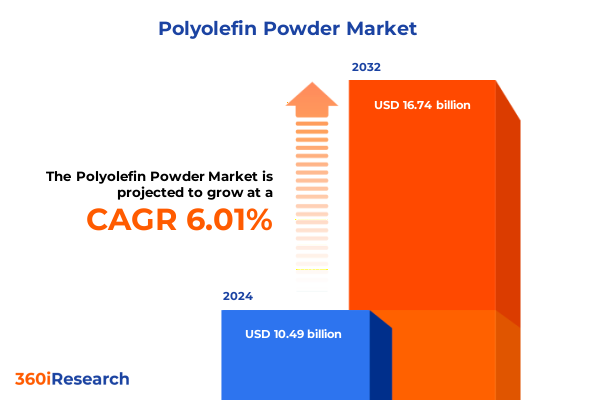

The Polyolefin Powder Market size was estimated at USD 11.09 billion in 2025 and expected to reach USD 11.74 billion in 2026, at a CAGR of 6.05% to reach USD 16.74 billion by 2032.

Unveiling the Strategic Imperatives Shaping the Polyolefin Powder Sector Through an Executive Lens of Innovation, Demand Dynamics and Growth Catalysts

The polyolefin powder industry has emerged as a critical enabler for advanced manufacturing, specialized coatings, and precision molding applications, driving a paradigm shift in how producers and end users approach material performance requirements. With molecular design innovations that enhance thermal stability and mechanical resilience, polyolefin powders are increasingly adopted across an array of sectors, from additive manufacturing to industrial surface treatments. Moreover, the convergence of sustainability imperatives and regulatory frameworks has amplified interest in powder-form polyolefin systems, as they often allow for reduced waste and superior coverage compared to traditional liquid resins. As organizations strive to meet escalating standards for efficiency and environmental compliance, the strategic value of polyolefin powders continues to gain prominence.

Throughout this analysis, executives and decision makers will uncover the catalysts propelling growth, the underlying structural shifts redefining competitive positioning, and the key risk factors demanding vigilant management. The narrative maintains a forward-looking lens, synthesizing current trends in technology development, raw material sourcing, and policy evolution. Armed with these insights, stakeholders can anticipate market trajectories and calibrate investment strategies to capture emerging opportunities in sectors such as automotive component manufacturing, consumer goods production, medical device fabrication, and beyond. This executive summary distills the essential findings of a rigorous research initiative, equipping leadership teams with the knowledge foundation required to navigate a dynamic landscape.

Examining the Pivotal Transformative Currents Redefining Polyolefin Powder Market Structures Through Technological Advancements and Regulatory Transitions

Innovation and regulatory evolution are driving profound transformations across the polyolefin powder market, catalyzing the emergence of next-generation materials and reconfigured value chains. In the realm of additive manufacturing, advances in binder jetting and selective laser sintering technologies have necessitated finely tuned particle morphologies and tailored flow properties, spurring producers to refine polymerization processes and invest in proprietary milling techniques. Concurrently, the push toward circularity has led to the exploration of chemically recycled feedstocks and depolymerization methods, challenging established supply chain models and prompting collaboration between material suppliers and recyclers.

On the regulatory front, stringent emissions criteria for volatile organic compounds and heightened scrutiny of microplastic release in industrial applications are reshaping formulation strategies. These policy developments have compelled industry players to adopt greener catalysts and optimize curing chemistries for powder coatings, while also driving investment in closed‐loop recycling systems for production scrap. Overarching these shifts is a growing emphasis on digitalization, as real-time analytics and process monitoring tools enable manufacturers to achieve tighter process controls, reduce batch-to-batch variability, and accelerate time-to-market for novel polyolefin powder grades. As a result, the competitive landscape is evolving toward a hybrid model in which material innovation and sustainability credentials are inextricably linked.

Assessing the Comprehensive Influence of 2025 United States Tariffs on Polyolefin Powder Supply Chains, Cost Structures and Trade Competitiveness

The enactment of targeted tariffs by the United States in 2025 has reverberated across polyolefin powder supply networks, altering cost structures and prompting strategic realignments. These levies, focused on select import categories linked to polyethylene and polypropylene intermediates, have translated into increased procurement expenses for many downstream producers. In response, several tier-one manufacturers have accelerated efforts to localize feedstock sourcing, leveraging domestic refinery capacities and seeking partnerships with regional petrochemical producers to mitigate import dependency.

Furthermore, the tariff-induced pressure has rippled through logistics channels, with importers reevaluating freight routing and inventory buffer strategies to avoid escalation of landed costs. The tariff landscape has also served as a catalyst for nearshoring initiatives, driving investment in capacity expansions within North America and invigorating discussions around transatlantic alliances for raw material bridging. While some producers have successfully offset added duties through pricing adjustments and operational efficiencies, smaller market participants continue to face margin compression, underscoring the importance of agile supply chain management and proactive regulatory monitoring. Overall, the 2025 tariff environment has crystallized the need for dynamic procurement frameworks and diversified supplier portfolios to sustain competitiveness in the polyolefin powder market.

Delving into Multifaceted Segmentation Insights to Illuminate Market Dynamics Across Types, Applications and End Use Industries in Polyolefin Powder Realm

A nuanced examination of market segmentation reveals critical differentiators that are shaping stakeholder strategies across the polyolefin powder value chain. In terms of polymer type, the spectrum encompasses polyethylene and polypropylene families, each presenting distinct property profiles. The high-density, low-density and linear low-density polyethylene variants deliver varying balances of rigidity, melt flow and chemical resistance, while homopolymer, random copolymer and impact copolymer grades of polypropylene offer tailored impact strength, processability and surface finish. These intrinsic differences are informing material selection protocols for manufacturers seeking to optimize performance characteristics in target applications.

Considerations of application further refine market dynamics, as key segments such as additive manufacturing, powder coating and rotational molding each impose specific requirements. Additive processes like binder jetting and selective laser sintering demand powders with controlled particle size distribution and thermal characteristics, whereas powder coating formulations for architectural, automotive or industrial finishes must balance adhesion, cure kinetics and weatherability. Rotational molding, employed in the production of automotive components, industrial equipment, storage tanks and recreational products, places a premium on consistent sintering behavior and mechanical toughness. End use industry breakdowns add another layer of strategic insight; the mobility sector is driving demand for lightweight, durable formulations, consumer goods manufacturers are prioritizing cost-efficient production and aesthetic versatility, the healthcare industry seeks biocompatible grades for sterile applications, and the packaging and industrial markets emphasize barrier performance and processing efficiency. By intersecting these axes of segmentation, organizations can pinpoint high-value niches, anticipate emerging demand pockets and tailor their product portfolios accordingly.

This comprehensive research report categorizes the Polyolefin Powder market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Polymer Type

- Molecular Weight Range

- Particle Morphology

- Particle Size Distribution

- Manufacturing Process

- Application

- End Use Industry

- Distribution Channel

Unpacking Regional Variations and Growth Drivers Spanning the Americas, Europe Middle East & Africa, and Asia Pacific in Polyolefin Powder Market Dynamics

Regional analysis highlights divergent growth trajectories and regulatory landscapes across the Americas, Europe Middle East & Africa and Asia Pacific, each offering distinct competitive advantages and operational challenges. In the Americas, robust investments in additive manufacturing infrastructure and rising consumer demand for high‐performance coatings are fueling incremental capacity expansions, particularly in the United States and Canada. At the same time, Latin American markets are emerging as cost-competitive production hubs, driven by favorable feedstock supply and government incentives to bolster local manufacturing.

Within Europe Middle East & Africa, stringent environmental mandates and circular economy directives are accelerating transitions toward recycled-content powders and low‐VOC coating solutions. Western European nations are pioneering advanced process technologies and forging public-private partnerships aimed at reducing carbon footprints, while Middle Eastern petrochemical complexes leverage integrated value chains to supply regional demand and export markets. Conversely, African markets are characterized by untapped growth potential, with underdeveloped processing infrastructures and nascent industrial bases presenting opportunities for targeted investment in compounding and milling facilities.

Asia Pacific remains at the forefront of scale-driven production capabilities, led by China, India, Japan and South Korea. Significant capital allocations in R&D and manufacturing outputs have positioned the region as the world’s largest producer of base resins, enabling local powder producers to secure feedstock at competitive rates. Nevertheless, supply chain bottlenecks and evolving trade policies introduce elements of volatility, prompting companies to establish strategic alliances and optimize distribution networks to meet burgeoning demand from automotive, electronics and consumer durables sectors.

This comprehensive research report examines key regions that drive the evolution of the Polyolefin Powder market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders and Strategic Collaborations Shaping Competitive Landscapes and Innovation Trajectories Within the Polyolefin Powder Industry

Key industry participants are actively pursuing strategic initiatives designed to solidify market leadership and drive innovation in polyolefin powders. Major integrated producers have announced expansions of polymerization capacities and new milling assets to capture incremental demand, often in collaboration with technology licensors and equipment OEMs. Joint ventures between resin suppliers and specialized compounders are enabling the co‐development of advanced powder formulations tailored for additive manufacturing platforms and high‐performance coating systems.

Competitive positioning is also being reinforced through targeted intellectual property investments, with firms filing patents that focus on sustainable chemistries, fine-tuned particle engineering and enhanced thermal stability. Partnerships with academic institutions and consortia dedicated to circular economy advancement underscore a collective move toward closed‐loop production models. Meanwhile, smaller innovators are leveraging agility to introduce niche-grade powders with unique functionalities, such as enhanced UV resistance, biocompatibility attributes and electrically conductive fillers. This ecosystem of collaboration and rivalry is fostering a dynamic environment in which scale advantages, technical differentiation and sustainability credentials converge to determine long-term success.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyolefin Powder market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abifor AG

- Asahi Kasei Corporation

- Axalta Coating Systems, LLC

- BASF SE

- Borealis AG

- Braskem S.A.

- Ceronas GmbH & Co. KG

- China Petroleum & Chemical Corporation

- Clariant Ltd.

- Dairen Chemical Corporation

- Dow Inc.

- Eastman Chemical Company

- Exxon Mobil Corporation

- Formosa Plastics Corporation

- INEOS Group AG

- Japan Polyethylene Corporation

- LyondellBasell Industries Holdings B.V.

- Mitsui Chemicals, Inc.

- Moretex Chemical Products, Inc.

- Münzing Corporation

- PetroChina Company Limited

- Saudi Basic Industries Corporation

- TotalEnergies SE

Delivering Impactful and Tactical Recommendations to Empower Industry Leaders in Steering Sustainable Growth and Operational Excellence in Polyolefin Powder Markets

Industry leaders should consider a multi-pronged approach to secure competitive differentiation and resilience in an evolving polyolefin powder landscape. Prioritizing investment in advanced particle engineering capabilities will enable rapid formulation of powders optimized for emerging additive manufacturing platforms and precision coating processes. Concurrently, cultivating strategic partnerships with feedstock producers and recycling networks will mitigate raw material volatility and reinforce commitments to circularity.

Furthermore, companies can unlock operational efficiencies by integrating digital process monitoring and predictive analytics across compounding, milling and finishing stages, thereby minimizing batch variability and reducing time-to-market for new grades. Embedding sustainability criteria within product development cycles, including life cycle assessments and end-of-life recovery planning, will not only satisfy regulatory mandates but also resonate with increasingly eco-conscious customers. Finally, leaders are encouraged to adopt flexible supply chain architectures that support nearshoring initiatives, build inventory buffers in critical regions and diversify logistics providers to navigate tariff fluctuations and geopolitical uncertainties. By implementing these actionable strategies, decision makers can steer sustainable growth, optimize cost structures and elevate their competitive positioning within the polyolefin powder arena.

Outlining Rigorous Research Methodologies Employed to Ensure Comprehensive Data Integrity, Analytical Robustness and Market Insight Credibility for Polyolefin Powder

This research leverages a rigorous methodology that synthesizes both secondary and primary data sources to deliver a comprehensive market perspective. Secondary research involved the systematic review of technical journals, patent filings, regulatory publications and industry white papers, providing historical context and trend analysis for key developments in polyolefin powder production and application. Simultaneously, proprietary databases of trade flows and production capacities were assessed to map global supply chain configurations and identify emerging manufacturing nodes.

Primary research comprised interviews with senior executives, R&D specialists, procurement managers and end‐use customers, offering on-the-ground insights into material performance requirements, purchasing behaviors and future investment priorities. These qualitative inputs were complemented by quantitative surveys targeting a broad cross-section of additive manufacturing service bureaus, coating applicators and rotational molding fabricators. Collected data points were triangulated against multiple sources to validate findings and minimize bias.

Analytical frameworks, including PESTEL analysis, SWOT evaluation and Porter's Five Forces, were applied to interpret market dynamics and competitive forces. Scenario modeling was used to assess the impact of tariff changes, raw material price fluctuations and regulatory shifts on supply-demand equilibria. The integrated approach ensures that conclusions and recommendations are grounded in robust evidence and reflective of both macroeconomic and microeconomic factors influencing the polyolefin powder market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyolefin Powder market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyolefin Powder Market, by Polymer Type

- Polyolefin Powder Market, by Molecular Weight Range

- Polyolefin Powder Market, by Particle Morphology

- Polyolefin Powder Market, by Particle Size Distribution

- Polyolefin Powder Market, by Manufacturing Process

- Polyolefin Powder Market, by Application

- Polyolefin Powder Market, by End Use Industry

- Polyolefin Powder Market, by Distribution Channel

- Polyolefin Powder Market, by Region

- Polyolefin Powder Market, by Group

- Polyolefin Powder Market, by Country

- United States Polyolefin Powder Market

- China Polyolefin Powder Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2067 ]

Synthesizing Executive-Level Conclusions to Highlight Core Findings, Strategic Imperatives and Forward-Looking Perspectives for Stakeholders in Polyolefin Powder Arena

The findings underscore the intersection of technological innovation, sustainability imperatives and geopolitical dynamics as pivotal drivers of the polyolefin powder market’s evolution. A clear demarcation emerges between producers that are actively investing in specialized particle engineering and closed‐loop systems, and those that risk commoditization by overlooking differentiation levers. The cumulative impact of new tariff structures has validated the strategic necessity of flexible sourcing and supply chain resilience, while regional contrasts highlight the importance of tailoring market entry and growth strategies to local regulatory environments and infrastructure maturity.

Segmentation analysis confirms that high-value applications in additive manufacturing and high‐performance coatings will serve as growth engines, whereas traditional molding processes continue to benefit from productivity enhancements and cost-saving initiatives. Leading companies are reinforcing their positions through collaborative ventures, intellectual property acquisitions and targeted sustainability programs, signaling a shift toward integrated ecosystems that marry scale advantages with technical expertise.

Collectively, these insights form a strategic blueprint for stakeholders seeking to navigate complex market conditions, seize emerging opportunities and safeguard long-term competitiveness. By aligning innovation roadmaps, operational capabilities and regulatory compliance strategies, organizations can chart a course for sustainable growth within the dynamic polyolefin powder landscape.

Engage with Ketan Rohom to Unlock Specialized Market Intelligence and Leverage Strategic Insights Through a Personalized Consultation on Polyolefin Powder Research Report

Eager to transform strategic ambitions into measurable outcomes, industry professionals are invited to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, for a personalized consultation tailored to unlock specialized intelligence within the polyolefin powder sector. By initiating this conversation, organizations will gain access to exclusive perspectives on emerging market drivers, supply chain optimization strategies, and proprietary insights into evolving demand patterns across critical end-use industries. Ketan’s expertise bridges the gap between data-driven analysis and practical execution, ensuring that decision makers are equipped with the nuanced recommendations necessary to navigate competitive landscapes. Prospective clients can explore custom research packages, flexible advisory engagements, and collaborative workshops designed to address unique operational challenges. Connect with Ketan to secure your comprehensive market research deliverable and position your organization at the forefront of innovation in the polyolefin powder domain

- How big is the Polyolefin Powder Market?

- What is the Polyolefin Powder Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?