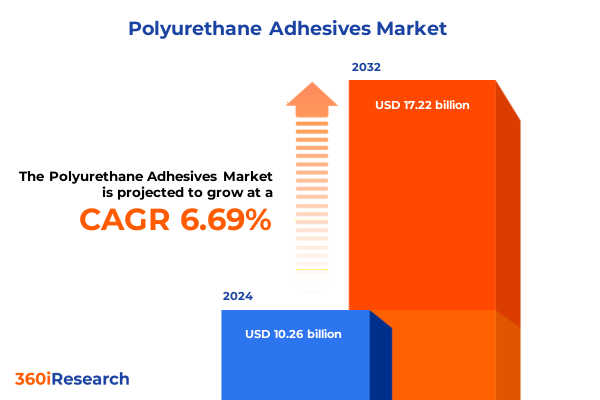

The Polyurethane Adhesives Market size was estimated at USD 9.83 billion in 2025 and expected to reach USD 10.51 billion in 2026, at a CAGR of 7.42% to reach USD 16.23 billion by 2032.

Positioning Polyurethane Adhesives as the Cornerstone of High-Performance Bonding Across Automotive, Construction, Electronics, and Packaging Industries

Polyurethane adhesives represent a versatile class of polymeric bonding solutions that deliver high performance across diverse substrates, combining exceptional durability with resilience under demanding conditions. Fueled by their unique chemical structure, these adhesives offer superior flexibility, chemical resistance, and environmental stability, making them an essential component in modern manufacturing and construction applications. By marrying the reactive nature of isocyanates with polyols, polyurethane adhesives form cross-linked networks that exhibit both elastomeric and structural characteristics, supporting everything from flexible laminates to rigid structural assemblies. This combination of mechanical strength and dynamic adaptability underscores the pivotal role these adhesives play in advancing industrial innovation and product longevity

Navigating Groundbreaking Sustainability and Technological Innovations Transforming the Polyurethane Adhesives Landscape for Future Growth

Over the past few years, the polyurethane adhesives landscape has undergone transformative shifts driven by sustainability mandates, technological breakthroughs, and ever-evolving regulatory frameworks. Industry stakeholders are increasingly prioritizing bio-based and low-VOC formulations to align with global environmental goals, thereby accelerating the adoption of renewable feedstocks and solvent-free chemistries. Research into waterborne systems and plant-derived polyols has reached maturation, enabling high-performance formulations that minimize environmental impact without compromising bond integrity. Concurrently, regulatory bodies in key markets have tightened restrictions on hazardous substances, compelling adhesive manufacturers to innovate rapidly or risk market exclusion

Assessing the Compound Effects of 2025 United States Tariff Measures on Polyurethane Adhesives Raw Material Prices and Industry Dynamics

In March 2025, the United States implemented a 20% additional ad valorem tariff on polyurethane raw materials imported from China, including Hong Kong, effectively amplifying existing anti-dumping and countervailing duties. This policy shift has prompted domestic suppliers to reassess cost structures as inflationary pressures mount, with many attempting to pass increased raw material costs into downstream pricing. Such adjustments threaten to disrupt established procurement strategies for original equipment manufacturers and contract assemblers alike, heightening cost of goods sold across the automotive, construction, and furniture sectors

Analytical Insights into Polyurethane Adhesive Market Segmentation by Type, Cure Mechanism, End Use, Application, and Distribution Channels

Market segmentation reveals distinct performance and growth potential across adhesive types, cure mechanisms, end-use industries, application methods, and distribution channels. Thermoplastic polyurethane adhesives excel in reversible bonding and recyclability, while thermoset formulations achieve structural integrity in critical assembly applications. Within cure mechanisms, heat cure systems dominate high-throughput production, moisture cure adhesives offer simplicity for field repairs, and radiation cure options such as electron beam and UV cure deliver rapid processing for electronics manufacturing. Automotive applications bifurcate into original equipment and aftermarket solutions, reflecting divergent performance demands, while construction uses span new builds and maintenance projects. Consumer and industrial electronics rely on precision bonding for fragile components, and both flexible and rigid packaging benefit from tailored adhesive technologies. Bonding processes encompass edge and panel bonding in composite fabrication, laminating includes film and sheet structures, and sealing covers gap and joint protection. Distribution is orchestrated through direct sales teams, brick-and-mortar distributors segmented into retail and wholesale channels, and growing online platforms that cater to agile procurement trends

This comprehensive research report categorizes the Polyurethane Adhesives market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Cure Mechanism

- End Use Industry

- Application

- Distribution Channel

Deciphering Regional Growth Patterns and Strategic Drivers across the Americas, Europe Middle East & Africa, and Asia-Pacific Polyurethane Adhesives Markets

The Americas region remains anchored by North America’s robust industrial base and supportive policy environment. The United States leads with advanced automotive and aerospace applications, driven by lightweighting initiatives and the Bipartisan Infrastructure Law’s push for energy-efficient construction materials. Meanwhile, Canada focuses on building envelope innovations to meet stringent energy codes, and Latin American markets are gaining traction as infrastructure investments and urbanization accelerate, particularly within Brazil, Mexico, and Colombia

Across Europe, Middle East & Africa (EMEA), regulatory rigor and technological prowess converge to shape market dynamics. In Europe, REACH regulations and green building standards underpin the shift toward low-VOC and bio-based formulations, while industry consortia such as FEICA spearhead diisocyanate training requirements. The Middle East leverages large-scale infrastructure projects and renewable energy investments to drive demand for advanced sealants and adhesives, and African markets are emerging with growing construction and automotive sectors supported by government-led development agendas

Asia-Pacific continues to outpace all other regions in growth rate, fueled by rapid industrialization, urban expansion, and booming electronics manufacturing hubs. China’s surge in green building projects and circuit board assembly, India’s expanding automotive sector underpinned by government incentives, and Southeast Asia’s rising e-commerce packaging needs collectively propel regional adoption of high-performance polyurethane adhesives. Japan and South Korea lead in precision electronics and electric vehicle battery assembly, applying cutting-edge moisture cure and low-VOC systems to meet exacting performance and sustainability criteria

This comprehensive research report examines key regions that drive the evolution of the Polyurethane Adhesives market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Unveiling the Strategies of Leading Global Adhesive Manufacturers Harnessing Innovation and Sustainability for Market Leadership

Leading global adhesive suppliers are capitalizing on these market dynamics through targeted innovations and strategic partnerships. H.B. Fuller has integrated sustainability into its core R&D pipeline, with over 60% of new product development focused on eco-friendly end solutions and the launch of ECO₂ Driven™ technology for roofing applications. 3M continues to expand its digital materials platform, providing engineers with real-time access to material data for accelerated prototyping, while also pledging to exit PFAS manufacturing by year-end 2025. Dow is enhancing its high-performance adhesive portfolio through nanotechnology and reactive formulations tailored to electric vehicle battery assemblies, and Sika is extending its footprint in Asia by scaling waterborne polyurethane capacity. Arkema’s bio-based polyol innovations and Huntsman’s partnerships in the construction sector further underline the competitive landscape’s emphasis on collaboration and sustainability

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethane Adhesives market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Abifor AG

- Agilis Chemicals Inc.

- Arkema S.A.

- Ashland Inc.

- Covestro AG

- Dongsung Chemical, Ltd.

- Fong Yong Chemical Co., Ltd.

- Great Eastern Resins Industrial Co. Ltd.

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Huntsman International LLC

- Nan Pao Resins Co., Ltd

- Parson Adhesives India Private Limited

- Shakun Industries

- Shandong INOV Polyurethane Co., Ltd.,

- Shenzhen Tunsing Plastic Products Co.,Ltd.

- Shenzhen Xiangyu New Material Co., Ltd

- Sika AG

- Soudal N.V.

- Taiwan PU Corporation

- Wacker Chemie AG

- Xiamen Keyuan Plastic Co.,Ltd

- Xuchuan Chemical(Suzhou) Co.,Ltd

- Yantai Linghua New Material Co., Ltd.

Strategic Actions and Best Practices for Industry Leaders to Navigate Tariff Volatility and Sustainability Mandates in Polyurethane Adhesives

To thrive amid evolving market and regulatory pressures, industry leaders should adopt a multi-pronged strategy. Executive teams must prioritize raw material diversification by qualifying alternative suppliers and exploring non-China feedstocks to mitigate tariff risk. Accelerating the development of solvent-free and bio-based chemistries will ensure compliance with upcoming VOC restrictions and unlock new customer segments. Investment in digital tools for end-to-end supply chain visibility will strengthen resilience, while partnerships with equipment manufacturers can integrate automated dispensing and quality monitoring, reducing labor costs and defects. Engagement with regulatory bodies through trade associations will help shape realistic standards, and a focus on lifecycle analysis will differentiate offerings in procurement processes weighted by environmental impact

Comprehensive Mixed-Methods Approach Integrating Expert Interviews, Secondary Research, and Data Triangulation for Reliable Market Insights

The research methodology combines extensive primary and secondary data collection to ensure robust analytics. Expert interviews with industry executives, visible through thematic panels spanning raw material suppliers to end-use manufacturers, provide qualitative depth. Secondary sources include trade journals, regulatory databases, and recent financial filings, triangulated with proprietary industry surveys. Data validation follows a multi-step approach incorporating cross-comparison of independent estimates and historical trends. A detailed segmentation framework underpins the analysis, encompassing type, cure mechanism, end-use, application, and distribution channel breakdowns. Regional insights leverage geospatial mapping of production facilities, consumption hubs, and policy impacts to deliver actionable intelligence across continents

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethane Adhesives market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethane Adhesives Market, by Type

- Polyurethane Adhesives Market, by Cure Mechanism

- Polyurethane Adhesives Market, by End Use Industry

- Polyurethane Adhesives Market, by Application

- Polyurethane Adhesives Market, by Distribution Channel

- Polyurethane Adhesives Market, by Region

- Polyurethane Adhesives Market, by Group

- Polyurethane Adhesives Market, by Country

- United States Polyurethane Adhesives Market

- China Polyurethane Adhesives Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 2544 ]

Converging Sustainability Imperatives and Geopolitical Dynamics to Inform Strategic Decision-Making in Polyurethane Adhesive Markets

As the polyurethane adhesives market continues to evolve under the dual pressures of sustainability imperatives and geopolitical dynamics, stakeholders must remain agile and informed. The interplay between advanced chemistries, shifting regulatory landscapes, and regional growth patterns underscores the complexity of strategic decision-making. By synthesizing insights from segmentation analysis, tariff impact assessments, and company innovation strategies, organizations can align their product roadmaps with emerging customer demands while safeguarding profitability. Ultimately, those who embrace sustainable innovation, diversify supply chains, and invest in digital capabilities will lead the next wave of market growth and secure competitive advantage

Drive Competitive Advantage with Expert Curated Polyurethane Adhesives Market Research and Strategic Analysis

Ready to gain strategic insights and drive innovation with a comprehensive market research report on polyurethane adhesives? Reach out to Ketan Rohom, Associate Director, Sales & Marketing at 360iResearch to secure your copy today and position your organization at the forefront of the adhesive industry landscape

- How big is the Polyurethane Adhesives Market?

- What is the Polyurethane Adhesives Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?