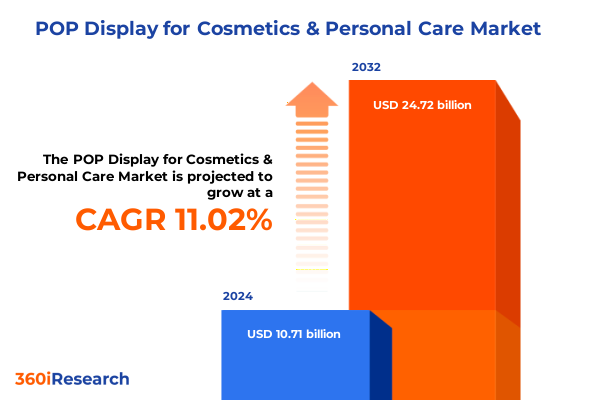

The POP Display for Cosmetics & Personal Care Market size was estimated at USD 11.77 billion in 2025 and expected to reach USD 12.94 billion in 2026, at a CAGR of 11.18% to reach USD 24.72 billion by 2032.

An Engaging Prelude Demonstrating How Point-of-Purchase Display Innovations Are Driving Consumer Interactions in Cosmetics and Personal Care

Point-of-purchase displays have emerged as a pivotal interface between brands and consumers in the cosmetics and personal care arena. These dynamic in-store installations extend beyond merely presenting products on shelves; they encapsulate brand stories convey promotional messages and cultivate multisensory experiences that resonate deeply with today’s empowered shoppers. In a market defined by rapid innovation and intensifying competition retail stakeholders increasingly view POP displays as strategic assets capable of differentiating merchandise and guiding purchasing decisions through immersive visual appeal and interactive elements.

Over recent years consumer expectations have evolved significantly. Shoppers now seek engaging touchpoints that blend tactile exploration with digital engagement enabling them to discover product benefits firsthand and access supplementary information via on-display screens or QR codes. Retailers have responded by integrating advanced display designs into store layouts optimizing sightlines and experimenting with modular components that can be rapidly updated or customized. This introductory overview sets the stage for a detailed exploration of transformative trends cost implications segmentation insights regional dynamics and forward-looking recommendations that shape the future of POP display solutions in this dynamic sector.

Insight into the Major Transformational Shifts Redefining Retail Environments and Consumer Engagement through POP Displays in Cosmetics

The landscape of in-store retail has undergone transformative upheaval driven by shifting consumer behaviors technological advancement and a growing emphasis on experiential marketing. Interactive digital signage equipped with touchscreens and augmented reality capabilities has shifted point-of-purchase displays from static showcases into dynamic brand ambassadors. This evolution enables customers to visualize makeup shades on virtual models access personalized skincare diagnostics or engage in gamified promotions directly at the shelf.

Concurrently sustainability considerations have transcended niche status to become mainstream imperatives. Brands and retailers are experimenting with biodegradable materials recycled substrates and carbon-neutral production methods for display structures. Additionally an omnichannel imperative has prompted the integration of unified inventory systems and QR-enabled price checks that bridge e-commerce and brick-and-mortar experiences. These converging shifts underscore a broad industry pivot toward data-driven engagement modular design and environmental stewardship heralding a new era of retail display innovation that delivers authenticity relevance and operational agility.

Comprehensive Examination of How Evolving United States Tariff Policies in 2025 Are Reshaping Supply Chains and Cost Structures for POP Displays

United States tariff regulations have exerted a profound and cumulative influence on the cost structures and supply chain strategies associated with point-of-purchase displays. Since the enactment of Section 232 measures on steel and aluminum several years ago manufacturers have faced additional duties on metal-based display components reaching 25 percent for steel substrates and 10 percent for aluminum framing. These charges have cascaded into elevated material costs for display builders who rely heavily on durable metal fixtures to support premium cosmetics brands.

Moreover Section 301 tariffs targeting imports from China have encompassed a range of display materials plastic substrates acrylic sheets and certain electronic display modules under a 7.5 percent duty. The combined effect of these policies has prompted many suppliers to reevaluate sourcing strategies pursue domestic fabrication partnerships and optimize product designs to reduce material intensity. Consequently supply chain networks have become more localized and leaner with an increased emphasis on agility to manage tariff volatility and ensure timely delivery of seasonal and campaign-driven displays.

Illuminating Deep Segmentation Perspectives Across Product Types Materials Technologies and End-User Channels Influencing POP Display Strategies

A nuanced understanding of market segmentation provides essential guidance for designing and deploying point-of-purchase displays that resonate with target retail environments and consumer expectations. Based on product type the market bifurcates into fixed displays and freestanding displays each offering distinct benefits. Within fixed displays countertop shelving and wall-mounted units deliver streamlined integration into existing retail fixtures while shelf attachments enhance visibility at the consumer touchpoint. Freestanding displays encompass a spectrum from versatile dump bins to commanding floor displays and specialized kiosks or totem signage creating standalone focal points that guide shopper traffic patterns.

Material type segmentation informs durability aesthetics and sustainability considerations guiding selection among acrylic composites cardboard alternatives metal constructs plastic configurations or natural wood assemblies. Technology choices further differentiate performance with digital displays leveraging dynamic content and interactive functionalities complemented by the reliability and simplicity of static printed displays. Finally end-user segmentation spans environments such as convenience stores departmental settings immersive experience outlets specialized boutiques and supermarkets each with unique spatial constraints shopper demographics and merchandising objectives that influence display design and placement strategies.

This comprehensive research report categorizes the POP Display for Cosmetics & Personal Care market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Material Type

- Technology

- End-User

Revealing Impactful Regional Dynamics Across the Americas EMEA and Asia-Pacific That Are Steering Growth Patterns in Cosmetics POP Displays

Regional dynamics exert profound influence on both consumer preferences and logistical frameworks for point-of-purchase displays in the cosmetics and personal care sector. In the Americas varying regulatory regimes encompass North America’s stringent safety and sustainability standards alongside emerging Latin American markets characterized by boutique-style specialty stores and evolving supermarket chains. These environments demand adaptable display solutions that address diverse retail footprints and shifting consumer priorities.

Meanwhile Europe Middle East and Africa present a tapestry of mature European cosmetics hubs with premium department store experiences alongside rapidly expanding Middle Eastern luxury malls and African convenience networks. Display providers must navigate complex trade agreements and local content regulations while customizing aesthetic approaches to reflect regional design sensibilities. In Asia-Pacific the convergence of digitally savvy consumers in East Asia and accelerating retail modernization across Southeast Asia and India has fueled demand for technologically advanced and locally optimized display strategies. Across these regions market participants balance uniform brand messaging with culturally nuanced activations to maximize in-market resonance and operational efficiency.

This comprehensive research report examines key regions that drive the evolution of the POP Display for Cosmetics & Personal Care market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Analytical Overview of Leading Industry Players Harnessing Innovation and Strategic Partnerships to Elevate POP Display Solutions in the Cosmetics Sector

Industry leaders in the point-of-purchase display arena are forging competitive advantages by integrating advanced manufacturing capabilities with strategic partnerships. Top-tier suppliers showcase expertise in modular design engineering scalable production and rapid prototyping enabling swift deployment of seasonal and promotional campaigns. Companies with in-house digital content studios offer end-to-end solutions that marry hardware expertise with content management to deliver seamless omnichannel experiences.

Collaborations with major cosmetics brands and retail chains have catalyzed bespoke display innovations tailored to iconic product launches or immersive pop-up activations. Strategic acquisitions have broadened portfolios to encompass sustainable material offerings and expanded regional footprints, further strengthening supply chain resilience. In addition investment in pilot programs testing biodegradable synthetics and electronic shelf labels underscores a collective commitment among leading players to pursue both environmental stewardship and operational efficiency in an increasingly competitive market landscape.

This comprehensive research report delivers an in-depth overview of the principal market players in the POP Display for Cosmetics & Personal Care market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Abbe Pty Ltd.

- Adequate Steel Fabricators

- Ardent Displays

- Array Marketing

- Ashtonne Packaging

- Avante Point-Of-Purchase Displays

- Bling Bling Creative Custom Packaging

- DIAM Group

- Diamond Cosmetics

- DS Smith PLC

- Felbro, Inc.

- Great Little Box Company Ltd.

- Great Northern Corporation

- Hicon POP Displays Ltd.

- JC Display Packaging Co., Ltd

- KSF Global Ltd.

- Kunshan Deco POP Display Co., Ltd.

- Landaal Packaging Systems

- Marketing Alliance Group

- Menasha Packaging Company, LLC

- Mitchel-Lincoln Packaging Ltd.

- PAX Solutions, Inc.

- PILOTES

- POP Solutions S.A.

- PPDANDG.com, Inc.

- Printex Transparent Packaging

- Rich Ltd. by DGS Retail

- RTC Europe Ltd.

- Shenzhen LangYi Packaging Display Co., Ltd.

- Smurfit Kappa Group PLC

- Sonoco Products Company

- Stephen Gould Corporation

- The Vomela Companies

- TPH Global Solutions

- Wrights Plastics

Strategic Action Plans for Industry Leaders to Enhance POP Display Effectiveness Embrace Sustainability and Leverage Digital Integration for Competitive Advantage

To excel in the evolving point-of-purchase display landscape industry leaders must adopt a proactive multifaceted approach that emphasizes both innovation and efficiency. Companies should prioritize integration of eco-friendly substrates and scalable modular designs that facilitate rapid updates for promotional rotations and product lifecycle changes. By embedding digital interfaces and real-time inventory sensors brands can deliver personalized experiences while optimizing replenishment processes.

Furthermore establishing localized production hubs close to major retail markets can reduce lead times mitigate tariff exposure and enhance supply chain agility. Strategic alliances with technology providers will enable experimentation with augmented reality try-on applications and interactive content systems that drive higher engagement rates. Additionally leveraging data analytics from in-store interactions will provide actionable insights into consumer behavior, enabling continuous refinement of display strategies. Such coordinated measures will equip market participants to navigate competitive pressures and capitalize on emerging opportunities.

In-Depth Description of the Methodological Framework Combining Primary Secondary Research and Robust Data Triangulation to Ensure Unbiased Market Insights

This research employs a robust methodology combining comprehensive secondary research with targeted primary engagements to ensure depth accuracy and objectivity. In the secondary phase data was compiled from industry white papers trade association reports and global customs databases supplemented by credible news sources and academic journals. This foundation established baseline insights into historical tariffs material trends and technological adoption patterns.

Subsequently primary research was conducted through structured interviews and surveys with senior executives from leading display manufacturers brand marketing teams and retail procurement decision-makers. Input from these stakeholders was triangulated with proprietary supply chain data to validate findings and fill critical information gaps. An iterative review process involving an external advisory panel of industry experts further refined the analysis while standardized quality checks safeguarded data integrity. This methodological framework ensures that conclusions and recommendations reflect the most reliable and current intelligence available.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our POP Display for Cosmetics & Personal Care market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- POP Display for Cosmetics & Personal Care Market, by Product Type

- POP Display for Cosmetics & Personal Care Market, by Material Type

- POP Display for Cosmetics & Personal Care Market, by Technology

- POP Display for Cosmetics & Personal Care Market, by End-User

- POP Display for Cosmetics & Personal Care Market, by Region

- POP Display for Cosmetics & Personal Care Market, by Group

- POP Display for Cosmetics & Personal Care Market, by Country

- United States POP Display for Cosmetics & Personal Care Market

- China POP Display for Cosmetics & Personal Care Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Concise Synthesis Underscoring the Key Takeaways and Strategic Imperatives for Leveraging POP Display Trends in Cosmetics and Personal Care

In summary point-of-purchase displays stand at the forefront of retail innovation in the cosmetics and personal care sector offering brands compelling avenues to captivate consumers and drive in-store performance. The convergence of digital technologies and sustainability mandates has propelled a wave of transformation reshaping design priorities and operational models. Concurrently tariff dynamics underscore the urgency of flexible sourcing strategies and localized manufacturing to offset cost increases and enhance supply chain resilience.

Strategic segmentation insights reveal the importance of customizing fixed and freestanding display formats to specific retail contexts while material and technology choices must align with brand values and shopper expectations. Regional nuances further necessitate culturally attuned activations that balance uniformity with localization. Leading suppliers distinguish themselves through integrated service models innovation partnerships and commitment to environmental stewardship. By embracing the actionable recommendations outlined here industry stakeholders can position themselves to thrive amid dynamic market shifts and emerging consumer trends.

This conclusive reflection underscores the critical role of informed decision-making and agile execution in maximizing the impact of point-of-purchase displays and sustaining competitive advantage in an increasingly complex global marketplace.

Prompt to Engage with Associate Director Sales and Marketing for Exclusive Access to the Comprehensive Cosmetics and Personal Care POP Display Market Research Report

We welcome industry visionaries and decision-makers to connect with Ketan Rohom Associate Director Sales & Marketing at 360iResearch to secure the definitive market research report on POP displays for the cosmetics and personal care domain. This report has been meticulously assembled to empower your organization with unparalleled insights strategic frameworks and practical guidance tailored to the unique demands of this vibrant industry. By engaging directly with Ketan Rohom you gain access to an exclusive overview of in-depth analyses of evolving consumer behaviors and competitive dynamics that can drive your brand’s growth trajectory.

Whether you aim to refine your product launch strategies optimize supply chains or build stronger partnerships with retail channels this research compendium serves as an invaluable resource. Through personalized discussions you can explore customized data modules and tailored advisory options that address your specific challenges and objectives. Don’t miss this opportunity to leverage data-driven intelligence and secure a competitive edge in an ever-intensifying marketplace. Reach out today to schedule a consultation and learn how this essential market research can catalyze your decision-making processes accelerate your innovation roadmap and unlock new pathways for sustainable success.

- How big is the POP Display for Cosmetics & Personal Care Market?

- What is the POP Display for Cosmetics & Personal Care Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?