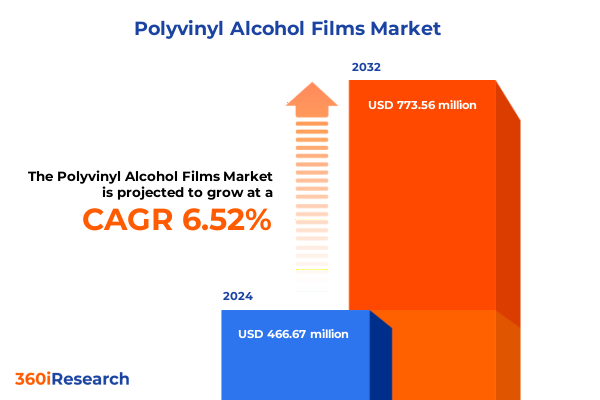

The Polyvinyl Alcohol Films Market size was estimated at USD 1.20 billion in 2025 and expected to reach USD 1.27 billion in 2026, at a CAGR of 5.41% to reach USD 1.74 billion by 2032.

Establishing the Strategic Importance of Polyvinyl Alcohol Films in Driving Efficiency, Sustainability, and Innovation Across Diverse Global Industries

Polyvinyl alcohol films have emerged as a versatile and high-performance polymer solution, prized for their exceptional barrier properties, water solubility, and biodegradability in specialized applications. Originally developed for niche uses in textile sizing and paper coatings, these films have expanded into diverse sectors due to their unique combination of chemical stability, mechanical strength, and eco-friendly profile. As the global manufacturing landscape shifts toward sustainable materials, polyvinyl alcohol films are increasingly recognized for reducing environmental impact while maintaining rigorous performance standards in packaging, agriculture, electronics, and pharmaceuticals.

In the context of evolving industry demands, polyvinyl alcohol films play a critical role in enhancing product protection and process efficiency. Their water-soluble nature enables innovations such as single-dose film pouches for detergents and agrochemicals, while their high oxygen and aroma barrier performance supports longer shelf life in food and pharmaceutical packaging. Moreover, advancements in coating technologies and film formulation have unlocked new opportunities in high-value electronics applications, including display polarizer substrates and flexible circuitry. Consequently, polyvinyl alcohol films stand at the intersection of sustainability and performance, offering manufacturers a pathway to meet stringent regulatory requirements and consumer preferences without compromising on functionality.

Identifying the Transformative Forces That Are Reshaping the Polyvinyl Alcohol Films Landscape Through Technological Advances and Regulatory Dynamics

The polyvinyl alcohol films market is undergoing a transformative shift driven by converging technological breakthroughs and evolving regulatory norms. On the technological front, developments in nanocoating and multilayer film fabrication have enhanced the barrier properties and mechanical resilience of polyvinyl alcohol films, enabling their deployment in demanding applications such as lithium-ion battery separators and high-barrier pharmaceutical packaging. Simultaneously, the integration of bio-based plasticizers and crosslinking agents has improved film biodegradability and reduced reliance on conventional petroleum-derived additives, aligning with corporate sustainability initiatives and circular economy principles.

Parallel to technological advancements, regulatory forces are reshaping the market landscape by mandating higher standards for recyclability, compostability, and toxicological safety. Extended Producer Responsibility (EPR) regulations in Europe and North America are incentivizing manufacturers to adopt water-soluble and biodegradable films that simplify end-of-life treatment. Furthermore, restrictions on single-use plastics are accelerating the shift toward water-soluble film solutions in detergent pods and agricultural chemigation systems. As a result, stakeholders across the value chain are reevaluating material formulations, supply chains, and product designs to capitalize on emerging regulatory tailwinds.

Unpacking the Profound Cumulative Implications of 2025 United States Tariffs on Polyvinyl Alcohol Films Across Supply Chains, Pricing Models, and Industry Viability

In late 2024, the Office of the United States Trade Representative announced increased Section 301 tariffs on key chemical imports from China, moving solar wafer and polysilicon duties to 50 percent and certain tungsten products to 25 percent effective January 1, 2025. While polyvinyl alcohol films were not explicitly itemized in this list, the broader trade policy signaled heightened import scrutiny and signaled potential downstream cost pressures for polymer-based products. This policy stance has underscored the need for producers to evaluate domestic and allied sources to mitigate supply chain risk.

Further compounding the tariff environment, an executive order implemented on February 4, 2025, imposed an additional 10 percent duty on all imports from China and Hong Kong not otherwise exempt under HTS Chapter 98. Given that polyvinyl alcohol films typically classify under Chapter 39, this additional duty has directly increased the landed cost of imported PVA films by 10 percent. The cumulative effect of these policy measures has prompted several strategic responses, including inventory restocking ahead of tariff enforcement, nearshoring of production processes, and renegotiation of supplier contracts to absorb cost fluctuations and maintain competitive pricing in end markets.

Deriving Key Insights from Segmentation Analyses Spanning End Use, Film Type, Manufacturing Processes, Grade, and Thickness Ranges to Uncover Market Opportunities

A detailed segmentation analysis reveals that polyvinyl alcohol films serve an array of end-use applications, each with distinct performance requisites and growth drivers. Within agriculture, these films facilitate controlled release of fertilizers and pesticides through soluble pouches, enhancing application precision. Electronics manufacturers leverage high-purity, uncoated films as substrates for polarizing and optical films, where dimensional stability and clarity are paramount. Industrial markets capitalize on single-side coated films for specialty adhesives and mold-release applications, while packaging demands-in both food and general segments-are driven by the need for robust moisture and aroma barriers. In pharmaceutical packaging, technical-grade films ensure sterility and dosage accuracy, and textile markets exploit the film’s sizing properties to improve yarn strength and weaving efficiency.

Film type further differentiates market needs: double-side coated variants enable superior adhesion and barrier enhancements for multilayer structures, while single-side coated films balance cost with functional performance for laminates and composites. Uncoated films offer pure polyvinyl alcohol properties where coating additives are unwanted. Manufacturing processes likewise influence product characteristics; solvent casting yields ultrathin films with exceptional uniformity, whereas extrusion excels in high-throughput, thicker gauge applications. Grade distinctions underscore regulatory compliance: food-grade films meet stringent safety and purity requirements for edible and medical use, whereas technical-grade variants cater to industrial performance with tailored additive packages. Finally, thickness ranges-from less than 25 microns for dissolution-sensitive applications to above 50 microns for mechanical durability-highlight the versatility of polyvinyl alcohol films in meeting specific operational demands.

This comprehensive research report categorizes the Polyvinyl Alcohol Films market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Thickness Range

- Form

- Production Technology

- Material Type

- Sales Channel

- Application

Illuminating Regional Dynamics and Emerging Opportunities in the Polyvinyl Alcohol Films Market Across Americas, EMEA, and Asia Pacific Territories

Regional dynamics in the Americas reflect a robust emphasis on innovation-driven applications and regulatory alignment. In North America, local producers have bolstered capacity for solvent-cast and coated films to support growth in water-soluble detergent pods and agricultural chemigation sachets, with state-level incentives accelerating adoption of biodegradable packaging solutions. Latin American markets exhibit rising demand for general packaging films, driven by food and beverage exports, prompting strategic partnerships between regional converters and global resin suppliers to ensure consistent quality and supply reliability.

The Europe, Middle East & Africa region is characterized by stringent environmental regulations and a strong push toward circular economy frameworks. EU directives on single-use plastics and compostable packaging have accelerated trials of water-soluble film technologies in consumer products, while the Middle East’s petrochemical hubs are exploring co-located production models to supply adjacent markets with technical-grade films. In Africa, limited infrastructure for plastic waste management has spurred interest in films that can dissolve or biodegrade, presenting niche opportunities for film suppliers capable of delivering localized technical support.

Asia-Pacific remains the largest consumption region, underpinned by a mature manufacturing base and expansive electronics and packaging sectors. China’s vast polymer industry produces a broad portfolio of double-side coated and high-barrier films, but recent tariff measures have incentivized manufacturers to diversify sourcing to India and Southeast Asia. Japan and South Korea continue to lead in optical-grade film innovation, driving premium applications in displays and advanced electronics, while Southeast Asian economies are rapidly scaling extrusion-based film lines to serve burgeoning agri-food and e-commerce packaging needs.

This comprehensive research report examines key regions that drive the evolution of the Polyvinyl Alcohol Films market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analyzing Strategic Movements and Competitive Positioning of Leading Companies in the Polyvinyl Alcohol Films Sector to Identify Growth Drivers

Leading industry players are directing capital toward capacity expansion and product differentiation to secure competitive advantage. Kuraray recently announced a strategic expansion of its optical-use Poval film production at the Saijo Plant in Ehime Prefecture, with a new line capable of manufacturing films up to three meters wide. This initiative, scheduled to commence operations in December 2027, aims to meet surging demand from the growing flat-panel display market driven by larger screen sizes and high-resolution formats. Under its “PASSION 2026” medium-term management plan, Kuraray has concurrently commissioned water-soluble film capacity additions in Poland and brought forward the start-up of an advanced production line at the Kurashiki Plant, signaling its commitment to both optical and soluble film segments.

Meanwhile, Sekisui Specialty Chemicals has implemented global price adjustments to address raw material cost pressures and ensure sustainable margins. On April 10, 2025, the company announced price increases of $200 per metric ton for its Selvol polyvinyl alcohol product lines-Ultiloc, Ultalux, and Premiol-across North America, Latin America, Asia, and EMEA markets, effective May 15, 2025. This price recalibration underscores tightness in PVA resin supply and highlights the strategic importance of maintaining secure sourcing agreements. Both Kuraray and Sekisui continue to invest in R&D initiatives aimed at developing high-barrier coatings and novel biodegradable formulations to drive the next wave of PVA film innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Polyvinyl Alcohol Films market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Kuraray Co., Ltd.

- Mitsubishi Chemical Corporation

- Sekisui Chemical Co., Ltd.

- Aicello Corporation

- Ecopol S.p.A.

- Solupak Ltd

- Toyobo Co., Ltd.

- Arrow GreenTech Ltd.

- Jeva Packaging Limited

- Bioplastics International

- Amtrex Nature Care Pvt Ltd.

- ANHUI LIWEI CHEMICAL CO.,LIMITED

- BASF SE

- BOULING CHEMICAL CO.,LIMITED

- Breton S.p.A.

- Chang Chun Group

- CiYu Polymer Material(Changzhou) Co., Ltd.

- Cortec Corporation

- Haining Sprutop Chemical Co., Ltd.

- HENAN JINHE INDUSTRY CO.,LTD

- Jiangmen Proudly Water‑Soluble Plastic Co., Ltd.

- Noble Industries

- Sinochem Nanjing Corporation

- Soltec Development SAS

- Zhaoqing FangXing Packing Material Co., Ltd.

Formulating Actionable Strategic Recommendations That Empower Industry Leaders to Navigate Challenges and Capitalize on Opportunities in Polyvinyl Alcohol Films

Industry leaders would benefit from diversifying their raw material sources and forging strategic partnerships with regional resin producers to offset tariff-related cost increases and ensure uninterrupted supply. By evaluating the cost-benefit trade-offs between extrusion and solvent casting, manufacturers can optimize production portfolios to serve both high-volume packaging markets and premium electronic applications more profitably. Investing in advanced coating technologies and multi-layer film structures will enable differentiation through enhanced barrier performance, particularly as consumer and regulatory demands for reduced preservation agents intensify.

To further capitalize on market trends, companies should integrate sustainability criteria into product development roadmaps, emphasizing bio-based additives and closed-loop recycling compatibility. Engaging with policymakers and industry associations on extended producer responsibility frameworks can preempt regulatory risk and secure early market access for water-soluble and biodegradable film innovations. Finally, adopting digital manufacturing platforms and real-time quality analytics will bolster operational agility, reduce waste, and support rapid scale-up of new film grades in response to evolving end-use demands.

Detailing a Robust and Transparent Research Methodology That Ensures Comprehensive, Credible, and Actionable Insights for Polyvinyl Alcohol Films Analysis

This analysis integrated multi-tiered research methods to ensure comprehensive coverage and credible insights. The secondary research phase included examination of policy documents, trade publications, and company press releases to map tariff changes, capacity investments, and regulatory developments. Concurrently, primary interviews were conducted with industry experts, technical consultants, and key stakeholders to validate market dynamics and uncover emerging use cases for water-soluble and high-barrier films.

Qualitative data were triangulated with competitive intelligence and technology trend analyses to align segmentation frameworks and regional perspectives. Insights from leading resin producers and film converters informed the evaluation of manufacturing process trade-offs and material performance considerations. Finally, a rigorous review process by polymer science specialists and senior market analysts ensured the clarity, accuracy, and strategic relevance of all findings, delivering an actionable framework for decision-makers.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Polyvinyl Alcohol Films market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Polyvinyl Alcohol Films Market, by Product Type

- Polyvinyl Alcohol Films Market, by Thickness Range

- Polyvinyl Alcohol Films Market, by Form

- Polyvinyl Alcohol Films Market, by Production Technology

- Polyvinyl Alcohol Films Market, by Material Type

- Polyvinyl Alcohol Films Market, by Sales Channel

- Polyvinyl Alcohol Films Market, by Application

- Polyvinyl Alcohol Films Market, by Region

- Polyvinyl Alcohol Films Market, by Group

- Polyvinyl Alcohol Films Market, by Country

- United States Polyvinyl Alcohol Films Market

- China Polyvinyl Alcohol Films Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 1908 ]

Synthesizing the Pivotal Findings and Strategic Imperatives That Will Guide Stakeholders in Maximizing Value from Polyvinyl Alcohol Films

The polyvinyl alcohol films market stands at a pivotal inflection point, driven by technological innovation, sustainability mandates, and evolving trade policies. Segmentation across end use, film type, manufacturing process, grade, and thickness highlights diverse growth pathways-from water-soluble agricultural sachets to optical substrates for next-generation displays. Regional analysis underscores the need for adaptive strategies in the Americas, EMEA, and Asia-Pacific, each with unique regulatory and demand dynamics.

In this shifting landscape, companies must combine agile supply chain management with targeted R&D investments to navigate tariff pressures and capitalize on environmental regulations. Strategic capacity expansions by key players such as Kuraray and pricing recalibrations by Sekisui Specialty Chemicals illustrate the competitive imperative of balancing cost, performance, and innovation. By aligning product portfolios with emerging sustainability requirements and leveraging advanced manufacturing techniques, stakeholders can unlock significant value and secure long-term market leadership in the dynamic polyvinyl alcohol films sector.

Connect Directly with Ketan Rohom to Secure Exclusive Insights and Purchase the Comprehensive Polyvinyl Alcohol Films Market Research Report Today

To gain immediate access to our comprehensive analysis, secure your copy of the full Polyvinyl Alcohol Films Market Research Report by contacting Ketan Rohom (Associate Director, Sales & Marketing) at your earliest convenience. He will provide you with exclusive insights, detailed data, and tailored support to help you make informed strategic decisions and unlock new growth opportunities.

- How big is the Polyvinyl Alcohol Films Market?

- What is the Polyvinyl Alcohol Films Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?