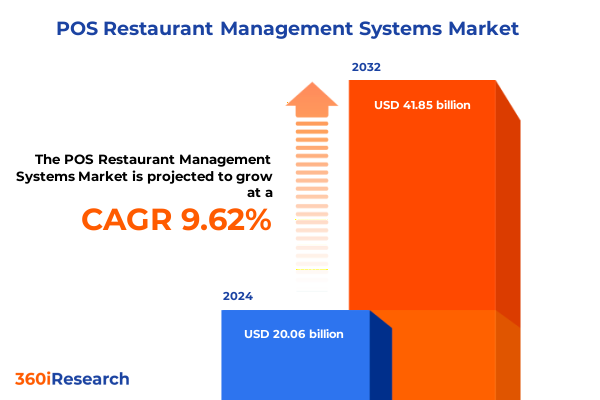

The POS Restaurant Management Systems Market size was estimated at USD 21.51 billion in 2025 and expected to reach USD 23.07 billion in 2026, at a CAGR of 9.97% to reach USD 41.85 billion by 2032.

Setting the Table for Digital Transformation and Growth with Next-Generation POS Restaurant Management Systems for Unmatched Operational Excellence

The restaurant industry’s relentless evolution underscores the critical role of advanced point-of-sale management systems as the backbone of efficient operations, superior guest experiences, and resilient supply networks. As restaurants navigate intense competition and rising expectations, modern POS solutions have emerged as a strategic imperative rather than a mere transactional tool. These platforms unify payment processing, order management, and guest analytics into a cohesive ecosystem that powers front- and back-of-house collaboration, fostering seamless service delivery and real-time decision making.

Moreover, the convergence of digital innovation and consumer demand for contactless interactions has accelerated POS modernization, prompting operators to integrate cloud architectures, mobile interfaces, and AI-enabled insights. From streamlining drive-thru workflows to personalizing menu recommendations, these next-generation systems redefine convenience and operational agility. This landscape demands a strategic understanding of transformative technologies, regulatory pressures, and market segmentation to harness POS platforms effectively and future-proof restaurant operations.

Exploring Major Technological and Operational Shifts Reshaping the Future of Restaurant POS Solutions in a Rapidly Evolving Hospitality Landscape

Restaurant operators are rapidly embracing digital platforms built on cloud-native and API-first architectures, establishing the foundation for scalable, integrated environments that support real-time data synchronization, device management, and third-party connectivity. Leading solutions are launching in-store and cloud APIs alongside event-driven services and webhook functionalities, granting unprecedented flexibility to integrate loyalty programs, kitchen display systems, and inventory tools in a unified workflow.

Concurrently, the infusion of artificial intelligence and machine learning into POS software has transformed how restaurants anticipate demand, optimize staffing levels, and curate personalized guest experiences. AI-driven smart menus dynamically adjust layout based on profit and popularity metrics, while predictive analytics forecast peak periods to reduce waste and enhance labor efficiency. As generative models refine menu innovation and voice-enabled ordering gains traction, POS systems are becoming indispensable command centers that elevate operational resilience and customer satisfaction.

Assessing the Complex Cumulative Impact of 2025 U.S. Tariff Measures on Restaurant POS Hardware Supply Chains and Industry Resilience

In early April 2025, the U.S. government enacted a universal 10% tariff on all imported goods, followed by targeted duties of 54% on Chinese products, 46% on Vietnamese goods, and 20% on European imports. This sweeping policy aims to bolster domestic manufacturing but imposes material cost pressures on restaurants that rely on imported POS hardware components, such as terminals, scanners, and printers. The immediate result has been accelerated supplier negotiations, heightened inventory stocking, and strategic re-evaluation of tariff classifications to minimize financial impact.

Beyond the headline percentages, proposed increases to electronics and semiconductor tariffs threaten to escalate costs for critical peripheral devices. Industry analyses project that upcoming duties could raise component prices by up to 60%, prompting many operators to explore localized assembly, alternative sourcing, and extended equipment lifecycles to preserve capital expenditure budgets. As a result, supply chain agility and classification expertise have become essential capabilities for operators seeking to mitigate tariff volatility while maintaining service continuity.

Uncovering Key Segmentation Insights Driving Diverse Adoption Patterns in Modern Restaurant POS Management Across Deployment Models and Applications

Insights into POS market segmentation reveal nuanced adoption patterns, shaped by deployment preferences, system components, restaurant formats, application requirements, and pricing philosophies. Operators opting for cloud-hosted architectures value remote accessibility and seamless updates, while those preferring on-premises deployments prioritize direct control over data and infrastructure. Similarly, hardware investments span robust terminals and peripheral devices like printers and scanners, supplemented by implementation and maintenance services to ensure peak performance. Software offerings extend across fixed-station, mobile, and kiosk platforms, enabling tailored guest interactions and channel flexibility.

Concurrently, restaurant formats from cafés and bars to full-service and quick-service establishments drive divergent feature sets and integration priorities. Applications range from core inventory and order management to advanced reporting and analytics, with payment processing options embracing credit and debit cards, EMV, and NFC technologies. Lastly, licensing models split between perpetual ownership and subscription-based agreements, reflecting strategic decisions around upfront investment versus ongoing flexibility. These segmentation insights underscore the importance of aligning system capabilities with operational objectives and budgetary frameworks.

This comprehensive research report categorizes the POS Restaurant Management Systems market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Restaurant Type

- Pricing Model

- Deployment Type

- Application

Highlighting Critical Regional Dynamics in the Restaurant POS Market Across Americas Europe Middle East Africa and Asia Pacific Environments

Regional dynamics in the POS landscape manifest in differentiated technology maturity, regulatory frameworks, and consumption behaviors. In the Americas, advanced digital payment networks and robust technology infrastructure underpin widespread migration toward cloud-native solutions, while data security mandates and appetite for loyalty integrations elevate the value of API-driven connectivity. Meanwhile, Europe, the Middle East, and Africa encounter a mosaic of compliance requirements-such as GDPR-and diverse market maturities, prompting modular, regionally compliant offerings that balance feature richness with localization nuances. In Asia-Pacific, exponential growth in cashless transactions, fueled by mobile wallet penetration and omnichannel dining, drives rapid uptake of cloud POS platforms, particularly in urban centers where efficiency and digital engagement converge. Collectively, these regional insights highlight the importance of tailored strategies that address local regulations, payment preferences, and innovation adoption speeds.

This comprehensive research report examines key regions that drive the evolution of the POS Restaurant Management Systems market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Innovators and Market Pioneers Powering Next-Generation Restaurant POS Systems with Advanced Services and Software Platforms

Leading technology providers are charting distinct pathways to differentiate their POS offerings through specialized software capabilities, hardware integration, and service ecosystems. Square and Toast continue to expand their omnichannel portfolios, embedding loyalty modules and kitchen automation features to enhance revenue per transaction. Lightspeed and Revel Systems have invested heavily in data analytics frameworks, enabling granular insights into menu performance and labor productivity. NCR and Oracle Hospitality reinforce large-scale enterprise deployments, focusing on reliability and global support networks, while emerging innovators like Clover and TouchBistro deliver streamlined, plug-and-play experiences suited for small and medium operators. Across the competitive landscape, companies prioritize open architectures, strategic partnerships, and agile roadmaps to respond to evolving restaurant needs and regulatory developments.

This comprehensive research report delivers an in-depth overview of the principal market players in the POS Restaurant Management Systems market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Agilysys, Inc.

- Block, Inc.

- Diebold Nixdorf, Incorporated

- Fiserv, Inc.

- Lightspeed Commerce Inc.

- NCR Corporation

- Oracle Corporation

- PAR Technology Corporation

- Shift4 Payments, Inc.

- Toast, Inc.

Empowering Industry Leaders with Actionable Strategies to Leverage Emerging POS Technologies and Navigate Tariff Challenges for Competitive Advantage

To thrive amidst technological upheaval and tariff uncertainties, industry leaders should prioritize a multi-pronged strategy. First, investing in cloud-native POS architectures with API-first designs will facilitate seamless integrations and rapid feature deployments. Second, enhancing AI and analytics capabilities can drive predictive inventory management and dynamic pricing strategies, ensuring operational efficiency and profitability. Third, cultivating supply chain flexibility through diversified sourcing and tariff classification expertise can mitigate cost escalations and lead-time disruptions. Fourth, embracing modular licensing models offers a balanced approach between capital expenditure and operational agility. Finally, forging strategic partnerships with fintech, delivery platforms, and compliance specialists will accelerate innovation adoption and create differentiated guest experiences that foster loyalty and revenue growth.

Detailing a Robust Hybrid Research Methodology Integrating Qualitative Quantitative and AI-Driven Approaches for Comprehensive Market Analysis

In conducting this market analysis, a hybrid research methodology was employed, combining quantitative data collection through structured surveys and transaction log analysis with qualitative insights obtained via in-depth interviews with restaurant operators and solution providers. This integrated approach adheres to best practices for modern market studies, ensuring statistical rigor alongside contextual depth.

Primary research was supplemented by secondary data from authoritative industry publications, regulatory documents, and technology whitepapers, enabling a comprehensive understanding of tariff regulations, technology roadmaps, and regional market nuances. Advanced AI-powered analytics tools were used to identify emerging patterns and forecast operational impacts, while iterative validation sessions with subject-matter experts ensured the accuracy and relevance of findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our POS Restaurant Management Systems market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- POS Restaurant Management Systems Market, by Component

- POS Restaurant Management Systems Market, by Restaurant Type

- POS Restaurant Management Systems Market, by Pricing Model

- POS Restaurant Management Systems Market, by Deployment Type

- POS Restaurant Management Systems Market, by Application

- POS Restaurant Management Systems Market, by Region

- POS Restaurant Management Systems Market, by Group

- POS Restaurant Management Systems Market, by Country

- United States POS Restaurant Management Systems Market

- China POS Restaurant Management Systems Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1749 ]

Concluding Reflections on the Evolutionary Journey of Restaurant POS Management Systems and Strategic Opportunities Amidst Emerging Technologies and Trade Dynamics

The convergence of cloud architectures, AI-driven intelligence, and flexible licensing models marks a pivotal inflection point for restaurant POS management systems. Operators equipped to harness these advancements can unlock new tiers of productivity, guest engagement, and data-driven decision making. Meanwhile, evolving trade policies underscore the need for meticulous supply chain strategies and tariff expertise to safeguard profitability and operational resilience. As technology and policy continue to intersect, restaurant leaders must adopt agile frameworks that align system capabilities with dynamic market realities while pursuing regional compliance and innovation agility. The strategic interplay of segmentation, regional adaptation, and partner ecosystems will define competitive differentiation in the years ahead.

Engaging with Ketan Rohom to Secure Your Comprehensive POS Restaurant Management Market Research Report for Strategic Decision Making

For an exclusive opportunity to deepen your strategic foresight and operational excellence, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to obtain the full in-depth market research report on POS restaurant management systems. Tailored to deliver actionable intelligence and comprehensive analysis across tariffs, technology adoption, and regional dynamics, this report equips decision-makers with the insights needed to drive sustainable growth and competitive advantage. Engage directly with Ketan Rohom to secure your copy and elevate your organization’s decision-making capabilities today

- How big is the POS Restaurant Management Systems Market?

- What is the POS Restaurant Management Systems Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?