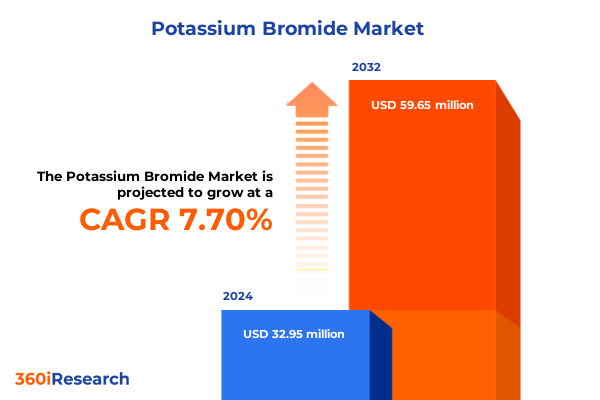

The Potassium Bromide Market size was estimated at USD 35.06 million in 2025 and expected to reach USD 38.37 million in 2026, at a CAGR of 7.88% to reach USD 59.65 million by 2032.

Positioning Potassium Bromide as a Strategic Asset Amid Evolving Industrial Demands and Regulatory Dynamics Across Diverse End-Market Applications

Potassium bromide, an inorganic salt composed of potassium and bromide ions, has evolved into a versatile industrial chemical whose applications span a broad array of sectors. With a crystalline structure and high solubility in water, this compound serves as a critical reagent in analytical chemistry, facilitating infrared spectroscopy sample preparation due to its optical transparency across a wide wavelength range. Beyond analytical laboratories, potassium bromide’s intrinsic properties underpin its roles in photographic processing, where it acts as a halide source for silver bromide emulsions and restrains development processes to improve image quality. In the pharmaceutical domain, its historical use as an anticonvulsant underscores its enduring significance in both human and veterinary medicine, particularly when modern alternatives are unsuitable.

As industries prioritize sustainability and performance, the chemical’s biocidal function in water treatment applications has driven renewed interest, especially in scenarios requiring microbial control without residual toxicity. Simultaneously, its utilization in oil and gas operations as a component of clear brine fluids demonstrates the compound’s value in enhancing wellbore stability and preventing equipment corrosion. This executive summary provides an integrated perspective on the potassium bromide market landscape, detailing the transformative shifts, regulatory impacts, segmentation dynamics, regional variances, competitive environment, and actionable recommendations essential for stakeholders navigating this evolving sector.

Unveiling the Decisive Transformations Redefining Supply Chain Resilience Sustainability and Technological Integration in the Potassium Bromide Industry

The potassium bromide sector is undergoing a fundamental realignment driven by the imperative to decarbonize production processes and integrate sustainable feedstocks. Overall industry greenhouse gas intensity has declined meaningfully in recent years, yet the chemical industry remains responsible for a notable share of global emissions, prompting renewed investments in low-carbon technologies and renewable energy integration. This shift is accompanied by government incentives and regulatory frameworks encouraging the transition to green chemistry principles, fostering circular economy models where waste valorization and resource efficiency take precedence over traditional linear manufacturing approaches.

Concurrently, digitalization and Industry 4.0 practices are reshaping supply chain networks and operational models. Advanced analytics, digital twins, and blockchain traceability solutions are increasingly applied to optimize logistics, ensure raw material provenance, and reduce lead times, thereby bolstering resilience against disruptions. Chemical producers are forming technology partnerships to implement real-time monitoring systems, enabling predictive maintenance of critical assets and enhancing process control under variable market conditions.

Moreover, regulatory scrutiny on chemical pollutants is intensifying globally, with initiatives targeting the reduction of persistent and hazardous substances. The emerging focus on mitigating chemical toxicity has led to the development of safer alternatives and stricter disclosure requirements. As a result, downstream industries are demanding higher transparency around purity levels and impurity profiles, incentivizing manufacturers to adopt state-of-the-art purification methods and invest in compliance capabilities. In response, companies are accelerating R&D to reformulate processes and align product specifications with evolving environmental and health standards.

Analyzing the Far-Reaching Consequences of the 2025 United States Reciprocal Tariff Regime on Potassium Bromide Sourcing Logistics and Cost Structures

In April 2025, the United States enacted a reciprocal tariff framework imposing a baseline 10 percent duty on the majority of imported goods, including chemicals, under HTSUS 9903.01.25. This measure, aimed at correcting trade imbalances and incentivizing domestic production, applies to goods not covered by the USMCA and initially took effect on April 5 2025. However, certain items deemed critical to national security are exempted under Annex II of the executive order, which specifically includes select inorganic chemicals and minerals. Within this context, potassium-bromide-containing products fall under HTS 2827.51.00.00, which historically carries a free general duty but may incur a column 2 rate of 22 cents per kilogram for goods from non-USMCA nations.

Further complexity arises from concurrent Section 232 investigations into critical minerals and pharmaceutical imports, which could lead to additional duties later in the year. Despite initial tariff impositions on imports from Canada, the White House has considered targeted exemptions for potash and related minerals, reflecting the essential role of bromide salts in industrial applications. Market participants face uncertainty around potential rate adjustments for suppliers in key producing countries, including Saudi Arabia, Egypt, and Russia, which has prompted strategic reevaluations of sourcing strategies and accelerated supplier diversification efforts.

These tariff dynamics have tangible repercussions across the potassium bromide value chain. Feedstock costs have increased due to higher import duties, creating downstream pressure on manufacturers of specialty chemicals and photographic reagents. Meanwhile, logistics providers have experienced shifting trade flows as bulk bromide shipments are redirected to avoid higher-duty corridors. In the oil and gas sector, operators are exploring alternative fluid chemistries and domestic suppliers to mitigate cost escalations, while water treatment and pharmaceutical segments are negotiating long-term agreements to lock in supply continuity and favorable pricing amid a volatile trade environment.

Deriving Actionable Insights from Multidimensional Market Segmentation to Optimize Product Offerings and Distribution Strategies in the Potassium Bromide Space

The market for potassium bromide reveals nuanced demand patterns when examined across multiple segmentation dimensions. Within oil and gas operations, clear brine fluids used for brine treatment in high-pressure wells command specialized formulations, whereas petroleum exploration phases require tailored density profiles and purity levels. The pharmaceutical sector distinguishes between over-the-counter products, often standardized formulations for seizure management, and prescription-only grades that mandate stringent purity thresholds and regulatory compliance. Meanwhile, in photographic processing, precise halide control remains vital to optimize silver halide crystal formation, and water treatment facilities rely on controlled bromide dosing to generate effective biocidal cycles without residual by-products.

Considering form factors, granular potassium bromide facilitates automated dosing in industrial reactors and treatment systems, while liquid concentrates enable rapid integration into continuous process streams. Powder variants offer analytical laboratories a convenient medium for pellet production in infrared spectroscopy and other precise applications. Each form presents unique handling, solubility, and storage considerations, influencing procurement strategies and distribution choices.

In terms of type, anhydrous potassium bromide is prized for its stability in optical components and spectroscopic windows, whereas dihydrate and monohydrate forms are selected based on solubility kinetics and hygroscopic characteristics needed in specific water treatment or oilfield scenarios. These polymorphic variations directly affect solubility rates and thermal behavior, thereby guiding product specification and inventory management.

Distribution channels also play a pivotal role, with direct engagements via bulk suppliers and manufacturers offering tailored logistics solutions and co-development partnerships. National and regional distributors ensure broad geographic coverage and localized support, while online platforms-through company websites and e-commerce portals-provide smaller-volume consumers and research institutions with rapid access and transparent pricing structures. The interplay of these channels shapes lead times, service levels, and total cost of acquisition, underscoring the importance of strategic alignment between producers, intermediaries, and end users.

This comprehensive research report categorizes the Potassium Bromide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Type

- Application

- Distribution Channel

Mapping Regional Variations in Demand Drivers Regulatory Environments and Growth Opportunities for Potassium Bromide Across the Americas EMEA and Asia-Pacific Markets

Geographic dynamics significantly influence potassium bromide demand and supply frameworks. In the Americas, robust pharmaceutical manufacturing hubs in the United States and Canada underpin consistent demand for pharmaceutical-grade salts, while the region’s mature oil and gas sector sustains specialized brine fluid requirements. North American laboratories lead the adoption of infrared spectroscopy techniques, driving steady procurement of spectroscopic-grade potassium bromide for research and quality-control applications. Simultaneously, Latin American water treatment initiatives, especially in municipal and industrial contexts, have elevated market uptake for bromide-based biocidal solutions.

Across Europe, the Middle East, and Africa, regulatory rigor regarding chemical purity and environmental compliance catalyzes demand for ultra-high-purity grades, particularly in pharmaceutical and specialty chemical applications. The European Union’s stringent REACH framework compels producers to maintain comprehensive impurity documentation, fostering a preference for domestically certified suppliers. In the Middle East, expanding petrochemical complexes and water desalination projects create incremental use cases for potassium bromide, particularly in scale inhibition and disinfectant formulations. African markets are gradually ramping up water treatment infrastructure, presenting nascent growth opportunities for bromide-based chemistries.

The Asia-Pacific region emerges as the fastest-growing market, propelled by expanding pharmaceutical and electronics manufacturing in China, India, and Southeast Asian economies. Government investments in advanced water treatment and semiconductor fabs have increased consumption of spectroscopic pellets and high-purity bromide salts. Local production capacity has surged, led by Chinese firms capturing economies of scale, yet producers in Japan and South Korea remain competitive through differentiated offerings and integrated supply-chain partnerships. Infrastructure expansions in Australia’s resource sector further contribute to demand for brine fluid additives in mining and oil operations.

This comprehensive research report examines key regions that drive the evolution of the Potassium Bromide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Stakeholders Shaping Innovation Competitive Dynamics and Strategic Partnerships Within the Global Potassium Bromide Value Chain

The competitive landscape for potassium bromide is characterized by a mix of global chemical giants and specialized regional producers. Albemarle Corporation leverages its lithium and bromine extraction operations in Arkansas to deliver high-purity potassium bromide, aligning supply with niche applications such as nuclear radiation shielding and veterinary sedation through strategic partnerships with oilfield service providers. In Europe and Asia, Tata Chemicals and Shandong Haiwang Chemical Co. dominate local output, benefiting from favorable energy tariffs, government subsidies, and vertically integrated brine processing capabilities that drive cost efficiencies for water treatment and electronics segments.

Israel Chemicals Ltd. (ICL) capitalizes on Dead Sea mineral reserves to produce bromide salts with consistent impurity profiles, catering to stringent pharmaceutical and analytical industries. Japanese firms like Tosoh and Arkema differentiate through proprietary purification technologies and collaborative R&D with optical component manufacturers. Smaller regional players, including Italmatch Chemicals in Italy and Salinity Solutions in Australia, compete by offering bespoke formulations and flexible logistics solutions for local end-users. The combination of scale, feedstock access, and technology differentiation defines market positioning, with alliances and joint ventures serving as key mechanisms to expand footprint and accelerate innovation.

This comprehensive research report delivers an in-depth overview of the principal market players in the Potassium Bromide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Albemarle Corporation

- American Elements

- Calibre Chemicals Pvt. Ltd.

- Central Drug House (P) Ltd.

- Dongying Bromate Chemicals Co.,Ltd.

- Dongying Ruineng Chemical Technology Co.,Ltd.

- Ebrator Biochemicals Inc.

- ICL-IP

- Mody Chemi Pharma Ltd.

- MORRE-TEC Industries, Inc.

- Nantong Guangrong Chemical Co., Ltd.

- New Alliance Fine Chem Private Limited

- Noah Chemicals

- Oakwood Products, Inc.

- Otto Chemie Pvt. Ltd.

- Parth Industries

- RFC INDUSTRIES

- Shandong Sinobrom Albemarle Bromine Chemicals Company Limited

- Sisco Research Laboratories Pvt. Ltd.

- Suzhou Yingke Biotechnology Co., Ltd.

- Twin International Co., Limited

- Visual Pharma Chem

- Weifang YuKai Chemical Co., Ltd.

- Yogi Intermediates PVT. LTD.

Driving Competitive Advantage Through Strategic Recommendations Focused on Sustainable Sourcing Digitalization Risk Mitigation and Collaborative Partnerships

Industry leaders should pursue diversification of feedstock sources to mitigate the risk of single-supplier dependencies, engaging with alternative brine and mineral reserves while developing contingency stockpiles. Investing in sustainable production pathways-such as leveraging renewable energy for evaporation and crystallization processes-will not only reduce carbon footprints but also enhance eligibility for green chemistry certifications and procurement in regulated markets.

To address escalating trade uncertainties, companies should implement digital supply-chain platforms that provide end-to-end visibility, enabling scenario planning for tariff changes and logistical constraints. Partnering with logistics providers to explore multi-modal transport options can buffer against port congestion and evolving customs protocols, ensuring reliable delivery to critical markets.

Collaborative R&D efforts focused on next-generation purification techniques and high-value derivative chemistries can unlock new applications while maintaining regulatory compliance. By establishing cross-industry consortia, stakeholders can share best practices in impurity management, quality assurance, and safety data protocols, fostering a unified approach to product stewardship.

Finally, strengthening direct engagement with end-users through technical application support and training programs will differentiate offerings in competitive markets. Tailored dosage optimization and process integration services will drive customer loyalty and create barriers to entry for low-cost competitors, ensuring sustainable revenue streams and long-term partnerships.

Ensuring Analytical Rigor Through a Comprehensive Research Methodology Emphasizing Data Triangulation Expert Collaboration and Supply Chain Verification Processes

This analysis synthesizes insights derived from a multi-stage research methodology combining secondary and primary data sources. Initially, an extensive review of industry publications, regulatory filings, and customs data provided a foundational understanding of global trade flows, tariff structures, and production capacities. Where available, harmonized tariff schedule entries and reciprocal tariff executive orders were consulted to quantify duty implications on potassium-bromide-containing imports.

Primary research was conducted through in-depth interviews with chemical producers, logistics providers, and end-users across key regions to validate secondary findings and capture real-time market dynamics. Responses were anonymized and aggregated to ensure confidentiality while enabling robust qualitative analysis of supply chain strategies and application requirements. Survey instruments addressed product form preferences, purity specifications, and procurement criteria, allowing segmentation insights to emerge organically.

Data triangulation was employed to reconcile discrepancies between trade statistics, supplier disclosures, and end-use demand estimates. Advanced analytics techniques, including time-series analysis and scenario modeling, facilitated the exploration of potential market impacts under varying tariff and regulatory scenarios. Throughout the research process, independent experts and legal advisors reviewed assumptions related to trade policy and environmental compliance to ensure accuracy and mitigate bias.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Potassium Bromide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Potassium Bromide Market, by Form

- Potassium Bromide Market, by Type

- Potassium Bromide Market, by Application

- Potassium Bromide Market, by Distribution Channel

- Potassium Bromide Market, by Region

- Potassium Bromide Market, by Group

- Potassium Bromide Market, by Country

- United States Potassium Bromide Market

- China Potassium Bromide Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1590 ]

Synthesizing Key Findings and Strategic Imperatives to Illuminate the Central Role of Potassium Bromide in Contemporary Industrial and Chemical Ecosystems

The potassium bromide landscape is defined by intersecting trends in sustainability, digital innovation, and regulatory evolution. Intensifying decarbonization mandates and green chemistry initiatives are steering producers toward low-carbon solid formation and purification methods, while digital supply chains enhance resilience in the face of trade volatility. The United States’ reciprocal tariff regime, with its baseline 10 percent duty and targeted exemptions, illustrates the complex policy environment that stakeholders must navigate to secure supply continuity and cost predictability.

Multidimensional segmentation analysis underscores the importance of aligning product form, type, and distribution channels with end-market requirements, particularly in high-purity pharmaceutical applications and specialized oil and gas fluid chemistries. Regional insights reveal divergent growth drivers, from the Americas’ mature lab and energy markets to EMEA’s regulatory-driven demand and Asia-Pacific’s rapid industrial expansion.

Competitive benchmarking highlights the strategic value of feedstock diversification, technological differentiation, and collaborative innovation. While global chemical leaders leverage resource endowments and scale, nimble regional producers excel through customization and proximity to key customers. The synthesis of these findings illuminates clear imperatives for industry stakeholders: invest in sustainable operations, harness digital tools for supply chain agility, and deepen direct engagement with end-users to maintain advantage in a dynamic chemical ecosystem.

Engage Directly with Ketan Rohom to Secure Your In-Depth Potassium Bromide Market Analysis and Empower Strategic Decision-Making Through Customized Insights

To secure comprehensive analysis and strategic insights tailored to your organization’s unique needs, we invite you to engage with Ketan Rohom, Associate Director of Sales & Marketing. Collaborating directly with him ensures access to detailed market intelligence, bespoke data interpretation, and dedicated support throughout the decision-making process. Whether you require in-depth benchmarking against competitors, scenario planning for supply chain disruptions, or guidance on regulatory developments, Ketan Rohom can facilitate customised deliverables that align with your strategic objectives. Reach out today to elevate your potassium bromide strategy with expert guidance and position your organization for sustained success in a dynamic chemical landscape.

- How big is the Potassium Bromide Market?

- What is the Potassium Bromide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?