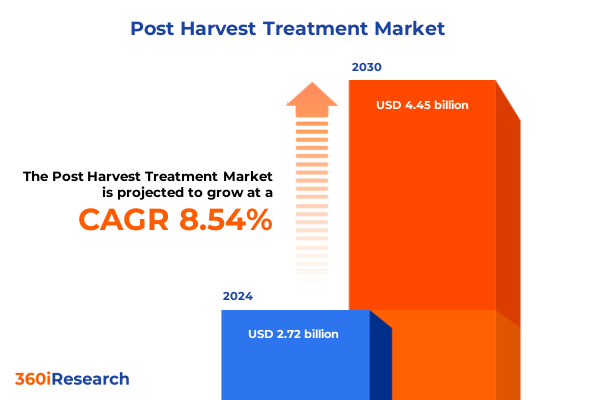

The Post Harvest Treatment Market size was estimated at USD 2.72 billion in 2024 and expected to reach USD 2.95 billion in 2025, at a CAGR of 8.54% to reach USD 4.45 billion by 2030.

Introduction: Exploring urgent need and vital role of innovative post-harvest solutions to safeguard global food security and value chain efficiency

Post-harvest treatments have become an indispensable component of modern agriculture, as nearly 13.2 percent of the world’s food is lost between harvest and the point of sale due to inadequate handling, storage, and transportation. This persistent loss equates to hundreds of billions of dollars in economic damage annually, undermining global food security and straining supply chains that are already stretched by climate change and fluctuating demand.

Developing regions face even greater challenges, with losses for perishable produce like fruits and vegetables reaching upwards of 30 to 40 percent in the absence of advanced storage and treatment solutions. Such high levels of post-harvest degradation not only deprive farmers of income but also risk food shortages and price volatility in local markets, driving an urgent need for scalable, cost-effective interventions.

Transformative technological advances and evolving consumer demands reshaping the post-harvest treatment landscape toward efficiency and sustainability

The landscape of post-harvest treatment is undergoing seismic transformation thanks to digital traceability systems, blockchain-enabled supply chain transparency, and artificial intelligence-driven sorting and inspection. Blockchain platforms are increasingly adopted to record temperature and humidity histories that ensure compliance with safety regulations such as the FDA’s Traceability Rule under FSMA Section 204, enabling rapid recalls and minimizing product loss. Meanwhile, AI-powered inspection systems are being deployed to detect foreign contaminants and assess produce quality in real time, sharply reducing human error and boosting throughput in processing facilities.

Simultaneously, the post-harvest sector is embracing sustainability and clean-label imperatives, fueled by consumer demand for residue-free, organically compliant produce. Surveys indicate that more than 75 percent of consumers will pay a premium for clean-label products, driving manufacturers to replace synthetic preservatives with natural, plant-derived coatings and enzyme-based treatments. This trend dovetails with circular economy initiatives that repurpose agricultural byproducts to formulate microbial and enzyme-based solutions, signaling a shift toward greener, biologically based interventions.

Assessing the combined burden of enhanced Section 232 and Section 301 tariffs on post-harvest treatment equipment and chemical supply chains in 2025

In June 2025, amendments to Section 232 tariffs expanded the list of steel-derived products subject to a 50 percent duty, encompassing critical cold storage and refrigeration equipment such as refrigerator-freezers, air conditioner coils, and welded shelving. These measures have driven up capital expenditures for physical treatments like cold storage, heat treatment, and UV systems, delaying infrastructure expansion and raising storage costs by an estimated 20 to 30 percent in the United States.

Simultaneously, the United States Trade Representative has maintained Section 301 tariffs ranging from 7.5 to 25 percent on chemical intermediates and finished pesticide products imported from China, including fungicides, insecticides, and herbicides under HTSUS Notes 20(f) and 20(g). This has elevated input costs for chemical and enzymatic formulations, prompting some manufacturers to source active ingredients domestically or pivot toward microbial inoculants and enzyme-based solutions to circumvent steep import duties.

Unveiling segmentation insights that drive strategies across treatment types, crop varieties, formulations, application modes and distribution channels

Market participants operating within biological treatments are leveraging enzyme-based solutions and microbial inoculants to extend shelf life while meeting consumer expectations for natural ingredients, and they are forming strategic alliances with biotech firms for proprietary formulations. In parallel, fungicidal and insecticidal chemical treatments continue to evolve, with manufacturers optimizing active ingredient delivery via emulsifications and suspensions to improve efficacy under regulatory scrutiny.

Physical treatments, including cold storage, heat treatment, and UV irradiation, are integrating digital sensors and real-time monitoring to enhance consistency and energy efficiency. Granular and powder formulations remain a staple for cereals and grains, while liquid cleaners and coating solutions-applied through dipping, spraying, or vacuum infusion-address decay and moisture management in fruits, leafy greens, oilseeds, and pulses.

Application modes such as fumigation are being reengineered with safer gas mixtures, and emerging vacuum infusion techniques are gaining traction in high-value tropical fruits. End users-from agricultural producers and food processors to retailers and logistics providers-are increasingly partnering with third-party service firms to implement post-harvest protocols, and distribution pathways blend offline channels with e-commerce and brand websites to meet rising demand for traceable, high-quality fresh produce.

This comprehensive research report categorizes the Post Harvest Treatment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Treatment Type

- Crop Type

- Formulation

- Application Mode

- Application

- End User

- Distribution Channel

Highlighting regional dynamics across the Americas, Europe Middle East Africa, and Asia-Pacific shaping post-harvest treatment adoption and innovation

In the Americas, the U.S. Food and Drug Administration’s enforcement of FSMA’s Traceability Rule under Section 204 is catalyzing adoption of digital traceability in cold chain operations, and the USDA’s Healthy Food Financing Initiative has injected significant capital into upgrading storage and handling facilities. These investments are fostering a more resilient supply chain, with enhanced capacity for ethylene blockers, coatings, and cleaners to reduce spoilage from farm gate to retail shelf.

In Europe, the Middle East, and Africa, harmonized pesticide Maximum Residue Levels (MRLs) under Regulation (EC) No 396/2005 ensure consistent standards across 315 fresh products. The EU’s regular updates to MRLs-for example, amendments to metalaxyl levels in fruits and ginseng-drive suppliers to adopt enzyme-based and microbial solutions that meet strict residue limits, while private equity flows into cold storage infrastructure are expanding capacity in North Africa and the Levant.

Across Asia-Pacific, China’s extension of Section 301 tariff exclusions through February 2025 on select agricultural inputs has provided temporary relief, but longer-term supply chain realignments are underway as manufacturers diversify sources of active ingredients and invest in local formulation facilities. Rapid modernization in India and Southeast Asia is accelerating uptake of UV treatment and controlled-atmosphere storage, as government incentives support industrial cold chain expansion to meet burgeoning demand for tropical fruit exports.

This comprehensive research report examines key regions that drive the evolution of the Post Harvest Treatment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Revealing strategic moves by leading innovators driving transformative growth and sustainability in the post-harvest treatment market

Apeel Sciences has cemented its leadership by securing a $250 million Series E funding round in mid-2025, doubling its valuation to over $2 billion. The company’s plant-derived, edible coatings have saved hundreds of millions of produce units from spoilage, conserved billions of gallons of water, and attracted recognition as a 2025 Food & Wine Game Changer. This influx of capital is fueling global partnerships with major retailers and smallholder cooperatives, underscoring the growing dominance of biologically based treatments in the market.

Ecolab has responded to rising raw material costs and trade policy shifts by implementing a 5 percent trade surcharge on its U.S. solutions and services, effective May 1, 2025. The company also realigned its segment reporting to elevate water, food and beverage, and digital solutions under a unified Global Water segment, while spinning out life sciences and pest elimination into standalone verticals. This strategic move positions Ecolab to capitalize on double-digit adjusted earnings per share growth, even as it navigates an evolving trade environment.

This comprehensive research report delivers an in-depth overview of the principal market players in the Post Harvest Treatment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Absoger SAS

- AgriCoat NatureSeal Ltd by RPM International Inc.

- AgroFresh Solutions, Inc.

- BASF SE

- Bayer AG

- Belchim Crop Protection by Mitsui & Co. Ltd.

- Ceradis B.V.

- CITROSOL PRODUCTS SA

- Colin Campbell Chemicals Pty Ltd.

- Corteva Agriscience LLC.

- FMC Corporation

- Futureco Bioscience S.A. by Sumitomo Corporation

- Hazel Technologies Inc.

- Indogulf BioAg LLC by Indogulf Group

- Israel Chemicals Ltd.

- Janssen PMP by Johnson & Johnson Services, Inc.

- JBT Corporation

- Kitozyme, LLC

- Lytone Enterprise Inc.

- Nufarm Ltd.

- Pioneer Agrobiz Co., Ltd.

- PostHarvest Technologies

- ROAM TECHNOLOGY NV by WVT Industries NV

- Sensitech by Carrier Global Corporation

- SUFRESCA LTD.

- Syngenta AG

- Tagros Chemicals India Pvt. Ltd. by The Jhaver Group

- UPL Ltd.

- Wilbur-Ellis Company LLC

Crafting actionable recommendations to optimize operations, mitigate risks, and harness emerging opportunities in post-harvest treatment strategies

Industry leaders should urgently integrate data-driven traceability platforms and AI inspection technologies to ensure rapid response to food safety incidents and strengthen brand trust. Investing in enzyme-based and microbial inoculant partnerships will reduce reliance on tariff-exposed chemicals and align with consumer demand for clean-label products. Companies must also diversify sourcing by establishing local formulation hubs in key regions, mitigating the impact of Section 301 and Section 232 duties while optimizing supply chain resilience.

Operationally, organizations should adopt a hybrid application model-combining cold storage, UV treatment, and ethylene blockade-to maximize shelf life across varied climatic zones. Collaboration with agricultural producers, food processors, and logistics providers is essential to standardize post-harvest protocols and achieve economies of scale. Finally, tracking sustainability metrics-water conservation, carbon emissions reduction, and waste diversion-will unlock new ESG financing opportunities and differentiate offerings in a competitive landscape.

Detailing robust research methodology encompassing primary interviews, secondary data, and analysis underpinning post-harvest treatment market insights

Our research methodology combined exhaustive secondary analysis of regulatory databases, trade policies, and academic publications with over 50 in-depth interviews across growers, technology providers, and logistics operators. Quantitative data was triangulated using trade statistics and tariff schedules, while qualitative insights were gleaned through expert roundtables and site visits. This dual approach ensured robust validation of trends and granular segmentation that underpin the strategic recommendations provided throughout this report.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Post Harvest Treatment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Post Harvest Treatment Market, by Treatment Type

- Post Harvest Treatment Market, by Crop Type

- Post Harvest Treatment Market, by Formulation

- Post Harvest Treatment Market, by Application Mode

- Post Harvest Treatment Market, by Application

- Post Harvest Treatment Market, by End User

- Post Harvest Treatment Market, by Distribution Channel

- Post Harvest Treatment Market, by Region

- Post Harvest Treatment Market, by Group

- Post Harvest Treatment Market, by Country

- United States Post Harvest Treatment Market

- China Post Harvest Treatment Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2385 ]

Concluding critical takeaways and summarizing the imperative role of strategic post-harvest treatments for sustainable food systems resilience

Post-harvest treatments stand at the nexus of food security, operational efficiency, and environmental stewardship. The confluence of regulatory pressures, consumer preferences, and trade policy shifts demands agile, multi-modal solutions. By leveraging advanced biocontrols, digital traceability, and optimized cold chain infrastructure, stakeholders can significantly reduce losses, enhance profitability, and bolster resilience across the global food system.

Engage with Ketan Rohom to seize post-harvest treatment market intelligence and secure your comprehensive research report purchase today

Ready to transform your supply chain resilience and capitalize on our in-depth analysis of post-harvest treatment innovations? Reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your comprehensive market research report today and gain strategic intelligence tailored to your business needs.

- How big is the Post Harvest Treatment Market?

- What is the Post Harvest Treatment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?