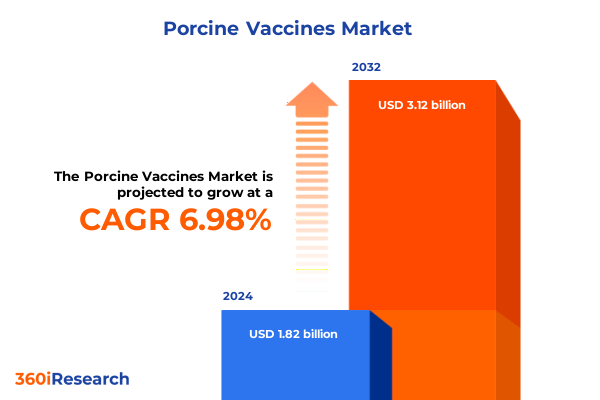

The Porcine Vaccines Market size was estimated at USD 1.94 billion in 2025 and expected to reach USD 2.07 billion in 2026, at a CAGR of 6.99% to reach USD 3.12 billion by 2032.

Porcine Vaccine Market Introduction Emphasizing Disease Control Imperatives Technological Evolution and Strategic Priorities for Sustainable Growth

Porcine vaccines form the cornerstone of modern swine health management, playing an essential role in safeguarding animal welfare, ensuring food security, and sustaining economic viability across global pork supply chains. The intensification of pig farming practices has heightened vulnerability to endemic and emerging pathogens such as classical swine fever, porcine reproductive and respiratory syndrome, and swine influenza, underscoring an urgent need for robust immunization protocols. In response, the industry has witnessed a marked acceleration in research and development activities aimed at delivering next-generation vaccines that offer enhanced efficacy, safety, and deployment flexibility. As regulatory agencies evolve to facilitate streamlined approvals for innovative platforms, stakeholders are presented with opportunities to align their strategic priorities with advancing technological capabilities and shifting market demands.

Emerging Innovations and Regulatory Developments Reshaping Porcine Vaccine Research Production and Access Across Global Biotech Ecosystem

The landscape of porcine vaccine development has undergone transformative shifts propelled by breakthroughs in molecular biology and delivery systems. Novel mRNA constructs are progressing from experimental research to field trials, promising rapid response to antigenic drift and enhanced immunogenicity without the risks associated with live organisms. Concurrently, recombinant virus vectored approaches leverage adenovirus and poxvirus backbones to target multiple disease indications within a single formulation, while advancements in subunit design and adjuvant combinations optimize targeted immune activation. These technological strides are complemented by digital tools such as AI-driven antigen screening and blockchain-enabled cold chain monitoring, which are redefining efficiency and transparency throughout the vaccine lifecycle. Consequently, traditional paradigms centered on inactivated whole-virus or live attenuated preparations are giving way to precision platforms that align with evolving biosecurity and sustainability standards.

Regulatory frameworks and market access pathways are also adapting to accommodate these innovations, with authorities instituting provisional licensing for platform-based vaccines and harmonizing data requirements across regions. Public–private partnerships have flourished, enabling faster translation of benchside discoveries into commercial offerings through coordinated funding, shared manufacturing capacities, and joint surveillance networks. Moreover, shifting consumer expectations for antibiotic reduction in livestock production have elevated the strategic importance of preventive immunization, prompting integrators and producers to integrate vaccine procurement into their quality assurance programs. As a result, the porcine vaccine sector is experiencing a convergence of scientific ingenuity, regulatory support, and end-user demand that sets the stage for sustained growth and resilience.

Assessing the Comprehensive Impact of 2025 United States Tariffs on Porcine Vaccine Value Chains Raw Material Sourcing and Cost Structures

In early 2025, the United States implemented a series of tariff measures targeting imports of key raw materials, single-use bioprocessing equipment, and ancillary components used in porcine vaccine manufacturing. These duties, applied at rates upward of 15 percent on select inputs sourced from specific trading partners, have exerted upward pressure on production costs and prompted manufacturers to reassess supply chain configurations. Many producers have responded by negotiating long-term contracts with domestic suppliers or relocating certain stages of fill–finish operations to tariff-exempt jurisdictions. While such adaptations mitigate immediate cost impacts, they also heighten complexity in inventory planning and logistical coordination across cross-border networks.

Beyond direct cost inflation, the tariff regime has spurred broader strategic realignment among vaccine developers and contract manufacturing organizations. Companies are increasingly investing in localized raw material production-such as adjuvant synthesis and vial fabrication-to insulate critical operations from policy volatility. Simultaneously, the prospect of retaliatory duties in export markets has catalyzed diversification of end-user engagement strategies, with sales teams targeting new regions where trade barriers remain minimal. This dynamic environment underscores the necessity for real-time tariff monitoring, agile sourcing strategies, and proactive stakeholder engagement with policymakers to influence future trade negotiations in ways that support both national biosecurity goals and global animal health objectives.

In-Depth Segmentation Analysis Revealing Insights Across Vaccine Types Disease Indications End Users Routes Technologies and Formulations for Porcine Immunization

Analyzing the porcine vaccine landscape through a lens of vaccine type segmentation reveals a rich tapestry of platform diversity. Traditional inactivated vaccines, whether split virus, subcellular, or whole virus, continue to anchor immunization programs against classical swine fever and erysipelas, yet are now complemented by live attenuated constructs designed for homologous and heterologous strain protection. The emergence of mRNA platforms, differentiated into self-amplifying and non-amplifying formats, signals a paradigm shift toward rapid antigen update and dose-sparseness. Similarly, subunit formulations-divided between protein subunits and polysaccharide subunits-offer refined safety profiles, while virus-vectored solutions built on adenovirus and poxvirus backbones enable multivalent targeting with a single administration.

Disease indication segmentation underscores priority areas for innovation and adoption. Vaccines targeting porcine reproductive and respiratory syndrome have benefited from iterative enhancements in adjuvant pairing and delivery, whereas novel candidates for swine influenza leverage advanced antigen mapping to contend with seasonal and zoonotic spillover risks. Research institutes and commercial farms alike continue to evaluate vaccine performance under diverse herd management practices, while veterinary hospitals and smallholder operations prioritize ease of administration when selecting intradermal, intramuscular, intranasal, oral, or subcutaneous routes tailored to their operational constraints.

Technology segmentation further illustrates evolution from conventional attenuated live or killed whole approaches to next-generation DNA, recombinant, RNA, and virus-like particle technologies. Within recombinant vaccines, expression systems spanning bacterial, insect cell, and yeast platforms yield scalable antigen production with consistent quality attributes. Concurrently, dosage form segmentation highlights the role of emulsion, liquid, and lyophilized presentations in optimizing shelf stability, cold chain resilience, and field deployment under varying climatic and logistical conditions. Taken together, these interconnected segmentation lenses offer a holistic understanding of the porcine vaccine market’s multifaceted innovation pathways and end-user preferences.

This comprehensive research report categorizes the Porcine Vaccines market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Vaccine Type

- Disease Indication

- End User

- Route Of Administration

- Technology

- Dosage Form

Regional Dynamics and Growth Drivers Unveiled Across Americas Europe Middle East Africa and Asia Pacific Porcine Vaccine Deployment Trends

In the Americas, robust investments in research infrastructure and strong collaborations between academic centers and industry have accelerated the translation of novel vaccine platforms into regulatory submissions. Producers within the United States and Canada increasingly incorporate advanced analytics to tailor immunization schedules for large-scale commercial operations, while Mexican swine farmers focus on cost-effective formulations that address local disease pressures. Moreover, government support for domestic manufacturing of critical reagents and equipment serves to buffer the region against trade disruptions and supply chain shocks.

Within Europe, the Middle East, and Africa, regulatory harmonization initiatives are enabling faster cross-border registration of enterprise-level vaccine solutions. European producers benefit from well-established channels for conducting multicenter trials and accessing advanced adjuvant technologies, while nations across the Middle East and Africa invest in capacity-building programs to expand local fill-finish and distribution networks. This concerted effort to decentralize production is particularly significant in regions grappling with African swine fever incursions, where rapid deployment of emergency vaccines is essential to curbing transboundary spread.

Asia-Pacific markets demonstrate the most dynamic growth trajectory, driven by recurring disease outbreaks and a surge in domestic biotech investments. China and Vietnam have ramped up state-sponsored R&D funding for live attenuated and mRNA candidates, supported by streamlined approval pathways for platform technologies. Meanwhile, Australia and New Zealand leverage their biosecure production environments to serve as regional hubs for vaccine export. Across the region, increasing adoption of intradermal and oral administration routes reflects a shift toward labor-efficient mass vaccination campaigns, ensuring broader herd immunity under diverse farming models.

This comprehensive research report examines key regions that drive the evolution of the Porcine Vaccines market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Strategic Positioning and Pipeline Innovations Among Leading Porcine Vaccine Developers Highlighting Competitive Collaborations and Market Differentiation

Leading developers in the porcine vaccine arena have distinguished themselves through strategic collaborations and robust pipelines. One major animal health company has secured partnerships with synthetic biology firms to co-develop mRNA candidates targeting multiple swine pathogens, while another has focused on expanding its portfolio of virus-vectored vaccines via licensing agreements with academic spin-outs. Outreach to contract manufacturing organizations and alliances with equipment suppliers further fortify their ability to scale production and meet surging demand for advanced formulations.

Smaller specialized biotech firms complement these efforts by driving early-stage innovation in antigen design and adjuvant engineering. Several have attracted venture funding to validate self-amplifying RNA constructs under field conditions, whereas others have carved niche positions around recombinant protein platforms expressed in yeast and insect cells. Collectively, these entities contribute to a vibrant ecosystem that spans discovery through commercialization, fostering competitive differentiation through intellectual property, formulation expertise, and go-to-market agility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Porcine Vaccines market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Bimeda Holdings PLC

- Boehringer Ingelheim International GmbH

- Ceva Santé Animale S.A.

- Chengdu Tianbang Biological Products Co., Ltd.

- Chopper Animal Health Co., Ltd.

- Elanco Animal Health Incorporated

- Hipra, S.A.

- Indian Immunologicals Ltd.

- Jinyu Bio-Technology Co., Ltd.

- Kyoritsu Seiyaku Corporation

- Merck & Co., Inc.

- Pharmgate Animal Health, LLC

- Phibro Animal Health Corporation

- Qilu Animal Health Products Co., Ltd.

- Vaxxinova International BV

- Venkateshwara Hatcheries Pvt. Ltd.

- Zoetis Inc.

Action-Oriented Strategies for Industry Leaders to Innovate Optimize Supply Chains and Navigate Regulatory Landscapes in the Porcine Vaccine Sector

Industry leaders should accelerate investments in modular manufacturing architectures that can pivot rapidly among different vaccine platforms, reducing time to market when responding to emergent disease challenges. Establishing strategic partnerships with domestic and international suppliers of critical raw materials-such as adjuvants, vials, and single-use bioreactors-will enhance supply chain resilience amid fluctuating trade policies. Furthermore, proactive engagement with regulatory authorities to co-create data guidelines for novel modalities can streamline approval timelines while ensuring safety and efficacy.

To maximize field uptake, organizations should integrate digital traceability solutions that monitor vaccination coverage and herd immunity in real time, thereby enabling data-driven adjustments to immunization strategies. Tailoring product offerings to the unique needs of smallholder and large-scale commercial farms through flexible administration formats and dosage presentations will broaden market access. Lastly, fostering a collaborative innovation ecosystem-bringing together academia, biotech innovators, and end-user associations-will catalyze the next wave of breakthroughs and drive sustainable growth in global swine health.

Robust Research Methodology Underpinning Porcine Vaccine Market Insights Including Data Collection Expert Validation and Analytical Frameworks for Reliability

This report synthesizes insights gathered through a rigorous research framework combining primary and secondary approaches. Primary data were obtained via in-depth interviews with senior executives, research scientists, and veterinary practitioners across key regions, ensuring diverse perspectives on emerging trends and unmet needs. Secondary research involved systematic review of scientific literature, regulatory filings, patent databases, and industry white papers, offering a comprehensive backdrop for understanding technological advancements and policy developments.

Quantitative analyses were triangulated by comparing multiple data sources to validate qualitative observations and identify consistent patterns in platform adoption, disease prioritization, and end-user preferences. Geographic and segmentation breakdowns were refined through expert panel discussions and scenario planning exercises, which helped to contextualize regional dynamics and supply chain considerations. Throughout this process, methodological rigor was upheld via continuous peer review and adherence to best practices in market research, ensuring that the findings presented here are both reliable and actionable.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Porcine Vaccines market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Porcine Vaccines Market, by Vaccine Type

- Porcine Vaccines Market, by Disease Indication

- Porcine Vaccines Market, by End User

- Porcine Vaccines Market, by Route Of Administration

- Porcine Vaccines Market, by Technology

- Porcine Vaccines Market, by Dosage Form

- Porcine Vaccines Market, by Region

- Porcine Vaccines Market, by Group

- Porcine Vaccines Market, by Country

- United States Porcine Vaccines Market

- China Porcine Vaccines Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2226 ]

Concluding Perspectives on Porcine Vaccine Market Opportunities Challenges and the Path Forward for Enhanced Animal Health Security and Industry Resilience

In conclusion, the porcine vaccine sector stands at the intersection of scientific innovation, regulatory evolution, and market demand for enhanced animal health security. The interplay of advanced platforms-from mRNA and virus-vectored constructs to refined subunit and recombinant approaches-signals a new era in swine immunization, characterized by precision, flexibility, and safety. While trade tensions and tariff regimes introduce complexities in global supply chains, the industry’s resilience is bolstered by strategic localization, partnership models, and digital enablement.

Looking ahead, stakeholders who proactively align their R&D investments with end-user preferences, regulatory pathways, and regional dynamics will be best positioned to capture emerging opportunities. By embedding agility in manufacturing, fostering collaborative innovation ecosystems, and maintaining continuous dialogue with policy makers and practitioners, vaccine developers can ensure that the health and productivity of swine populations are safeguarded against both present and future threats.

Engage with Ketan Rohom to Access a Comprehensive Porcine Vaccine Market Research Report Tailored to Drive Informed Decisions and Competitive Advantage

To gain unparalleled visibility into the evolving porcine vaccine market and leverage strategic insights for your organization’s growth, connect with Ketan Rohom (Associate Director, Sales & Marketing) to secure a tailored report that addresses the pivotal trends, competitive dynamics, and regulatory shifts shaping the future of swine immunization. This comprehensive analysis will empower your team to make informed decisions regarding portfolio planning, supply chain resilience, and innovative platform investments, driving competitive advantage and safeguarding animal health across diverse production systems.

- How big is the Porcine Vaccines Market?

- What is the Porcine Vaccines Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?