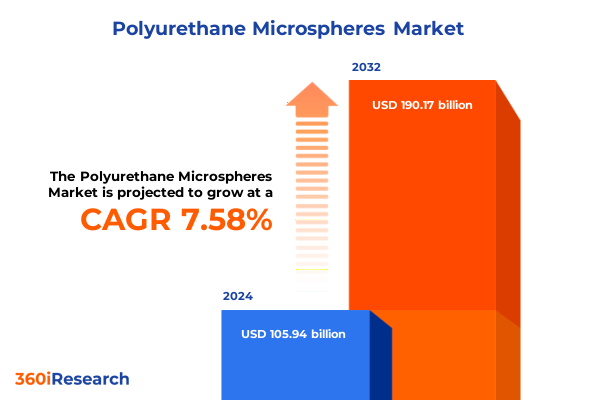

The Polyurethane Microspheres Market size was estimated at USD 114.16 billion in 2025 and expected to reach USD 123.09 billion in 2026, at a CAGR of 7.56% to reach USD 190.17 billion by 2032.

Unlocking the Potential of Polyurethane Microspheres: A Comprehensive Overview of Materials Driving Advanced Application Innovations

Polyurethane microspheres have emerged as a material of choice across a spectrum of applications, driven by their versatility in tailoring density, mechanical strength, and functional performance. In recent years, these microspheres have transcended traditional niches to address pressing industry demands such as lightweighting, enhanced thermal insulation, and surface texture modification. As key enablers of innovation, polyurethane microspheres are now being engineered to deliver controlled release in coatings, reinforce composite matrices, and serve as rheology modifiers in sealants and adhesives, reflecting their foundational role in next-generation material solutions. Moreover, the escalating emphasis on circular economy principles has sparked exploration into bio-based polyurethanes and closed-loop recycling processes, setting the stage for a new era of sustainable microsphere production.

Against this backdrop, a comprehensive understanding of market dynamics, technological advances, and regulatory influences is essential for stakeholders seeking to harness the full potential of these engineered particles. This executive summary synthesizes the core facets of the current polyurethane microsphere landscape, offering a concise yet authoritative snapshot that aligns product innovation trajectories with evolving supply chain considerations. It lays the groundwork for deeper strategic dialogues by delineating transformative shifts, tariff implications, segmentation nuances, regional performance drivers, competitive positioning, and actionable guidance, all distilled from rigorous primary and secondary research.

Emerging Sustainability Mandates and Technological Breakthroughs Reshaping Polyurethane Microsphere Manufacturing and Application Dynamics Worldwide

The polyurethane microspheres market is experiencing a profound transformation catalyzed by an intersection of sustainability imperatives and technological breakthroughs. Regulatory bodies worldwide are intensifying restrictions on volatile organic compounds and hazardous additives, compelling manufacturers to reformulate microspheres with renewable feedstocks and non-solvent chemistries. This shift is complemented by advancements in polymerization techniques, such as microfluidic and controlled radical processes, which enable tighter control over particle size distribution, surface functionality, and crosslink density. As a result, a new generation of microspheres is taking shape-one that balances performance with environmental stewardship.

Concurrently, demand patterns are evolving in response to end-market expectations for lightweight, high-performance materials. Automotive OEMs are integrating low-density microspheres into composite panels to drive fuel efficiency, while electronics manufacturers leverage dielectric properties to miniaturize devices. In personal care, formulators capitalize on microspheres’ tactile attributes to enhance product feel without compromising formulation stability. These trends are further amplified by digitalization in formulation design, where predictive modeling and machine learning accelerate innovation cycles and reduce time-to-market. Collectively, these transformative forces are redefining how industry participants conceptualize and deploy polyurethane microspheres across diverse applications.

Analyzing the Cumulative Impacts of 2025 United States Tariffs on Polyurethane Microsphere Supply Chains, Costs, and Competitive Strategies

In 2025, the United States introduced a set of tariffs targeting key raw materials and intermediate chemicals used in polyurethane microsphere production, triggering a chain reaction across global supply chains. Manufacturers reliant on imported polyols and isocyanates faced elevated input costs, which in turn compelled downstream producers to reassess sourcing strategies and renegotiate supplier contracts. Many companies pivoted toward domestic feedstock partnerships, investing in localized supply agreements to mitigate exposure to future tariff adjustments. This realignment has engendered closer collaboration between raw material suppliers and microsphere formulators, fostering co-development initiatives and joint ventures that secure long-term raw material availability.

Additionally, the tariff regime has accelerated the exploration of alternative chemistries, with some innovators experimenting with non-traditional polyol backbones and bio-derived isocyanate substitutes. While these efforts underline the industry’s resilience, they also introduce transitional challenges such as revalidation of end-use performance and compliance with existing regulatory frameworks. Nonetheless, the cumulative impact of the 2025 United States tariffs has ultimately strengthened supply chain transparency, incentivized risk-diversification, and prompted a wave of strategic realignments that are likely to shape competitive dynamics well into the latter half of the decade.

Illuminating Multifaceted Segmentation Insights Revealing Application, End-Use Industry, Product Type, and Form Dimensions for Polyurethane Microsphere Markets

A closer examination of market segmentation reveals how polyurethane microspheres are tailored to distinct application requirements and industry verticals. When viewed through the lens of application, the adhesives and sealants domain emerges as a cornerstone, featuring construction adhesives optimized for high-bond strength alongside industrial variants engineered for temperature and chemical resistance. Coatings applications, spanning automotive topcoats, decorative finishes, and industrial protective layers, leverage microspheres to enhance durability and achieve smooth texture control. In composite materials, aerospace components benefit from weight reduction without sacrificing structural integrity, automotive interiors gain improved acoustic damping, and consumer goods witness novel tactile finishes. The oil and gas sector exploits the role of microspheres in drilling fluids to modulate viscosity and in oilfield chemicals to serve as lightweight fillers under extreme downhole conditions. Meanwhile, in personal care formulations, hair care products utilize hollow microspheres for volumizing effects and skin care items incorporate solid variants to refine sensory aesthetics.

When end-use industry perspectives are considered, the automotive sector bifurcates between aftermarket applications-where durability and cost-efficiency are paramount-and OEM collaborations that demand stringent quality standards and certification. The construction vertical differentiates commercial infrastructure mandates from residential build projects, each with unique regulatory and performance outputs. Electronics users, both consumer and industrial, adopt dielectric microspheres to support circuit miniaturization and thermal management. The medical field navigates a dual pathway of consumables, such as controlled-release wound dressings, and high-precision medical devices requiring validated biocompatibility. Packaging converts to flexible films that exploit barrier improvements and to rigid containers targeting impact resistance. Finally, the textile realm embraces apparel enhancements for breathability and technical textiles that underpin industrial filtration and reinforcement functions.

On a product type axis, composite microspheres-encompassing core-shell architectures and interpenetrating polymer networks-provide multifunctionality and tunable mechanical properties. Hollow microspheres offer superior buoyancy and energy absorption, while solid variants deliver compressive strength for load-bearing applications. Form considerations further refine performance: dispersions, whether aqueous or non-aqueous, facilitate seamless integration into liquid systems, with non-aqueous formats subdivided into radiation-curable and solvent-based chemistries. Dry powders, in contrast, afford ease of transport and storage, enabling on-demand dispersion into target matrices. Together, these segmentation insights elucidate how material designers can precisely align microsphere characteristics with end-use performance criteria.

This comprehensive research report categorizes the Polyurethane Microspheres market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Application

- End-Use Industry

- Product Type

- Form

Discovering Key Regional Performance Variations Across the Americas, Europe Middle East & Africa, and Asia-Pacific in Polyurethane Microspheres Landscape

Regional landscapes for polyurethane microspheres are defined by unique interplays of regulatory environments, manufacturing capabilities, and end-market demands. In the Americas, particularly North America, a robust industrial base underpinned by stringent environmental protocols has galvanized investment in low-VOC and bio-based microsphere solutions. Collaborations between academic institutions and material producers have accelerated the commercialization of next-generation chemistries, while a mature logistics infrastructure supports efficient distribution across diverse end-use sectors. Latin America, albeit at an earlier stage of adoption, is witnessing growing applications in automotive and construction arenas as local manufacturers seek lightweight alternatives and enhanced product durability.

In Europe, Middle East & Africa, the regulatory framework is among the most rigorous globally, driving rapid uptake of sustainable microsphere formulations, especially within decorative coatings and automotive lightweighting programs. Regional OEMs are forging partnerships with local and international microsphere suppliers to co-develop tailored offerings that meet EU emissions and waste directives. The Middle East’s oil and gas stronghold leverages hollow microspheres to optimize drilling operations, while African markets are gradually integrating polyurethane microspheres into consumer goods sectors as disposable incomes and urbanization rates climb.

Asia-Pacific stands out as the fastest evolving region, propelled by surging demand from electronics manufacturing hubs, burgeoning automotive production, and an expanding personal care industry. China’s emphasis on technological self-reliance has led to significant domestic R&D in microsphere synthesis, while Southeast Asian economies capitalize on competitive labor costs to attract manufacturing investments. Across the region, infrastructure projects and e-commerce growth are catalyzing packaging innovations that rely on lightweight and robust microsphere-enhanced materials.

This comprehensive research report examines key regions that drive the evolution of the Polyurethane Microspheres market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Shapers Driving Competitive Differentiation in the Polyurethane Microspheres Industry Ecosystem

The competitive landscape for polyurethane microspheres is characterized by a blend of global chemical titans and specialized innovators. Leading players have leveraged extensive R&D budgets to advance proprietary polymerization techniques that yield microspheres with unprecedented precision in size uniformity and surface functionality. These firms often pursue vertical integration strategies, aligning feedstock procurement with in-house production to secure supply chain resilience amid tariff pressures and raw material volatility. At the same time, agile niche suppliers emphasize collaboration with end-users, offering bespoke microsphere formulations and co-development programs that address application-specific challenges.

Innovation leadership can also be seen in strategic patent portfolios, where companies protect core technologies related to core-shell architectures, radiation-curable dispersions, and bio-based polyurethane systems. Partnerships between material producers and OEMs in sectors such as aerospace and medical devices underscore the importance of co-engineering frameworks that bridge material science expertise with rigorous performance testing. Furthermore, mergers and acquisitions continue to shape market dynamics, as larger entities seek to broaden their product offerings and geographic reach by integrating specialized microsphere businesses. Collectively, these competitive maneuvers highlight the strategic importance of innovation, supply chain integration, and customer-centric collaboration in defining market leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethane Microspheres market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Advanced Polymer, Inc.

- BASF SE

- Bayer MaterialScience LLC

- Chase Corporation

- Cospheric LLC

- Covestro AG

- EPRUI Biotech Co., Ltd.

- Evonik Industries AG

- Heyo Enterprises Co., Ltd.

- HOS-Technik GmbH

- Huntsman International LLC

- ICB Pharma Sp. z o.o.

- Kolon Industries, Inc.

- Lamberti S.p.A.

- Microchem Laboratory, Inc.

- Mitsubishi Chemical Corporation

- Nippon Kayaku Co., Ltd.

- Sanyo Chemical Industries, Ltd.

- Supercolori S.p.A.

Strategic Actionable Recommendations for Industry Leaders to Capitalize on Polyurethane Microsphere Innovations and Navigate Emerging Market Complexities

Industry leaders can capitalize on emerging opportunities by prioritizing the development of sustainable chemistries that meet evolving regulatory requirements and end-market expectations. Establishing flexible supply chains through multi-supplier engagements and strategic alliances will mitigate tariff risks and ensure uninterrupted access to critical feedstocks. Simultaneously, investing in advanced characterization and digital formulation platforms can accelerate product innovation cycles and enhance the precision of microsphere design.

To further strengthen market positioning, companies should engage in collaborative partnerships with key end-users-particularly within automotive OEMs and medical device manufacturers-to co-develop application-specific solutions that deliver demonstrable performance advantages. Expanding geographically through targeted joint ventures and distribution agreements, especially in high-growth Asia-Pacific markets, will unlock new revenue streams and diversify risk. Additionally, embedding sustainability metrics into corporate strategy by setting clear targets for renewable content and lifecycle emissions will resonate with environmentally conscious stakeholders and elevate brand differentiation.

Transparent Research Methodology Combining Primary Stakeholder Engagement and Secondary Data Synthesis Underpinning Polyurethane Microsphere Insights

This research synthesis is grounded in a rigorous methodology integrating primary qualitative interviews with executives, R&D leaders, and procurement specialists across key manufacturing and end-use sectors. Primary insights were complemented by secondary data analysis drawn from patent filings, peer-reviewed journals, and industry conference proceedings, ensuring a balanced perspective on technological advancements and application trends. Market segmentation frameworks were developed through a structured mapping exercise, aligning microsphere variants with specific application requirements and end-use metrics.

Data validation protocols included cross-referencing supplier disclosures, regulatory filings, and trade association reports to confirm material specifications and adoption patterns. Geographic segmentation analyses were reinforced by regional trade statistics and import-export databases, while competitive intelligence was derived from corporate filings and strategic partnership announcements. This multi-layered approach ensures the findings presented in this executive summary are robust, transparent, and directly applicable to strategic planning and innovation road-mapping initiatives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethane Microspheres market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethane Microspheres Market, by Application

- Polyurethane Microspheres Market, by End-Use Industry

- Polyurethane Microspheres Market, by Product Type

- Polyurethane Microspheres Market, by Form

- Polyurethane Microspheres Market, by Region

- Polyurethane Microspheres Market, by Group

- Polyurethane Microspheres Market, by Country

- United States Polyurethane Microspheres Market

- China Polyurethane Microspheres Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 3021 ]

Synthesizing Critical Insights and Forward-Looking Perspectives to Conclude the Executive Summary on Polyurethane Microspheres Advancements

In summary, polyurethane microspheres stand at the nexus of materials innovation and market demand, driven by sustainability mandates, performance optimization, and supply chain realignments. The transformative shifts outlined-ranging from advanced polymerization techniques to the implications of tariff policies-underline the critical need for agile strategies and collaborative innovation frameworks. Segmentation analyses offer clarity on how varying microsphere attributes align with end-use performance criteria, while regional insights highlight both mature and emerging markets ripe for strategic engagement.

Competitive dynamics reinforce that leadership will be defined by innovation intensity, supply chain resilience, and customer-centric partnerships. By adopting the actionable recommendations detailed herein, industry participants can navigate complexity, unlock new application frontiers, and secure a leadership position in the evolving polyurethane microsphere landscape. Moving forward, the integration of sustainability metrics and digital tools will serve as catalysts for continued growth and differentiation.

Engage with Ketan Rohom to Secure Comprehensive Polyurethane Microsphere Market Intelligence Report Tailored for Strategic Decision-Making and Growth

I encourage industry stakeholders and decision-makers seeking an authoritative and granular perspective on polyurethane microspheres to connect directly with Ketan Rohom, whose expertise in sales and marketing will guide you to the tailored research assets that align with your strategic imperatives. By engaging with Ketan, you will gain prioritized access to comprehensive analyses, competitive benchmarking, and detailed insights designed to inform product development, market entry strategies, and partnership evaluations. Reach out to secure your full report today and empower your organization with the data-driven intelligence required to achieve sustainable growth and maintain a competitive edge in this rapidly evolving materials landscape.

- How big is the Polyurethane Microspheres Market?

- What is the Polyurethane Microspheres Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?