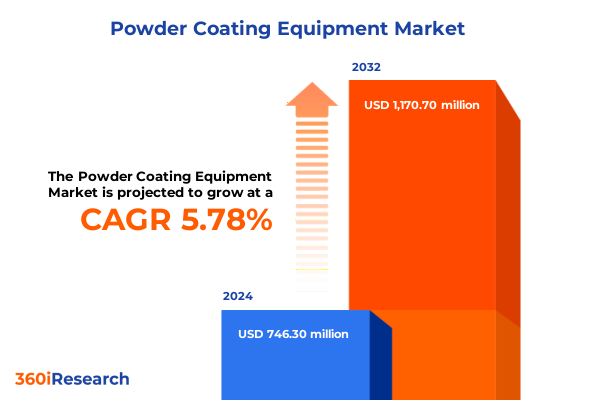

The Powder Coating Equipment Market size was estimated at USD 787.27 million in 2025 and expected to reach USD 832.47 million in 2026, at a CAGR of 5.83% to reach USD 1,170.69 million by 2032.

Unlocking the Future of Powder Coating Equipment: An Overview of Industry Dynamics, Technological Evolution, and Strategic Imperatives

The powder coating equipment landscape has emerged as a critical enabler of sustainable, high-performance surface finishing solutions across a wide range of industries, including automotive, aerospace, and general industrial applications. Driven by increasing demand for durable, corrosion-resistant coatings that meet stringent environmental regulations, equipment manufacturers and end-users alike are placing a premium on reliability, precision, and energy efficiency. Given the sector’s capital-intensive nature and technological complexity, stakeholders must stay abreast of evolving process innovations and regulatory shifts to maintain a competitive edge.

Over the past several years, advancements in automation, digital controls, and process monitoring have redefined operational excellence, enabling consistent coating thickness, reduced waste, and optimized throughput. Additionally, the integration of modular designs and quick-change features in powder coating booths and ovens allows manufacturers to rapidly adapt to varied product lines and shifting production schedules. As volatile raw material costs and compliance pressures accelerate, the focus on lifecycle cost reduction and total cost of ownership has intensified, making equipment reliability and ease of maintenance paramount considerations for procurement teams.

This executive summary encapsulates the key highlights from the in-depth research on powder coating equipment, outlining transformative trends, trade policy impacts, segmentation dynamics, regional variations, leading industry players, and actionable recommendations. It provides a cohesive foundation for strategic planning and supports decision-makers in navigating the complexities of the market environment.

Navigating Transformative Shifts in Powder Coating Equipment through Automation Advances and Sustainable Materials Adoption

The powder coating equipment industry is undergoing a fundamental transformation as automation and data-driven process controls become embedded in every stage of the finishing workflow. Robotics-enabled spraying systems and advanced gantry configurations have enabled precise and repeatable deposition, reducing manual intervention and enhancing worker safety. Simultaneously, real-time process monitoring tools, such as inline thickness gauges and infrared temperature sensors, are being integrated to provide immediate feedback loops that ensure consistent coating quality and minimal rework.

Moreover, sustainability considerations have driven a shift toward eco-friendly powder chemistries and resource-efficient equipment designs. Manufacturers are investing in closed-loop recovery systems and high-efficiency cyclones that reclaim overspray and minimize material loss, while next-generation ovens feature rapid heating technologies and improved insulation to reduce energy consumption. These technological shifts not only align with tightening emissions regulations but also contribute to lower operating costs over the equipment lifecycle.

In parallel, digital transformation strategies are paving the way for smart factories in surface treatment facilities. Enterprise-level integration of powder coating lines with manufacturing execution systems and enterprise resource planning platforms enables holistic visibility into production metrics and supply chain performance. As a result, decision-makers can leverage predictive maintenance algorithms and digital twins to proactively address equipment downtime risks and streamline capacity planning, ultimately accelerating time to market and boosting operational resilience.

Assessing the Cumulative Impact of the United States Tariffs Implemented in 2025 on Powder Coating Equipment Supply Chains

The introduction of new United States tariffs in early 2025 has exerted significant pressure on the powder coating equipment supply chain, affecting both imported components and finished machinery. Increased duties on control systems, powder guns, and specialized oven parts have elevated landed costs and prompted manufacturers to reassess sourcing strategies, driving a surge in supplier diversification efforts and nearshore production initiatives to mitigate tariff exposure.

As a direct consequence of the tariff regime, equipment providers have sought to adjust their value propositions by sharpening cost-reduction measures and emphasizing locally assembled solutions. Some leading suppliers have streamlined their global footprint by relocating critical manufacturing operations to North America, while others have forged strategic alliances with regional fabricators to ensure component continuity and reduce lead times. These shifts have fostered greater agility in responding to fluctuating input costs and geopolitical uncertainties.

Despite the initial cost headwinds, the tariff-driven restructuring offers long-term benefits by bolstering domestic supply chain resilience. With local supply bases now more deeply integrated, end-users can expect improved service support, shorter delivery schedules, and enhanced customization capabilities. Nevertheless, close collaboration between policymakers and industry stakeholders remains essential to balance fair trade practices with the goal of sustaining a robust, innovation-driven equipment ecosystem.

Key Segmentation Insights Revealing How Component, Type, Technology, Coating Material, Application, and Distribution Dynamics Shape Market Opportunities

When dissected by component, the powder coating equipment sector encompasses a spectrum of systems ranging from sophisticated control panels to high-capacity ovens, covering essential hardware such as powder coating booths, guns, feed systems, pre-treatment stations, and recovery units. This breadth underlines the critical role of modular design and seamless integration in delivering end-to-end finishing solutions that address diverse production requirements.

Analysis based on type reveals that electrostatic spray coating and fluidized bed powder coating techniques each offer distinct advantages, with electrostatic applications favoring fine-detail parts and high transfer efficiencies, while fluidized bed methods excel in coating large, heat-tolerant components. Technology classification further differentiates the equipment landscape into thermoplastic and thermoset powder processes, reflecting variations in curing profiles and mechanical properties that align with specific end-use criteria.

Considering the spectrum of coating materials-acrylic, epoxy, epoxy-polyester hybrids, polyester, and polyurethane-manufacturers must calibrate their equipment choices to accommodate unique powder rheologies and curing temperature requirements. Application-centric insights show that sectors such as aerospace, automotive, and general industrial demand precision and compliance with strict performance standards, whereas consumer appliance and furniture applications prioritize aesthetic versatility and throughput efficiency. Finally, distribution channel dynamics, whether through traditional offline networks or emerging online platforms, shape customer engagement models and influence aftermarket support offerings.

This comprehensive research report categorizes the Powder Coating Equipment market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Component

- Type

- Technology

- Coating Material

- Application

- Distribution Channel

Key Regional Insights Exploring Trends and Growth Drivers across the Americas, Europe Middle East and Africa, and the Asia Pacific Regions

Regional examination highlights distinct growth drivers and operational challenges across the Americas, Europe Middle East and Africa, and the Asia Pacific. In the Americas, robust infrastructure investment, coupled with strong aftermarket service networks, underpins steady demand for both replacement and new powder coating lines, particularly in the automotive and heavy equipment manufacturing sectors.

Across Europe Middle East and Africa, regulatory mandates on volatile organic compound emissions and an accelerated transition toward sustainable manufacturing practices have catalyzed the adoption of energy-efficient ovens and automated spray booths. Meanwhile, heightened focus on local content and reshoring strategies in several European countries is reshaping supply chain configurations and fostering regional partnerships.

In the Asia Pacific, rapid industrialization, expanding construction activity, and growing consumer electronics production are fueling demand for versatile powder coating solutions. However, suppliers must navigate varied regulatory regimes and address skill gaps in process engineering to fully capitalize on the region’s potential. Cross-border collaboration and targeted training programs are emerging as key enablers for sustainable revenue growth and operational excellence in this dynamic landscape.

This comprehensive research report examines key regions that drive the evolution of the Powder Coating Equipment market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Key Companies Insights Highlighting Competitive Strategies, Innovation Portfolios, and Collaborative Partnerships in the Powder Coating Equipment Sector

Leading equipment manufacturers are leveraging a multi-pronged approach to secure their market positions through continuous product innovation, targeted acquisitions, and strategic alliances. Established global players have expanded their portfolios with digitally enabled control systems and modular powder recovery units, enhancing the flexibility and connectivity of coating lines for end-users seeking scalable solutions.

Simultaneously, specialized firms have carved niches by introducing advanced spray gun designs and high-efficiency cyclone separators that improve transfer efficiency and minimize environmental impact. Partnerships between equipment vendors and coating material producers are also gaining traction, aimed at co-developing turnkey systems optimized for emerging powder chemistries and custom color formulations.

In response to tariff challenges, many companies have accelerated the localization of assembly facilities and forged partnerships with regional service providers to strengthen aftermarket support. Collaboration with academic institutions and research consortia has further spurred breakthroughs in rapid curing technologies and low-temperature ovens, reinforcing the competitive edge of first-movers. Collectively, these efforts underscore the industry’s commitment to delivering cost-effective, sustainable, and technologically advanced powder coating solutions.

This comprehensive research report delivers an in-depth overview of the principal market players in the Powder Coating Equipment market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Akzo Nobel N.V.

- Anesta Iwata Corporation

- Asahi Sunac Corporation

- Carlisle Fluid Technologies.

- Electrostatic Magic Limited

- Finishing Systems, Inc.

- Fuji Spray

- Gema Switzerland Gmbh

- Hangzhou Color Powder Coating Equipment Co., Ltd.

- Hangzhou Kafan Machinery & Equipment Co., Ltd.

- J. Wagner GmbH

- Koryo Coating Machine Industrial Co., Ltd.

- Nordson Corporation

- Powder Coating Solutions Inc.

- PPG Industries, Inc.

- Protech Powder Coating, Inc.

- RPM International Inc.

- Sames

- Statfield Equipments Pvt. Ltd.

- Vijay Enterprises

- Yantai Parker Machinery Co., Ltd.

Actionable Recommendations to Empower Industry Leaders with Strategic Initiatives, Operational Excellence, and Market Expansion Tactics

To thrive amid shifting trade policies and evolving technology trends, industry leaders should prioritize the deployment of automated spraying systems and smart process controls that deliver consistent coating quality and real-time performance insights. By investing in predictive maintenance frameworks and digital twins, organizations can preemptively address equipment downtime and streamline capacity planning to maintain uninterrupted production.

At the same time, fostering closer collaboration with local suppliers and contract manufacturers will mitigate the risk of future tariff disruptions and shorten lead times for critical components. Embracing circular economy principles through advanced powder recovery systems and modular booth designs can further enhance resource efficiency and reduce operational costs over the equipment lifecycle.

Furthermore, executives should allocate resources to targeted workforce training initiatives, equipping technicians and process engineers with the skills needed to operate smart coating lines and interpret advanced analytics dashboards. Finally, establishing cross-industry alliances to co-develop next-generation curing technologies and low-emission materials will position enterprises at the forefront of sustainable surface finishing innovation.

Comprehensive Research Methodology Detailing Data Collection, Analysis Frameworks, and Validation Processes Underpinning the Market Intelligence

The research methodology underpinning this analysis combines extensive primary and secondary data gathering, including in-depth interviews with equipment manufacturers, coating material suppliers, and end-user representatives across key regions. In tandem, proprietary transaction databases and trade records were systematically reviewed to assess supply chain flows and tariff implications.

Quantitative data was triangulated with qualitative insights from expert panels and site visits to production facilities, ensuring a robust understanding of current technology adoption rates and operational bottlenecks. A rigorous validation process involving statistical consistency checks and cross-source corroboration was applied to maintain analytical integrity.

Segmentation frameworks were constructed based on components, coating types, powder chemistries, applications, and distribution channels, enabling a nuanced exploration of market dynamics. Geographic analysis leveraged regional regulatory reviews and infrastructure investment forecasts to contextualize demand drivers. Throughout the study, iterative peer-review sessions and stakeholder workshops provided continuous feedback, refining the narrative and reinforcing the credibility of the findings.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Powder Coating Equipment market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Powder Coating Equipment Market, by Component

- Powder Coating Equipment Market, by Type

- Powder Coating Equipment Market, by Technology

- Powder Coating Equipment Market, by Coating Material

- Powder Coating Equipment Market, by Application

- Powder Coating Equipment Market, by Distribution Channel

- Powder Coating Equipment Market, by Region

- Powder Coating Equipment Market, by Group

- Powder Coating Equipment Market, by Country

- United States Powder Coating Equipment Market

- China Powder Coating Equipment Market

- Competitive Landscape

- List of Figures [Total: 18]

- List of Tables [Total: 1113 ]

Conclusion Emphasizing Strategic Imperatives, Future Outlook, and the Path Forward for Stakeholders in the Powder Coating Equipment Industry

The evolving landscape of powder coating equipment reflects the convergence of automation, sustainability, and supply chain resilience as critical imperatives for the industry. Technological breakthroughs in process controls and energy-efficient components are setting new performance benchmarks, while tariff-driven local sourcing efforts are reshaping global manufacturing footprints. Segmentation analysis illuminates the diverse needs of end-users across applications and distribution channels, underscoring the importance of tailored solutions.

Regional variations reveal both opportunities and challenges, from infrastructure-led growth in the Americas to regulatory-driven modernization in Europe Middle East and Africa and rapid industrial expansion in the Asia Pacific. Leading companies are responding with strategic alliances, localized operations, and dual focus on innovation and service excellence. As stakeholders look ahead, embracing digital transformation and collaborative partnerships will be essential to capture emerging opportunities and navigate potential headwinds.

In sum, the insights presented herein offer a strategic compass for executives seeking to optimize equipment investments, enhance operational efficiency, and drive sustainable growth in the powder coating arena.

Take the Next Step Today by Engaging with Ketan Rohom to Access Exclusive Market Research Insights and Drive Competitive Advantage

Engage with Ketan Rohom to secure unparalleled access to the full market research report and unlock detailed insights, strategic recommendations, and proprietary data essential for informed decision making. By connecting directly with Ketan Rohom, Associate Director of Sales & Marketing, you will be guided through the report’s comprehensive findings, tailored to your organization’s priorities and growth objectives.

Take advantage of this opportunity to differentiate your business with cutting-edge intelligence on technology advancements, tariff impacts, and evolving customer requirements. Reach out to Ketan Rohom today to arrange a personalized briefing, explore sample insights, and discuss flexible licensing options that align with your budget and timeline. Act now to harness the competitive advantage and steer your powder coating equipment strategy toward lasting success.

- How big is the Powder Coating Equipment Market?

- What is the Powder Coating Equipment Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?