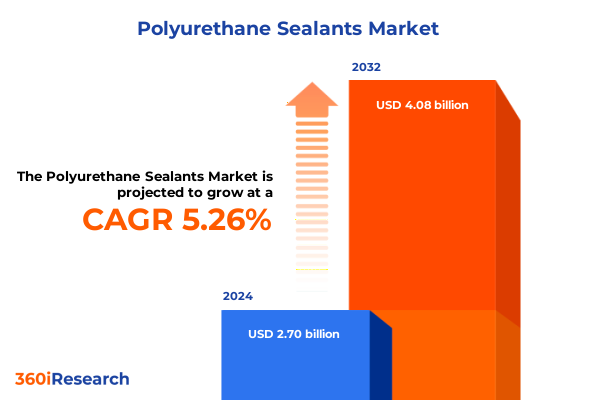

The Polyurethane Sealants Market size was estimated at USD 2.84 billion in 2025 and expected to reach USD 2.98 billion in 2026, at a CAGR of 5.29% to reach USD 4.08 billion by 2032.

Exploring the Evolution of Polyurethane Sealants and Their Pivotal Role in Advancing Performance and Sustainability Across Diverse Industrial End Markets

Polyurethane sealants have evolved from rudimentary formulations into highly engineered materials that provide superior adhesion, flexibility, and environmental resistance. Their chemical versatility, arising from the reaction between polyols and diisocyanates, has allowed formulators to tailor performance characteristics for sealing applications that demand resilience against moisture ingress, thermal cycling, and chemical exposure. Over successive decades, innovations in polymer chemistry led to hybrid systems that combine the durability of one-component formulations with the strength of two-component technologies, creating novel solutions for increasingly complex sealing challenges.

In parallel, growing awareness of environmental regulations and end-user sustainability goals has driven the development of water-based and solvent-free systems that minimize volatile organic compounds without sacrificing performance. This commitment to eco-friendly chemistry is complemented by digitalization in manufacturing processes, enabling tighter quality controls and more efficient curing cycles. As a result, modern polyurethane sealants not only secure structural integrity in aerospace cabins and automotive windshields but also support green building certifications and emerging renewable energy installations. Consequently, these materials have become integral components across multiple industries, delivering both technical excellence and regulatory compliance to satisfy the rigorous demands of today’s markets.

Looking ahead, the interplay between innovation in raw material sourcing, advanced processing methods, and end-use customization foresees a future where polyurethane sealants will further adapt to electrification trends, lightweight design imperatives, and circular economy principles. By leveraging renewable feedstocks and adopting closed-loop manufacturing practices, providers can enhance product sustainability while meeting the performance benchmarks set by conventional chemistries. This dynamic evolution underscores the indispensable nature of these sealants, positioning them as catalysts for broader industrial transformation where performance, efficiency, and environmental stewardship converge.

Identifying the Most Significant Technological, Regulatory, and Market Dynamics That Are Driving Transformative Shifts in Polyurethane Sealant Applications

Recent years have witnessed an unprecedented convergence of factors reshaping the polyurethane sealant landscape. Technologically, the maturation of hybrid systems that blend the attributes of high-temperature resistant polymers with moisture-curing mechanisms has elevated performance thresholds across demanding environments. Additionally, advancements in nanotechnology have introduced formulations with enhanced adhesion at the molecular level, facilitating thinner sealant beads without compromising protective integrity. These innovations are enabling end users to pursue lighter, leaner designs without forfeiting durability or safety.

Simultaneously, tightening environmental regulations in key markets such as North America and Europe have accelerated the adoption of solvent-free and water-based systems. These regulatory pressures are steering R&D efforts toward formulations that comply with stringent volatile organic compound limits while maintaining long-term reliability. At the same time, increasingly sophisticated digital tools for process control and quality assurance are reducing variability in application and curing, thereby lowering waste and improving productivity on shop floors.

On the market front, the growing emphasis on electrification across the automotive and energy sectors has opened new application frontiers for sealants that can withstand high voltage potentials and thermal fluctuations. Meanwhile, the expansion of offshore wind installations and marine infrastructure is driving demand for specialized chemistries that resist saltwater corrosion and biofouling. As a result, cross-industry collaborations are emerging to leverage domain-specific expertise, propelling the polyurethane sealant industry into new realms of performance and sustainability.

Analyzing the Cumulative Economic, Supply Chain, and Pricing Impacts Resulting from United States Tariff Measures on Polyurethane Sealants in 2025

In 2025, the United States implemented a series of tariff measures targeting key raw materials and imported sealant formulations, leading to a cascading effect on cost structures throughout the polyurethane sealant value chain. These tariffs, applied to precursor polyols and specialized isocyanates sourced predominantly from Europe and Asia, have elevated input costs for domestic manufacturers. Consequently, producers reliant on imported feedstocks have faced margin compression, prompting a strategic pivot toward local sourcing agreements and long-term off-take contracts with domestic chemical suppliers.

Supply chain disruptions have further compounded these cost pressures. Elevated duties have incentivized some end users to diversify their procurement strategies by qualifying alternative suppliers in emerging markets, though these adjustments often require rigorous performance validation. Moreover, the accelerated lead times associated with customs clearance under new tariff classifications have heightened inventory carrying expenses, causing manufacturers to reassess their just-in-time inventory models in favor of more resilient, higher-capacity buffer stocking strategies.

From a pricing standpoint, the cumulative impact of tariffs and logistical delays has gradually filtered through to downstream industries. Automotive OEMs and construction material suppliers have begun negotiating supply agreements to secure stable pricing, often incorporating cost escalation clauses tied to global chemical indices. As a mitigation strategy, some sealant providers have introduced tiered product lines that substitute premium imported components with locally developed alternatives, striking a balance between performance and affordability. Over time, these shifts are fostering a more geographically distributed supply base, albeit with an increased emphasis on supply chain transparency and regulatory compliance.

Uncovering Critical Insights from Multi-Dimensional Segmentation to Illustrate Variations in Polyurethane Sealant Adoption and Performance Across Applications, Forms, Technologies, and Channels

When examining the market through the lens of application, it becomes clear that the aerospace segment commands specialized sealant requirements for cabin sealing, fuel tank sealing, and structural bonding due to stringent safety standards and extreme operating conditions. In the automotive arena, applications such as bodywork, trim sealing, underbody sealing, and windshield bonding each impose unique demands for elasticity, impact resistance, and curing speed. Similarly, construction-focused sealants designed for façade, floor, roof, and window and door gasket installation are formulated to resist moisture infiltration and thermal expansion, addressing the long-term durability needs of buildings. Meanwhile, electronics encapsulation, gasket creation, and potting applications prioritize chemical inertness and dielectric properties, while industrial equipment uses machinery assembly, pipe sealing, and tank sealing solutions that endure mechanical stress. In marine contexts, deck sealing, hull sealing, and window bonding applications require chemistries that withstand saltwater exposure and UV degradation.

Considering form factors, one-component sealants offer ease of use and rapid application for maintenance and repair scenarios, providing a balance between convenience and performance. By contrast, two-component systems deliver higher mechanical strength and heat resistance, making them well suited for heavy-duty industrial applications where extended exposure to aggressive chemicals or temperature extremes is common. This bifurcation underscores the crucial role of formulation flexibility in meeting diverse operational requirements.

From a technology perspective, high temperature-resistant sealants maintain structural integrity in environments exceeding typical operating ranges, while hybrid chemistries leverage synergistic combinations of moisture-curing and reactive functional groups to enhance both adhesion and elasticity. Solvent-based products continue to provide established performance benchmarks, whereas solvent-free and water-based alternatives are prioritized when low volatile organic compound content and compliance with environmental regulations are paramount.

Lastly, distribution channels shape market accessibility, with direct sales arrangements supporting large-scale industrial end users through tailored technical support and supply agreements. Distributor networks extend reach into regional markets, offering stock availability and local expertise, and the rise of online sales platforms is simplifying procurement for smaller operations seeking convenience and digital order tracking. Together, these layers of segmentation reveal the multifaceted nature of polyurethane sealant demand and the importance of aligning product portfolios to precise end-use requirements.

This comprehensive research report categorizes the Polyurethane Sealants market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Technology

- Form

- Curing Mechanism

- Packaging Type

- Application

- Distribution Channel

Evaluating Regional Demand Drivers, Regulatory Landscapes, and Growth Opportunities for Polyurethane Sealants Across the Americas, EMEA, and Asia-Pacific Markets

In the Americas, strong demand emanates from the automotive sector, where lightweighting initiatives and the transition to electric vehicles are fostering the adoption of advanced sealants with superior crash performance and electrical insulation properties. The construction industry is also injecting momentum through green building certifications, spurring the uptake of low-emission and high-durability sealants for façade and fenestration applications. Regulatory bodies in the United States and Canada are enforcing stricter emissions guidelines, prompting local suppliers to introduce compliant formulations and expand their domestic production footprints to meet accelerated timelines.

Europe, the Middle East, and Africa present a diverse set of regulatory landscapes. In the European Union, the REACH framework and regional volatile organic compound directives are pivotal in driving the shift toward water-based and solvent-free technologies. Across the Middle East, rapid infrastructure projects, including urban development and oilfield maintenance, are creating a demand for high-temperature and corrosion-resistant sealants. African markets, while nascent, are beginning to value long-term asset protection, encouraging the adoption of premium industrial sealant solutions that ensure uptime in remote installations.

The Asia-Pacific region is characterized by robust growth in electronics manufacturing hubs and marine infrastructure development. Countries such as China, South Korea, and Japan are leading in the integration of sealants into semiconductor assembly processes, where precise encapsulation and thermal management are critical. Simultaneously, Southeast Asian shipyards are increasingly specifying marine-grade sealants to enhance vessel longevity in tropical and maritime climates. Regional policies emphasizing local content and manufacturing self-sufficiency are prompting international players to establish joint ventures and regional research centers, thereby localizing supply chains and tailoring product innovations to market-specific needs.

This comprehensive research report examines key regions that drive the evolution of the Polyurethane Sealants market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Examining Strategic Initiatives, Innovation Pipelines, and Competitive Positioning of Leading Polyurethane Sealant Manufacturers in a Global Context

Leading manufacturers are prioritizing sustainable product portfolios by integrating renewable polyol feedstocks and deploying bio-based isocyanates across select sealant lines, a move that aligns with corporate sustainability goals and bolsters brand differentiation. Partnerships with chemical technology firms are accelerating the development of next-generation formulations, such as those incorporating multifunctional additives to improve UV resistance and elongation properties. Concurrently, strategic acquisitions of specialty chemical producers are enabling established suppliers to broaden their technology base and enter high-marginal niche segments.

Innovation pipelines are increasingly focused on digital process integration, where real-time monitoring systems track cure kinetics and ensure consistent performance across batches. This convergence of materials science and Industry 4.0 capabilities is reducing quality variances and shortening time-to-market for new formulations. Moreover, several key players are collaborating with end-use OEMs to co-develop tailor-made sealants that precisely address vehicle architecture and building envelope requirements, fostering deeper customer loyalty and establishing high entry barriers for competitors.

To strengthen global reach, top companies are expanding manufacturing capacities in strategic locations, including greenfield facilities in emerging markets and joint ventures in regions with favorable tax and trade frameworks. Comprehensive after-market support services, such as field application training and digital troubleshooting platforms, are complementing product offerings, elevating the barrier for new entrants and reinforcing incumbent competitive positioning. These combined efforts underscore a trend toward vertically integrated capabilities and closer alignment with evolving customer needs.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethane Sealants market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Akkim Construction Chemicals Inc.

- Arkema S.A.

- Ashland Inc.

- Asian Paints Limited

- BASF SE

- Chemence Inc.

- Dow Chemical Company

- EMS-CHEMIE AG

- H.B. Fuller Company

- Henkel AG & Co. KGaA

- Hodgson Sealants Ltd.

- Illinois Tool Works Inc.

- KCC Corporation

- Lord Corporation by Parker-Hannifin Corporation

- Mapei S.p.A.

- Master Builders Solutions Holdings GmbH

- Pidilite Industries Limited

- RPM International Inc.

- Selena FM S.A.

- Shenzhen Splendor Chemical Industry Co, Ltd.

- Sika AG

- Soudal Holding N.V.

- The Yokohama Rubber Co., Ltd.

- Wacker Chemie AG

Offering Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends, Optimize Operations, and Drive Sustainable Growth in the Polyurethane Sealant Sector

To stay ahead of shifting market dynamics, companies should invest in expanding sustainable formulation capabilities, including water-based and solvent-free technologies, to meet tightening environmental regulations and growing end-user demand for greener alternatives. Moreover, establishing collaborative R&D frameworks with both chemical innovators and end users will accelerate the co-creation of hybrid and high-temperature resistant sealants tailored to specific application challenges.

Diversification of supply chains is paramount in mitigating risks associated with tariffs and raw material shortages. Firms are advised to cultivate multiple sourcing partnerships across geographic regions, balancing cost efficiency with resilience. This can be achieved through long-term supply agreements, localized manufacturing strategies, and real-time inventory monitoring systems that adapt swiftly to logistical disruptions.

Embracing digital transformation across production and distribution channels will create operational efficiencies and enhance customer engagement. Implementation of advanced process control solutions and predictive maintenance protocols will reduce downtime while improving product consistency. Furthermore, scaling omnichannel sales models, from direct-to-OEM relationships to digital order platforms, can optimize market coverage and strengthen service synergies.

Finally, companies should cultivate targeted training and technical support programs to elevate end-user competence and ensure correct installation. By positioning field service teams as value-added advisors, suppliers can foster deeper customer relationships, minimize application errors, and capture additional aftermarket value streams, thereby reinforcing long-term revenue stability.

Detailing the Comprehensive Research Methodology and Multistage Data Collection Process Ensuring the Rigor and Reliability of Polyurethane Sealant Market Insights

The research process commenced with a thorough review of industry publications, regulatory filings, and patent databases to map the technological evolution of polyurethane chemistries. This desk research was complemented by expert interviews with formulation scientists, OEM engineers, and procurement specialists, ensuring a balanced perspective that spans both upstream innovation and downstream application challenges.

Secondary data sources, including trade association reports and government trade statistics, provided a quantitative foundation. These data points were cross-validated through key informant discussions and triangulated against proprietary shipment records from select manufacturers to ensure consistency. Particular attention was given to verifying the impact of 2025 tariff measures through customs data analysis and industry feedback on lead-time fluctuations.

To capture segmentation insights, structured surveys were deployed across end-user organizations in aerospace, automotive, construction, electronics, industrial equipment, and marine sectors. Respondents detailed their procurement criteria, performance requirements, and distribution channel preferences. The resulting dataset enabled in-depth segmentation mapping, while advanced statistical techniques were employed to identify correlation trends between formulation choices and application outcomes.

Rigorous quality checks, including participant validation and data integrity reviews, were conducted at each stage. The final analytical framework was peer-reviewed by external consultants specializing in polymer chemistry and market analysis, guaranteeing that findings accurately reflect current market realities and provide actionable intelligence for strategic decision making.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethane Sealants market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethane Sealants Market, by Type

- Polyurethane Sealants Market, by Technology

- Polyurethane Sealants Market, by Form

- Polyurethane Sealants Market, by Curing Mechanism

- Polyurethane Sealants Market, by Packaging Type

- Polyurethane Sealants Market, by Application

- Polyurethane Sealants Market, by Distribution Channel

- Polyurethane Sealants Market, by Region

- Polyurethane Sealants Market, by Group

- Polyurethane Sealants Market, by Country

- United States Polyurethane Sealants Market

- China Polyurethane Sealants Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesizing Key Findings to Provide a Cohesive Overview of Market Dynamics, Challenges, and Strategic Opportunities Shaping the Future of Polyurethane Sealants

The overview of polyurethane sealant developments highlights a sector in flux, driven by a complex interplay of technological breakthroughs, regulatory imperatives, and shifting end-user requirements. Innovations in hybrid chemistries and sustainable formulations are redefining performance benchmarks, allowing applications in electrified vehicles, advanced aerospace assemblies, and environmentally certified construction projects.

Meanwhile, the 2025 tariff landscape has instigated a strategic realignment of supply chains, prompting manufacturers to embrace local production partnerships and optimize inventory strategies. Although these measures have elevated input costs, they have also catalyzed diversification efforts and fostered greater supply chain transparency, ultimately strengthening industry resilience against future trade disruptions.

Segmentation analysis underscores the importance of tailoring product portfolios to the precise demands of each application, whether that be high-temperature robustness for industrial equipment or dielectric stability for electronic encapsulation. Regional insights reveal distinct growth trajectories, with the Americas leveraging automotive electrification, EMEA enforcing stringent sustainability standards, and Asia-Pacific capitalizing on electronics and marine infrastructure expansion.

Taken together, these findings point to an industry at a critical inflection point where strategic innovation, operational agility, and customer-centric engagement will determine market leadership. Organizations that align their capabilities with evolving performance criteria, regulatory frameworks, and distribution models are best positioned to capture growth opportunities and secure long-term competitive advantage.

Empowering Decision Makers to Access In-Depth Polyurethane Sealant Market Intelligence by Connecting with Our Sales and Marketing Leadership Today

For a comprehensive deep dive into the trends, segmentation, and strategic imperatives shaping the polyurethane sealant sector, reach out to Ketan Rohom, Associate Director of Sales & Marketing at 360iResearch. He can provide tailored insights, detailed analysis, and support in understanding how the latest developments can impact your organization’s objectives.

Whether you are seeking clarity on tariff implications, segmentation nuances, or best practice recommendations for sustainable formulation, Ketan Rohom will guide you through our report’s key findings and answer any questions you may have regarding its application.

Contact Ketan Rohom today to secure your copy of the full polyurethane sealant market intelligence report and gain the actionable knowledge needed to inform your strategic initiatives and drive future growth.

- How big is the Polyurethane Sealants Market?

- What is the Polyurethane Sealants Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?