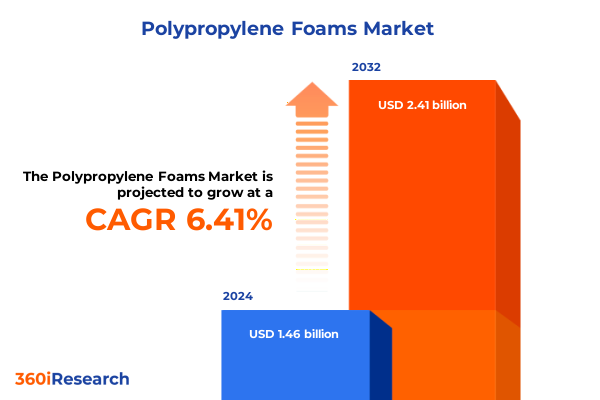

The Polypropylene Foams Market size was estimated at USD 1.56 billion in 2025 and expected to reach USD 1.66 billion in 2026, at a CAGR of 7.62% to reach USD 2.61 billion by 2032.

Revealing How Polypropylene Foams Serve as Fundamental Lightweight, Durable, Cost-Effective Materials Driving Diverse Industrial and Consumer Applications

Polypropylene foams have emerged as indispensable materials across a broad spectrum of industrial and consumer applications, thanks to their lightweight nature, exceptional durability, and superior chemical resistance. As closed-cell cellular polymers, they offer a unique combination of thermal insulation, impact cushioning, and dimensional stability that traditional foams struggle to match. This foundational overview outlines how polypropylene foams have transitioned from niche specialty applications into mainstream usage, driven by ongoing advances in polymer chemistry and processing technologies.

In recent years, manufacturers have refined the nucleation and expansion processes to produce foams with precisely controlled cell sizes and density gradients. These enhancements have not only improved mechanical performance under compression and flexural loads but have also unlocked new design possibilities for complex shapes and customized part geometries. Such versatility has made polypropylene foams particularly attractive for sectors demanding both high performance and cost-efficiency.

Looking ahead, the demand for lightweight solutions is converging with stringent sustainability mandates and the push for circular economy principles. Against this backdrop, polypropylene foams stand out for their recyclability and potential to reduce overall carbon footprints when compared with heavier or less durable materials. As environmental regulations tighten and supply chains evolve, this introductory perspective sets the stage for examining the transformative forces reshaping the market and guiding strategic decision-making.

Charting the Transformative Shifts Propelling Polypropylene Foams into an Era of Sustainable Performance and Advanced Manufacturing Innovation

The polypropylene foam landscape is undergoing a profound transformation driven by intersecting trends in sustainability, digitalization, and advanced manufacturing. Increasing regulatory scrutiny on single-use plastics and carbon emissions is propelling manufacturers to adopt closed-loop recycling systems, integrating reclaimed polymeric feedstocks into foam production. This shift away from virgin resins has spurred significant improvements in life-cycle analysis metrics, enabling end users to deliver greener products without sacrificing performance.

Parallel to environmental imperatives, digital printing and additive manufacturing techniques are reshaping conventional processing paradigms. By leveraging 3D printing, producers can now fabricate complex foam structures with gradient densities and tailored mechanical profiles, meeting the precise demands of automotive, aerospace, and medical device sectors. These capabilities are complemented by advancements in simulation software, which optimize cell morphology, thermal conductivity, and mechanical resilience before the first prototype is even created.

Moreover, the emergence of hybrid composite foams-where polypropylene matrix is reinforced with nanofillers or natural fibers-reflects the industry’s ongoing quest for multifunctionality. These engineered materials deliver enhanced electrical conductivity, flame retardancy, and acoustic absorption, expanding the potential use cases in electronics housing, building insulation, and sports equipment. As these transformative forces converge, they are redefining competitive benchmarks and opening new avenues for innovation.

Assessing the Cumulative Effects of 2025 United States Tariffs on Polypropylene Foam Supply Chains, Cost Structures, and Global Trade Dynamics

The imposition of new tariffs by the United States in 2025 has reverberated throughout the polypropylene foam supply chain, reshaping cost structures and prompting strategic realignments. Import duties on key polymer feedstocks escalated raw material expenses, compelling foam producers to reassess sourcing strategies and explore alternative suppliers in lower-tariff jurisdictions. Simultaneously, fluctuations in currency exchange rates amplified price volatility, forcing contract renegotiations and closer collaboration between resin manufacturers and foam fabricators.

In response to these challenges, many organizations have accelerated efforts to localize production and reduce dependence on transpacific trade routes. Nearshoring initiatives have gained momentum, with new investments in North American polymer compounding facilities that can process recycled polypropylene and maintain consistent throughput volumes. This localized approach not only mitigates tariff exposure but also enhances supply chain resilience against geopolitical uncertainties and shipping disruptions.

Additionally, the tariff environment has spurred greater interest in techno-economic analyses, where companies are quantifying the total landed cost of materials and evaluating the trade-offs between tariff savings and logistics expenditures. While some foam fabricators have absorbed a portion of the added charges to preserve market share, others have introduced differentiated product tiers, shifting premium applications toward domestically sourced foams with transparent tariff pass-through. Collectively, these adaptations underscore a more dynamic, cost-conscious marketplace where agility and strategic sourcing are paramount.

Unraveling the Nuanced Market Segmentation of Polypropylene Foams Across End-Use Industries, Processing Methods, Product Types, Densities, and Channels

A nuanced understanding of polypropylene foam market segmentation reveals a tapestry of end-use industries, processing methods, product types, density grades, and distribution channels that collectively shape demand patterns. Within end-use applications, the automotive sector stands out, spanning exterior components that benefit from the foam’s impact resistance, interior trim elements valued for noise dampening, and under-the-hood parts that leverage thermal shielding. In parallel, the construction industry incorporates flooring underlays, thermal insulation panels, and wall cladding systems, while the consumer goods arena utilizes foamed polypropylene for appliance housings, modular furniture elements, and durable playthings.

On the processing front, 3D printing is carving out specialized niches for prototyping and low-volume complex parts, whereas extrusion and hot pressing dominate high-throughput sheet, block, and film production. Injection molding remains critical for producing precision molded parts, often in hybrid assemblies where foam inserts enhance functionality. These processing distinctions closely intersect with product typologies: spherical beads lend themselves to engineered foamed blocks, continuous films offer flexible packaging and barrier solutions, rigid molded parts integrate into structural assemblies, and sheets provide flat substrates for laminating or panel construction.

Density classification further segments the marketplace, with low-density foams delivering maximum cushion and energy absorption, medium-density grades balancing lightweight performance with structural integrity, and high-density materials enabling load-bearing applications. Distribution channels span direct sales agreements for tailored industrial contracts, an tiers of distributors offering regional inventory coverage, and emerging online platforms that supply standardized sheet, film, and prototyping kits directly to small-volume end users. By mapping these intersecting layers of segmentation, stakeholders can pinpoint areas of high growth potential and tailor their go-to-market propositions accordingly.

This comprehensive research report categorizes the Polypropylene Foams market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Process

- Density

- End-Use Industry

- Distribution Channel

Highlighting the Diverse Regional Dynamics Shaping Polypropylene Foam Deployment and Growth Patterns Across the Americas, EMEA, and Asia-Pacific

Regional dynamics play a pivotal role in shaping local demand drivers, regulatory landscapes, and logistical considerations for polypropylene foams. In the Americas, particularly the United States and Canada, infrastructure spending on transportation and green building projects underpins robust demand for insulation boards and automotive interior trims. Regulatory encouragement for recycled content in construction materials is further stimulating the integration of post-consumer polypropylene into foam formulations, enabling manufacturers to differentiate based on sustainability credentials while meeting stringent building codes.

Across Europe, the Middle East, and Africa, a complex interplay of environmental directives and industrial modernization efforts is unfolding. The European Union’s emphasis on circular economy targets is mandating end-of-life recycling channels, incentivizing closed-loop partnerships between foam producers and waste management operators. In parallel, the Gulf Cooperation Council states are investing in advanced manufacturing hubs, drawing on low-cost feedstocks to develop value-added foam products for regional construction booms and diversified industrial portfolios.

In Asia-Pacific, rapid urbanization and consumer electronics proliferation drive widespread adoption of polypropylene foams in packaging and thermal management applications. Chinese and Indian OEMs are scaling up local foam compounding and processing facilities to meet cost-sensitive mass-market requirements, while Japanese and South Korean technology companies focus on high-performance grades for automotive lightweighting and electronic insulation components. Together, these regional narratives illustrate how localized policies, infrastructure trends, and end-market priorities converge to define the global competitive landscape.

This comprehensive research report examines key regions that drive the evolution of the Polypropylene Foams market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing Competitive Strategies and Collaborative Innovations from Leading Polypropylene Foam Manufacturers and Market Participants in 2025

Leading participants in the polypropylene foam domain are actively refining their competitive strategies and forging collaborative alliances to access new markets and technologies. Global polymer giants are vertically integrating compounding, foaming, and finishing operations, thereby streamlining quality control while optimizing cost efficiencies. At the same time, specialty foam fabricators are entering joint development agreements with raw material suppliers to customize resin formulations for next-generation applications in aerospace and medical devices.

Research-driven companies are placing significant emphasis on R&D investments, focusing on bio-based nucleating agents, advanced cell-structure control, and nanocomposite enhancements. These efforts have yielded foams with unprecedented thermal conductivity profiles and mechanical strength metrics, enabling deployment in high-value sectors such as electric vehicle battery modules and acoustic management systems. Meanwhile, strategic acquisitions of niche foam technology providers are enabling larger players to broaden their product portfolios and accelerate time-to-market for tailored solutions.

Collaborations extend beyond upstream innovation, encompassing multi-stakeholder initiatives aimed at establishing standardized recycling protocols and enhancing supply chain transparency. By participating in industry consortia and sustainability working groups, these forward-looking organizations are collectively elevating the environmental performance of polypropylene foams, bolstering customer confidence, and unlocking new opportunities for circular-economy branding.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polypropylene Foams market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Avient Corporation

- BASF SE

- Huhtamaki Oyj

- JSP Corporation

- K. K. Nag Pvt. Ltd.

- Kaneka Corporation

- Knauf Industries

- LyondellBasell Industries N.V.

- Miles Manufactured Products, Inc.

- Mitsui Chemicals, Inc.

- Saudi Basic Industries Corporation

- Sealed Air Corporation

- Sonoco Products Company

- Sumitomo Chemical Co., Ltd.

Providing Actionable Roadmaps for Industry Leaders to Leverage Polypropylene Foam Innovations, Optimize Value Chains, and Drive Sustainable Growth

To navigate this increasingly complex environment, industry leaders must pursue a set of targeted, actionable strategies that balance innovation with operational excellence. First, prioritizing investments in advanced processing technologies-such as microcellular extrusion and precision injection molding-enables the production of differentiated foam structures that command premium pricing. Coupling these capabilities with real-time process analytics ensures consistent product quality and reduces scrap rates.

Second, integrating recycled polypropylene through certified supply chains not only enhances sustainability credentials but also provides insulation against feedstock price volatility and tariff fluctuations. Establishing take-back programs and forging partnerships with waste management entities will accelerate the creation of closed-loop ecosystems and reinforce brand reputation among environmentally conscious customers. Third, diversifying geographic footprints by expanding licensed compounding and foaming operations into emerging markets will capture local growth opportunities and mitigate exchange-rate risks.

Finally, fostering cross-industry collaboration on material standardization and regulatory advocacy will streamline market entry for novel foam applications. By participating in industry associations and sponsoring joint pilot projects, companies can influence policy frameworks, establish best practices, and accelerate the commercialization of high-performance, eco-friendly foam products. Executing these recommendations in a coordinated manner will fortify competitive positioning and drive sustainable, profitable growth.

Detailing the Rigorous Multi-Source Research Methodology and Analytical Framework Underpinning the Polypropylene Foams Market Study

This market research report combines rigorous secondary and primary research methodologies to deliver a thoroughly validated analysis of the polypropylene foam landscape. Secondary research involved comprehensive reviews of technical journals, patent databases, regulatory filings, and publicly available company disclosures to develop a broad understanding of material technologies, processing innovations, and macroeconomic drivers. Building upon these insights, targeted primary interviews were conducted with C-level executives, R&D directors, and key procurement managers to capture real-world perspectives on emerging trends and strategic imperatives.

Data triangulation techniques were employed to cross-verify quantitative inputs and qualitative insights, ensuring that the final findings reflect both ground-level realities and high-level market drivers. The report’s analytical framework integrates SWOT analysis, technology readiness assessments, and risk-return matrices to evaluate competitive positioning and identify high-potential growth corridors. Segmentation schemas were refined through iterative consultations with industry experts, resulting in a multidimensional view that spans end-use industries, processing routes, product typologies, density grades, and distribution channels.

Throughout the research process, strict validation protocols were maintained to reconcile discrepancies, confirm assumptions, and uphold data integrity. The resulting study offers decision-makers a clear, evidence-based roadmap for understanding the complex interplay of forces shaping polypropylene foams today and in the years ahead.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polypropylene Foams market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polypropylene Foams Market, by Product Type

- Polypropylene Foams Market, by Process

- Polypropylene Foams Market, by Density

- Polypropylene Foams Market, by End-Use Industry

- Polypropylene Foams Market, by Distribution Channel

- Polypropylene Foams Market, by Region

- Polypropylene Foams Market, by Group

- Polypropylene Foams Market, by Country

- United States Polypropylene Foams Market

- China Polypropylene Foams Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1908 ]

Synthesizing Key Findings and Strategic Considerations to Navigate the Evolving Landscape of Polypropylene Foam Innovations and Market Dynamics

Drawing together the report’s key findings reveals a market at the intersection of performance optimization, cost management, and sustainability imperatives. Technological advances in foam cell-structure control and composite integration are unlocking new application domains, while digital and additive manufacturing techniques are redefining production capabilities. Simultaneously, the 2025 tariff regime has underscored the critical importance of supply chain agility and strategic sourcing, prompting industry players to localize operations and diversify procurement channels.

The segmentation analysis highlights the nuanced requirements of each end-use sector, from automotive thermal management to packaging cushioning, and underscores the need for tailored material solutions that address specific density, mechanical, and processing attributes. Regionally, distinct regulatory environments and infrastructure investments are shaping demand trajectories across the Americas, EMEA, and Asia-Pacific, offering both challenges and opportunities for entrants and incumbents alike. Key market participants are responding through targeted R&D collaborations, M&A activity, and sustainability partnerships, elevating the competitive bar and accelerating the pace of innovation.

Strategic considerations for decision-makers center on balancing rapid adoption of advanced technologies with robust risk-management frameworks, integrating circular-economy approaches to meet escalating environmental targets, and forging the partnerships necessary to scale next-generation foam solutions. This synthesized perspective equips stakeholders to make informed, forward-looking decisions as polypropylene foams continue to evolve in complexity and impact.

Connect Directly with Ketan Rohom to Secure Exclusive Insights and Access the Comprehensive Polypropylene Foams Market Research Report Today

To explore the full depth of insights, analysis, and strategic recommendations presented in this comprehensive market research on polypropylene foams, reach out directly to Ketan Rohom, Associate Director, Sales & Marketing. Engage in a personalized discussion to understand how the report’s findings can inform your organization’s priorities and drive competitive advantage. Secure your copy of this definitive study today to gain exclusive access to in-depth data, expert perspectives, and actionable roadmaps tailored for success in the evolving polypropylene foam landscape.

- How big is the Polypropylene Foams Market?

- What is the Polypropylene Foams Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?