon Mobil Corporation

- Hanwha Solutions Corporation

- Huntsman Corporation

- JSP Corporation

- Kaneka Corporation

- Rogers Corporation

- Saudi Basic Industries Corporation

- Sekisui Chemical Co., Ltd.

- Toray Industries, Inc.

- UFP Technologies, Inc.

- Zotefoams Plc

Strategic Roadmap for Industry Leaders to Capitalize on Emerging Opportunities, Mitigate Risks, and Drive Growth in the Polyolefin Foam Sector

Industry leaders should embrace a multifaceted strategy to navigate challenges and harness emerging opportunities. First, prioritizing investments in sustainable raw material sourcing and circular economy programs will build resilience against raw material volatility and regulatory pressure. Strategic integration of recycled content or bio-derivatives can unlock new customer segments and enhance brand value.

Second, diversifying supply chains beyond traditional trading partners will mitigate tariff exposure and logistical disruptions. This calls for a deliberate mix of regional sourcing, toll-processing agreements, and localized manufacturing footprints tailored to end-market demand. Concurrently, forging strategic alliances with technology providers can accelerate adoption of digital production tools-such as predictive maintenance platforms and process analytics-to boost yield and reduce total cost of ownership.

Third, refining product portfolios toward high-value applications, including acoustic metamaterials, multi-functional insulation, and medical-grade foams, will drive margin expansion. Engaging closely with OEMs through joint-development agreements can ensure early access to design requirements and foster sticky customer relationships. Lastly, a proactive stance on sustainability communication-through transparent ecolabeling, lifecycle analyses, and third-party validation-will differentiate market positioning and support premium pricing.

Outlining the Rigorous Research Framework Employed to Derive Actionable Insights Through Data Collection, Validation, and Analytical Techniques

The insights presented herein derive from a rigorous, multi-tiered research methodology designed to ensure data integrity and actionable outcomes. Secondary data sources encompassed a comprehensive review of industry reports, regulatory publications, technical journals, and company disclosures, allowing for a robust benchmarking of competitive and technological landscapes. This information was cross-verified with primary intelligence obtained through in-depth interviews with key stakeholders-including foam producers, end-user engineers, and supply chain intermediaries-to capture nuanced perspectives on market drivers, pain points, and innovation trajectories.

Quantitative analysis involved segmentation mapping based on product type, form factor, applications, end-user verticals, density, and thickness. Regional modeling accounted for distinct regulatory environments, supply chain configurations, and demand drivers. A stringent data validation protocol, including triangulation between independent sources and reconciliation of contradictory findings, underpinned the research framework. The result is a cohesive, reliable set of insights to support informed decision-making and strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyolefin Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyolefin Foam Market, by Product Type

- Polyolefin Foam Market, by Form

- Polyolefin Foam Market, by Density

- Polyolefin Foam Market, by Thickness

- Polyolefin Foam Market, by Application

- Polyolefin Foam Market, by End User

- Polyolefin Foam Market, by Region

- Polyolefin Foam Market, by Group

- Polyolefin Foam Market, by Country

- United States Polyolefin Foam Market

- China Polyolefin Foam Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1749 ]

Synthesizing Critical Insights From Market Trends, Segment Analysis, and Regulatory Impacts to Inform Strategic Decision-Making in Polyolefin Foam

As demonstrated throughout this analysis, the polyolefin foam sector is at a pivotal juncture shaped by sustainability imperatives, trade realignments, and material innovation. Producers and stakeholders who capitalize on circular economy initiatives, diversify supply chains, and invest in advanced manufacturing technologies will be best positioned to capture growth and defend margins. The interplay of evolving application requirements-from green building to electric vehicle interiors-offers fertile ground for tailored foam solutions that combine high performance with environmental stewardship.

Looking ahead, strategic collaboration across the value chain, coupled with a steadfast commitment to R&D and process optimization, will define market leadership. Navigating regulatory complexity and tariff volatility demands a proactive, data-driven approach to supply-chain management and product portfolio refinement. Stakeholders equipped with the insights detailed in this summary can confidently align their strategic roadmaps to emerging trends and secure competitive advantage.

Engage With Our Insights and Secure Your Competitive Edge by Accessing the Full Polyolefin Foam Market Research Report Today

To gain a comprehensive and in-depth understanding of the polyolefin foam landscape, including detailed segment analyses, regional breakdowns, and strategic recommendations, we invite you to connect with Ketan Rohom, Associate Director of Sales & Marketing. Secure your full copy of the market research report to unlock data-driven insights and propel your organization ahead of emerging trends and competitive challenges.

- How big is the Polyolefin Foam Market?

- What is the Polyolefin Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?