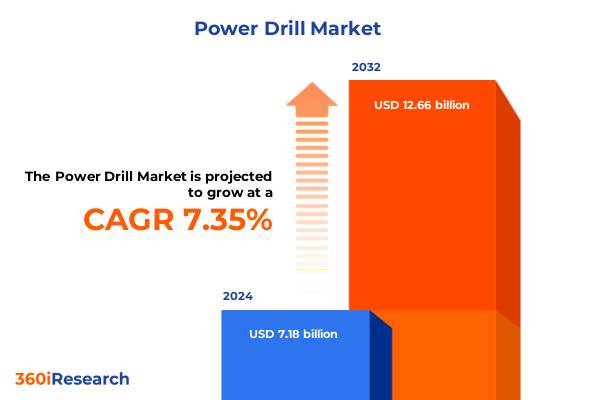

The Power Drill Market size was estimated at USD 7.71 billion in 2025 and expected to reach USD 8.31 billion in 2026, at a CAGR of 7.34% to reach USD 12.66 billion by 2032.

Understanding the Evolving Power Drill Market and Its Strategic Importance for Professionals and Do-It-Yourself Enthusiasts Across Applications

The power drill sector stands at a pivotal moment as innovations in design and functionality converge with evolving end user requirements. Energized by both professional contractors demanding robust performance and do-it-yourself enthusiasts prioritizing convenience and safety, the market underscores the importance of mobility, precision, and durability. In addition, the rising emphasis on ergonomic form factors and smart connectivity solutions reflects a broader trend toward tools that mesh seamlessly with digital workflows and safety protocols.

Moreover, this market is characterized by a fierce interplay between established manufacturing titans introducing next-generation brushless motors and agile newcomers pushing boundaries in battery chemistry. Consequently, the competitive environment demands constant refinement of core capabilities, from torque delivery and battery runtime to noise reduction and integrated LED lighting. Furthermore, sustainability considerations are now influencing material selection and end-of-life recycling initiatives, reinforcing the need for eco-friendly design without compromising performance.

As such, the wider adoption of cordless technology and the phasing out of legacy corded models signal a transformative shift in user expectations. The growing convergence between professional-grade power tools and accessible consumer-focused offerings underscores an urgent requirement for manufacturers to maintain cross-segment relevance. This report begins by contextualizing these forces within the current market landscape, setting the stage for deeper exploration of technological drivers, regulatory influences, and strategic imperatives.

Exploring Technological Advancements and Market Dynamics Redefining Power Drill Innovation and Competitive Advantage in Modern Industries

In recent years, continuous technological breakthroughs have reshaped the power drill landscape, elevating user experiences and operational efficiency. Leading advancements in brushless motor designs, for instance, have unlocked higher torque-to-weight ratios while extending battery life, prompting a decisive shift away from traditional brushed offerings. As a result, manufacturers are investing heavily in proprietary motor architectures and embedded electronics to deliver real-time performance monitoring and safety shutdown capabilities.

Furthermore, improvements in battery technology have been equally transformative. The industry’s embrace of lithium ion chemistries over nickel cadmium cells has slashed charging times and mitigated memory effect, empowering professionals to sustain workflows without interruption. Coupled with burgeoning developments in fast-charging platforms and modular battery systems, these enhancements have fostered greater on-site flexibility and down-time minimization.

In addition, integration of IoT-enabled features such as tool tracking, predictive maintenance alerts, and usage analytics has begun to gain traction. By leveraging cloud-based dashboards and mobile applications, stakeholders can now manage fleets of cordless drills with unparalleled visibility, thereby reducing loss, optimizing asset utilization, and enhancing field productivity. This digital overlay represents an inflection point that will drive new service models and after-sales revenue streams, further intensifying competition and incentivizing ongoing R&D.

Unpacking the Ongoing Impact of 2025 Tariff Measures on Power Drill Supply Chains, Cost Structures, and Market Accessibility in the United States

The United States government’s tariff adjustments implemented in early 2025 have exerted notable pressure on power drill import costs, compelling both OEMs and distributors to reevaluate their supply chain strategies. These duties, applied broadly across power tool components and finished products, have translated into incremental unit costs that are frequently passed through to end users. As a result, pricing structures have been recalibrated to preserve margin thresholds amid rising input expenditures.

In response to these levies, several manufacturers have explored nearshoring options and alternative sourcing routes to mitigate financial impacts. By relocating critical production stages closer to end markets or diversifying supplier networks, industry players aim to stabilize supply chain continuity while containing logistics costs. Concurrently, strategic inventory management and forward buying agreements have emerged as tactical countermeasures to counter tariff-induced volatility.

Nevertheless, the cumulative effect of these trade measures has prompted a reexamination of product portfolios, with some companies prioritizing premium cordless offerings less susceptible to price sensitivity. At the same time, distributors and retailers are leaning into value-added service packages, bundling accessories, and extended warranties to justify elevated price points. As the market adapts to this new regulatory environment, long-term competitive positioning will increasingly depend on the agility of sourcing strategies and the ability to optimize cost per application.

Uncovering Market Dynamics Through Segmentation by Product Type, Power Source, Chuck Size, Technology, Voltage, Application, End User, and Distribution Channels

Segmentation analysis reveals distinct pockets of demand shaped by product type, where corded variants continue to serve niche industrial settings while cordless models capture broader adoption among mobile professionals and home users. Within cordless solutions, the underlying power source further stratifies preferences: electric mains-powered units remain steadfast in assembly line and fabrication contexts, whereas battery-operated drills, especially those leveraging lithium ion chemistry rather than legacy nickel cadmium, dominate on-the-go tasks.

Delving deeper, chuck size represents another axis of variation, as heavier 1/2 inch chucks excel in high-torque drilling applications, while 3/8 inch configurations appeal to light-duty and precision work. In parallel, motor technology choices between brushed assemblies and advanced brushless systems dictate energy efficiency, maintenance cycles, and upfront investment levels. This technological divide has become a critical differentiator for discerning buyers seeking long-term reliability.

Voltage segmentation further illuminates usage patterns: 12 volt platforms deliver compact form factors for overhead or confined-space operations, whereas industry-standard 18 and 20 volt tools strike a balance between power and weight. At the upper end, 24 volt options cater to heavy-duty masonry or structural framing projects. Application-based segmentation underscores functional demand, with masonry drilling tasks requiring robust impact resistance, metal drilling emphasizing precision tolerances, and wood drilling prioritizing speed and clean cuts.

End user segmentation highlights the commercial sector’s focus on turnkey tool solutions and rental fleets, contrasted by the industrial segment’s demand for ruggedized, high-durability models. Residential users, meanwhile, gravitate toward versatile, user-friendly designs with integrated safety features. Finally, distribution channel scrutiny reveals an entrenched offline presence through retail stores and specialty resellers, complemented by an accelerating shift toward online platforms encompassing both direct-to-consumer brand websites and third-party marketplaces.

This comprehensive research report categorizes the Power Drill market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Product Type

- Power Source

- Chuck Size

- Technology

- Voltage

- Application

- End User

- Distribution Channel

Analyzing Regional Trends Influencing Power Drill Demand and Growth Trajectories Across the Americas, Europe Middle East & Africa, and Asia Pacific

Regional variations underscore unique growth drivers and competitive pressures across the Americas, Europe Middle East & Africa, and Asia-Pacific. In the Americas, strong infrastructure development initiatives and a culture of home improvement fuel robust interest in cordless solutions, supported by widespread retailer networks that blend national hardware chains with specialty tool suppliers.

Transitioning to Europe Middle East & Africa, regulatory frameworks emphasizing energy efficiency and noise control are shaping product designs, while established tool rental markets in urban hubs increase demand for multi-user tool sharing schemes. Moreover, currency fluctuations and regional trade agreements influence import dynamics, prompting manufacturers to tailor regional manufacturing footprints.

Meanwhile in Asia-Pacific, rapid urbanization and large-scale construction projects in emerging economies are driving demand for heavy-duty corded and high-voltage cordless platforms. At the same time, shifting consumer preferences toward smart home integration in mature markets stimulate interest in IoT-enabled tool systems. Supply chain densification across Southeast Asia is also facilitating more cost-effective component sourcing and assembly operations, reinforcing the region’s strategic importance.

Across all regions, digital commerce continues to expand, but with varying penetration rates: the Americas and Asia-Pacific lead in direct-to-consumer online sales, whereas Europe Middle East & Africa exhibits a more balanced split between e-retail and traditional distribution. Recognizing these regional distinctions will be key for stakeholders looking to optimize market entry strategies and allocate resources effectively.

This comprehensive research report examines key regions that drive the evolution of the Power Drill market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Highlighting Leading Innovators and Strategic Moves Shaping the Competitive Power Drill Industry Market Landscape on a Global Scale

The competitive landscape features a dynamic interplay of legacy power tool manufacturers and nimble specialized brands. Industry stalwarts such as DeWalt and Bosch consistently invest in next-generation brushless platforms and proprietary battery ecosystems to reinforce customer loyalty and lock-in. Concurrently, Makita and Milwaukee emphasize system scalability, introducing cross-platform batteries that serve diverse tool categories and reduce total cost of ownership.

Emerging players are also carving niches through targeted innovations: some focus on ultra-lightweight, high-speed cordless drills optimized for overhead construction work, while others deliver modular tool heads that adapt a single drive unit to drilling, fastening, and mixing tasks. Strategic partnerships between tool brands and software providers have begun to materialize, reflecting a growing emphasis on data-driven fleet management and predictive maintenance services.

Moreover, select manufacturers have pursued vertical integration strategies by acquiring battery cell producers or investing in proprietary charging infrastructure, thereby securing supply chain resilience and differentiating on total energy throughput. At the distribution level, online-focused entrants are leveraging direct-to-consumer channels to offer subscription-based tool access models, intensifying pressure on traditional retail networks.

Benchmarking these corporate maneuvers reveals that sustained market leadership will hinge on the ability to synergize mechanical engineering excellence with digital service offerings. Organizations that successfully marry hardware innovation, integrated software solutions, and agile supply chain practices will command the next wave of competitive advantage.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Drill market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Black & Decker Corporation

- C. & E. Fein GmbH

- Chicago Pneumatic Tool Company, LLC

- Craftsman

- DEWALT Industrial Tool Co.

- Hilti Aktiengesellschaft

- Ingersoll-Rand Inc.

- Jiangsu Dongcheng Power Tools Co., Ltd.

- Koki Holdings Co., Ltd.

- Makita Corporation

- Metabo GmbH

- Milwaukee Electric Tool Corporation

- Porter-Cable Corporation

- Ridgid

- Robert Bosch GmbH

- Ryobi Limited

- SKIL Power Tools (legal entity: Chervon

- Stanley Black & Decker, Inc.

- TTS Tooltechnic Systems AG & Co. KG

- Yongkang Makute Electric Appliance Co., Ltd.

Delivering Strategic Recommendations to Strengthen Market Position, Enhance Product Offerings, Optimize Supply Chains and Drive Growth in the Power Drill Sector

Industry leaders should prioritize investment in cordless brushless technologies to meet rising demand for lightweight, high-efficiency performance solutions. By enhancing battery-to-motor integration and expanding voltage offerings across 12, 18, 20, and 24 volt platforms, decision-makers can address diverse user scenarios from fine woodworking to heavy masonry tasks.

Furthermore, executives must explore supply chain diversification to alleviate ongoing tariff pressures. This could include nearshoring assembly operations, establishing alternative component sourcing channels, or negotiating multi-year supplier agreements to lock in favorable pricing. At the same time, reinforcing partnerships with logistics providers and deploying predictive demand planning tools will strengthen inventory resilience.

In addition, embracing direct-to-consumer digital channels-both brand websites and third-party marketplaces-will enable more precise customer insights and margin capture. Leveraging usage analytics and integrated IoT features will also open new avenues for value-added services such as preventive maintenance alerts and subscription-based tool access models, thereby fostering recurring revenue streams.

Finally, companies should tailor product portfolios to specific end user segments, ensuring that solutions for commercial rental fleets, industrial heavy-duty applications, and residential DIY enthusiasts each deliver optimal ergonomics, safety features, and performance characteristics. By adopting a customer-centric, segment-driven approach and embedding sustainability considerations throughout the lifecycle, market participants can secure long-term brand preference and profitability.

Detailing Rigorous Research Methodology Combining Primary and Secondary Data Sources with Qualitative Analysis and Expert Validation Processes

This analysis integrates both primary and secondary research methodologies to construct a comprehensive view of the power drill market. Primary data was collected through in-depth interviews with tool industry executives, procurement leaders, and end user groups spanning commercial contractors, industrial maintenance teams, and residential consumers. These discussions elucidated key pain points related to performance, ergonomics, and total cost of ownership.

Secondary research involved a thorough review of industry publications, patent filings, regulatory directives, and technology white papers to trace product evolution and monitor competitive intelligence. Additionally, company press releases and case studies provided insights into strategic partnerships, M&A activity, and supply chain adjustments triggered by tariff changes. Where available, technical datasheets and certification documentation were cross-referenced to validate product specifications and compliance with emerging energy efficiency standards.

Qualitative analysis techniques, including SWOT evaluation and trend extrapolation, were applied to synthesize findings and identify opportunities for differentiation. This was complemented by expert validation workshops, during which tool designers, materials scientists, and field service professionals reviewed preliminary conclusions to ensure accuracy and relevance. The result is an actionable framework that anchors strategic decision making in robust, multi-source evidence.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Drill market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Drill Market, by Product Type

- Power Drill Market, by Power Source

- Power Drill Market, by Chuck Size

- Power Drill Market, by Technology

- Power Drill Market, by Voltage

- Power Drill Market, by Application

- Power Drill Market, by End User

- Power Drill Market, by Distribution Channel

- Power Drill Market, by Region

- Power Drill Market, by Group

- Power Drill Market, by Country

- United States Power Drill Market

- China Power Drill Market

- Competitive Landscape

- List of Figures [Total: 20]

- List of Tables [Total: 1908 ]

Summarizing Core Strategic Insights and Market Imperatives to Empower Decision Makers Navigating the Dynamic Power Drill Industry Environment with Confidence

This executive summary distills the essential insights required to navigate an increasingly complex power drill market landscape. It underscores the critical influence of advanced brushless technologies, modular battery systems, and digital integration on competitive positioning and user satisfaction. Moreover, it highlights how 2025 tariff measures have recalibrated cost structures, prompting supply chain innovation and product portfolio optimization.

Segmentation analysis reveals that demand patterns vary significantly across product types, power sources, chuck sizes, technologies, voltages, applications, end users, and distribution channels. Regional nuances further shape growth trajectories in the Americas, Europe Middle East & Africa, and Asia-Pacific, calling for tailored market entry and expansion strategies. Meanwhile, a diverse mix of legacy incumbents and specialized disruptors is redefining the competitive frontier through strategic partnerships, vertical integration, and direct-to-consumer models.

By following the actionable recommendations outlined herein-ranging from technology investments and supply chain diversification to digital channel development and segment-focused product tailoring-industry leaders can build resilient business models that withstand regulatory shifts and capitalize on emerging user demands. This body of work provides a strategic compass for decision makers committed to maintaining market leadership amidst relentless technological and economic change.

Connect with Ketan Rohom Associate Director of Sales and Marketing to Secure a Power Drill Market Research Report for Informed Strategic Decision Making

To obtain detailed insights and equip your organization with comprehensive analysis of market dynamics, reach out to Ketan Rohom Associate Director of Sales and Marketing to secure a power drill market research report designed to inform and empower strategic decision making. This tailored study will provide qualitative perspectives on emerging trends, technological investments, and competitive strategies driving success in the sector. By engaging with this report, you will gain clarity on how to navigate supply chain complexities and optimize product portfolios in light of evolving tariffs and shifting consumer preferences. Take the next step toward informed leadership and connect with Ketan Rohom to ensure you have the actionable intelligence needed to stay ahead in this dynamic market.

- How big is the Power Drill Market?

- What is the Power Drill Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?