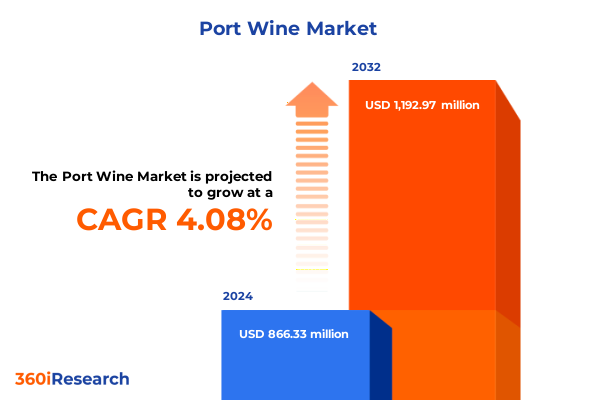

The Port Wine Market size was estimated at USD 901.77 million in 2025 and expected to reach USD 943.57 million in 2026, at a CAGR of 4.07% to reach USD 1,192.97 million by 2032.

Unlocking the Rich Heritage and Modern Resurgence of Port Wine’s Storied Douro Valley Tradition and Contemporary Appeal

Port wine stands as an emblem of heritage, tracing its origins to the lush vineyards of Portugal’s Douro Valley. Rooted in centuries-old viticultural traditions, this fortified wine embodies a synthesis of history and terroir that has captivated connoisseurs worldwide. Initially produced to ensure safe passage during long sea voyages, Port’s high-alcohol content and rich flavor profile quickly earned it a place of prestige on European tables and beyond. Over time, iconic houses have refined production methods, balancing innovation with the reverence for ancestral techniques that define the region’s legacy.

In recent years, Port wine has experienced a modern resurgence, fueled by renewed consumer interest in premium and unique experiences. Millennials and Generation Z are drawn to the storied narratives behind each bottle, seeking authenticity and craftsmanship in every pour. Simultaneously, the rise of wine tourism in the Douro Valley has transformed estates into immersive destinations, inviting enthusiasts to explore ancient terraced vineyards and traditional lagares. This renaissance underscores Port wine’s enduring allure and its evolving role in a global market that prizes both tradition and transformation.

Navigating the Turning Tides of Premiumization Digital Innovation and Sustainability Shaping the Future Landscape of Port Wine

The Port wine category is undergoing transformative shifts, driven by a renewed emphasis on premiumization and digital innovation. Consumers are increasingly placing value on quality over quantity, opting for fortified wines that deliver complex flavor profiles and a sense of exclusivity. This premiumization trend has prompted winemakers to introduce limited-edition runs, heritage vintages, and experimental blends that cater to discerning palates seeking distinctive sensory experiences. Moreover, the incorporation of Port into modern cocktail culture has expanded its reach beyond the traditional dessert wine niche, encouraging mixologists to craft fortified wine–based creations that resonate with younger, adventurous audiences.

Concurrently, sustainability has emerged as a defining force reshaping production and packaging practices. Winemakers are adopting organic viticulture, exploring resistant grape varieties suited to changing climates, and experimenting with eco-friendly closures and lightweight bottles to reduce carbon footprints. Digital transformation is complementing these efforts, with direct-to-consumer e-commerce platforms and virtual tasting experiences forging deeper connections between brands and consumers. As immersive technologies evolve, wine estates are leveraging augmented reality labels and interactive storytelling to convey authenticity and provenance, ensuring Port wine remains at the forefront of a dynamically evolving marketplace.

Assessing the Ripple Effects of 2025 United States Tariffs on Port Wine Imports Supply Chains and Consumer Pricing Dynamics

In April 2025, sweeping United States tariffs reshaped the Port wine landscape, imposing a baseline 10% duty on all imports and an additional 20% reciprocal tariff on European products. Collectively, the effective 30% levy on wines from leading producers such as France, Spain, and Portugal immediately elevated shelf prices and strained traditional supply chains. Importers in key metropolitan hubs began recalibrating their inventories, with initial shipments arriving untariffed affording temporary relief before cost pressures inevitably materialized. As wholesalers deplete these pre-tariff stocks, many have signaled forthcoming price adjustments that could reverberate through retail and on-premise establishments across the country.

The exclusion of Canadian wines under USMCA rules has provided a vital alternative source, sheltering compliant products from the baseline and reciprocal duties imposed on European bottles. This preferential treatment has prompted some retailers to expand Canadian offerings, while European houses are exploring localized bottling agreements and direct-import partnerships to mitigate customs fees. In parallel, domestic producers have ramped promotional efforts, highlighting the comparative stability of homegrown alternatives. Against this backdrop, multi-tier pricing strategies and nimble portfolio adjustments are now central to sustaining profitability and maintaining consumer loyalty in an environment punctuated by regulatory uncertainty and elevated import costs.

Revealing Consumer Demand Diversity Through Product Type Distribution Channel Price Range Age Category and Closure Type Segmentation

The Port wine market displays a rich tapestry of consumer preferences when examined through multiple segmentation lenses. By product type, aficionados gravitate toward expressions such as Late Bottled Vintage and Vintage for their depth and aging potential, while Rosé and White ports appeal to those seeking lighter, fruit-forward alternatives. Ruby and Tawny selections maintain enduring popularity, balancing accessibility and complexity for both neophytes and seasoned collectors alike.

Distribution channels further underscore the category’s adaptability. Off-trade remains a cornerstone, with consumers procuring bottles through online portals that deliver convenience, specialty stores that offer expert curation, and supermarkets that cater to everyday indulgence. Conversely, on-trade venues such as bars, hotels, and restaurants continue to elevate Port’s profile by integrating fortified pairings into gastronomy and cocktail programs, forging new consumption occasions.

Price range segmentation reveals divergent growth opportunities. Economy and Standard tiers drive volume in mass-market contexts, enabling broader audience engagement. Yet Premium and Super Premium brackets command significant margins and fuel aspirational purchasing, particularly among collectors and gift buyers. This duality underscores the importance of calibrated pricing architectures that resonate across demographics.

Age-based preferences also shape demand trajectories. Twenty-Year and Thirty-Year Tawny ports offer a bridge between connoisseurship and experiential exploration, while expressions aged Forty-Year and Above epitomize luxury and celebration. Complementing these divisions, closure types contribute to perceived authenticity and convenience: traditional cork closures reinforce heritage, screw caps ensure consistency for early consumption styles, and synthetic alternatives address sustainability and cost-efficiency concerns.

This comprehensive research report categorizes the Port Wine market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Distribution Channel

- Price Range

- Closure Type

Mapping the Global Footprint of Port Wine Consumption and Production Across Americas Europe Middle East Africa and Asia-Pacific

Regional dynamics profoundly influence Port wine consumption patterns and production strategies. In the Americas, the United States remains a pivotal market, navigating tariff-driven headwinds while sustaining robust demand for premium and Super Premium offerings. Canada’s tariff exemption under USMCA has amplified its share in North American portfolios, and Latin American markets such as Brazil and Mexico are emerging as growth frontiers for both entry-level and aged expressions.

Europe, Middle East & Africa represent the traditional stronghold of Port’s heritage. Portugal and Spain continue to anchor production and export volumes, while niche markets across Germany, the United Kingdom, and the Nordic region display renewed interest in fortified classics. In contrast, Middle East restrictions on alcohol consumption are easing in select markets, unlocking new on-trade and tourism-linked channels. African demand is concentrated in South Africa and emerging urban centers, where fortified wines are gaining visibility through curated retail experiences and wine tourism initiatives.

Asia-Pacific presents a mosaic of opportunity and complexity. Established importers such as Japan and Australia demonstrate steady appetite for Ruby and Vintage Ports, supported by mature specialty retail networks. Meanwhile, China’s burgeoning middle class and growing wine education infrastructure are fueling trials of Tawny and Late Bottled Vintage styles. In India, rising premiumization and an expanding on-trade segment signal future potential, although regulatory frameworks and distribution challenges remain important considerations for market entry strategies.

This comprehensive research report examines key regions that drive the evolution of the Port Wine market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Key Port Wine Producers and Industry Leaders Driving Innovation Strategic Partnerships and Brand Differentiation

The competitive landscape of Port wine is anchored by venerable houses and innovative disruptors alike. Symington Family Estates, a multigenerational custodian, continues to invest in sustainable vineyard management and limited-edition releases that underscore lineage and terroir. The Fladgate Partnership has expanded its portfolio through strategic alliances and travel retail exclusives, leveraging global distribution channels to amplify brand visibility.

Sogevinus Fine Wines has differentiated itself via organic and vegan Port offerings, appealing to environmentally conscious consumers. Taylor’s, renowned for its Historical Collection, has captivated collectors with ultra-aged Tawny expressions, fostering brand loyalty through storytelling and experiential tasting events. Ramos Pinto and Ferreira are forging dynamic partnerships with on-premise operators, introducing bespoke programs that integrate fortified wines into culinary and mixology narratives.

Alongside these legacy players, agile boutique producers are gaining traction by emphasizing micro-vinification techniques and regionally distinctive grape varieties. Their willingness to experiment with cask finishes and unconventional blends resonates with younger demographics seeking novelty. Collectively, these key companies illustrate an industry that balances reverence for tradition with entrepreneurial zeal.

This comprehensive research report delivers an in-depth overview of the principal market players in the Port Wine market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Churchill's Port

- Cockburn's Port

- Dow's Port

- Fonseca Port

- Graham's Port

- Kopke Port

- Quarles Harris Port

- Quinta da Romaneira

- Quinta do Crasto

- Quinta do Noval

- Quinta do Vallado

- Ramos Pinto

- Rozès

- Sandeman & Co.

- Sogrape Vinhos, S.A.

- Symington Family Estates

- Taylor's Port

- The Fladgate Partnership

- W. & J. Graham's

Implementing Strategic Initiatives to Diversify Sourcing Enhance Profitability and Engage Emerging Consumer Segments in Port Wine

Industry leaders can seize competitive advantage by diversifying sourcing strategies and strengthening resilience against tariff volatility. Establishing localized bottling partnerships in key markets allows companies to circumvent import duties while ensuring consistent supply. Simultaneously, adopting a multi-tier pricing architecture that spans Economy through Super Premium segments will optimize revenue streams, meeting entry-level demand without compromising aspirational offerings.

Investments in direct-to-consumer platforms and virtual engagement initiatives are essential to cultivating brand loyalty and collecting actionable consumer data. Interactive digital experiences, including augmented reality labels and immersive virtual tastings, can extend the reach of Port wine narratives beyond traditional on-trade environments. Enhancing supply chain transparency through blockchain-enabled provenance tracking will further distinguish brands in an increasingly discerning marketplace.

Sustainability must remain a cornerstone of long-term strategy. Prioritizing organic viticulture, recyclable closures, and lightweight packaging will appeal to eco-minded consumers while reducing operational costs. Finally, aligning marketing efforts with emerging consumption occasions-such as fortified-based cocktails and gastronomic pairings-will ensure that Port wine maintains relevancy among both seasoned connoisseurs and new-generation drinkers.

Explaining the Rigorous Research Methodology Combining Primary Expert Interviews Secondary Data and Triangulation for Port Wine Analysis

This analysis leverages a robust research methodology designed to ensure rigor, accuracy, and comprehensive insight. Secondary data collection encompassed industry publications, trade journals, and public domain sources, augmented by targeted news outlets to capture real-time developments in tariffs, premiumization, and distribution dynamics. Primary research involved in-depth interviews with senior executives from leading Port producers, importers, and on-trade operators across major markets.

Quantitative data was triangulated with qualitative insights to reconcile divergent perspectives and validate emerging trends. Market segmentation frameworks were refined through iterative expert consultations, ensuring alignment with practical industry categorizations in product type, channel, price range, age, and closure. Regional analyses integrated macroeconomic indicators and regulatory considerations to contextualize consumption patterns.

Throughout the process, peer review and data verification protocols were employed to maintain the highest standards of objectivity. This multi-layered approach provides stakeholders with a nuanced understanding of the Port wine ecosystem, equipping decision-makers with actionable intelligence for strategic planning and investment.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Port Wine market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Port Wine Market, by Product Type

- Port Wine Market, by Distribution Channel

- Port Wine Market, by Price Range

- Port Wine Market, by Closure Type

- Port Wine Market, by Region

- Port Wine Market, by Group

- Port Wine Market, by Country

- United States Port Wine Market

- China Port Wine Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1113 ]

Synthesizing Crucial Insights on Growth Drivers Market Challenges and Strategic Imperatives in the Evolving Port Wine Industry

Port wine’s journey from the Douro Valley to global markets illustrates a category that seamlessly melds heritage with modernity. The confluence of premiumization, digital engagement, and sustainability initiatives underscores an industry at a pivotal inflection point. Producers and distributors must navigate evolving tariff regimes, adapt segmentation strategies, and leverage regional nuances to maintain relevance and profitability.

Key growth drivers include the allure of limited-edition and aged expressions, the expansion of direct-to-consumer channels, and the integration of fortified wines into contemporary consumption occasions. Conversely, regulatory uncertainties and supply chain disruptions necessitate agile sourcing and localized production solutions. By embracing data-driven segmentation frameworks and deploying targeted marketing initiatives across product types, distribution channels, and price tiers, stakeholders can unlock new revenue avenues and reinforce brand equity.

In an environment characterized by both opportunity and complexity, this synthesis of insights offers a strategic compass for navigating the Port wine landscape. Whether refining portfolio architectures, expanding into emerging regions, or enhancing operational efficiencies, decision-makers now possess the intelligence required to chart a course toward sustainable growth.

Connect with Ketan Rohom Associate Director Sales Marketing to Secure Comprehensive Port Wine Market Insights and Drive Informed Business Decisions

Elevate your strategic planning and secure a competitive edge by obtaining the full Port Wine market research report. Our comprehensive study delivers deep-dive analysis across product trends, distribution dynamics, tariff implications, and regional opportunities tailored to your business needs. Reach out to Ketan Rohom, Associate Director, Sales & Marketing, to explore customized licensing options, enterprise packages, and exclusive add-on insights. Engage directly with an expert to discuss how this research can inform your investment decisions, marketing strategies, and supply chain optimization. Don’t miss the chance to harness data-driven intelligence that empowers you to navigate market complexities and capitalize on emerging consumer preferences. Connect today to initiate your purchase process and unlock actionable pathways for sustained growth in the Port Wine industry

- How big is the Port Wine Market?

- What is the Port Wine Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?