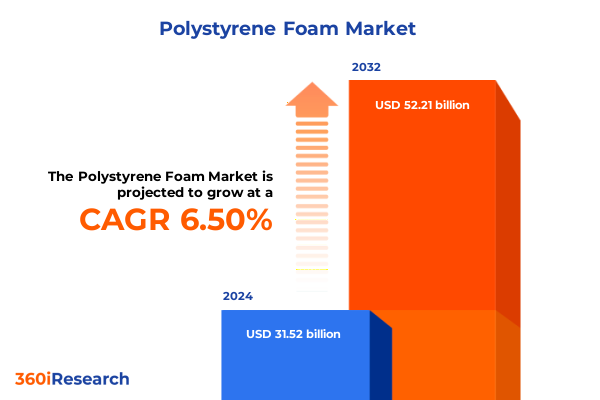

The Polystyrene Foam Market size was estimated at USD 319.56 billion in 2025 and expected to reach USD 344.03 billion in 2026, at a CAGR of 8.25% to reach USD 556.87 billion by 2032.

Navigating the Expanding Horizons and Core Foundations of Polystyrene Foam Across Evolving Industrial and Commercial Applications

Navigating the Expanding Horizons and Core Foundations of Polystyrene Foam Across Evolving Industrial and Commercial Applications

The polystyrene foam industry has matured into a multifaceted arena characterized by its lightweight composition, superior thermal properties, and exceptional versatility. Synthesized through controlled polymerization techniques, both expanded and extruded polystyrene variants have emerged as indispensable materials spanning construction insulation to protective packaging. Their closed-cell structures afford outstanding resistance to moisture ingress, compressive loads, and temperature fluctuations, thus establishing polystyrene foam as a cornerstone of modern engineering and design solutions.

Over the last decade, rising global emphasis on energy efficiency has driven intensified demand for thermal insulation products. Simultaneously, the proliferation of e-commerce and consumer electronics has placed a premium on impact-resistant packaging solutions. These dual forces of sustainability mandates and logistical optimization have converged to shift polystyrene foam firmly into the strategic plans of manufacturers, architects, and logistics providers alike. As environmental concerns mount, the industry faces both challenges and opportunities-ranging from evolving regulatory landscapes governing flame retardants to the development of recycling and reuse pathways.

Within this context, decision-makers must understand not only the material’s core performance attributes but also the broader market dynamics steering innovation. Technological advancements in processing equipment have enhanced dimensional precision in block molding and board stock production, while breakthroughs in additive formulations are expanding acoustic insulation applications. Taken together, these developments underscore why polystyrene foam remains central to cost-effective design, performance optimization, and sustainability transitions across sectors. Navigating these expanding horizons requires a holistic grasp of product technologies, supply chain intricacies, and end-use trends, which together form the foundation for strategic growth in this versatile material category.

Uncovering the Disruptive Technological and Environmental Drivers Reshaping the Polystyrene Foam Industry Amid Regulatory Evolution

Uncovering the Disruptive Technological and Environmental Drivers Reshaping the Polystyrene Foam Industry Amid Regulatory Evolution

Recent years have witnessed transformative shifts across the entire polystyrene foam value chain, driven by a convergence of technological breakthroughs, heightened environmental stewardship, and evolving regulatory frameworks. Innovations in foaming agents and catalyst systems, for example, have unlocked greater process control, yielding foam densities that optimize both insulation performance and mechanical resilience. Such advances have made it possible to tailor block and board stock products specifically for acoustic dampening in automotive cabins or high-compression packaging for delicate electronic components.

Concurrently, growing emphasis on cradle-to-cradle lifecycle assessments is prompting manufacturers to redesign formulations with more recyclable or bio-based additives. Industry leaders are piloting closed-loop recycling programs that reclaim post-consumer packaging and construction scrap, converting it back into feedstock for block molding or loose-fill applications. In parallel, academic and private-sector collaborations are exploring depolymerization pathways aimed at recovering styrene monomers from end-of-life foam, signaling a potential paradigm shift toward chemical recycling at scale.

On the regulatory front, jurisdictions in North America and Europe are tightening restrictions on brominated flame retardants and volatile organic compounds, compelling producers to reformulate products without compromising fire safety or thermal efficiency. These mandates are accelerating adoption of novel halogen-free flame retardants and nano-enhanced barriers that meet stringent environmental and performance benchmarks. Taken together, these disruptive forces are reshaping competitive dynamics: established players are investing in digital process controls and advanced material chemistries, while agile newcomers leverage sustainability credentials and niche applications to carve out market share. As the industry navigates these crosscurrents, strategic agility and innovation will be the key differentiators in capturing the next wave of growth.

Assessing the Layered Consequences of 2025 United States Tariff Measures on Supply Chains Cost Structures and Competitive Dynamics

Assessing the Layered Consequences of 2025 United States Tariff Measures on Supply Chains Cost Structures and Competitive Dynamics

In 2025, the introduction of revised United States tariff measures targeting key precursors, additives and imported foam products has introduced significant friction into established supply chains. These measures have elevated landed costs for certain feedstocks while simultaneously incentivizing domestic sourcing of core polystyrene resins. The resulting recalibration of supplier relationships has triggered dual outcomes: on one hand, increased localization of resin production fosters improved lead times and supply reliability; on the other hand, manufacturers face higher input costs that erode margin structures unless offset by efficiency gains or strategic price adjustments.

Importantly, the cumulative impact extends beyond direct tariff obligations. Logistics networks have been forced to adjust routing strategies to circumvent higher-duty ports, and regional distribution centers have been reconfigured to optimize bonded storage arrangements. In response, major foam producers are investing in advanced kiln drying and extrusion lines near domestic resin production hubs, thereby creating vertically integrated clusters that mitigate cross-border exposure. This reorientation, however, necessitates elevated capital spending and rigorous cost-benefit analyses to ensure return on investment under shifting duty regimes.

Competitive dynamics are likewise in flux, as domestic smaller-scale foam fabricators seize the opportunity to differentiate through rapid turnaround times and flexible batch processes. Meanwhile, multinational incumbents leverage their global footprint to reallocate production volumes across low-tariff jurisdictions, preserving cost competitiveness in large-scale board stock and loose-fill segments. As the market adapts to these compounded tariff effects, industry participants will need to reassess supplier portfolios, renegotiate long-term contracts with resin suppliers, and accelerate innovation in high-density and ultra-high density foam offerings to justify revised pricing structures.

Revealing In-Depth Segmentation Perspectives Across Product Types Forms Applications End-Use Industries Density Categories and Manufacturing Methods

Revealing In-Depth Segmentation Perspectives Across Product Types Forms Applications End-Use Industries Density Categories and Manufacturing Methods

A nuanced examination of the polystyrene foam landscape requires dissecting the market by both product technology and functional deployment. When classified by product type, the dichotomy between expanded polystyrene and extruded polystyrene underpins fundamental differences in cell structure, compressive strength, and insulative performance. EPS, with its bead-based morphology, offers adaptability in shaping and constructive insulation, whereas XPS delivers higher compressive resilience suited to heavy-load environments in board stock and engineered fire board.

Beyond these technological divisions, the form factor dimension reveals how board stock and fire board function as rigid panels in building envelopes, while block products and loose fill deliver customized shaping and void fill solutions. Loose fill formulations are increasingly adopted for retrofitting existing structures due to their ability to conform to irregular cavities, while precision-cut blocks support modular architectural designs. Complementing these product forms, shaping processes enable bespoke geometries for appliance components and automotive interior modules that demand tight tolerances and aesthetic surface finishes.

Turning to application categories, insulation remains the cornerstone of specification across both acoustic and thermal performance domains, capturing demand from residential and commercial construction projects. Packaging applications bifurcate into flexible variants for cushioning delicate consumer electronics and rigid configurations for protective shipping crates. As consumer electronics cycles accelerate, designers rely on foam liners engineered through continuous processes to maintain consistent density profiles and shock absorption characteristics.

Further segmentation by end-use industry underscores cross-sector relevance: automotive manufacturers integrate polystyrene foam for lightweight acoustic panels and underbody insulation, while food and beverage distributors adopt hygienic board stock liners for cold-chain pallets. Electronics firms specify flame-retardant fire board for server racks, and healthcare OEMs require high-density foam supports for sterile packaging systems. Meanwhile, density gradations from high density to ultra-high density dictate mechanical load thresholds, influencing selections in structural applications versus cushioning contexts.

Manufacturing methodologies-whether batch or continuous processes-contribute to critical distinctions in production scalability and cost efficiency. Batch operations excel at small-to-midsize runs with rapid changeover capabilities, whereas continuous lines drive economies of scale for high-volume board stock output. Integrating these layered segmentation perspectives illuminates the interplay between polymer chemistry, processing techniques, and end-user value propositions, ultimately guiding strategic product positioning and portfolio management.

This comprehensive research report categorizes the Polystyrene Foam market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- Density

- Manufacturing Process

- Application

- End-Use Industry

Exploring Critical Regional Nuances in the Polystyrene Foam Arena Across the Americas EMEA and Asia-Pacific Markets Under Varied Economic and Regulatory Climes

Exploring Critical Regional Nuances in the Polystyrene Foam Arena Across the Americas EMEA and Asia-Pacific Markets Under Varied Economic and Regulatory Climes

Regional dynamics play a pivotal role in shaping competitive advantage and strategic priorities for polystyrene foam manufacturers. In the Americas, robust residential and commercial construction pipelines continue to drive demand for both thermal and acoustic insulation. This growth is underpinned by sustainability incentives and stringent energy codes, prompting local producers to refine board stock offerings that marry high R-values with reduced greenhouse gas emissions during manufacturing. At the same time, packaging sectors in North America leverage loose fill solutions to accommodate e-commerce expansions, forcing foam fabricators to prioritize on-demand production and regional distribution efficiencies.

Shifting to Europe, the Middle East and Africa, regulatory heterogeneity and climate variations necessitate tailored portfolio approaches. Western Europe’s rigorous sustainability mandates and circular economy directives exert pressure on producers to develop post-consumer reclamation systems and low-carbon production footprints. In contrast, Middle East markets prioritize high-temperature resilience and cost-effective fire board products to address infrastructure growth, while Sub-Saharan regions demand affordable, low-density block solutions capable of withstanding diverse environmental stresses.

Across the Asia-Pacific sphere, dynamic urbanization trajectories in Southeast Asia, China and India have fostered surging requirements for insulation in rapid-build housing and industrial facilities. These markets exhibit a pronounced appetite for extruded polystyrene board that balances insulation performance with scalability across continuous process lines. Parallel growth in electronics and consumer appliance manufacturing hubs has driven specialized foam liners for packaging and component integration. Meanwhile, Australia and Japan maintain mature sectors characterized by advanced fire safety codes and acoustic standards, incentivizing research into next-generation halogen-free retardant systems and nano-reinforced composites.

Collectively, these regional insights underscore the imperative for a geographically nuanced growth strategy: global players must calibrate their manufacturing footprints, optimize logistics networks, and localize technical service capabilities to align with distinct market drivers and regulatory contours.

This comprehensive research report examines key regions that drive the evolution of the Polystyrene Foam market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Illuminating Strategic Movements Partnerships and Innovation Trajectories Among Leading Global Participants in the Polystyrene Foam Ecosystem

Illuminating Strategic Movements Partnerships and Innovation Trajectories Among Leading Global Participants in the Polystyrene Foam Ecosystem

The competitive arena for polystyrene foam is populated by a mix of integrated resin producers, specialized foam fabricators, and technology-focused disruptors. Traditional chemical majors continue to invest in resin capacity expansions, leveraging scale to secure cost leadership and supply chain resilience. In parallel, mid-sized fabricators have forged collaborative partnerships with materials science innovators to co-develop proprietary flame retardant and bio-based additive systems, thereby extending differentiation beyond commodity specifications.

Strategic alliances between equipment manufacturers and polymer developers have catalyzed the adoption of digital process controls, enabling real-time monitoring of cell morphology and density uniformity. These partnerships have also stimulated aftermarket service models, wherein OEMs deploy IoT-enabled extruders and cutting systems that provide predictive maintenance insights and uptime guarantees. Meanwhile, joint ventures between recycling technology startups and established foam producers are accelerating the rollout of mechanical and chemical reclamation facilities, signaling a nascent but growing circular ecosystem.

Mergers and acquisitions represent another key lever, with larger entities acquiring regional fabricators to consolidate distribution networks and achieve downstream integration. Such moves aim to strengthen service offerings for sectors like automotive and electronics, where just-in-time inventory management is critical. At the same time, venture investments back emerging firms exploring nanofoam composites and advanced binder chemistries, positioning them to disrupt legacy processing paradigms in insulation and packaging.

Taken together, these strategic movements reveal a dual focus on scale and specialization: leading participants are balancing the pursuit of global platform efficiencies with targeted innovation ventures that address end-use requirements and sustainability objectives. As the competitive terrain evolves, the ability to orchestrate partnerships across the value chain will determine which players capture premium segments and drive long-term growth.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polystyrene Foam market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Alpek, S.A.B. de C.V.

- BASF SE

- BEWI ASA

- DuPont de Nemours, Inc.

- Formosa Plastics Corporation

- INEOS Styrolution Group GmbH

- JSP Corporation

- Kaneka Corporation

- Kingspan Group plc

- LG Chem, Ltd.

- Loyal Group

- Owens Corning Inc.

- PJSC SIBUR Holding

- Ravago Group

- Saudi Basic Industries Corporation (SABIC)

- Synthos SA

- The Dow Chemical Company

- TotalEnergies SE

- Trinseo S.A.

- Wuxi Xingda New Foam Plastics Materials Co., Ltd.

Delivering Impactful Strategic Imperatives and Practical Pathways for Industry Leaders to Navigate Market Complexities and Capitalize on Growth Levers

Delivering Impactful Strategic Imperatives and Practical Pathways for Industry Leaders to Navigate Market Complexities and Capitalize on Growth Levers

To thrive amid converging regulatory pressures and technological shifts, industry leaders must adopt a multi-pronged strategic approach that weaves together innovation, operational efficiency, and stakeholder alignment. First, organizations should intensify investment in advanced material chemistries, focusing on halogen-free flame retardants, bio-based foaming agents, and polymer blends that enhance mechanical properties without compromising recyclability. Such initiatives not only pre-empt tightening environmental regulations but also open avenues for premium product positioning in sensitive applications.

Simultaneously, forging deeper collaborations across the supply chain can unlock synergies in resin sourcing, energy utilization, and logistics optimization. By negotiating long-term partnerships with resin suppliers and integrating digital supply chain platforms, manufacturers can mitigate tariff-driven cost volatility and improve inventory turns. Adoption of predictive analytics for demand forecasting further ensures production volumes align with shifting consumer and industrial requirements, minimizing waste and overproduction.

Operationally, leaders should accelerate the implementation of Industry 4.0 methodologies across processing lines. Integrating IoT sensors within extrusion and block molding equipment enables real-time tracking of key parameters, such as melt temperature and cell nucleation rates, facilitating instant adjustments that safeguard product consistency. Concurrently, embracing circular economy principles through mechanical and chemical recycling infrastructure can defray raw material expenses while enhancing corporate sustainability credentials.

Finally, aligning internal capabilities with external ecosystems through targeted M&A activity and strategic venture investments will secure access to emerging technologies and new customer channels. Evaluating potential acquisitions based on capabilities in nano-composite development or closed-loop recycling positions organizations to leapfrog competitors and reinforce long-term value creation. Collectively, these imperatives form a robust roadmap for industry leaders aiming to consolidate competitive advantage and future-proof their portfolios against dynamic market headwinds.

Detailing Rigorous Research Methodology Frameworks Ensuring Robust Data Collection Analytical Approaches and Insight Validation Protocols

Detailing Rigorous Research Methodology Frameworks Ensuring Robust Data Collection Analytical Approaches and Insight Validation Protocols

The research underpinning this report followed a multifaceted methodology designed to maximize data accuracy and relevance. Primary interviews were conducted with senior executives, product development leaders, and procurement specialists across manufacturing, end-use, and regulatory domains. These conversations provided firsthand perspectives on technological adoption, tariff impacts, and sustainability initiatives. Secondary research involved an exhaustive review of industry standards publications, patent filings, and white papers to map emerging material chemistries and processing technologies. Particular emphasis was placed on comparative analyses of closed-cell morphology advancements and flame retardant alternatives.

Quantitative data inputs were triangulated from company financial disclosures, trade association reports, and customs import-export databases to chart supply chain adjustments and regional trade flows. Although granular market sizing figures are omitted here, segmentation matrices were meticulously developed by examining product types, form factors, applications, end-use industries, density classifications, and manufacturing processes. Validation of these segmentation frameworks was achieved through cross-checking with multiple stakeholder interviews and observational site visits at leading extrusion and block molding facilities.

Analytical models incorporated sensitivity testing to gauge the potential effects of tariff fluctuations, energy cost variability, and raw material price swings. Scenario planning sessions with industry experts helped refine assumptions around capacity expansions, recycling program scalability, and regulatory compliance timelines. Finally, the report’s conclusions and recommendations were peer-reviewed by an advisory panel of materials scientists, supply chain consultants, and market strategists to ensure alignment with real-world operational constraints and strategic imperatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polystyrene Foam market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polystyrene Foam Market, by Product Type

- Polystyrene Foam Market, by Form

- Polystyrene Foam Market, by Density

- Polystyrene Foam Market, by Manufacturing Process

- Polystyrene Foam Market, by Application

- Polystyrene Foam Market, by End-Use Industry

- Polystyrene Foam Market, by Region

- Polystyrene Foam Market, by Group

- Polystyrene Foam Market, by Country

- United States Polystyrene Foam Market

- China Polystyrene Foam Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1431 ]

Synthesizing Key Takeaways and Strategic Imperatives to Guide Stakeholders Through the Future Trajectory of the Polystyrene Foam Industry

Synthesizing Key Takeaways and Strategic Imperatives to Guide Stakeholders Through the Future Trajectory of the Polystyrene Foam Industry

The polystyrene foam landscape is poised at a strategic inflection point where regulatory evolution, technological innovation, and supply chain realignment converge. Stakeholders must acknowledge that cost structures will remain under pressure as tariff regimes and sustainability mandates drive input premiums and compliance investments. Yet within these challenges lie significant opportunities to differentiate through advanced material formulations, localized production clusters, and circular economy initiatives that resonate with end customers and regulatory bodies alike.

Looking ahead, the capacity to execute on digital transformation agendas will determine the speed at which foam fabricators can respond to shifting demand patterns and quality expectations. Companies that integrate real-time process controls and predictive maintenance frameworks will achieve superior product consistency while avoiding costly downtime. Similarly, those that embed recycling pathways into their operational blueprint will not only reduce environmental footprints but also secure a competitive cost advantage in securing recycled feedstocks.

Ultimately, market leadership will accrue to organizations that strike a balanced approach, harmonizing innovation investments, strategic partnerships, and agile operational models. By leveraging the insights laid out in this report-ranging from segmentation analyses and regional nuances to competitive mappings and actionable recommendations-executives can chart a course that anticipates regulatory inflection points and captures growth levers across insulation, packaging, and specialty foam applications. Success will hinge on embracing both the technical and commercial dimensions of polystyrene foam evolution, ensuring that strategic imperatives remain tightly aligned with emerging customer requirements and sustainable performance benchmarks.

Engage Directly with Ketan Rohom to Secure the Comprehensive Polystyrene Foam Market Report and Unlock In-Depth Strategic Advantages

For stakeholders seeking to harness deep data-driven insights and capitalize on emerging market dynamics within the polystyrene foam sector, direct engagement represents the most efficient path to unlocking tailored strategic advantages. Ketan Rohom stands ready to offer a guided walkthrough of the comprehensive report’s structure, delving into segment-specific nuance, regional outlooks, competitive intelligence, and tactical growth levers. By collaborating with an expert versed in both sales and marketing dimensions, organizations can expedite decision cycles and align internal initiatives with actionable market intelligence. This personalized interaction ensures that your team secures targeted recommendations suited to unique operational priorities, while also clarifying any queries around research methodology or data interpretations. Reach out to initiate a conversation, and position your company at the forefront of product innovation, sustainability best practices, and regulatory adaptation in the evolving polystyrene foam landscape.

- How big is the Polystyrene Foam Market?

- What is the Polystyrene Foam Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?