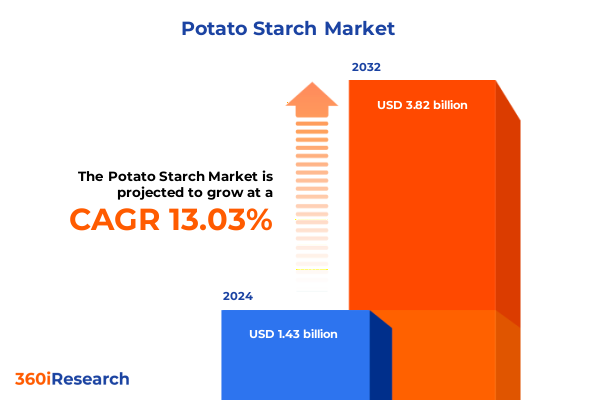

The Potato Starch Market size was estimated at USD 1.62 billion in 2025 and expected to reach USD 1.80 billion in 2026, at a CAGR of 13.02% to reach USD 3.82 billion by 2032.

Potato Starch Market Dynamics and Opportunities Explored Through a Comprehensive Executive Summary for Strategic Direction in a Rapidly Evolving Industry

Potato starch stands as a cornerstone ingredient within food and industrial formulations, recognized for its exceptional thickening, stabilizing, and binding properties. With an array of functional characteristics that contribute to texture enhancement, moisture retention, and clarity in finished goods, this versatile ingredient has become indispensable across multiple sectors. Recent data indicate that global production of potato starch reached approximately 8.4 million tons in 2024, reflecting a relatively flat yet resilient trend as the market consolidates after peak volumes recorded in 2022.

Among producing nations, China leads with an output of 1.6 million tons, followed by India and the United States, which accounted for 433,000 tons-or roughly 5.2 percent of global volume-in the same period. This distribution of production underscores the strategic importance of diversified supply chains and raw material sourcing. Moreover, value estimates suggest that production output approached nine billion U.S. dollars in export price terms, highlighting the economic significance of the potato starch industry on an international scale.

Driven by evolving consumer preferences for clean-label and gluten-free ingredients, manufacturers are increasingly leveraging the native and modified variants of potato starch to develop products that resonate with health-conscious audiences. These dynamics are further informed by cost considerations, sustainability imperatives, and emerging regulatory frameworks, all of which collectively shape the strategic landscape for stakeholders looking to navigate growth opportunities.

Emerging Consumer Demands and Technological Innovations Driving Transformative Shifts in the Global Potato Starch Industry Landscape and Competitive Dynamics

The potato starch sector is undergoing transformative shifts fueled by technological advancements and shifting consumer expectations. Enhanced processing techniques, particularly within the realm of modified starches, have enabled the development of acid-modified, cross-linked, enzymatically modified, and oxidized variants that exhibit improved thermal stability, shear resistance, and freeze-thaw resilience. These innovations not only unlock new application possibilities but also allow producers to address increasingly stringent performance requirements within food and non-food industries.

Simultaneously, end users have grown more discerning regarding ingredient provenance and functionality. The resurgence of clean-label initiatives has elevated demand for minimally processed botanicals and gluten-free alternatives, positioning native potato starch as a premium offering. This trend extends beyond culinary uses into industrial sectors such as paper and pulp, textiles, and pharmaceuticals, where the biodegradability and minimal chemical footprint of potato starch support sustainability goals and regulatory compliance.

Another pivotal shift arises from the increased prioritization of plant-based and vegan formulations. Potato starch’s neutral flavor profile, high purity, and hypoallergenic characteristics make it a preferred thickening and stabilizing agent in plant-based dairy substitutes, meat analogues, and confectionery products. As consumer demand for ethical and sustainable food choices continues to rise, industry participants are accelerating research and development efforts to refine starch functionalities, reduce environmental impact, and strengthen alignment with circular-economy principles.

Assessing the Comprehensive Impact of 2025 United States Tariff Policies on the Potato Starch Supply Chain and Import Economics and Market Dynamics

In 2025, the United States implemented a layered tariff structure that has reshaped the cost and flow of imported potato starch. Under the Harmonized Tariff Schedule, raw potato starch (HTS 1108.13.00) is subject to a general duty rate of 0.56 U.S. cents per kilogram, while modified starch derivatives derived from potato (HTS 3505.10.00) carry a slightly higher levy of 0.7 U.S. cents per kilogram. These baseline duties apply universally, though certain free-trade agreement partners enjoy reduced rates or exemptions.

In addition to ad valorem duties, imports originating from China face an extra surcharge equivalent to the general rate plus 25 percent for human consumption categories, reflecting the broader reciprocal tariff policy enacted in April 2025. This additional duty, combined with universal baseline tariffs of 10 percent under the International Emergency Economic Powers Act and targeted levies on major trading partners, has elevated overall import costs and prompted buyers to secure alternative sources or consider domestic production expansion.

The cumulative impact of these measures extends beyond pricing. Elevated duties have disrupted established supply chains, increased inventory carrying costs, and introduced margin pressure for downstream manufacturers reliant on potato starch for food, paper, and pharmaceutical applications. Moreover, uncertainty around potential policy reversals and ongoing trade negotiations has fostered a climate of risk aversion, compelling industry stakeholders to adopt hedging strategies, diversify supplier relationships, and invest in tariff classification reviews to mitigate duty exposure and maintain cost competitiveness.

Unveiling Critical Segmentation Insights into Type Function Application and Distribution Channels for the Potato Starch Market Enhancing Strategic Positioning

A nuanced understanding of market segmentation is critical for developing targeted strategies and capturing value across diverse end-use scenarios. From a product perspective, the market divides into native and modified starches, with modified variants further distinguished by acid modification, cross-linking, enzymatic treatment, and oxidation processes. These tailored modifications enhance specific performance attributes such as viscosity control, freeze-thaw stability, and clarity, enabling formulators to address complex texture and stability challenges in food and industrial systems.

Functional segmentation reveals four primary roles: adhesive strength for packaging and paper applications; binding and cohesion in pharmaceutical and feed formulations; stabilization in emulsification and gelation systems for dairy, sauces, and confectionery; and thickening to achieve desired viscosity profiles in soups, sauces, and dressings. Stabilization functions, particularly emulsification and gelation, are increasingly sophisticated, facilitating the development of clean-label and gluten-free products with consistent sensory qualities.

Application-based segmentation spans animal feed, food, paper and pulp, pharmaceuticals, and textiles. Within food, critical subsegments encompass bakery, confectionery, dairy products, meat analogues, and soups and sauces, each demanding distinct functional specifications. As demand for clean-label and plant-based offerings accelerates, potato starch finds new opportunities in vegan meat substitutes and novel dairy alternatives, leveraging its neutral taste and texturizing capabilities.

Distribution channels bifurcate into industrial and retail networks. Industrial distribution serves large-scale processors and formulators, while retail distribution-comprising convenience stores, specialty outlets, and supermarkets and hypermarkets-caters to smaller-scale packaging and private-label brands. Navigating these channels requires adaptive logistics, customized packaging formats, and tailored marketing approaches to meet varying volume requirements and customer expectations.

This comprehensive research report categorizes the Potato Starch market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Function

- Application

- Distribution Channel

Illuminating Regional Variations and Growth Catalysts Across the Americas Europe Middle East Africa and Asia Pacific in Potato Starch Demand

Regional dynamics exhibit marked differences in production capacity, consumption patterns, and growth trajectories. In the Americas, North America stands as a mature market anchored by a robust agricultural base and established processing infrastructure. The United States, with its integrated supply chain and focus on clean-label innovation, continues to drive demand, while Latin American producers explore export markets to capitalize on rising global consumption.

The Europe, Middle East & Africa region demonstrates a heterogeneous landscape. Western European markets are characterized by stringent regulatory standards and high consumer demand for natural and functional ingredients, fostering innovation in modified starch applications. In Eastern Europe, agricultural expansion and investments in processing facilities have enhanced the region’s role as both a producer and exporter. Meanwhile, Middle Eastern and African markets are in early stages of growth, with urbanization and food-processing industry development creating new opportunities for value-added starch products.

Asia-Pacific represents the most dynamic region, driven by rapid economic growth, expanding food and beverage sectors, and evolving consumer preferences. China retains its position as the largest producer, yet climatic variability and raw material constraints have driven some processors to explore alternative sourcing. Southeast Asian markets, especially Vietnam and Thailand, are emerging as important production and export hubs. Japan and South Korea continue to innovate in high-purity and specialty starches, leveraging advanced processing technologies to meet demanding quality standards.

This comprehensive research report examines key regions that drive the evolution of the Potato Starch market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Industry Players and Competitive Profiles Shaping the Evolving Potato Starch Market with Strategic Innovations and Partnerships

The competitive environment within the potato starch market features a mix of global agribusiness conglomerates and specialized regional players. Cargill, Ingredion, and Tate & Lyle lead in global reach, leveraging extensive distribution networks and diversified portfolios to offer native and modified starch solutions. These firms invest significantly in research to develop novel functionalities that address emerging market needs, including gluten-free and plant-based formulations.

European cooperatives and processors, such as Tereos, Royal Avebe, and Agrana Beteiligungs, capitalize on deep agricultural roots, proprietary processing technology, and strong cooperative models to maintain stable raw material access and drive product innovation. Pepees and Südzucker emphasize sustainability and circular-economy initiatives, integrating renewable energy and waste valorization into their manufacturing processes. Collectively, these key participants influence pricing benchmarks, quality standards, and technology adoption throughout the value chain.

Smaller, niche operators also contribute to the competitive dynamics by focusing on specialized segments, such as organic starches and regionally tailored formulations. Partnerships and joint ventures between global players and local producers facilitate market entry, technology transfer, and localized product development, enabling agility in responding to shifting consumer demands and regulatory landscapes.

This comprehensive research report delivers an in-depth overview of the principal market players in the Potato Starch market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- AGRANA Beteiligungs AG

- Aloja Starkelsen

- Anil Ltd.

- Avebe U.A.

- Cargill Incorporated

- Crest Cellulose

- Emsland Group

- Gulshan Polyols Ltd.

- Ingredion Incorporated

- KMC Kartoffelmelcentralen amba

- Lyckeby Starch AB

- Novidon Starch BV

- Pepees S.A.

- Roquette Frères

- Sanstar Bio Polymers Ltd.

- Santosh Starch Products

- Sayaji Industries Limited

- Shree Bhawani Paper Mills Ltd.

- Shree Ganesh Khandsari Udyog

- Shree Ganesh Starch

- Shubham Starch

- Shubham Starch Chem Pvt. Ltd.

- Tate & Lyle PLC

Actionable Strategic Recommendations for Industry Leaders to Capitalize on Emerging Trends in the Potato Starch Market and Sustain Competitive Advantage

Industry leaders should prioritize innovation in modified starch technologies to differentiate their offerings and meet emerging performance requirements. Focused investment in research and development can unlock new functionalities-such as enhanced freeze-thaw stability and cold-water solubility-that cater to fast-growing segments like plant-based dairy and meat alternatives.

Given the evolving trade environment, manufacturers and importers must strengthen supply chain resilience by diversifying sourcing across multiple geographies. Cultivating relationships with suppliers in emerging production hubs can mitigate tariff exposure and raw material shortages, while joint forecasting and collaborative planning reduce inventory risks.

To capture clean-label demand, stakeholders should develop transparency initiatives that trace ingredient provenance and promote sustainability credentials. Certifications, sustainability reporting, and participation in circular-economy programs will enhance brand trust and support premium pricing strategies in retail channels.

Finally, forging strategic alliances between starch producers, food and beverage manufacturers, and technology providers can accelerate innovation and streamline product development cycles. Collaborative platforms and consortiums facilitate knowledge sharing, co-creation of value-added solutions, and alignment on regulatory compliance, ultimately driving competitive advantage.

Robust Research Methodology Combining Primary Expert Interviews Data Triangulation and Comprehensive Secondary Sources for Potato Starch Analysis

This analysis is grounded in a multi-tiered research methodology combining primary expert interviews with processing facility executives, supply chain managers, and end-user formulators. Qualitative insights were triangulated with quantitative data derived from customs and trade databases, production statistics, and publicly available fiscal reports. Secondary research included a review of peer-reviewed journals, industry publications, government trade documents, and company disclosures to ensure the comprehensiveness and reliability of findings.

Data triangulation techniques were employed to reconcile discrepancies between sources and validate underlying assumptions, while sensitivity analyses tested the robustness of segmentation and regional breakouts. The synthesis of primary and secondary inputs enabled a holistic view of market dynamics, supported by cross-referencing of technical specifications and functional requirements across application segments.

Where applicable, case studies and best practices were incorporated to illustrate strategic moves by leading organizations, providing actionable context for stakeholders seeking to enhance their competitive positioning. Methodological limitations were addressed through continual updates to reflect tariff changes, technological advancements, and evolving regulatory frameworks.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Potato Starch market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Potato Starch Market, by Type

- Potato Starch Market, by Function

- Potato Starch Market, by Application

- Potato Starch Market, by Distribution Channel

- Potato Starch Market, by Region

- Potato Starch Market, by Group

- Potato Starch Market, by Country

- United States Potato Starch Market

- China Potato Starch Market

- Competitive Landscape

- List of Figures [Total: 16]

- List of Tables [Total: 1431 ]

Conclusive Perspectives on Market Dynamics and Strategic Imperatives in the Global Potato Starch Industry Informing Future Decision Making

The global potato starch industry is poised at a pivotal juncture where technological innovation, shifting consumer preferences, and trade policy complexities intersect. While production volumes have stabilized, the push toward clean-label, gluten-free, and sustainable solutions underscores the strategic importance of both native and modified starch variants in diverse applications. Regions such as North America and Europe remain stable growth engines, while the Asia-Pacific emerges as a dynamic frontier buoyed by expanding food-processing sectors and rising consumer demand.

Tariff structures enacted in 2025 have introduced cost pressures but also fostered supply chain diversification and strategic realignment among producers and buyers. Segmentation insights point to significant opportunities within high-performance applications-namely emulsification, gelation, and adhesive uses-where tailored functionality commands premium positioning. Key players are leveraging innovation and collaboration to capture these opportunities, supported by robust research and development frameworks.

Looking ahead, success will hinge on the ability of industry participants to balance cost competitiveness with quality differentiation, embrace sustainability imperatives, and harness data-driven insights to anticipate market shifts. By aligning strategic investments with evolving end-user demands and regulatory landscapes, stakeholders can navigate uncertainty and capitalize on the enduring versatility of potato starch.

Engaging Call to Action for Strategic Acquisition of the Comprehensive Potato Starch Market Research Report with Associate Director Ketan Rohom

To explore the full breadth of insights and nuance captured in this detailed market research report, reach out to Associate Director, Sales & Marketing, Ketan Rohom, and secure access to the latest analysis, data, and strategic recommendations essential for driving growth and innovation in the potato starch market

- How big is the Potato Starch Market?

- What is the Potato Starch Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?