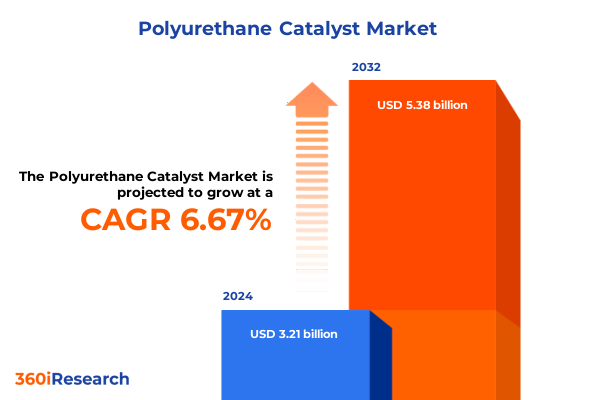

The Polyurethane Catalyst Market size was estimated at USD 3.41 billion in 2025 and expected to reach USD 3.62 billion in 2026, at a CAGR of 6.73% to reach USD 5.38 billion by 2032.

Discover the Pivotal Role of Polyurethane Catalysts in Revolutionizing Modern Material Science and Driving Breakthroughs Across Diverse Industries

The rapid evolution of polyurethane catalyst technology reflects an industry in the midst of significant innovation and expansion. From the earliest applications focusing on simple foam stabilization to today’s advanced multifunctional systems, catalysts have continuously pushed the boundaries of what is possible in polymer science. Driven by demand for lightweight automotive components, high-performance coatings, and eco-friendly insulation, researchers and manufacturers alike have intensified efforts to develop catalysts that deliver superior reactivity, precise control over polymerization, and enhanced sustainability profiles.

Transitioning from legacy systems dominated by heavy metals to organo-metallic and novel bismuth-based formulations, the market narrative underscores a shift toward reducing toxicity while improving performance metrics. As emerging regulations tighten permissible levels of hazardous substances, developers are racing to formulate catalysts that comply with stringent safety standards without compromising efficiency. At the same time, the integration of digital process monitoring and process intensification techniques is redefining rate control and quality assurance, ensuring consistent throughput across diverse production environments.

Looking ahead, the intersection of green chemistry principles and catalytic innovation promises to deliver next-generation solutions that not only meet functional requirements but also align with broader corporate sustainability agendas. By setting the stage for circularity in material design, the industry is positioning catalysts as critical enablers of closed-loop manufacturing systems. Consequently, stakeholders from raw material suppliers to end-use product manufacturers are recalibrating strategies in anticipation of an era where performance, safety, and environmental responsibility converge.

How Emerging Technologies and Sustainable Practices Are Transforming the Polyurethane Catalyst Landscape to Enable Next-Generation Performance

In recent years, several transformative shifts have redefined how polyurethane catalysts are developed, produced, and applied. Foremost among these is the accelerated adoption of bio-based raw materials. Drawing on feedstocks derived from agricultural byproducts and renewable oils, catalyst chemists have engineered functional organo-metallic complexes that match or surpass traditional petrochemical counterparts. This pivot toward sustainability not only addresses regulatory and public pressure to reduce carbon footprints but also unlocks new performance metrics, inspiring product differentiation across coatings, foams, and elastomer applications.

Simultaneously, advances in nanotechnology have introduced particle-engineered catalysts that exhibit unprecedented surface area and active site accessibility. By fine-tuning nanoparticle size distribution and surface functionalization, manufacturers can now exert unparalleled control over reaction kinetics, resulting in faster cure times and reduced energy consumption. Meanwhile, digitalization efforts-particularly through in-line process analytics and artificial intelligence-driven optimization-have rendered reaction monitoring more robust and predictive, ensuring consistency even as batch scales fluctuate.

Moreover, a growing emphasis on end-to-end lifecycle traceability has prompted the integration of blockchain and secure data-logging platforms within catalyst supply chains. This not only enhances transparency around origin and composition but also supports compliance with global environmental regulations. Consequently, industry participants are forging cross-sector collaborations to accelerate catalyst innovation, pooling expertise from biotechnology, automation, and materials science to navigate the complexity of next-generation polyurethane systems.

Assessing the Far-Reaching Consequences of Recent United States Tariff Measures on Polyurethane Catalyst Trade Flows and Industry Competitiveness

The introduction of new tariff measures by the United States in early 2025 has had a pronounced cumulative impact on the supply chain dynamics of polyurethane catalysts. By imposing additional duties on key precursor chemicals and imported catalyst formulations, these measures have altered cost structures for domestic processors and prompted a reevaluation of sourcing strategies. Suppliers have responded by diversifying procurement, shifting to alternative manufacturing hubs and forging regional alliances that mitigate the effects of increased border levies.

In parallel, end users in high-volume sectors such as automotive and construction have felt the ripple effects. Production budgets have been recalibrated to absorb higher input costs, while engineering teams have been incentivized to explore in-house catalyst manufacturing or co-development agreements. This trend reflects a broader push toward vertical integration, aiming to stabilize supply and maintain competitive pricing. At the same time, small and medium-sized specialty formulators have faced margin compression, spurring calls for streamlined regulatory pathways and greater transparency in tariff application.

Looking beyond immediate cost implications, the tariff regime has also prompted a strategic reassessment of geographic footprints. Plant relocations and greenfield investments are being evaluated with tariff exposures in mind, leading to a more nuanced appreciation of regional trade agreements and preferential frameworks. Consequently, stakeholders are prioritizing dual-sourcing strategies and long-term partnerships that hedge against further policy shifts, cultivating resilience amid an increasingly uncertain policy environment.

Unlocking In-Depth Insights into Polyurethane Catalyst Market Segmentation by Type Category Application and End-Use Industry Dynamics

Deep examination of market segmentation reveals nuanced performance drivers across catalyst categories. In the type segment, amine catalysts continue to dominate applications requiring rapid cure rates, while the emergence of bismuth and zinc catalysts addresses demands for low-toxicity alternatives. Simultaneously, organo-metallic systems leverage tailored ligand structures to optimize crosslink density in high-performance coatings. Mercury catalysts, though less favored thanks to regulatory pressures, still find niche applications where extreme durability is paramount, whereas tin catalysts retain a strong foothold in specialized foam formulations due to their versatile activity profiles.

When evaluating catalysts by category, blowing catalyst variations demonstrate how gas-generation kinetics influence foam microstructure, directly impacting insulation and cushioning performance. Crosslinking catalysts, in contrast, are pivotal in imparting mechanical strength and dimensional stability, particularly in advanced elastomeric seals. Curing catalysts balance reactivity controls, ensuring uniform polymer hardening, while foam-stabilization formulations maintain cell structure integrity during expansion. Gelling catalysts, meanwhile, govern the onset of network formation, a critical phase for high-precision molding and elastic memory applications.

Across applications, adhesives and sealants benefit from catalysts engineered for rapid initial tack and durable bond formation, whereas coatings require fine-tuned reaction rates to accommodate variable film thicknesses. Elastomers demand catalysts that support both flexibility and abrasion resistance, while flexible foam systems focus on low-temperature foaming profiles. Rigid foams, in turn, rely on catalysts that ensure consistent structural rigidity and thermal insulation. Finally, end-use industries from automotive to textiles leverage this segmentation intelligence to align catalyst properties with functional and regulatory requirements, driving both performance optimization and compliance objectives.

This comprehensive research report categorizes the Polyurethane Catalyst market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Category

- Application

- End-Use Industry

Regional Dynamics Decoded How Americas Europe Middle East Africa and Asia-Pacific Territories Navigate Polyurethane Catalyst Market Evolution

Regionally, stakeholders are navigating distinct market conditions that shape catalyst demand and innovation trajectories. In the Americas, growth is underpinned by robust automotive output and expanding construction projects, driving the adoption of catalysts tailored for lightweight composites and high-efficiency insulation. Meanwhile, local manufacturers are benefiting from incentives aimed at strengthening domestic supply chains, leading to increased research collaborations and pilot-scale production facilities in strategic locations.

Across Europe, Middle East and Africa, a heightened focus on sustainability regulations is accelerating the phase-out of heavy-metal catalysts in favor of bio-based and low-toxicity alternatives. European Union directives and EHS frameworks are prompting formulators to validate lifecycle emissions and invest in advanced catalyst recovery systems. At the same time, burgeoning construction and infrastructure initiatives in the Middle East, coupled with industrial modernization in Africa, are creating pockets of demand for high-performance foams and protective coatings, underscoring the need for regionally adapted catalyst solutions.

In the Asia-Pacific region, rapid industrialization and urbanization continue to generate strong demand for both rigid and flexible foam applications. China’s large-scale manufacturing capacities and government directives on energy efficiency are fostering the uptake of catalysts that support closed-loop recycling and improved thermal performance. Similarly, Southeast Asian markets are emerging as pivotal growth areas for electronics-grade grade catalyst systems, driven by expanding semiconductor and consumer electronics sectors. Collectively, these regional dynamics are compelling global suppliers to tailor product portfolios and investment strategies to local regulatory and commercial landscapes.

This comprehensive research report examines key regions that drive the evolution of the Polyurethane Catalyst market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Leading Polyurethane Catalyst Innovators and Strategic Collaborators Shaping Competitive Landscapes through Research Partnerships and Product Diversification

A cohort of key companies is actively shaping the competitive contours of the polyurethane catalyst space through strategic partnerships, targeted R&D, and capacity expansions. Leading specialty chemical manufacturers have intensified investments in next-generation catalyst platforms, leveraging proprietary ligand design and process intensification technologies to introduce differentiated solutions. At the same time, innovative startups are entering the market with platform technologies that accelerate catalyst screening and reduce time-to-market, often in collaboration with academic research centers.

Multinational corporations are reinforcing their positions through mergers and acquisitions, integrating catalyst systems into broader material science portfolios to offer end-to-end processing solutions. In parallel, joint ventures and licensing agreements between Western and Asian players are facilitating technology transfer while optimizing regional production capabilities. This convergence of global expertise and local execution is enabling the delivery of customized catalyst formulations tailored to the variable performance and regulatory requirements of different geographies.

Furthermore, alliances between catalyst suppliers and OEMs are fostering co-development initiatives, where end-use specifications drive the design of bespoke catalytic systems. Such collaborations extend to digital workflow integrations, enabling real-time process monitoring and feedback loops that refine catalyst performance in operational settings. Through these strategic maneuvers, industry leaders are not only expanding their product breadth but also cementing relationships that underpin long-term value creation in the polyurethane catalyst domain.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethane Catalyst market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Air Products and Chemicals, Inc.

- Alfa Chemicals

- BASF SE

- Biesterfeld AG

- Covestro AG

- DURA Chemicals, Inc.

- Evonik Industries AG

- Gulbrandsen

- Huntsman International LLC

- Kao Corporation

- Lanxess AG

- MAPEI S.p.A.

- Merck KGaA

- Mitsui Chemicals, Inc.

- Momentive Performance Materials Inc.

- PATCHAM

- SEHOTECH Inc.

- Shanghai Dimonds Chemical Technology Co., Ltd.

- Sinocure Chemical Group Co.,Limited

- Solvay S.A.

- The Chemours Company

- The Dow Chemical Company

- Tokyo Chemical Industry Co., Ltd.

- Tosoh Europe B.V.

- Umicore

Strategic Imperatives for Industry Stakeholders to Capitalize on Polyurethane Catalyst Advancements and Drive Sustainable Growth amid Market Disruptions

To capitalize on prevailing trends and fortify market positions, industry leaders must adopt a series of strategic imperatives. First, embedding sustainability criteria at the core of catalyst development will be critical; investing in bio-derived raw materials and recycling processes mitigates regulatory risks and resonates with end-user mandates for eco-friendly solutions. At the same time, scaling digital analytics and machine learning platforms can optimize reaction parameters, improving yield consistency and reducing operational downtime.

Moreover, cultivating partnerships across the value chain offers a pathway to accelerated innovation. By collaborating with raw material suppliers, OEMs, and research institutions, companies can co-create catalysts tailored to specific application requirements, expediting commercialization cycles. Concurrently, exploring regional dual-sourcing strategies will help safeguard supply continuity against tariff volatility and geopolitical uncertainties. This dual-sourcing approach ensures access to critical precursors from different markets, thereby minimizing cost fluctuations.

Finally, enhancing transparency through blockchain-enabled traceability and compliance reporting will strengthen stakeholder confidence and streamline regulatory approvals. Such systems not only document origin and formulation data but also provide verifiable proof points for environmental and safety claims. By implementing these recommendations, businesses can position themselves to navigate market disruptions, meet evolving demand profiles, and deliver differentiated value in the competitive polyurethane catalyst arena.

Comprehensive Research Methodology Employed to Deliver Rigorous Analysis Validated Data and Actionable Intelligence on Polyurethane Catalyst Markets

This analysis was constructed through a rigorous methodology combining primary and secondary research streams to ensure robust, actionable intelligence. Primary data collection involved in-depth interviews with industry veterans, including senior R&D scientists, procurement managers, and regulatory experts, whose insights provided clarity on emerging innovation drivers and supply chain constraints. Complementing this, a comprehensive review of trade publications, patent filings, and technical whitepapers delivered contextual depth and identified technology adoption trends.

Secondary research encompassed a systematic survey of proprietary databases, governmental regulatory documents, and public company filings to validate market dynamics and policy impacts. Data triangulation techniques were applied to cross-verify information, mitigating bias and ensuring consistency across multiple sources. Advanced analytics tools facilitated the synthesis of qualitative inputs with quantitative datasets, enabling the construction of thematic matrices that highlight performance differentials among catalyst segments and regions.

Finally, the findings were subjected to peer review by subject matter experts, whose feedback refined the strategic implications and ensured the precision of terminology. This multi-layered approach, blending empirical evidence with expert judgment, underpins the credibility of the insights presented and empowers stakeholders with a clear, data-driven understanding of the polyurethane catalyst market.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethane Catalyst market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethane Catalyst Market, by Type

- Polyurethane Catalyst Market, by Category

- Polyurethane Catalyst Market, by Application

- Polyurethane Catalyst Market, by End-Use Industry

- Polyurethane Catalyst Market, by Region

- Polyurethane Catalyst Market, by Group

- Polyurethane Catalyst Market, by Country

- United States Polyurethane Catalyst Market

- China Polyurethane Catalyst Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 795 ]

Synthesis of Critical Polyurethane Catalyst Insights and Strategic Outlook to Empower Decision Makers in Addressing Future Material Science Challenges

In reflecting on the evolving landscape of polyurethane catalysts, it is evident that innovation, sustainability, and strategic agility will define success in the coming years. The convergence of bio-based materials, nanotechnology advancements, and digital process optimization has created fertile ground for the next wave of catalytic breakthroughs. At the same time, regulatory shifts and geopolitical developments have underscored the necessity for resilient supply chains and adaptive partnerships.

Segmentation and regional nuances further illustrate how performance demands and compliance requirements vary across types, categories, applications, and geographies. By understanding these drivers, stakeholders can align product roadmaps and investment priorities with market realities. In addition, key companies’ strategies emphasize the importance of collaboration and diversification in maintaining competitive advantage.

Ultimately, those who integrate sustainability at the heart of catalyst innovation, leverage data-driven decision making, and pursue strategic alliances will be best positioned to thrive. This comprehensive analysis equips decision makers with the necessary context, insights, and recommendations to anticipate challenges and harness opportunities. As material science continues to advance, the role of well-designed catalysts in shaping high-performance, sustainable products will only grow more pivotal.

Engage with Ketan Rohom to Explore the Full Polyurethane Catalyst Market Research Report and Uncover Tailored Insights for Your Business Success

To gain a deeper understanding of the nuances shaping polyurethane catalyst dynamics and to access a comprehensive exploration of market intelligence, reach out to Ketan Rohom (Associate Director, Sales & Marketing) today. He can guide you through tailored insights on catalyst trends, competitive positioning, and strategic considerations essential to your organization’s success. Initiating a conversation with Ketan will ensure you receive not only the high-level overviews but also the granular data and actionable recommendations that will help you stay ahead in an increasingly complex environment. Engage now to secure your copy of the full market research report and unlock the strategic advantage your team needs to excel.

- How big is the Polyurethane Catalyst Market?

- What is the Polyurethane Catalyst Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?