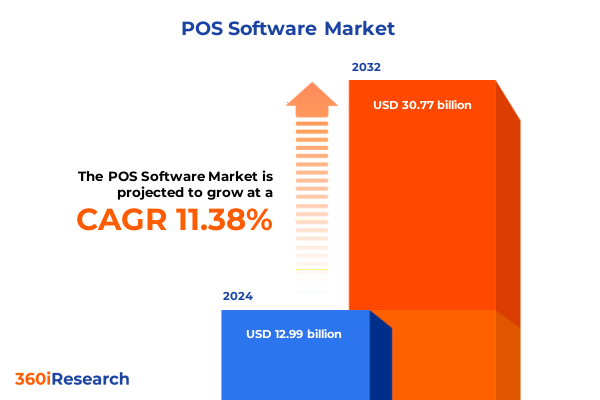

The POS Software Market size was estimated at USD 12.99 billion in 2024 and expected to reach USD 14.40 billion in 2025, at a CAGR of 11.38% to reach USD 30.77 billion by 2032.

Exploring the Current State and Emerging Forces in Point-of-Sale Software Landscapes that Define Industry Trends and Competitive Dynamics

Point-of-sale (POS) software has evolved from basic transaction processing tools into sophisticated, multifunctional platforms that drive customer engagement, operational efficiency, and strategic decision-making. As businesses across multiple industries seek to differentiate through superior client experiences and streamlined workflows, POS solutions have become indispensable. Modern systems integrate payment processing, inventory tracking, customer relationship management, and analytics into cohesive environments, allowing enterprises to respond rapidly to shifting consumer preferences and market volatility.

With the proliferation of digital channels and the growing expectation for frictionless transactions, the landscape of POS software is expanding in both complexity and reach. Vendors are racing to enhance modular architectures, incorporate artificial intelligence for predictive insights, and facilitate omnichannel capabilities that seamlessly connect in-store, online, and mobile commerce. In this dynamic environment, understanding the foundational drivers-from technological innovations and regulatory changes to evolving end-user requirements-is critical for industry stakeholders aiming to capture value and anticipate emerging trends.

This executive summary delivers a concise, yet comprehensive, overview of the key forces shaping the POS software sector. By examining transformative shifts, tariff impacts, segmentation and regional nuances, competitive positioning, and actionable recommendations, decision-makers will gain the clarity and foresight needed to refine strategies, prioritize investments, and maintain a competitive edge in a rapidly changing market.

Illuminating the Transformative Technological and Operational Shifts Reshaping Point-of-Sale Software Adoption and Competitive Advantage Across Verticals

The POS software domain is undergoing a profound transformation driven by advances in cloud computing, artificial intelligence, and the increasing convergence of retail, hospitality, and financial services ecosystems. Cloud-native solutions are replacing legacy on-premise installations, enabling scalability, rapid feature deployment, and remote management without the constraints of local infrastructure. Concurrently, hybrid architectures have gained traction among enterprises seeking to balance security concerns with the flexibility of public and private cloud models.

Artificial intelligence and machine learning have transcended buzzword status to become core elements of next-generation POS platforms. Through intelligent analytics and real-time data processing, retailers and service providers can forecast demand, personalize promotions, and optimize staffing levels. This shift toward data-driven decision-making not only enhances operational efficiency but also deepens customer loyalty by delivering tailored experiences at every touchpoint.

Moreover, the increasing importance of integrated payment methods-from contactless cards and mobile wallets to buy-now-pay-later solutions-has prompted vendors to embed advanced payment processing capabilities within their offerings. Security and compliance considerations, particularly around PCI DSS standards and emerging digital identity frameworks, are now central to platform design, ensuring that customer data remains protected without compromising transactional speed or convenience. These intertwined technological and operational shifts are recalibrating competitive dynamics and setting a new benchmark for functionality and reliability in the POS market.

Analyzing the Cumulative Effects of 2025 United States Tariff Policies on Point-of-Sale Software Supply Chains, Cost Structures, and Market Resilience

The United States’ tariff adjustments in 2025 have introduced a new layer of complexity for POS software vendors and their supply chains. Increased duties on imported hardware components, such as terminals, card readers, and handheld devices, have elevated production costs and pressured manufacturers to reassess sourcing strategies. In response, some providers are exploring regional assembly hubs to mitigate duty burdens, while others are renegotiating contracts with key suppliers to secure more favorable terms.

These tariff-induced cost escalations have, in many cases, been partially passed through to end users, resulting in higher total cost of ownership for new system deployments. To offset these increases, software vendors are emphasizing subscription-based models that spread expenses over time and bundle hardware maintenance, integration services, and upgrades into predictable expense profiles. This shift has underscored the value of modular software architectures that can be updated independently of hardware refresh cycles.

Despite the immediate challenges, the tariff landscape has also stimulated innovation in domestic manufacturing and sparked greater collaboration between vendors and channel partners. Integration and support service providers have expanded their offerings to include tariff impact assessments and localized compliance assistance, helping end users navigate the evolving regulatory environment. As enterprises adapt to these cumulative effects, agility in supply chain management and pricing flexibility will remain paramount for sustaining growth and maintaining competitiveness.

Uncovering Critical Insights into Point-of-Sale Software Market Segmentation Across Components, Deployment Models, End Users, Enterprise Sizes, and Platform Variations

A comprehensive understanding of the POS software market requires examining the nuanced layers of segmentation that define product offerings and customer engagement models. From a component perspective, hardware remains foundational for transaction execution, while services-comprising consulting, integration, and ongoing support-enable seamless deployments and continuous optimization. Software modules bifurcate into back-office solutions, where customer relationship management and inventory management underpin operational control, and front-office applications, where payment processing and robust reporting and analytics drive real-time insights and customer interactions.

Equally critical is the deployment mode, which spans cloud, hybrid, and on-premise options. Cloud environments facilitate rapid provisioning and scale, with distinctions between private clouds offering enhanced security and public clouds providing cost efficiencies. Hybrid models allow enterprises to tailor the balance of control and agility according to regulatory requirements and performance targets. End-user segmentation further refines the market, with BFSI institutions demanding stringent compliance, healthcare providers prioritizing patient data security, hospitality operators focusing on guest experience personalization, and retail merchants emphasizing inventory turnover and omnichannel integration.

Enterprise size and platform preferences also shape solution design and delivery. Large enterprises gravitate toward comprehensive, customizable systems that integrate with complex IT ecosystems, while small and medium businesses seek turnkey applications with fast implementation cycles. Platform choices vary between mobile interfaces-where Android and iOS dominate for portability-and PC-based setups that operate on Linux or Windows for traditional point-of-sale stations. Recognizing these overlapping dimensions is vital for vendors aiming to tailor value propositions and achieve deep market penetration.

This comprehensive research report categorizes the POS Software market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Component

- Platform

- Pricing Model

- Deployment Model

- Application

- Enterprise Size

- Industry Vertical

Revealing the Key Regional Dynamics Driving Growth and Adoption of Point-of-Sale Software in the Americas, Europe Middle East & Africa, and Asia-Pacific Markets

Regional dynamics play a crucial role in shaping POS software adoption patterns and technology preferences. In the Americas, well-established retail and hospitality sectors have accelerated the uptake of cloud-native solutions, leveraging digital payment integration and loyalty program enhancements to meet consumer demand for seamless, personalized experiences. Market maturity in North America has also fostered competitive pricing and an ecosystem of specialized professional services that support ongoing innovation and system upgrades.

Across Europe, the Middle East, and Africa, regulatory diversity and varying levels of digital infrastructure create a patchwork of opportunity and challenge. In Western Europe, stringent data protection frameworks and cross-border commerce drive demand for solutions that are both secure and interoperable. Meanwhile, emerging markets in the Middle East and Africa present high potential for mobile-first implementations as businesses leapfrog traditional infrastructure constraints and adopt portable, cloud-backed POS systems to capture rapidly growing consumer segments.

The Asia-Pacific region stands out for its rapid digital transformation and deep penetration of mobile payment methods. From mature economies that prioritize advanced analytics and real-time inventory optimization, to emerging markets embracing smartphone-based terminals, vendors must navigate a highly diverse landscape. Strategic partnerships with local system integrators and a focus on multilingual, multi-currency support are essential for success in APAC’s fragmented yet dynamic environments.

This comprehensive research report examines key regions that drive the evolution of the POS Software market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Point-of-Sale Software Providers and Strategic Competitive Actions That Influence Market Positioning and Innovation Trajectories

Leading vendors in the POS software space are executing differentiated strategies to secure market share and foster innovation. Established technology providers have doubled down on cloud investments and API-centric architectures that enable partners to develop specialized add-ons for sectors like hospitality and retail. At the same time, challenger brands leverage vertical-specific expertise in areas such as restaurant management and mobile commerce to carve out niche positions.

Strategic partnerships and acquisitions have further intensified competition, as companies seek to integrate value-added services such as fraud detection, loyalty management, and omnichannel orchestration. Alliances with financial institutions and payment processors enhance ecosystem connectivity, ensuring that end users benefit from seamless checkout experiences and comprehensive back-office reconciliation. Meanwhile, in-house R&D efforts are increasingly focused on embedding AI-powered forecasting and intelligent pricing engines directly within POS platforms.

The battle for customer loyalty extends to service quality as well, with top providers augmenting their offerings through robust consulting and integration packages. Subscription-based pricing models, bundled with dedicated support and managed services, have become a differentiator for enterprises aiming to minimize internal IT burdens. By aligning product roadmaps with emerging technologies-such as contactless biometrics, blockchain reconciliation, and immersive analytics-these key players are setting new benchmarks for the future of point-of-sale software.

This comprehensive research report delivers an in-depth overview of the principal market players in the POS Software market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advantech Co., Ltd.

- Agilysys Inc.

- Aptos, LLC

- Block, Inc.

- Castles Technology Co., Ltd.

- Cegid Retail

- CTAC NV

- Diebold Nixdorf, Incorporated

- Elavon Inc.

- Fiserv, Inc.

- GK Software SE

- Global Payments Inc.

- HP Development Company, L.P.

- Infor by Koch Industries, Inc.

- Ingenico

- Intuit Inc.

- Lightspeed Commerce Inc.

- NCR Voyix Corporation

- Oracle Corporation

- PAR Technology Corporation

- Shift4 Payments, Inc.

- Shopify Inc.

- SpotOn

- Squirrel Systems Inc.

- Toast, Inc.

- Toshiba Corporation

- TouchBistro Inc.

- VeriFone, Inc.

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Innovations and Navigate Regulatory, Technological, and Competitive Challenges

To thrive in the rapidly evolving POS software marketplace, industry leaders must adopt a forward-looking, action-oriented approach. First, investing in cloud-native frameworks and microservices architectures will ensure rapid deployment of new features and seamless scaling of system capacity as transaction volumes fluctuate. Emphasizing robust security protocols, including advanced encryption and real-time fraud analytics, will mitigate compliance risks and reinforce customer trust.

Next, organizations should cultivate partnerships with fintech firms, value-added resellers, and system integrators to co-develop innovative payment interactions and analytics capabilities. By co-creating targeted solutions for verticals such as hospitality, healthcare, and retail, vendors can accelerate time to market and deliver specialized value that resonates with end-user needs. At the same time, integrating AI-driven forecasting and dynamic pricing engines into POS platforms will enable clients to optimize inventory levels and enhance promotional effectiveness.

Finally, leaders must refine their go-to-market strategies by offering flexible, subscription-based billing models and tiered support plans tailored to both large enterprises and small to medium businesses. Expanding regional service footprints-especially in high-growth markets within the Middle East, Africa, and Asia-Pacific-will capture new revenue streams and build resilience against localized economic headwinds. Through these targeted actions, industry participants can solidify their competitive positions and drive sustained growth.

Detailing a Robust Research Methodology Integrating Primary and Secondary Data Collection Techniques to Ensure Analytical Rigor and Actionable Insights

This study integrates a multi-layered research methodology designed to deliver rigorous, actionable insights. Primary research involved structured interviews with C-level executives, IT decision-makers, and technology buyers across retail, hospitality, healthcare, and financial services sectors. These discussions provided firsthand perspectives on procurement drivers, integration challenges, and emerging feature priorities.

Complementing primary insights, secondary research drew on industry-specific journals, publicly available financial disclosures, regulatory filings, and expert commentary to validate and contextualize market developments. Vendor briefings and product documentation were systematically analyzed to map solution capabilities, pricing structures, and innovation roadmaps. Data triangulation ensured that qualitative narratives aligned with quantitative evidence.

The research process also incorporated iterative validation workshops, where preliminary findings were refined through feedback from industry experts and end users. This continuous review cycle enhanced the accuracy and relevance of the analysis, enabling the identification of key trends, strategic imperatives, and sector-specific nuances. The resulting framework offers a robust foundation for informed decision-making and long-term strategic planning.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our POS Software market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- POS Software Market, by Type

- POS Software Market, by Component

- POS Software Market, by Platform

- POS Software Market, by Pricing Model

- POS Software Market, by Deployment Model

- POS Software Market, by Application

- POS Software Market, by Enterprise Size

- POS Software Market, by Industry Vertical

- POS Software Market, by Region

- POS Software Market, by Group

- POS Software Market, by Country

- United States POS Software Market

- China POS Software Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 2385 ]

Concluding Perspectives on the Future Trajectory of Point-of-Sale Software Industry Evolution, Highlighting Enduring Value Drivers and Strategic Imperatives

As point-of-sale software continues its evolution from transactional engines to comprehensive business management platforms, its role in driving operational excellence and customer engagement will only deepen. The convergence of cloud, AI, and integrated payment technologies is reshaping expectations for speed, customization, and security, creating new opportunities for vendors and end users alike. By understanding the interplay of tariff influences, segmentation dynamics, and regional variances, stakeholders can craft strategies that are both resilient and adaptive.

The enduring value drivers in this landscape include modular architectures that facilitate continuous innovation, subscription-based models that align vendor incentives with client outcomes, and the integration of advanced analytics to unlock real-time operational insights. Enterprises that prioritize these capabilities will be best positioned to respond to shifting consumer behaviors and competitive pressures.

Looking forward, the POS software sector is poised to embrace emerging paradigms such as decentralized ledger reconciliation, biometric payment authentication, and immersive analytics dashboards. Strategic imperatives for market participants will center on fostering ecosystem partnerships, driving differentiated user experiences, and maintaining agile development cycles. By adhering to these principles, industry leaders can secure sustainable growth and shape the next generation of point-of-sale innovation.

Engage with Ketan Rohom, Associate Director Sales & Marketing, to Secure Your Access to the Comprehensive Point-of-Sale Software Market Research Report Today

For organizations seeking an in-depth, actionable understanding of the point-of-sale software landscape, an exclusive opportunity awaits. Engage with Ketan Rohom, Associate Director, Sales & Marketing, to schedule a personalized consultation and discover how this comprehensive research report can empower your strategic initiatives. Secure direct access to expert analysis that addresses your most pressing challenges-from navigating tariff impacts to optimizing platform capabilities-and gain the insights needed to stay ahead of market shifts. Connect today to explore tailored subscription options, receive a customized executive briefing, and take the next strategic step toward maximizing the value of your point-of-sale technology investments

- How big is the POS Software Market?

- What is the POS Software Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?