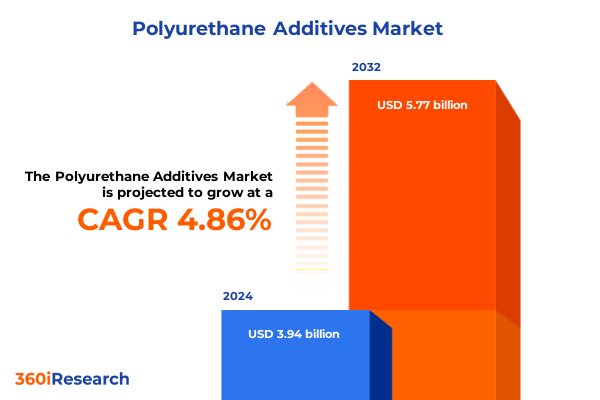

The Polyurethane Additives Market size was estimated at USD 4.35 billion in 2025 and expected to reach USD 4.64 billion in 2026, at a CAGR of 7.79% to reach USD 7.36 billion by 2032.

Forging Ahead With Cutting-Edge Polyurethane Additives: An Overview Of Their Vital Function And Emerging Potential Across Diverse Applications

The world of polyurethane technology is defined by a complex interplay of raw materials, innovative processes, and specialized additives. These additives enhance performance characteristics, drive efficiency, and enable materials to meet the evolving demands of diverse industries. From thermal stability and flame retardance to processing ease and end-product durability, the strategic selection and formulation of additives underpin every application of polyurethane. In this context, a comprehensive understanding of additive functions provides a critical foundation for stakeholders aiming to optimize product performance and differentiate in competitive markets.

Over time, the emphasis on additives has shifted from rudimentary performance enhancers to multifunctional components that address regulatory compliance, sustainability goals, and cost pressures simultaneously. As markets embrace lightweight materials, renewable feedstocks, and circular economy principles, additive formulators face new challenges and opportunities. This executive summary sets the stage for an in-depth exploration of key trends, regulatory impacts, segmentation insights, and strategic imperatives within the polyurethane additives landscape, offering decision-makers a concise yet profound lens through which to view this dynamic sector.

Examining The Shift To Sustainable Solutions And Technological Advances That Are Redefining The Polyurethane Additives Ecosystem Today

Polyurethane additives are undergoing a profound metamorphosis driven by breakthroughs in green chemistry, digital manufacturing, and stricter environmental mandates. Recent years have witnessed the integration of bio-based antioxidants derived from plant oils, as formulators seek to reduce carbon footprints without compromising performance. Simultaneously, the rise of digital twin simulations allows additive developers to predict property enhancements and optimize formulations virtually, accelerating time-to-market and reducing costly trial-and-error cycles.

In parallel, regulatory bodies across major economies are tightening limits on volatile organic compounds and halogenated flame retardants, compelling manufacturers to innovate with non-toxic alternatives. This convergence of environmental scrutiny and technological advancement has catalyzed the emergence of multi-functional additives that can impart flame resistance, UV stability, and mechanical reinforcement in a single package. As a result, the additive landscape is shifting from single-purpose ingredients to hybrid solutions capable of meeting stringent performance and sustainability benchmarks.

Analyzing The Far-Reaching Effects Of 2025 United States Tariffs On Polyurethane Additives Supply Chains And Cost Structures Nationwide

In 2025, a series of revised tariff schedules imposed by the United States on key chemical imports significantly altered the cost dynamics in the polyurethane supply chain. Tariffs affecting raw chemical precursors and specialty intermediates have driven manufacturers to reassess their procurement strategies, leading to heightened interest in domestic sourcing and vertically integrated supply models. These measures, while intended to bolster local production, have also introduced price volatility and complicated long-term contract negotiations.

Consequently, some additive producers have responded by relocating production facilities closer to upstream suppliers or investing in tariff-engineered blends that optimize import compliance. Others have engaged in strategic alliances with regional chemical manufacturers to share R&D costs and mitigate exposure to cross-border trade disruptions. As a result, the 2025 tariff landscape has not only reshaped cost structures but also triggered a more resilient, region-focused approach to additive sourcing and manufacturing.

Unveiling Critical Insights Through Segment Analysis Based On Product Type Form End-Use Industry And Distribution Channel Dimensions

The additive market can be understood through a detailed examination of its product type dimensions, where antioxidants serve to prevent oxidative degradation, blowing agents enable foam expansion, catalysts control polymerization rates, and cross-linking agents enhance network formation. Meanwhile, fillers contribute to mechanical strength and reduce material costs, flame retardants ensure compliance with fire safety standards, and surfactants improve dispersion and surface tension properties. Collectively, these functional classes define the core toolkit that formulators deploy to tailor polyurethane performance.

Beyond product types, the physical form of additives plays a crucial role in processing convenience and end-use application. Liquid additives offer ease of blending and rapid integration into polyol streams, whereas pastes provide concentrated performance at higher viscosities for specialized formulations. Powder additives, in contrast, enable precise dosing in dry-blend systems and reduce transportation costs due to lower density. Understanding these form-based considerations is essential for selecting the right additive format to match specific production workflows and equipment.

End-use industry diversity further underscores the complexity of the additive landscape. In automotive & transportation, stringent requirements for durability, weight reduction, and flame retardancy dictate specialized antioxidant and flame-proofing packages. The bedding & furniture segment prioritizes comfort, off-gassing reduction, and antimicrobial properties, whereas building & construction demands fire safety, thermal insulation, and long-term stability. Electronics applications call for dielectric performance and heat resistance, footwear & apparel focus on flexibility and abrasion resistance, packaging revolves around barrier properties and recyclability, and pharmaceutical uses require biocompatibility and purity. Each sector presents unique performance and regulatory imperatives that guide additive selection.

Finally, distribution channels shape market accessibility and service models. Offline networks, anchored by distributors and local representatives, offer technical support and on-site troubleshooting, catering to established formulators. Online platforms, however, are increasingly favored by emerging players and niche producers seeking rapid procurement, transparent pricing, and digital formulation assistance. The evolving interplay between these channels reflects broader shifts toward e-commerce integration and value-added digital services in the additives domain.

This comprehensive research report categorizes the Polyurethane Additives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Form

- End-Use Industry

- Distribution Channel

Revealing Regional Dynamics And Growth Drivers Shaping Polyurethane Additive Demand Across The Americas EMEA And Asia-Pacific Territories

Regional dynamics exert a profound influence on additive innovation, regulatory compliance, and supply chain resilience. In the Americas, robust automotive and construction sectors drive demand for high-performance antioxidants and specialized flame retardants, while nearshoring trends encourage investment in local manufacturing and rapid-response logistics. North American formulators benefit from established petrochemical infrastructure yet must navigate stringent environmental regulations that favor low-VOC and non-halogenated solutions.

Across Europe, the Middle East & Africa, a mosaic of regulatory regimes and end-use requirements creates both opportunities and challenges. European Union directives on chemical safety and circular economy targets compel additive developers to pursue recyclability and non-toxic compositions. At the same time, growth in the Middle East’s construction sector and Africa’s emerging automotive assembly plants offers new markets for thermal and flame resistance solutions. Harmonizing additive portfolios to meet varied regional standards remains a key strategic imperative.

In the Asia-Pacific region, rapid industrialization and urbanization drive surging demand for cost-effective and scalable additives. China’s expanding electronics and packaging industries foster continuous innovation in dielectric stabilizers and barrier-enhancing agents, while Southeast Asia’s burgeoning footwear & apparel and furniture sectors emphasize lightweight, flexible formulations. Simultaneously, regional governments are introducing tighter environmental regulations that align with global sustainability commitments, accelerating the adoption of bio-derived and low-emission additive technologies.

This comprehensive research report examines key regions that drive the evolution of the Polyurethane Additives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Industry Players And Their Strategic Initiatives Driving Innovation Partnerships And Competitive Positioning In Polyurethane Additives

A cadre of leading chemical companies is steering the polyurethane additives market through targeted R&D investments, strategic alliances, and portfolio diversification. Major manufacturers have accelerated development of bio-based antioxidants, collaborating with specialty biotech firms to reduce reliance on petrochemical feedstocks. Partnerships with processing equipment suppliers are enabling seamless integration of digital monitoring systems to ensure real-time quality control and optimize energy consumption during compounding.

Simultaneously, several industry players have expanded global manufacturing footprints to mitigate tariff exposure and improve service levels. Joint ventures in emerging markets provide access to local raw material streams and regulatory insights, while greenfield sites in proximity to key end-use industries facilitate rapid product delivery. Licensing agreements allow smaller regional suppliers to leverage advanced additive technologies under co-branding arrangements, broadening commercial reach and addressing niche application needs. These strategic maneuvers underscore the competitive imperative to balance innovation leadership with operational agility in a rapidly evolving marketplace.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethane Additives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Arkema S.A.

- BASF SE

- Clariant AG

- Covestro AG

- Dow Inc.

- Eastman Chemical Company

- Evonik Industries AG

- Huntsman Corporation

- Kao Corporation

- Lanxess AG

- Solvay SA

- Wanhua Chemical Group Co., Ltd.

Crafting Actionable Strategies For Industry Leadership To Navigate Evolving Trends Regulatory Shifts And Competitive Disruptions In Additives

Industry leaders seeking to capitalize on the evolving polyurethane additives landscape should prioritize investment in sustainable, multifunctional ingredient platforms that align with tightening environmental standards. By accelerating development of bio-based antioxidants and non-halogenated flame retardants, companies can differentiate their offerings and appeal to eco-conscious end users. Concurrently, embedding digital sensors and IoT-enabled monitoring in production lines will enhance process transparency and preemptively address quality deviations.

Moreover, diversifying supply chains by forging partnerships with regional chemical producers and pursuing backward integration can mitigate tariff-induced cost fluctuations. Engaging in collaborative R&D consortia will accelerate the sharing of technical breakthroughs and distribute the financial burden of scale-up. Equally important is the development of omnichannel distribution strategies that blend offline technical support with robust online platforms, catering to both established formulators and agile startups. By adopting these actionable measures, industry stakeholders can fortify their competitive positions and drive sustainable growth.

Detailing The Rigorous Research Framework Data Collection Techniques And Analytical Processes Underpinning This Comprehensive Analysis

This analysis is underpinned by a structured research framework combining both primary and secondary methodologies. Secondary research encompassed comprehensive reviews of industry publications, regulatory filings, patent databases, and corporate disclosures to map out technological trends and competitive landscapes. These insights were cross-validated against proprietary data sets covering chemical production capacities, trade flows, and patent registries.

Primary research involved in-depth interviews with key stakeholders, including additive formulators, raw material suppliers, equipment manufacturers, and end users across target industries. Qualitative insights were gathered to understand performance priorities, formulation challenges, and regulatory compliance strategies. Quantitative surveys provided statistical validation of emerging trends, adoption rates of novel additives, and supply chain resilience metrics. The synthesis of these data sources was subjected to rigorous triangulation processes to ensure reliability and mitigate biases.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethane Additives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethane Additives Market, by Product Type

- Polyurethane Additives Market, by Form

- Polyurethane Additives Market, by End-Use Industry

- Polyurethane Additives Market, by Distribution Channel

- Polyurethane Additives Market, by Region

- Polyurethane Additives Market, by Group

- Polyurethane Additives Market, by Country

- United States Polyurethane Additives Market

- China Polyurethane Additives Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Concluding Reflections On Emerging Trends Challenges And Collaborative Opportunities Shaping The Future Trajectory Of Polyurethane Additives

As the polyurethane additives market continues to evolve, the convergence of sustainability mandates, digital innovation, and geopolitical policies will define the next wave of competitive advantage. The demand for multifunctional, eco-friendly additives is set to intensify, while digitalization of compounding processes will heighten expectations for real-time quality assurance. Simultaneously, tariff realignments and trade uncertainties will compel manufacturers to adopt more flexible and regionally focused strategies.

The insights presented herein underscore the critical importance of proactive adaptation. Companies that harness advanced bio-based chemistries, leverage digital toolkits, and cultivate resilient supply partnerships will emerge as industry frontrunners. By maintaining a keen awareness of regulatory shifts and continuously refining their additive portfolios, stakeholders can navigate complexity and capitalize on emerging opportunities in this dynamic sector.

Secure Expert Guidance And Exclusive Insights With A Tailored Market Research Report From Ketan Rohom Associate Director Sales And Marketing

Unlock unparalleled market intelligence by securing the full report directly with Ketan Rohom (Associate Director, Sales & Marketing at 360iResearch). Engage with a seasoned expert to gain tailored insights that align with your strategic goals and operational challenges. Through this direct collaboration, you will benefit from an in-depth discussion of the report’s findings, ensuring you can apply its conclusions with maximum impact.

Take proactive steps to stay ahead of the competition by purchasing the comprehensive market research report. Reach out to Ketan Rohom to discuss customized data packages, volume-based pricing, or enterprise-wide licensing options that suit your organization’s unique requirements. Elevate your decision-making capabilities today by investing in the detailed analysis and actionable intelligence encapsulated in this indispensable resource.

- How big is the Polyurethane Additives Market?

- What is the Polyurethane Additives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?