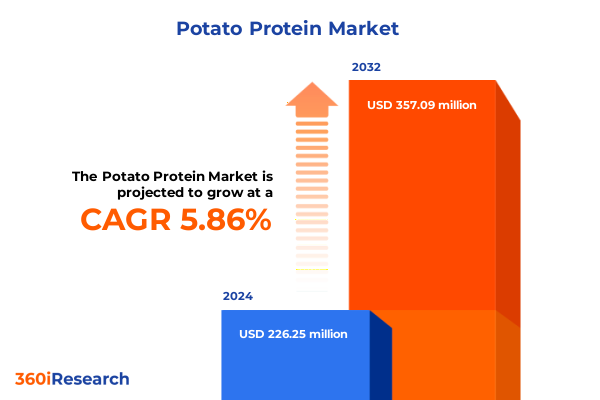

The Potato Protein Market size was estimated at USD 239.83 million in 2025 and expected to reach USD 252.36 million in 2026, at a CAGR of 5.85% to reach USD 357.09 million by 2032.

Unveiling the Rising Significance of Potato Protein as a Sustainable and Functional Ingredient Reshaping Food and Nutraceutical Industries

Unveiling the Rising Significance of Potato Protein as a Sustainable and Functional Ingredient Reshaping Food and Nutraceutical Industries

Potato protein is emerging as a highly valuable ingredient within the global food and nutraceutical landscape, driven by its exceptional nutritional profile and functional properties. As a byproduct of starch production, potato protein not only offers a high concentration of essential amino acids but also aligns with the growing consumer demand for plant-based and allergen-friendly proteins. In recent years, manufacturers and formulators have increasingly turned to potato-derived proteins to enhance textural properties in bakery goods, deliver clean-label fortification in beverages, and meet rigorous nutritional standards in specialized dietary applications.

Furthermore, the sustainability credentials of potato protein resonate with environmental and health-conscious stakeholders. Compared to many traditional plant protein sources, its production can integrate seamlessly into existing starch processing facilities, reducing waste streams and optimizing resource utilization. Moreover, advancements in extraction technology have significantly improved yield and purity, leading to broader adoption in cosmetics, animal feed, and nutraceutical formulations. As regulatory agencies worldwide reaffirm their support for plant-based alternatives, and consumer interest in functional, clean-label ingredients continues to accelerate, potato protein stands out as a strategic asset for companies seeking to differentiate their product portfolios while contributing to a circular and sustainable food system.

Examining How Technological Consumer and Regulatory Shifts Are Catalyzing Transformative Changes in the Potato Protein Market Landscape

Examining How Technological Consumer and Regulatory Shifts Are Catalyzing Transformative Changes in the Potato Protein Market Landscape

Over the past five years, the potato protein industry has been reshaped by rapid advancements in extraction and processing technologies. Drum-dried and spray-dried powder applications have seen dramatic enhancements in protein purity and functional performance, while innovations in wet extraction methods-encompassing acid, alkali, and enzyme routes-have enabled manufacturers to tailor molecular characteristics for specific applications. These technological strides have not only elevated product performance in food systems but also unlocked new potential in high-value sectors such as cosmetics and nutraceuticals.

Simultaneously, consumers are demanding cleaner labels and plant-based alternatives with demonstrable health benefits, pushing companies to develop native and modified protein variants that align with these preferences. Regulatory bodies in key markets have also introduced frameworks that encourage sustainable sourcing and circular economy principles, further bolstering the appeal of potato protein. For instance, incentives for byproduct valorization and grants for green processing technologies have been instituted across Europe and North America. Taken together, these developments are driving a paradigmatic shift: potato protein is no longer relegated to niche applications but is recognized as a mainstream, multifunctional ingredient with a transformative impact on product innovation and supply chain resilience.

Analyzing the Multifaceted Impacts of 2025 United States Tariff Measures on Potato Protein Supply Chains Demand and Cost Structures

Analyzing the Multifaceted Impacts of 2025 United States Tariff Measures on Potato Protein Supply Chains Demand and Cost Structures

In 2025, the United States enacted a series of cumulative tariffs on agricultural protein imports, including a specific levy on potato protein shipments. These tariff measures have resulted in a two-fold impact: first, the direct cost of imported concentrates and isolates has increased, compelling downstream users to reassess their sourcing strategies; and second, domestic processors have experienced both heightened demand for local supply and upward pressure on raw material costs. As a result, some manufacturers have shifted toward powder forms derived from existing starch-processing facilities to mitigate cost escalation, albeit at the expense of additional in-house drying investments.

Moreover, the tariff environment has prompted a redistribution of trade flows, with modified and native protein fractions finding alternative export destinations in regions where tariff barriers are lower. While this shift has alleviated short-term supply constraints in North America, it has also introduced volatility in price negotiations and contract structures. Tier-one food and beverage companies have begun to incorporate more flexible clauses in their procurement agreements, accounting for potential tariff fluctuations and supply interruptions. Looking ahead, the industry is poised to explore strategic partnerships with domestic wet and dry extraction facilities to improve cost transparency and build more resilient supply chains capable of withstanding ongoing policy shifts.

Unlocking Comprehensive Segmentation Insights Highlighting Form Extraction Source Application End User and Distribution Channel Dynamics in Potato Protein Markets

Unlocking Comprehensive Segmentation Insights Highlighting Form Extraction Source Application End User and Distribution Channel Dynamics in Potato Protein Markets

The potato protein market demonstrates distinct behaviors across its varied product forms, ranging from concentrates and isolates to powder variants. Drum-dried and spray-dried powders have gained prominence in applications demanding rapid rehydration and consistent functional properties, whereas isolates are sought after in formulations where high purity is critical. Concentrates continue to play an important role where cost efficiency is paramount. Furthermore, the choice between native and modified sources dictates protein solubility and textural outcomes, driving formulation decisions in both food and cosmetics.

Extraction methodology also plays a pivotal role in defining product attributes. Dry extraction techniques yield a cost-effective, albeit lower purity, fraction suitable for feed and bulk food applications. Conversely, wet extraction processes-including acid, alkali, and enzyme-aided methods-enable greater control over functionality, unlocking advanced uses in nutraceuticals and personal care. When examining downstream applications, food and feed remain core segments, but cosmetics and dietary supplements are emerging as high-growth areas where protein performance and purity command premium positioning.

In terms of end-user alignment, animal feed producers leverage lower-cost concentrates, while bakeries and confectionery owners favor isolates and powders for their emulsifying and texturizing benefits. Meat alternative developers similarly depend on enzyme-extracted proteins to achieve meat-like textures. Distribution channels bifurcate between B2B networks serving industrial processors and retail pathways targeting smaller formulators. This nuanced segmentation underscores the importance of tailored strategies to capture value at each juncture of the supply chain.

This comprehensive research report categorizes the Potato Protein market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Form

- Source

- Extraction Method

- Application

- End User

Mapping Regional Growth Patterns and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific with Emerging Market Dynamics

Mapping Regional Growth Patterns and Opportunities Across the Americas Europe Middle East Africa and Asia Pacific with Emerging Market Dynamics

In the Americas, the growing emphasis on plant-based diets and functional foods has accelerated adoption of potato protein, with both local processors and multinational food firms integrating it into snacks, beverages, and supplements. North America’s well-developed starch industry provides a reliable feedstock stream, enabling rapid scale-up of concentrates, isolates, and drum-dried powders. Latin American processors are also exploring native protein variants, leveraging the region’s abundant potato cultivation to fuel local innovation.

Within Europe, the Middle East, and Africa, stringent regulatory frameworks on health claims and clean-label transparency have driven formulators toward modified and wet-extracted protein solutions that meet rigorous purity and safety standards. Countries such as Germany and the Netherlands have become hubs for advanced enzyme-extraction facilities, while emerging markets in the Gulf Cooperation Council are investing in localized production to reduce import dependencies. Meanwhile, North African feed producers are capitalizing on cost-effective dry-extracted concentrates for livestock nutrition.

Asia-Pacific presents a blend of mature and emerging opportunities. Japan and South Korea are pioneering high-purity isolates for nutraceutical and personal care products, while Australia and New Zealand focus on feed and bulk food uses. In Southeast Asia, rapid urbanization and rising disposable incomes are catalyzing interest in powder forms that deliver both textural benefits and protein enrichment in bakery and confectionery applications. Across all regions, strategic partnerships and joint ventures are enhancing technology transfer, bolstering capacity, and aligning product portfolios with evolving consumer preferences.

This comprehensive research report examines key regions that drive the evolution of the Potato Protein market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Identifying Leading Innovators Strategic Partnerships and Competitive Positioning Among Key Players Driving Potato Protein Industry Advancements

Identifying Leading Innovators Strategic Partnerships and Competitive Positioning Among Key Players Driving Potato Protein Industry Advancements

A handful of specialized processors and ingredient innovators have emerged as frontrunners in the potato protein arena. Companies such as Avebe and the Emsland Group have established integrated starch and protein operations, leveraging proprietary enzyme-extraction platforms to supply high-purity isolates to global nutraceutical and food sectors. Meanwhile, Tereos has made significant investments in optimizing drum-dried and spray-dried powder technologies to serve both industrial and retail markets.

Roquette has focused on strategic partnerships with downstream food and personal care formulators to co-develop customized protein formulations, positioning itself as a solutions provider rather than a mere ingredient supplier. In parallel, Axiom Foods has concentrated on functional concentrates and modified variants, targeting the dietary supplement market with products designed for rapid solubility and clean-label compliance. Other regional players are engaging in joint ventures to enhance distribution networks; for example, North American firms are collaborating with local feed producers to integrate concentrates into livestock nutrition programs.

Beyond production capabilities, these companies are differentiating through active investment in R&D centers and sustainability initiatives. Efforts to reduce water and energy consumption in extraction processes, coupled with circular economy partnerships to repurpose residual biomass, are becoming key competitive levers. As customer requirements evolve, these leading organizations will need to maintain agility in product innovation and deepen collaborative frameworks across the value chain to uphold their market standing.

This comprehensive research report delivers an in-depth overview of the principal market players in the Potato Protein market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs‑AG

- AKV Langholt AmbA

- Bioriginal Food & Science Corp.

- Cargill, Incorporated

- Emsland Stärke GmbH

- Finnamyl Oy

- Ingredion Incorporated

- Kemin Industries, Inc.

- KMC Kartoffelmelcentralen a.m.b.a.

- Koninklijke Avebe U.A.

- Lyckeby Starch AB

- Meelunie B.V.

- PEPEES S.A.

- PPZ Niechłow Sp. z o.o.

- Roquette Frères S.A.

- Royal Ingredients Group B.V.

- Südstärke GmbH

- Tate & Lyle PLC

- Tereos Group S.A.

- The Scoular Company

Practical Strategic Recommendations for Industry Leaders to Leverage Trends Innovations and Policy Shifts in the Potato Protein Ecosystem

Practical Strategic Recommendations for Industry Leaders to Leverage Trends Innovations and Policy Shifts in the Potato Protein Ecosystem

To harness the full potential of potato protein, industry leaders should first prioritize integration of flexible extraction technologies. By investing in modular acid, alkali, or enzyme systems, organizations can dynamically adjust product portfolios to meet shifting demands across food, feed, cosmetics, and nutraceutical segments. This flexibility helps manage the dual pressure of cost optimization and functional performance.

Next, companies must cultivate robust domestic supply chains in response to evolving tariff landscapes. Strategic alliances with regional starch producers and feedstock suppliers can mitigate price volatility and ensure uninterrupted access to raw materials. Simultaneously, collaboration with policymakers to advocate for transparent tariff structures and sustainable processing incentives will enhance long-term supply security.

Furthermore, a focused expansion into high-growth regional markets is advisable. In Europe and North America, premium promotions of high-purity isolates in dietary supplements and personal care products can capitalize on clean-label trends. Conversely, in Asia-Pacific, aligning with local distribution partners to introduce cost-efficient powder variants will capture emerging consumer segments. Finally, a commitment to sustainability-through water-efficient extraction and residual biomass valorization-will not only reduce operational costs but also resonate with eco-conscious customers and regulators alike.

Outlining Rigorous Research Methodology Combining Primary and Secondary Data Validation Techniques for Accurate Potato Protein Market Insights

Outlining Rigorous Research Methodology Combining Primary and Secondary Data Validation Techniques for Accurate Potato Protein Market Insights

This study employs a comprehensive approach that integrates both secondary and primary research methods. Initially, a thorough review of industry publications, patent filings, and technical white papers was conducted to map the landscape of extraction technologies, regulatory frameworks, and end-use applications. This desk research provided the foundational understanding of market drivers, historical developments, and competitive dynamics.

Subsequently, extensive primary research was undertaken, including in-depth interviews with key stakeholders across the value chain. These interviews encompassed product development leaders at ingredient manufacturers, procurement heads at major food and beverage companies, regulatory experts, and sustainability consultants. Insights gathered from these conversations were systematically triangulated with secondary data to ensure accuracy and consistency.

Quantitative validation involved distributing structured questionnaires to a targeted sample of formulators and end users, capturing perspectives on segmentation preferences, tariff impacts, and regional growth expectations. The combined data sets were then subjected to rigorous cross-verification through expert panel reviews and iterative consultations with industry veterans. This multi-layered research process assures that the insights presented are both reliable and reflective of current market realities.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Potato Protein market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Potato Protein Market, by Form

- Potato Protein Market, by Source

- Potato Protein Market, by Extraction Method

- Potato Protein Market, by Application

- Potato Protein Market, by End User

- Potato Protein Market, by Region

- Potato Protein Market, by Group

- Potato Protein Market, by Country

- United States Potato Protein Market

- China Potato Protein Market

- Competitive Landscape

- List of Figures [Total: 17]

- List of Tables [Total: 1272 ]

Synthesizing Key Findings and Strategic Imperatives to Conclude a Comprehensive Executive Summary of the Potato Protein Industry Today

Synthesizing Key Findings and Strategic Imperatives to Conclude a Comprehensive Executive Summary of the Potato Protein Industry Today

The evolution of potato protein from a byproduct to a strategic ingredient underscores its multifaceted value in food, feed, cosmetics, and nutraceutical sectors. Technological advancements in drum and spray drying, along with acid, alkali, and enzyme extraction methodologies, have expanded functional applications and opened new markets. Simultaneously, consumer preferences for plant-based, clean-label proteins and sustainability incentives have reinforced potato protein’s appeal as a circular economy asset.

Moreover, the 2025 United States tariff changes have catalyzed a realignment of supply chains, highlighting the importance of flexible domestic partnerships and adaptive procurement strategies. Segmentation insights reveal that concentrate, isolate, and powder forms each serve distinct market needs, while native and modified source variants drive tailored performance attributes. Regionally, the Americas lead in scale and innovation, Europe Middle East Africa emphasize regulatory compliance and high-purity solutions, and Asia Pacific offers dynamic growth potential across diverse end markets.

As leading companies continue to vie for competitive advantage through R&D investments, sustainability initiatives, and strategic alliances, the industry stands at a pivotal juncture. Stakeholders equipped with actionable intelligence and robust market understanding will be best positioned to navigate emerging challenges and capture opportunities in the evolving potato protein landscape.

Take the Next Step in Strategic Decision Making Secure Comprehensive Potato Protein Market Intelligence by Engaging with an Associate Director Today

For decision makers seeking to capitalize on these comprehensive insights in potato protein, direct engagement with Ketan Rohom ensures seamless access to the full market research report. As Associate Director of Sales & Marketing, he can provide tailored guidance on customizing sections to meet your organization’s specific strategic requirements. Whether your team requires deeper dives into tariff impact analysis or segmentation performance benchmarks, a conversation with Ketan will help you unlock actionable intelligence that aligns with your growth objectives. Contacting him today will streamline the process and equip your leadership with the critical data and analysis needed to drive informed investments, optimize supply chains, and sustain competitive advantage in the rapidly evolving potato protein landscape.

- How big is the Potato Protein Market?

- What is the Potato Protein Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?