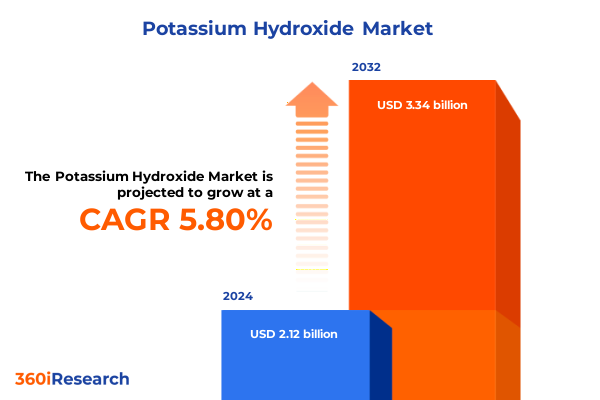

The Potassium Hydroxide Market size was estimated at USD 2.25 billion in 2025 and expected to reach USD 2.37 billion in 2026, at a CAGR of 5.81% to reach USD 3.34 billion by 2032.

An In-Depth Exploration of How Potassium Hydroxide Powers Diverse Industries Through Its Versatile Uses in Chemical Manufacturing, Water Treatment, Food Processing, and Pharmaceuticals

Potassium hydroxide stands as a cornerstone chemical reagent renowned for its potent alkaline properties, positioning it as an indispensable resource across a multitude of industrial and commercial domains. In chemical manufacturing contexts, it catalyzes essential reactions, enabling the synthesis of a wide variety of downstream products. Meanwhile, its role in water treatment processes ensures regulatory compliance and operational efficiency by adjusting pH levels and precipitating contaminants. The compound’s significance further extends into food processing, where it contributes to both chemical leavening and precise pH control, enhancing product texture and safety.

As demand for high-purity solutions intensifies, potassium hydroxide’s applications in pharmaceutical settings-ranging from active pharmaceutical ingredient synthesis to drug formulation-underscore its critical importance in healthcare innovation. Equally noteworthy is its utility in pulp and paper operations for bleaching and pulping, as well as in soaps and detergents for both industrial cleaning agents and personal care formulations. With each sector presenting unique performance requirements, potassium hydroxide’s versatility and reliability form the backbone of countless manufacturing and treatment processes globally.

Transformative Industry Dynamics Driven by Technological Innovation and Sustainability Imperatives Reshaping Potassium Hydroxide Production, Distribution, and End-Use Applications

Recent years have witnessed a paradigm shift in the potassium hydroxide landscape driven by technological advancement and growing sustainability mandates. The emergence of membrane cell production technologies offers lower energy consumption and reduced environmental impact compared to traditional mercury cell processes, prompting leading producers to retrofit or replace older facilities. Concurrently, digital transformation initiatives-such as real-time process monitoring, predictive maintenance analytics, and supply chain digitization-are optimizing operational efficiencies and enhancing product traceability from feedstock handling to final distribution.

Regulatory frameworks are increasingly favoring green chemistry principles, resulting in stricter emissions targets and incentives for low-carbon manufacturing. These trends encourage companies to integrate closed-loop systems for waste treatment and utilize renewable energy sources whenever feasible. In parallel, rising demand for specialized grades has spurred innovation in purification techniques and custom formulations, enabling manufacturers to address specific segment needs, such as electronic-grade purity for battery applications or tailored concentrations for municipal water treatment.

Assessing the Comprehensive Effects of 2025 United States Tariffs on Potassium Hydroxide Imports and Their Broad Implications for Supply Chain Stability and Cost Structures

With the enactment of new United States tariffs on potassium hydroxide imports in early 2025, market participants have had to rapidly recalibrate sourcing strategies and cost models. The revised duties, designed to bolster domestic production capabilities, have elevated landed prices for key feedstocks, prompting downstream users to evaluate alternative procurement routes. As a result, some chemical manufacturers have shifted toward regional suppliers or negotiated long-term agreements to secure supply continuity and mitigate the volatility introduced by import levies.

In parallel, these tariff-induced cost pressures have accelerated investments in local capacity expansions, particularly within membrane cell and diaphragm cell production facilities, as domestic producers seek to capture incremental demand. End users, from pulp and paper to soaps and detergents, are passing through higher input costs, leading to more rigorous cost-control initiatives throughout the value chain. Despite these adjustments, the evolving tariff regime continues to create friction in global trade flows, underscoring the need for robust supply chain resilience planning.

Unlocking Market Insights through Advanced Segmentation Analysis Encompassing Applications, Product Types, Purity Levels, Physical Forms, Distribution Channels, and Manufacturing Processes

An intricate segmentation framework reveals nuanced performance patterns across the potassium hydroxide market. In application segments, chemical manufacturing retains a foundational role, yet food processing is emerging as a high-growth arena, driven by demand for chemical leavening and precision pH control in baked goods and beverages. The pharmaceutical sector’s reliance on active pharmaceutical ingredient synthesis and drug formulation underscores the importance of ultra-high-purity grades, while pulp and paper operations for bleaching and pulping remain key volume drivers. Meanwhile, soaps and detergents diversify consumption through industrial and personal care channels, and water treatment spans both industrial effluent management and municipal supply purification.

Differentiation by product type further sharpens strategic insights. Liquid formulations, whether concentrated or dilute, dominate applications requiring rapid dissolution and uniform distribution, whereas solid flakes, pellets, and powders provide logistical and handling advantages in storage-sensitive environments. Purity tiers-from electronic to pharmaceutical grade-cater to critical markets such as semiconductor manufacturing and healthcare. Physical forms also drive decision criteria, with prills offering reduced dusting in large-scale operations. Distribution through direct sales, third-party distributors, and online channels, including company websites and major e-commerce marketplaces, mirrors broader shifts toward digital procurement. Underlying these trends, the choice of diaphragm, membrane, or mercury cell production processes influences cost structures, sustainability standings, and product specifications.

This comprehensive research report categorizes the Potassium Hydroxide market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Purity

- Physical Form

- Manufacturing Process

- Application

- Distribution Channel

Revealing Regional Variations across the Americas, Europe Middle East & Africa, and Asia-Pacific Illustrating Unique Demand Drivers, Regulatory Landscapes, and Growth Trajectories

Regional landscapes for potassium hydroxide exhibit distinct characteristics shaped by local demand drivers and policy frameworks. In the Americas, North American producers leverage advanced membrane cell technologies to serve domestic pulp and paper, food processing, and water treatment markets, while South American industries increasingly adopt potassium hydroxide for biofuel production and agricultural applications. Cross-border trade routes remain vital, supporting capacity optimization and responsiveness to seasonal demand fluctuations.

In Europe, the Middle East, and Africa, stringent environmental regulations in the European Union encourage producers to prioritize low-emission manufacturing methods and invest in circular economy initiatives. Growth corridors in the Middle East focus on industrial water treatment projects, while Africa’s burgeoning consumer goods sector fuels expansion in soaps and detergents. Across Asia-Pacific, China and India dominate manufacturing output, capitalizing on cost advantages, but are joined by emerging markets in Southeast Asia investing in purification infrastructure and pharmaceutical-grade production to meet rising healthcare requirements.

This comprehensive research report examines key regions that drive the evolution of the Potassium Hydroxide market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Profiling Leading Players in the Potassium Hydroxide Market Highlighting Strategic Alliances, Capacity Expansions, Innovation Pipelines, and Competitive Differentiation Drivers

Leading participants in the potassium hydroxide market are extending their strategic footholds through capacity investments, joint ventures, and the development of differentiated product portfolios. Several global chemical firms have forged alliances to co-develop membrane cell facilities, aiming to enhance energy efficiency and reduce carbon footprints. Others are establishing specialized purification lines dedicated to electronic and pharmaceutical grade outputs, capitalizing on robust demand from semiconductor and healthcare sectors.

Innovation pipelines reflect a dual focus on performance enhancement and sustainability credentials. Companies are exploring proprietary catalysts and membrane materials to optimize cell productivity and lifespan. Concurrently, partnerships with technology providers are accelerating digital monitoring solutions for real-time quality control and predictive maintenance. This competitive landscape integrates both established multinationals and regional specialists, each leveraging localized expertise to deliver tailored customer solutions and capture share in specialty segments.

This comprehensive research report delivers an in-depth overview of the principal market players in the Potassium Hydroxide market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- A. B. Enterprises

- Alpha Chemika

- Altair Chimica S.p.A.

- Annexe Chem Pvt. Ltd.

- Caesar & Loretz GmbH

- Gujarat Alkalies and Chemicals Limited

- Hänseler AG

- INEOS Group Holdings S.A.

- Jigs Chemical Limited

- Kirti Chemicals

- Kosmetika Enterprises

- Oasis Fine Chem

- Occidental Chemical Corporation

- Olin Corporation

- Pharm Rx Chemical Corp

- Potasse et Produits Chimiques SAS

- Raj Pellets Industries

- Rajendra Chemicals Pvt. Ltd.

- Sihauli Chemicals Pvt. Ltd.

- Tessenderlo Group NV

- UNID Company Ltd.

Actionable Strategic Imperatives for Industry Stakeholders to Harness Emerging Potassium Hydroxide Trends, Mitigate Tariff Pressures, and Drive Sustainable Long-Term Growth

Industry leaders should prioritize the transition toward membrane cell production, guided by the dual benefits of reduced energy consumption and minimized environmental impact. Investing in digital supply chain platforms that integrate demand forecasting with real-time logistics tracking can further mitigate risks associated with tariff fluctuations and geopolitical disruptions. By diversifying sourcing strategies to include both regional suppliers and strategic inventory reserves, stakeholders can ensure uninterrupted operations and optimize input cost structures.

Moreover, developing targeted product variations for high-value segments-such as food-grade solutions tailored for leavening applications or ultra-pure formulations for pharmaceutical use-will unlock premium margins. Embracing omnichannel distribution strategies, combining direct sales with enhanced online platforms, can expand market reach and improve customer engagement. Finally, commitment to sustainability certifications and transparent reporting will strengthen brand reputation and align with evolving compliance requirements.

Comprehensive Research Methodology Outlining Data Collection Techniques, Primary and Secondary Validation, and Analytical Frameworks Ensuring Rigorous and Reliable Market Insights

This analysis was underpinned by a rigorous research methodology combining secondary and primary data sources to ensure comprehensive market coverage. Secondary research involved reviewing industry publications, regulatory filings, company annual reports, and technical whitepapers to map out production technologies and regulatory landscapes. Primary research consisted of interviews with senior executives, plant managers, procurement leaders, and technical specialists across diverse end-use industries to validate market dynamics and segmentation frameworks.

Quantitative data was triangulated through cross-referencing institutional databases, customs records, and trade association statistics, while qualitative insights were refined via expert panel discussions. The segmentation structure was developed to capture the multi-dimensional nature of product forms, applications, distribution channels, and manufacturing processes. Data integrity was maintained through iterative validation cycles, ensuring alignment between market intelligence and firsthand stakeholder perspectives.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Potassium Hydroxide market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Potassium Hydroxide Market, by Product Type

- Potassium Hydroxide Market, by Purity

- Potassium Hydroxide Market, by Physical Form

- Potassium Hydroxide Market, by Manufacturing Process

- Potassium Hydroxide Market, by Application

- Potassium Hydroxide Market, by Distribution Channel

- Potassium Hydroxide Market, by Region

- Potassium Hydroxide Market, by Group

- Potassium Hydroxide Market, by Country

- United States Potassium Hydroxide Market

- China Potassium Hydroxide Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 2385 ]

Integrating Core Insights on Market Dynamics, Segmentation Findings, Regional Nuances, and Strategic Recommendations to Deliver a Cohesive Conclusion for Stakeholders

Bringing together the breadth of market dynamics, segmentation analysis, regional nuances, and strategic recommendations, this executive overview offers a cohesive perspective on the evolving potassium hydroxide landscape. The interplay between technological innovation, sustainability imperatives, and regulatory developments continues to reshape production paradigms, while targeted segmentation unveils pathways for value creation across diverse applications and product types.

Navigating tariff-induced cost pressures requires a balanced approach of strengthening domestic capacity and optimizing global supply chains. Regional assessments highlight the importance of tailoring strategies to local market conditions and compliance environments. Ultimately, stakeholders who align investment decisions with emergent trends-such as membrane cell adoption, digital transformation, and specialized product development-will be best positioned to capture growth opportunities and secure competitive advantage in this dynamic market environment.

Secure Expert Guidance and Comprehensive Potassium Hydroxide Market Insights by Engaging with Ketan Rohom, Associate Director of Sales & Marketing, for Report Acquisition

We invite stakeholders seeking unparalleled insights and a competitive edge in the potassium hydroxide market to engage directly with Ketan Rohom, Associate Director of Sales & Marketing, to acquire our comprehensive report. His deep understanding of market challenges and strategic opportunities makes him the ideal partner to guide your next steps toward maximizing value and mitigating risk.

Reach out to Ketan to schedule a personalized consultation where he will outline how our in-depth analysis can inform your investment decisions, streamline your supply chain strategies, and propel your organization toward leadership in this dynamic industry.

- How big is the Potassium Hydroxide Market?

- What is the Potassium Hydroxide Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?