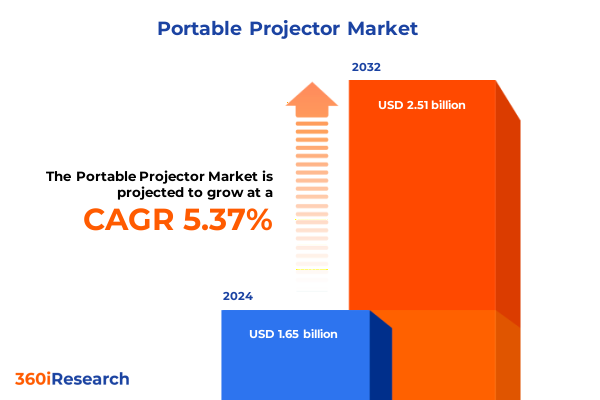

The Portable Projector Market size was estimated at USD 1.74 billion in 2025 and expected to reach USD 1.84 billion in 2026, at a CAGR of 5.37% to reach USD 2.51 billion by 2032.

Unveiling the Evolution of Portable Projection Technology Shaping Mobility, Immersive Experiences, and Seamless Connectivity in Modern Environments

Portable projection devices have undergone a remarkable transformation, shifting from bulky presentation equipment to sleek, mobile solutions that cater to a wide array of professional and consumer needs. Originally designed for corporate boardrooms and lecture halls, these compact systems now deliver high-definition visuals, seamless connectivity, and intelligent feature sets that rival traditional fixed installations. As a result, stakeholders across industries have begun to recognize the distinct advantages of portability, leading to widespread adoption in both established enterprises and emerging digital contexts.

In recent years, advancements in optical engines, battery efficiency, and thermal management have converged to drive significant enhancements in device miniaturization. Smaller footcases conceal powerful light sources capable of vivid color reproduction, while integrated batteries support extended on-the-go usage. This convergence of core technologies not only facilitated the rise of pico and pocket projectors but also paved the way for tabletop variants that balance performance and convenience. Consequently, business leaders and end users alike can now orchestrate immersive presentations and entertainment experiences without logistical constraints.

Looking forward, the portable projector market is poised for further innovation as manufacturers continue to explore new materials and design methodologies. The blending of digital ecosystems with projection hardware signals a shift toward unified user experiences, where content creation and display occur within interconnected environments. This introductory overview establishes the groundwork for understanding how portability, affordability, and feature integration are collectively reshaping projection solutions, setting the stage for deeper analysis across emerging trends and strategic dimensions.

Emergence of AI-Powered, Wireless and Ultra-Compact Projectors Redefining User Engagement Through Intelligent Features and Enhanced Portability

The portable projector arena has undergone a profound metamorphosis, marked by the rapid emergence of AI-driven intelligence and robust wireless capabilities. Manufacturers now embed machine learning algorithms to optimize image scaling, noise reduction, and ambient light sensing, delivering consistently crisp projections regardless of environmental variables. Moreover, voice control and on-device assistants have migrated from smartphones into compact projection units, enabling hands-free operation and dynamic content navigation.

Concurrently, the proliferation of high-speed wireless standards such as Wi-Fi 6 and Bluetooth 5.3 has eradicated many of the historical barriers associated with cable-dependent setups. These advancements facilitate instant screen mirroring and direct streaming from cloud services, ensuring that presentations, gaming sessions, or movie nights remain uninterrupted by hardware constraints. Furthermore, improvements in battery chemistry and power management have extended continuous operation ranges, allowing uninterrupted projection for durations that rival low-to-mid-range laptops.

In terms of optical and display technologies, the industry has witnessed a shift toward laser and hybrid light sources that offer greater longevity and deeper color gamuts than traditional LEDs. This shift, coupled with emerging microdisplay techniques, is fostering a new class of ultra-compact devices capable of 4K/UHD rendering. As these transformative shifts converge, portable projectors are rapidly redefining how individuals and organizations conceive of visual communication, heralding a new paradigm in mobility and user engagement.

Evaluating the Layered Consequences of Recent U.S. Tariff Policies on Portable Projection Imports, Pricing Dynamics and Supply Chain Resilience

The introduction of heightened U.S. import tariffs in early 2025 has generated a cascading set of implications for the portable projector supply chain, pricing structures, and competitive dynamics. As levies on select components and finished goods entered into force, manufacturers confronted elevated costs that were subsequently passed through to distributors and end users. This acute pricing pressure prompted many stakeholders to reevaluate procurement strategies, with particular emphasis on cost-containment and value extraction.

In response, several original equipment manufacturers initiated nearshoring initiatives, redirecting portions of production to North American facilities or regional partners in Mexico and Canada. This strategic pivot sought to circumvent the most onerous tariff bands, shorten lead times, and fortify resilience against future policy shifts. At the same time, inventory management protocols evolved to incorporate advanced demand forecasting, minimizing the risk of stockouts and optimizing working capital allocation. These operational adjustments underscore the agility required to navigate an increasingly complex geopolitical environment.

Long term, the cumulative impact of tariff policy adjustments has stimulated greater collaboration between suppliers and technology licensors, as firms explore cost-sharing arrangements and co-investment in innovative light engines and optical modules. From a market perspective, downstream distributors have leveraged these partnerships to offset margin erosion, offering extended integration services and bundled financing options. Ultimately, the 2025 tariff measures have catalyzed a new era of strategic alignment across the portable projection ecosystem, fostering supply chain robustness and diversified production footprints.

Illuminating Distinct Application, User, Resolution and Connectivity Pathways Through Granular Portable Projector Market Segmentation

A granular examination of portable projector segmentation reveals evolving opportunities across diverse application contexts and user typologies. In corporate business environments, high-brightness models equipped with advanced wireless mirroring dominate boardroom deployments, while the education sector has embraced portable projection across higher education campuses, K-12 classrooms, and online learning platforms. These distinct educational settings have varying performance requirements, prompting manufacturers to tailor lumen outputs and interactive features to match pedagogical needs. Additionally, gaming enthusiasts demand instantaneous device pairing and low-latency performance, bolstering the appeal of pocket-sized solutions optimized for fast refresh rates. Home entertainment consumption, spanning personal home theaters, streaming-integrated devices, and TV replacement scenarios, further underscores the importance of versatility, as these environments require easy content access and premium audio-visual integration. On the other end of the spectrum, outdoor and experiential applications prioritize durability, weather resistance, and extended battery endurance, enabling spontaneous gatherings and pop-up events.

From an end-user standpoint, commercial entities focus on reliability and service-level agreements to support recurring client engagements, whereas educational institutions emphasize interactive capabilities and cost-effective warranty models. Government bodies often mandate compliance with stringent security protocols, influencing connectivity and data management features. Residential consumers, meanwhile, exhibit a confluence of demands, seeking both affordability and premium resolution across 4K/UHD, Full HD, and HD tiers. Light source preferences further diversify the landscape, as laser projectors promise unparalleled lifespan and consistent brightness, LCD units balance cost efficiency with vibrant color accuracy, and LED varieties-spanning RGB LED and white LED configurations-address specific power consumption and color performance trade-offs. Connectivity options extend beyond legacy interfaces such as HDMI and USB to encompass seamless screen mirroring and Wi-Fi Direct for cable-free content delivery, while Bluetooth and VGA maintain relevance in specialized scenarios. Portability classifications, ranging from ultraportable pico and pocket units to more robust tabletop models, enable stakeholders to align form factor with use-case mobility requirements. Distribution channels layer additional complexity, as direct sales teams, modern trade outlets, and specialty showrooms coexist alongside online retail platforms, which include major marketplaces, manufacturer storefronts, and third-party e-tailers. This multi-faceted segmentation matrix highlights the necessity for manufacturers and channel partners to deploy differentiated go-to-market strategies that resonate with each unique consumer cohort.

This comprehensive research report categorizes the Portable Projector market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Resolution

- Light Source

- Connectivity

- Portability Type

- Application

- End User

- Distribution Channel

Comparative Regional Dynamics Shaping Portable Projection Adoption Trends and Market Nuances Across Americas, EMEA and Asia-Pacific Markets

Regional dynamics in the portable projector market reveal nuanced adoption patterns driven by economic, infrastructural, and cultural factors. In the Americas, established corporate and educational institutions in North America have fueled demand for premium models, while Latin American markets demonstrate strong uptake of entry-level devices, supported by e-commerce channels and localized financing programs. The prevalence of remote work and hybrid learning models across the region has further catalyzed interest in portable solutions, as end users prioritize flexibility and rapid deployment.

Turning to Europe, Middle East & Africa, market expansion is marked by contrasting trajectories. Western Europe’s emphasis on sustainability and energy efficiency has propelled adoption of laser-based projectors, particularly in government and research institutions. Meanwhile, growth corridors in the Middle East reflect a penchant for large-venue projection within cultural and entertainment sectors. Sub-Saharan Africa, though still emerging, exhibits promising potential as connectivity infrastructure investments expand and mobile-first pedagogical models take hold.

Across Asia-Pacific, robust consumer electronics ecosystems in East Asia drive rapid assimilation of the latest technological breakthroughs, including 4K/UHD portable projectors and advanced light-source hybrids. Secondary markets in Southeast Asia emphasize affordability and distribution versatility, leveraging vibrant online retail platforms to connect rural and urban consumers alike. In Oceania, pockets of early adoption align with outdoor recreation cultures, as portable projection becomes integral to lifestyle and tourism applications. Collectively, these regional distinctions underscore the importance of localized go-to-market models, strategic distributor alliances, and region-specific feature customization.

This comprehensive research report examines key regions that drive the evolution of the Portable Projector market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Decoding Competitive Strategies, Innovation Trajectories and Collaborative Ventures Among Leading Portable Projector Manufacturers

Leading manufacturers have adopted differentiated strategies to capture share in the competitive portable projector arena, blending aggressive product innovation with targeted channel development. Some firms prioritize proprietary light-engine technologies, securing patent portfolios that bolster their premium positioning. Others invest heavily in user-experience enhancements, from embedded AI-based image correction to integrated content services, effectively elevating product ecosystems above standalone hardware offerings.

Collaborative ventures and strategic alliances play a significant role in shaping competitive dynamics. Partnerships with semiconductor vendors and optical specialists have enabled quicker time-to-market for new feature sets, while joint development agreements with software providers enhance interactive capabilities and content delivery options. On the distribution front, direct-to-consumer e-commerce storefronts coexist with expansive retail partnerships, as companies calibrate omnichannel strategies to maximize reach. In mature markets, exclusive supply agreements with educational and corporate resellers strengthen repeat business pipelines and service contracts.

Additionally, many market leaders are diversifying business models to include subscription-based firmware updates, extended warranty packages, and value-added installation services. These initiatives not only deepen customer loyalty but also generate recurring revenue streams, reinforcing resilience in cyclical economic climates. Collectively, these competitive maneuvers illustrate how manufacturing excellence, ecosystem integration, and forward-looking commercialization approaches are converging to define the next generation of portable projection leadership.

This comprehensive research report delivers an in-depth overview of the principal market players in the Portable Projector market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Acer Inc.

- Anker Innovations Limited

- ASUSTeK Computer Inc.

- BenQ Corporation

- Canon Inc.

- Casio Computer Co., Ltd.

- Dell Inc.

- InFocus Corporation

- Koninklijke Philips N.V.

- LG Electronics Inc.

- NEC Display Solutions, Ltd.

- Optoma Technology Ltd

- Panasonic Corporation

- Seiko Epson Corporation

- Sony Corporation

- Texas Instruments Incorporated

- The Eastman Kodak Company

- The Ricoh Company, Ltd.

- ViewSonic Corporation

Strategic Imperatives for Industry Leaders to Capitalize on Emerging Portable Projection Market Opportunities and Address Evolving Customer Demands

To capitalize on evolving market dynamics, industry leaders should prioritize investments in adaptable product platforms that support modular upgrades for emerging features such as AI-driven image optimization and advanced connectivity standards. By architecting hardware with future-proof interfaces and scalable light-source modules, companies can extend product lifecycles and meet diverse end-user preferences without complete redesigns.

Moreover, building a resilient supply chain through a multi-source procurement strategy remains critical. Organizations are advised to cultivate relationships with regional manufacturing partners to mitigate tariff impacts and reduce lead times. This nearshoring approach should be complemented by digital inventory management systems, enabling real-time demand forecasting and agile production scheduling.

Strategic geographic expansion demands localized go-to-market blueprints that respect regional regulatory frameworks and cultural contexts. Engaging with government initiatives for educational technology deployment or sustainability grants can unlock new growth channels, particularly in EMEA and APAC regions. At the same time, strengthening omnichannel distribution-leveraging online retail, direct sales teams, and specialty showroom partnerships-will ensure comprehensive market coverage.

Finally, fostering collaborative ecosystems through content partnerships and developer communities can differentiate offerings beyond hardware alone. By nurturing platforms for third-party applications, streaming integrations, and interactive educational tools, industry players can create stickier user experiences and generate ancillary revenue streams. These targeted actions will equip leaders to outpace competitors and address shifting customer expectations effectively.

Comprehensive Methodological Approach Integrating Primary Interviews, Secondary Data Triangulation and Multi-Stage Validation Processes

This research employs a multi-methodological framework to ensure comprehensive coverage and robust validation of findings. The quantitative foundation includes structured surveys distributed to a cross-section of corporate, educational, government, and residential end users, capturing sentiment on performance expectations, feature preferences, and procurement drivers. These primary insights are supplemented by in-depth qualitative interviews with C-suite executives, product managers, channel partners, and technical specialists to contextualize statistical trends and uncover latent market needs.

Secondary research leverages a diverse spectrum of published materials, including industry white papers, technology roadmaps, patent filings, and regulatory documentation. Data triangulation across these sources enhances the integrity of segmentation analyses and regional assessments. To further reinforce accuracy, forecast models are subjected to multi-stage validation, incorporating peer reviews by subject-matter experts and sensitivity testing against alternative market scenarios.

Finally, rigorous cross-verification processes ensure that proprietary and public data streams align, while methodological transparency is maintained through detailed documentation of sampling criteria, interview protocols, and data cleansing procedures. This holistic approach guarantees that strategic recommendations are supported by empirical evidence and reflect the latest developments across the portable projection landscape.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Portable Projector market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Portable Projector Market, by Resolution

- Portable Projector Market, by Light Source

- Portable Projector Market, by Connectivity

- Portable Projector Market, by Portability Type

- Portable Projector Market, by Application

- Portable Projector Market, by End User

- Portable Projector Market, by Distribution Channel

- Portable Projector Market, by Region

- Portable Projector Market, by Group

- Portable Projector Market, by Country

- United States Portable Projector Market

- China Portable Projector Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2226 ]

Synthesis of Market Dynamics, Strategic Insights and Future Trajectories Underpinning the Portable Projection Ecosystem’s Growth Potential

Bringing together the preceding analyses reveals a market characterized by rapid technological innovation, dynamic competitive maneuvering, and evolving regional adoption patterns. The convergence of AI-powered optimization, next-generation light sources, and advanced wireless standards is unlocking new use cases and broadening the utility of portable projection beyond traditional environments. At the same time, recent tariff adjustments have underscored the imperative for supply chain agility and strategic diversification.

Segment-driven insights demonstrate that a one-size-fits-all approach is no longer viable; instead, stakeholders must align product offerings to the nuanced requirements of corporate, educational, gaming, home entertainment, and outdoor scenarios. Regional considerations further shape strategic priorities, with each territory presenting its own blend of infrastructure capabilities, regulatory landscapes, and consumer preferences.

Competitive positioning will hinge on an organization’s ability to integrate hardware excellence with ecosystem services, whether through subscription models, content partnerships, or developer platforms. Ultimately, the portable projector market’s trajectory will be defined by those who can marry technological leadership with nimble operational execution, delivering compelling value propositions across the full spectrum of end-user segments.

Engage Ketan Rohom for Tailored Insights and Unmatched Strategic Guidance to Leverage the Portable Projection Market’s Emerging Opportunities

Engaging directly with Ketan Rohom as the dedicated Associate Director of Sales & Marketing offers an unparalleled opportunity to secure customized market intelligence and strategic direction. Through a collaborative dialogue you can gain clarity on specific market segments, address questions about regional performance nuances, and explore partnership models designed to align with your corporate objectives. With this one-on-one engagement, complex considerations such as tariff mitigation, channel optimization, and product innovation roadmaps are simplified into actionable steps.

Elevate your planning process by leveraging the in-depth findings and nuanced insights embedded within the full market research report. By partnering with Ketan Rohom, you unlock access to executive-level summaries tailored to your organizational priorities, as well as priority support for implementation frameworks. Seize this moment to differentiate your offerings in a competitive environment and realize growth potential across diverse customer segments. Contact Ketan Rohom today to transform these insights into strategic advantage and drive measurable results.

- How big is the Portable Projector Market?

- What is the Portable Projector Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?