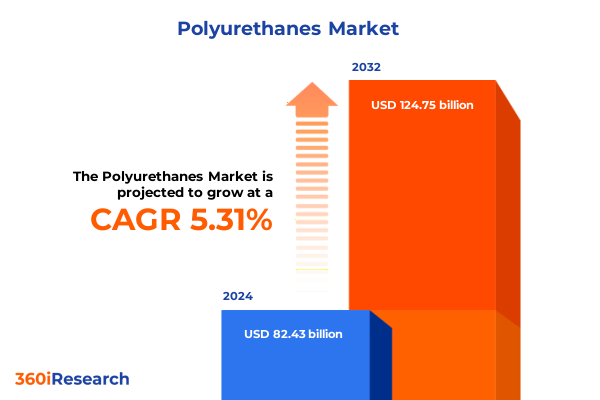

The Polyurethanes Market size was estimated at USD 86.87 billion in 2025 and expected to reach USD 90.98 billion in 2026, at a CAGR of 5.30% to reach USD 124.75 billion by 2032.

Exploring How Polyurethane Innovations Are Shaping Tomorrow’s Industries With Advanced Performance And Sustainability at the Core

Polyurethanes stand at the crossroads of innovation and utility, offering a remarkable blend of mechanical strength, chemical resistance, and design versatility. As a polymer family, they span rigid and flexible foams, coatings, adhesives, sealants, and elastomers, meeting exacting performance requirements across industries. This introduction unfolds the underlying chemistry that enables polyurethanes to adapt their molecular architecture and deliver tailored functionalities from impact-resistant insulation panels to soft-touch cushioning in furniture.

In recent years, the drive for sustainable solutions has accelerated the evolution of polyurethane formulations. Bio-based polyols, novel isocyanate alternatives, and low-emission processing techniques are emerging to address environmental regulations and consumer expectations. Downstream stakeholders are demanding lower-carbon footprints and enhanced recyclability, which is prompting raw material suppliers and compounders to rethink feedstock sourcing and end-of-life strategies.

This executive summary synthesizes key market dynamics without delving into specific volume projections, focusing instead on the forces reshaping the industry. By examining transformative shifts, tariff implications, segmentation nuances, regional variances, and leading corporate strategies, this section establishes the foundation for a holistic understanding of polyurethane’s role in the modern materials ecosystem. Anticipate a clear, concise roadmap that connects market drivers to actionable insights for decision-makers.

Examining The Major Transformative Shifts In The Polyurethane Landscape Driven By Sustainability Demands And Technological Breakthroughs

The polyurethane sector is undergoing a fundamental transformation driven by mounting environmental imperatives and circular economy initiatives. Manufacturers are actively developing renewable feedstocks to replace petroleum-derived polyols, accelerating research into catalytic processes that minimize energy consumption and waste generation. This shift is not merely incremental but represents a strategic realignment toward cradle-to-cradle lifecycle models that prioritize end-of-life recovery and material reuse.

Concurrently, digitalization of production and the integration of Industry 4.0 technologies are redefining operational efficiency. Smart sensors monitor reactor conditions in real time, enabling precise control over foam density and polymer crosslinking. Additive manufacturing is emerging as a complementary fabrication method, delivering complex geometries with reduced material waste and faster prototyping cycles. These technological breakthroughs are expanding polyurethane’s utility into emerging applications such as personalized medical devices and advanced electronic housings.

Regulatory landscapes are tightening global emissions standards and volatile organic compound limits, prompting a wave of reformulation across coatings and sealant portfolios. Companies are responding through advanced dispersion chemistries and innovative crosslinkers that reduce solvent dependency while maintaining durability and adhesion performance. Together, these technological and regulatory catalysts are forging a more resilient and sustainable polyurethane industry.

Understanding The Cumulative Effects Of 2025 United States Tariff Measures On Polyurethane Value Chains And Global Supply Dynamics

In 2025, the implementation of new United States tariff measures has exerted significant pressure on polyurethane value chains, particularly in the importation of key raw materials. Freshly imposed duties on polyether polyols and methylene diphenyl diisocyanate from certain countries have driven up landed costs, squeezing margins for downstream processors. As a result, many manufacturers are reassessing their procurement strategies and evaluating local supply partners for improved cost stability.

Beyond direct cost implications, the tariffs have triggered a ripple effect across global sourcing networks. Companies reliant on Asia-based feedstock are diversifying into European and Latin American suppliers to mitigate exposure. This strategic realignment has increased logistical complexity, lengthened lead times, and necessitated closer collaboration between procurement, logistics, and quality teams to ensure uninterrupted production runs.

Looking ahead, the cumulative impact of these tariff measures underscores the need for supply chain resilience. Forward-thinking players are pursuing nearshoring initiatives and forging long-term partnerships with domestic producers. By enhancing visibility through digital procurement platforms and building buffer inventories, they aim to insulate their operations from future trade policy shifts and maintain competitive positioning.

Revealing Core Market Segmentation Insights That Illuminate Diverse Polyurethane Applications Material Types End Uses And Form Variations

Insights into polyurethane performance begin with application segmentation, where adhesives and sealants demand high bond strength and flexibility, while coatings prioritize chemical resistance and aesthetic finish. Elastomer applications require tailored crosslink densities to deliver impact absorption and mechanical resilience, whereas flexible and rigid foams each fulfill distinct insulation and cushioning roles. Recognizing these functional distinctions enables innovators to align formulation strategies with end-use performance specifications.

Material type further refines the product roadmap, as polyester-based systems offer superior hydrolytic stability compared to polyether variants that excel in low-temperature flexibility and weather resistance. This material dichotomy influences everything from raw feedstock selection to process parameters and additive choices, guiding research and development investments toward polyol chemistries that best match application requirements.

End-use segmentation maps polyurethane solutions onto diverse industries such as automotive and transportation, where lightweight structural components and interior trim benefit from high strength-to-weight ratios. Building and construction applications hinge on energy-efficient insulation and protective coatings, while electronics, footwear and apparel, furniture and flooring, and medical and healthcare all leverage unique polyurethane attributes. These nuanced segments shape targeted innovation pipelines.

Formulation form also plays a pivotal role in processing and performance. Aqueous and solvent-based dispersions enable low-VOC coatings and waterborne systems, while liquid resins offer rapid curing for cast elastomers. Solid forms deliver ease of handling and precise dosing for rigid foams. Each form factor carries distinct handling, curing, and performance characteristics that inform manufacturing investments and downstream application compatibility.

This comprehensive research report categorizes the Polyurethanes market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Material Type

- Form

- Application

- End Use

Mapping Regional Market Dynamics To Highlight How Americas Europe Middle East & Africa And Asia Pacific Markets Showcase Unique Demand Drivers And Growth Catalysts

In the Americas, polyurethane consumption is anchored by robust automotive and construction markets. North American OEMs are pursuing lightweighting strategies and high-efficiency insulation solutions to meet stringent fuel economy and energy code requirements. Meanwhile, innovation hubs in Mexico and Brazil are catalyzing local growth through mixed-material assemblies and low-cost production capabilities, balancing regional cost pressures with demand momentum.

Europe, Middle East & Africa regions are shaped by stringent environmental regulations and burgeoning circular economy initiatives. EU directives on building insulation and chemical emissions have spurred advanced foam recycling technologies and the adoption of bio-based feedstocks. In the Middle East, investments in large-scale infrastructure and petrochemical integration are driving capacity expansions, while Africa’s nascent markets respond to rising urbanization and demand for resilient construction materials.

Asia-Pacific remains the fastest-growing region, propelled by expanding electronics manufacturing in Southeast Asia and a resurgent residential construction boom in India. Chinese producers continue to scale production of base chemicals, exerting downward pressure on global raw material prices while competing on quality improvements. In Japan and South Korea, specialty companies emphasize high-performance elastomers for automotive and consumer electronics applications, reinforcing the region’s leadership in technical polyurethane formulations.

This comprehensive research report examines key regions that drive the evolution of the Polyurethanes market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Strategic Moves And Innovations From Leading Polyurethane Companies Shaping Competitive Advantage And Technology Leadership Across The Value Chain

Leading chemical producers are doubling down on sustainability by integrating renewable feedstocks and advanced recycling technologies. Strategic partnerships between raw material suppliers and tier-one converters are facilitating pilot operations for closed-loop processing, with the goal of reducing waste streams and carbon footprints. These collaborative ventures often leverage government incentives and cross-industry consortia to validate new chemistries at scale.

Major companies are also expanding geographic footprints through targeted capacity additions in emerging markets. Recent announcements include greenfield polyol plants and modular isocyanate reactors, designed to support regional demand spikes while minimizing transportation costs. Concurrently, many firms are reorganizing R&D centers to focus on digital formulation tools and predictive performance modeling, accelerating new product rollouts.

Smaller innovators are carving competitive niches by delivering specialty formulations for high-value end uses. These companies emphasize rapid prototyping, agile manufacturing, and application-specific testing services to secure contracts with OEMs in sectors such as medical devices and electronics. Their agility in tailoring chemistries often outpaces larger competitors, underscoring the value of flexible platforms and dedicated application laboratories.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyurethanes market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- 3M Company

- Armacell International S.A.

- BASF SE

- Covestro AG

- DIC Corporation

- Dow Inc.

- Evonik Industries AG

- FoamPartner Group

- FXI Holdings Inc.

- Huntsman Corporation

- INOAC Corporation

- LANXESS AG

- Lubrizol Corporation

- Mitsui Chemicals, Inc.

- RAMPF Holding GmbH & Co. KG

- Recticel NV/SA

- Rogers Corporation

- Saint-Gobain S.A.

- Sekisui Chemical Co., Ltd.

- Sika AG

- Tosoh Corporation

- Trelleborg AB

- Wanhua Chemical Group Co., Ltd.

Offering Actionable Recommendations For Industry Leaders To Capitalize On Sustainability Trends Supply Chain Resilience And High Value Sector Opportunities

Industry leaders should prioritize investment in sustainable chemistry platforms that incorporate bio-based polyols and next-generation isocyanate alternatives. By aligning research budgets with circular economy objectives, organizations can reduce regulatory risk and capture premium pricing from environmentally conscious customers. Continuous evaluation of feedstock pipelines will ensure resilience against commodity volatility and evolving emissions standards.

Enhancing supply chain resilience remains critical in the face of ongoing tariff uncertainties. Companies are advised to strengthen collaborations with domestic and nearshore suppliers, implement advanced procurement analytics, and maintain contingency inventories. Such measures not only cushion against policy shifts but also improve lead time reliability and quality control consistency across geographies.

A deepened focus on digital integration will unlock further operational efficiencies. Deploying smart manufacturing platforms, predictive maintenance algorithms, and digital twin simulations can optimize reactor performance and reduce energy consumption. Coupled with cross-functional pilot projects, these capabilities will accelerate new product development and shorten time to market in competitive end-use segments.

Detailing Rigorous Research Methodology That Underpins Insights Through Comprehensive Data Collection Primary Interviews And Robust Secondary Validation

The research underpinning these insights combines extensive primary interviews with industry executives, technical directors, and procurement specialists. Structured conversations explored key challenges in raw material sourcing, formulation optimization, and end-of-life considerations, providing qualitative depth to the analysis. These firsthand perspectives were essential in identifying emerging best practices and strategic priorities.

Complementary secondary research drew on company reports, regulatory filings, patent databases, and academic publications. This exhaustive review ensured a robust understanding of technology trends and policy developments, contextualizing individual case studies within broader industry trajectories. Data triangulation across multiple publicly available and proprietary sources enhanced reliability and mitigated biases inherent in any single information stream.

All findings underwent rigorous validation through cross-referencing and peer review by subject-matter experts. Quantitative and qualitative data points were reconciled to confirm consistency, while detailed checks on terminology and chemical nomenclature safeguarded technical accuracy. This methodological rigor ensures that the executive summary presents dependable, actionable intelligence for stakeholders at every level.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyurethanes market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyurethanes Market, by Material Type

- Polyurethanes Market, by Form

- Polyurethanes Market, by Application

- Polyurethanes Market, by End Use

- Polyurethanes Market, by Region

- Polyurethanes Market, by Group

- Polyurethanes Market, by Country

- United States Polyurethanes Market

- China Polyurethanes Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Concluding Key Takeaways On How Polyurethane Market Evolution Addresses Industry Needs Through Innovation Sustainability And Strategic Adaptation

Across the polyurethane sector, sustainability and innovation are no longer optional but central to competitive advantage. Renewed focus on circularity has catalyzed the emergence of renewable feedstocks and closed-loop recycling, signaling a paradigm shift in material sourcing and waste management. These transformative trends are reshaping product portfolios and guiding capital investment decisions worldwide.

Segmentation analysis reveals that each application, material type, end-use sector, and formulation form carries its own set of performance requirements and growth opportunities. By tailoring resin chemistries and processing methods to specific segments, companies can optimize resource allocation and accelerate time to market. Regional distinctions further refine strategic planning, as varying regulatory landscapes and demand drivers influence investment priorities in the Americas, EMEA, and Asia-Pacific.

Ultimately, industry leaders who integrate sustainable formulations, fortify supply chains against tariff disruptions, and harness digital technologies will be best positioned to meet evolving customer needs. The convergence of these strategic imperatives offers a clear path to innovation excellence and long-term value creation in the global polyurethane ecosystem.

Take The Next Step To Secure Comprehensive Polyurethane Market Insights By Contacting Ketan Rohom Associate Director Sales And Marketing To Purchase The Full Report

To secure unparalleled insights into the evolving polyurethane landscape, reach out to Ketan Rohom, Associate Director Sales & Marketing. He can guide you through tailored engagement options and ensure you receive the comprehensive strategic analysis your team needs. Invest in this proven resource to align your product development, supply chain strategy, and sustainability roadmap with the latest industry intelligence.

- How big is the Polyurethanes Market?

- What is the Polyurethanes Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?