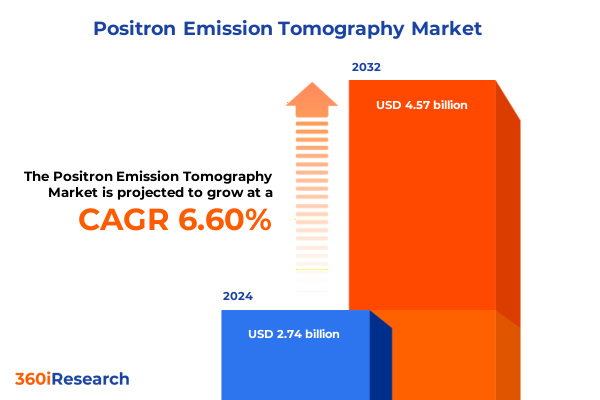

The Positron Emission Tomography Market size was estimated at USD 2.92 billion in 2025 and expected to reach USD 3.12 billion in 2026, at a CAGR of 6.61% to reach USD 4.57 billion by 2032.

Revolutionizing Diagnostic Imaging by Harnessing Functional Visualization to Transform Clinical and Research Understanding of Disease Processes

Positron emission tomography has emerged as a cornerstone of modern molecular imaging, offering unparalleled ability to visualize physiological and metabolic processes in vivo. Since its clinical inception, this technology has transformed the diagnostic landscape by providing functional insights that complement anatomical data, enabling earlier detection and more precise characterization of diseases. Initially focused on oncology applications, PET rapidly expanded into cardiology and neurology, where its capacity to quantify tissue perfusion and neurotransmitter dynamics has informed critical therapeutic decisions.

Over the past decade, the convergence of detector innovations, radiochemistry advances, and computational analytics has propelled PET into new realms of clinical and pre-clinical utility. These developments have intensified adoption across hospitals, diagnostic centers, and research institutes alike, reinforcing the modality’s role in personalized medicine and drug development. As healthcare stakeholders seek to enhance patient outcomes while managing cost pressures, PET’s capacity to streamline diagnostic pathways and guide targeted therapies remains a powerful value proposition.

Emergence of Digital and Time‐of‐Flight Technologies alongside AI‐Driven Workflows Reshaping the Molecular Imaging Landscape

The PET imaging ecosystem is undergoing a paradigm shift driven by breakthroughs in detector technology, hybrid imaging modalities, and artificial intelligence. Transitioning from traditional analog detectors to digital silicon photomultiplier arrays has dramatically improved count sensitivity and timing resolution. By integrating time-of-flight capabilities, modern scanners deliver sharper images with lower radiotracer doses, reducing patient exposure while enhancing lesion detectability. Furthermore, the emergence of fully digital systems has accelerated throughput in high-volume clinical settings, addressing capacity constraints without compromising image quality.

Beyond hardware, the fusion of PET with magnetic resonance imaging has unlocked synergistic benefits: simultaneous structural and functional imaging enable multiparametric assessments in neurodegenerative disorders and complex oncological cases. Concurrently, advances in radiotracer chemistry have expanded the PET portfolio beyond 18F-FDG to include novel ligands for amyloid plaques, PSMA receptors, and immune checkpoint markers. Machine learning algorithms are increasingly embedded in reconstruction and analysis pipelines, automating lesion segmentation, quantifying kinetic parameters, and predicting therapeutic response with unprecedented accuracy.

Together, these innovations form a cohesive ecosystem that is reshaping clinical workflows, streamlining trial designs for novel therapeutics, and opening new frontiers in precision health.

Assessing the Effect of Escalated US Import Duties on Equipment and Radiotracer Supply Chains Impacting Clinical Accessibility and Research Endeavors

In early 2025, updated trade policies introduced additional levies on imported medical imaging equipment and radiotracers, creating a ripple effect across procurement and operational budgets. These tariffs have disproportionately impacted hospital systems and diagnostic centers reliant on international supply chains for both dedicated PET scanners and hybrid PET/CT platforms. The resulting cost pressures have prompted many providers to re-evaluate capital expenditure plans, delaying upgrades while exploring alternative sourcing strategies.

Radiotracer manufacturers have also encountered increased production expenses due to higher import duties on key precursor chemicals and consumables. This has translated into elevated pricing for tracer doses, potentially hindering accessibility in cost-sensitive research settings and emerging diagnostic centers. In response, several domestic producers have accelerated investments in localized radiochemistry infrastructure, aiming to mitigate cross-border dependencies. Such initiatives underscore a strategic pivot toward regional self-sufficiency but will require sustained regulatory support and public–private partnerships to scale effectively.

Consequently, industry stakeholders must navigate a more complex regulatory and commercial environment, balancing short-term budget constraints with the imperative to maintain cutting-edge diagnostic capabilities.

Unveiling Critical Product, Application, End User, and Technological Segmentation Trends Shaping Strategic Decision Making in Molecular Imaging

Market segmentation by product type distinguishes between imaging equipment and radiotracers, with the former category encompassing dedicated PET scanners designed solely for functional imaging and hybrid PET/CT scanners that integrate metabolic and anatomical insights within a single examination. Radiotracers, led by the ubiquitous fluorodeoxyglucose tracer, continue to drive PET utilization by revealing metabolic hotspots associated with tumor activity and neuroinflammation.

Examining clinical applications reveals cardiology as a key growth area, where PET’s high sensitivity delivers precise myocardial perfusion mapping, while neurology benefits from specialized tracers that quantify neurotransmitter receptor interactions and track the progression of neurodegenerative diseases. Oncology remains the dominant application segment, with PET guiding biopsy sites, staging malignancies, and monitoring therapeutic efficacy.

End-user analysis highlights diagnostic centers as agile early adopters of emerging PET technologies, leveraging lower overheads and flexible service models, whereas large hospital systems integrate PET within multidisciplinary care pathways to support comprehensive oncology and cardiology programs. Research institutes, for their part, use PET’s quantitative capabilities to validate novel therapeutic compounds, model disease processes, and refine translational pipelines.

From a technology perspective, analog PET systems persist in settings where cost containment is paramount, while digital PET scanners deliver enhanced resolution for time-sensitive studies. Time-of-flight PET represents the cutting edge of detection performance, offering the fastest acquisition times and the most precise localization of radiotracer signals.

This comprehensive research report categorizes the Positron Emission Tomography market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Application

- End User

- Technology

Comparative Analysis of Regional Adoption Dynamics Reveals Divergent Growth Drivers and Infrastructure Maturation Across Global Markets

Regional dynamics in PET imaging reflect disparities in healthcare infrastructure maturity, reimbursement frameworks, and research investments. Within the Americas, the United States leads in adoption of high-performance digital PET scanners, supported by robust public and private funding for oncology and neurology research studies. Canada’s unified healthcare system has facilitated wider application of PET in cardiac diagnostics through centralized imaging consortia, improving access to advanced perfusion mapping services.

In Europe, Middle East & Africa, adoption patterns vary significantly. Western European nations maintain high penetration of hybrid PET/CT systems, underpinned by progressive reimbursement policies and a dense network of imaging centers. Eastern Europe is gradually expanding PET infrastructure, driven by cross-border research collaborations and philanthropic support aimed at improving cancer diagnostics. The Middle East is investing heavily in molecular imaging facilities to support burgeoning healthcare ecosystems, while select African academic centers are integrating PET into clinical research programs despite limited availability.

Across Asia-Pacific, governments in China, Japan, and Australia are prioritizing domestic manufacturing of PET equipment and tracers, stimulated by trade uncertainties and national innovation agendas. Emerging markets in Southeast Asia are establishing regional imaging hubs to serve broader populations, balancing cost-effective analog systems with strategic deployment of digital PET in tertiary care centers.

This comprehensive research report examines key regions that drive the evolution of the Positron Emission Tomography market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Industry Leaders Leveraging Strategic Collaborations and Technological Innovations to Advance PET Imaging Solutions Worldwide

Key industry participants continue to drive PET innovation through strategic alliances, targeted research collaborations, and iterative platform enhancements. Leading multinational imaging companies expand their footprints by partnering with academic centers to validate new radiotracer candidates and incorporate advanced detector technologies. They also pursue joint ventures with regional distributors to streamline service delivery and accelerate installation timelines in underserved markets.

Smaller specialized firms contribute to ecosystem diversity by developing niche tracers for emerging biomarkers, often collaborating with biotechnology startups and research hospitals to expedite clinical translation. These partnerships enable rapid iteration of radioisotope chemistries and imaging protocols, fostering a more dynamic pipeline of diagnostic agents. Meanwhile, established equipment vendors leverage modular hardware architectures to offer scalable upgrade paths, allowing purchasers to add time-of-flight capability or transition from analog to digital detection without full system replacement.

Through these collective efforts, the competitive landscape is characterized by continuous innovation, agile collaboration models, and a shared commitment to enhancing PET’s clinical impact and research utility.

This comprehensive research report delivers an in-depth overview of the principal market players in the Positron Emission Tomography market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Advanced Accelerator Applications

- Canon Medical Systems Corporation

- Cardinal Health, Inc.

- Curium Pharma

- General Electric Company

- IBA Worldwide

- Jubilant DraxImage Inc.

- Koninklijke Philips N.V.

- Lantheus Medical Imaging, Inc.

- Mediso Medical Imaging Systems Kft.

- Molecure S.A.

- Neusoft Medical Systems Co., Ltd.

- Nordion Inc.

- Positron Corporation

- Samsung Electronics Co., Ltd.

- Siemens Healthineers AG

- Sofie Biosciences, Inc.

- United Imaging Healthcare Co., Ltd.

- Yangzhou Kindsway Biotech Co., Ltd.

Strategic Imperatives for Stakeholders to Navigate Regulatory Complexity Optimize Supply Chains and Drive Sustainable Growth in PET Imaging

To navigate shifting trade policies and capital constraints while capitalizing on technological progress, industry leaders should prioritize a diversified supply chain strategy. Cultivating relationships with multiple equipment manufacturers and radiotracer producers can mitigate exposure to single-source dependencies and safeguard against future tariff fluctuations. In parallel, investing in modular imaging platforms will enable incremental upgrades-such as adding digital detectors or time-of-flight capabilities-without necessitating full system replacements.

Aligning with regulatory bodies early in the development cycle can accelerate approval pathways for novel tracers and imaging protocols. Proactively engaging with policymakers to demonstrate clinical value and cost-effectiveness may also support favorable reimbursement frameworks. Additionally, forming consortiums that pool resources across hospital networks and research institutes can optimize radiotracer production logistics, lowering per-dose costs and improving distribution consistency.

Embracing data-driven operations through artificial intelligence and standardized imaging analytics can enhance throughput and diagnostic accuracy. Training internal teams on AI-enabled tools will foster confidence in automated workflows and unlock new insights from historical image archives. Finally, exploring regional manufacturing partnerships in key markets can align production capacities with local demand, bolstering resilience and reducing lead times.

Comprehensive Mixed Method Research Approach Detailing Primary Interviews Secondary Data Analysis and Validation Protocols for Robust Insights

This analysis was conducted through a comprehensive mixed-method approach, beginning with in-depth primary interviews among imaging specialists, radiochemists, healthcare executives, and regulatory experts. These firsthand insights were complemented by secondary data collection from peer-reviewed journals, government trade publications, and industry white papers. Rigorous triangulation procedures ensured consistency across qualitative findings and publicly available evidence.

The methodology incorporated a multi-tier validation framework: preliminary observations were reviewed by an advisory panel of clinical researchers and manufacturing leaders, followed by structured feedback sessions to refine thematic interpretations. Data integrity protocols, including cross-checks against independent data repositories and quality audits of interview transcripts, reinforced the robustness of conclusions. Ethical guidelines for participant confidentiality and responsible data reporting were strictly adhered to throughout the project.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Positron Emission Tomography market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Positron Emission Tomography Market, by Product Type

- Positron Emission Tomography Market, by Application

- Positron Emission Tomography Market, by End User

- Positron Emission Tomography Market, by Technology

- Positron Emission Tomography Market, by Region

- Positron Emission Tomography Market, by Group

- Positron Emission Tomography Market, by Country

- United States Positron Emission Tomography Market

- China Positron Emission Tomography Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 954 ]

Synthesis of Key Findings Reinforces the Critical Role of Technological Advancement and Strategic Partnerships in Driving PET Imaging Evolution

The collective insights underscore positron emission tomography’s pivotal role at the intersection of clinical innovation and research advancement. Technological breakthroughs in detection, hybrid imaging, and analytics are driving unprecedented diagnostic precision, while evolving trade policies necessitate adaptive sourcing and collaborative infrastructure investments. Segmentation analysis reveals nuanced opportunities across product types, applications, and end-user environments, and regional assessments highlight diverse adoption trajectories.

Forward-looking strategies should integrate flexible platform architectures, diversified partnerships, and data-driven operational models to ensure resilience in the face of regulatory shifts and budgetary constraints. As PET imaging continues to mature, stakeholders who balance technological agility with strategic collaboration will be best positioned to harness its full potential for patient care and scientific discovery.

Engage Directly with Our Associate Director to Unlock Comprehensive PET Imaging Insights and Elevate Your Strategic Initiatives Today

For organizations seeking a comprehensive understanding of positron emission tomography’s evolving landscape and its strategic implications across clinical and research settings, direct engagement presents an invaluable opportunity. Ketan Rohom, Associate Director of Sales & Marketing, stands ready to guide you through a tailored overview of the full report’s insights and methodologies. By collaborating with his expertise, stakeholders can unlock actionable intelligence that aligns with their operational priorities, whether refining investment decisions in advanced imaging systems or optimizing radiotracer development strategies. Reach out to Ketan Rohom to arrange a personalized consultation and secure immediate access to the definitive market research on PET imaging.

- How big is the Positron Emission Tomography Market?

- What is the Positron Emission Tomography Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?