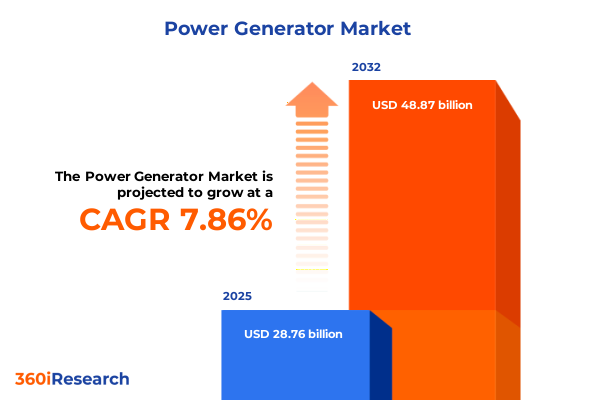

The Power Generator Market size was estimated at USD 28.76 billion in 2025 and expected to reach USD 30.95 billion in 2026, at a CAGR of 7.86% to reach USD 48.87 billion by 2032.

Unpacking the Dynamics of Power Generation in an Era of Evolving Technologies, Policy Disruptions, and Market Resilience Challenges

In today’s rapidly changing energy environment, power generation technologies are at the heart of global efforts to ensure reliable, resilient, and sustainable electricity supply. Across industries and geographies, decision-makers face mounting pressure to balance the imperatives of decarbonization with the need for cost-effective backup and continuous power solutions. The convergence of traditional and emerging energy sources is driving a fundamental re-evaluation of how generators are designed, deployed, and operated.

Regulatory frameworks and policy incentives are accelerating adoption of hybrid systems, renewable-fuel generators, and digital control platforms. Concurrently, heightened concerns around grid reliability-exacerbated by extreme weather events and rising electrification-are reinforcing the enduring relevance of standby and prime generators. As market participants seek adaptive solutions that bridge supply-demand gaps, an integrated understanding of technology, policy, and customer needs has become indispensable.

This executive summary synthesizes the latest industry trends, transformative shifts, and strategic imperatives that will define the power generator market over the coming years. By examining tariff impacts, segment-level insights, regional developments, and competitive positioning, this research equips you with the knowledge required to seize emerging opportunities and navigate challenges in a dynamic landscape.

Mapping the Technological and Regulatory Shifts That Are Redefining Power Generation with Digitalization and Renewables Integration

The power generation sector is experiencing an unprecedented wave of transformation driven by technological innovation and regulatory evolution. Digitalization, for instance, is enabling predictive maintenance and asset optimization, with leading analytics tools projected to reduce operations and maintenance costs by as much as 5% of total power system expenditure-equating to annual savings of nearly USD 20 billion globally. Artificial intelligence and advanced sensors are seamlessly integrating variable renewables into the grid by smoothing output fluctuations and enhancing system flexibility.

Meanwhile, the rapid ascent of low-emissions sources is reshaping traditional generation mixes. Global electricity forecasts indicate that renewables and nuclear will meet all incremental demand by 2027, with solar PV alone expected to account for roughly half of new capacity additions during this period. This surge underscores the dual imperative for generator manufacturers to bolster hybrid solutions that can deliver both grid-support services and off-grid resilience.

At the same time, policy frameworks are evolving to incentivize clean fuel generators, including hydrogen fuel cells and biofuel units, while also extending emissions regulations to standby applications. As digital control systems become ubiquitous, manufacturers must deliver secure, automated platforms capable of remote monitoring, real-time diagnostics, and seamless integration with energy management systems. These converging trends mark a pivotal shift from traditional diesel-centric models to diversified, intelligence-driven power ecosystems.

Analyzing the Comprehensive Effects of 2025 United States Import Tariffs on Power Generation Equipment and Critical Supply Chains

In January 2025, the United States intensified tariffs on critical power-generation inputs, doubling duties on polysilicon and solar wafers from 25% to 50% to fortify domestic clean-energy supply chains. At the same time, the U.S. Commerce Department initiated preliminary anti-dumping duties of 93.5% on graphite imports from China, a key component in lithium-ion batteries, further elevating procurement costs for utility-scale storage projects. These measures have reverberated through global value chains, prompting a strategic reconfiguration of sourcing strategies and inventory management practices.

Moreover, February 2025 executive orders imposed 25% duties on all Canadian and Mexican exports-excluding Canadian energy products at 10%-marking a notable escalation in North American trade tensions under emergency powers authority. Stakeholders across the generator sector have reported price increases and delivery delays as manufacturers and distributors navigate new customs procedures and origin requirements. The compounded effect of these tariffs has introduced uncertainty in capital budgeting, with project developers adjusting timelines and contingency provisions to accommodate higher equipment costs.

Despite short-term cost pressures, these tariff developments are accelerating efforts to localize manufacturing capacity for inverters, control modules, and renewable-fuel generators. Industry leaders are exploring joint ventures, near-shoring partnerships, and technology licensing to reduce exposure to import duties and ensure supply continuity. As companies recalibrate operations to align with the evolving trade landscape, the cumulative impact of 2025 tariffs will continue to serve as a catalyst for both risk mitigation strategies and innovation in power generation solutions.

Illuminating Critical Market Segments Across Generator Types, Portability Options, Control Systems, Capacity Tiers, and Customer Applications

A nuanced view of the power generator market emerges when examining its core segments across multiple dimensions. By type, the landscape extends beyond conventional diesel and gas-fired units to encompass hybrid configurations that marry combustion engines with battery storage, as well as renewable-fuel generators leveraging biofuels, hydrogen fuel cells, and solar-powered systems. Within gas generators, distinctions among biogas, natural gas, and propane not only influence emissions profiles but also dictate regional fuel-sourcing strategies and infrastructure requirements.

Portability considerations further delineate market opportunities. Fixed installations underpin utility and industrial scale deployments, demanding robust control systems for continuous power provision, whereas portable generators address intermittent needs in construction, events, and residential backup, where manual controls often suffice and low to medium power ratings dominate. In contrast, automatic control platforms are gaining traction across both categories, offering remote monitoring, load-sensing algorithms, and seamless integration with smart grid architectures.

Capacity tiers also shape purchasing behavior: high-power generators above 375 kVA serve large commercial and public sector clients, while the sub-75 kVA segment appeals to residential and small business users. In between, the 75–375 kVA range commands usage in mid-sized manufacturing, healthcare, and telecommunications settings. Application-driven demands diverge between prime/continuous power solutions, typically deployed in primary load fulfillment scenarios, and standby units that act as fail-safes during outages.

Finally, sales channels exert a significant influence on market dynamics. Offline avenues, including direct sales, distributors, and retail outlets, remain the predominant routes for commercial and industrial clients seeking personalized service and turnkey solutions. Meanwhile, online platforms-comprising company websites and e-commerce marketplaces-have risen in prominence for small-to-medium enterprises and residential buyers, accelerating digital engagement and enabling data-driven after-sales support.

This comprehensive research report categorizes the Power Generator market into clearly defined segments, providing a detailed analysis of emerging trends and precise revenue forecasts to support strategic decision-making.

- Type

- Portability

- Control Systems

- Power Rating (Capacity)

- End-User Industry

- Application

- Sales Channel

Deciphering Regional Demand Drivers and Infrastructure Trends Shaping Power Generator Markets in the Americas, EMEA, and Asia-Pacific

The Americas region is witnessing robust demand for backup and off-grid power solutions, driven by increased frequency of extreme weather events along coastlines and heightened infrastructure resilience mandates. Across North America, utilities and commercial end users are investing in hybrid generator systems to complement renewable portfolios and hedge against transmission vulnerabilities. Latin American markets, meanwhile, are characterized by a surge in decentralized gas generator installations, where abundant natural gas reserves and expanding microgrid pilot projects are reshaping rural electrification strategies.

In Europe, Middle East & Africa (EMEA), policy imperatives around emissions reduction are catalyzing a shift towards biogas and hydrogen-ready generators. European operators are replacing aging diesel fleets with advanced units capable of dual-fuel operation to navigate renewable integration and stricter air quality regulations. In the Middle East, gas-fired generators remain the backbone of utility and industrial infrastructures, underpinned by ample natural gas supplies and government incentives for cogeneration. Across sub-Saharan Africa, off-grid solar-hybrid and diesel backup systems are essential for bridging persistent electrification gaps, with microfinance initiatives emerging to underwrite decentralized deployment.

The Asia-Pacific region is set for transformative growth as industrialization and digital infrastructure build-outs accelerate power demand. China and India are expanding gas and renewables-ready generator capacities to support data centers and manufacturing clusters, while Southeast Asian nations are adopting solar-diesel hybrid microgrids to enhance rural energy access. In Japan and Korea, strict grid reliability standards and environmental targets are accelerating the deployment of advanced battery-integrated generator systems. Across Oceania, remote mining operations continue to rely on high-power diesel generators, though there is growing interest in hydrogen blending as operators seek to decarbonize energy-intensive sectors.

This comprehensive research report examines key regions that drive the evolution of the Power Generator market, offering deep insights into regional trends, growth factors, and industry developments that are influencing market performance.

- Americas

- Europe, Middle East & Africa

- Asia-Pacific

Assessing Strategic Moves and Competitive Positioning of the Leading Power Generator Manufacturers and Service Providers

Leading power generator manufacturers are leveraging strategic partnerships, technological alliances, and targeted acquisitions to consolidate market positions and accelerate innovation. Cummins has expanded its gas-powered portfolio through joint ventures that enhance module integration capabilities and support emerging hydrogen applications. Meanwhile, Caterpillar has intensified its digital services offering, embedding advanced telematics and predictive analytics into its core product lines to optimize asset performance and reduce total cost of ownership.

In the residential and small commercial segment, Generac and Kohler have harnessed e-commerce channels to augment dealer networks, while investing in renewable-fuel compatibility that appeals to eco-conscious consumers. European players such as Rolls-Royce and MTU are advancing high-efficiency gas generators with low emissions profiles, targeting stringent emissions standards and power quality requirements in urban deployments.

Rental specialists and aggregate providers like Aggreko and Atlas Copco are capitalizing on the growing demand for short-term and emergency power, differentiating through rapid mobilization capabilities and turnkey service contracts. OEMs are also forging alliances with battery and inverter manufacturers to introduce integrated hybrid systems that support both prime and standby applications. As competition intensifies, companies with end-to-end solutions-spanning equipment, controls, financing, and after-sales-are securing preferential contracts in key infrastructure markets.

This comprehensive research report delivers an in-depth overview of the principal market players in the Power Generator market, evaluating their market share, strategic initiatives, and competitive positioning to illuminate the factors shaping the competitive landscape.

- Cummins Inc.

- Generac Holdings Inc.

- Caterpillar Inc.

- Mitsubishi Heavy Industries Ltd.

- Kohler Co.

- Yanmar Co., Ltd.

- Honda Motor Co., Ltd.

- Atlas Copco AB

- GE Vernova

- Mahindra & Mahindra Limited

- Rolls-Royce Holding PLC

- Yamaha Motor Co. Ltd.

- John Deere Group

- Doosan Corporation

- Ashok Leyland Ltd. by Hinduja Group

- Aggreko Ltd

- BRAVO Genset

- Briggs & Stratton, LLC

- DAZZLE POWER GENERATORS

- Greaves Cotton Limited

- Gulf Power Company by NextEra Energy, Inc

- Himalayan Power Machines Mfg Co.

- Kirloskar Oil Engines Ltd.

- Kubota Corporation

- REDA Group

Strategic Imperatives for Industry Leaders to Navigate Supply Chain Risks, Technology Disruption, and Regulatory Challenges in Power Generation

To navigate an increasingly complex environment, industry leaders must adopt proactive supply chain diversification strategies. This involves leveraging near-shoring partnerships and establishing multi-sourcing arrangements for critical components like control modules and power electronics. Early collaboration with semiconductor and inverter suppliers can insulate manufacturers from tariff escalations and customs delays, while joint forecasting initiatives can enhance visibility across extended value chains.

Investing in modular and scalable platform designs will enable faster adaptation to evolving fuel and emissions requirements. By standardizing interfaces and control protocols, companies can accelerate roll-out of hybrid and renewable-fuel-ready generators across multiple regions. Embedding advanced remote monitoring and analytics into product offerings will not only support predictive maintenance but also add service-based revenue streams that improve equipment utilization rates.

Engaging with policymakers and regulatory bodies is critical to shaping supportive frameworks for emerging technologies, such as hydrogen-blending standards and electric vehicle grid integration. Strategic leaders should also cultivate aftermarket and rental portfolios to capture residual value and deepen customer relationships. Ultimately, a balanced innovation roadmap-spanning digital solutions, next-generation fuels, and flexible financing models-will position organizations to thrive amid shifting market dynamics and accelerate the transition to lower-carbon generation.

Delineating Rigorous Research Methodology Through Primary Interviews, Expert Consultations, and Comprehensive Data Triangulation Techniques

This research employs a multi-tiered methodology to ensure depth, accuracy, and relevance. Primary interviews were conducted with senior executives at leading generator manufacturers, distributors, and end-users across key regions to elicit firsthand perspectives on technology adoption, tariff impacts, and market priorities. These qualitative insights were complemented by expert panel consultations, bringing together industry analysts, policy advisors, and engineering specialists to validate trends and address divergent viewpoints.

Secondary data sources included authoritative energy sector publications, regulatory filings, and trade databases. Key policy developments and tariff schedules were analyzed using official USTR and Commerce Department announcements, while trade litigation developments were reviewed through court filings such as those challenging IEEPA-based tariff orders. Segment definitions and classifications were derived from established industry frameworks to maintain consistency and comparability.

Data triangulation was achieved by cross-referencing insights from multiple sources, ensuring that quantitative and qualitative findings were aligned. This comprehensive approach, underpinned by rigorous quality control protocols and iterative validation cycles, provides a robust foundation for the strategic recommendations and market segmentation insights presented herein.

This section provides a structured overview of the report, outlining key chapters and topics covered for easy reference in our Power Generator market comprehensive research report.

- Preface

- Research Methodology

- Executive Summary

- Market Overview

- Market Insights

- Cumulative Impact of United States Tariffs 2025

- Cumulative Impact of Artificial Intelligence 2025

- Power Generator Market, by Type

- Power Generator Market, by Portability

- Power Generator Market, by Control Systems

- Power Generator Market, by Power Rating (Capacity)

- Power Generator Market, by End-User Industry

- Power Generator Market, by Application

- Power Generator Market, by Sales Channel

- Power Generator Market, by Region

- Power Generator Market, by Group

- Power Generator Market, by Country

- United States Power Generator Market

- China Power Generator Market

- Competitive Landscape

- List of Figures [Total: 19]

- List of Tables [Total: 2067 ]

Synthesizing Key Findings to Highlight Emerging Opportunities and Strategic Priorities in the Evolving Power Generator Ecosystem

The power generator market is at a pivotal juncture, poised between enduring demand for reliable backup power and the accelerating shift towards low-carbon, digitally enabled solutions. Technological advances in control systems, hybrid architectures, and renewable-fuel compatibility are unlocking new avenues for market expansion while also introducing complexity in design, sourcing, and compliance.

Tariff actions in 2025 have injected short-term supply chain pressures, yet they have also galvanized strategic efforts to localize critical component manufacturing and diversify procurement channels. Segmentation analysis reveals a mosaic of customer needs-from large utilities requiring high-power installations to remote communities adopting portable solar-hybrid microgrids. Regional dynamics further underscore the need for tailored strategies, as policy frameworks and infrastructure priorities vary significantly across the Americas, EMEA, and Asia-Pacific.

Competitive positioning is being reshaped by alliances that blend digital services, financing solutions, and advanced fuel capabilities. As industry leaders respond to evolving regulations and customer expectations, agility and foresight will be paramount. By embracing modular designs, data-driven service models, and proactive policy engagement, organizations can harness emerging opportunities and drive sustainable growth in the evolving power generator ecosystem.

Connect with Ketan Rohom to Secure Your Comprehensive Power Generator Market Research Report and Drive Informed Strategic Decisions

I’m delighted to invite you to discover our in-depth market research on the power generator industry, where we unpack critical trends, regulatory dynamics, and competitive strategies shaping the future. To gain complete visibility into technology shifts, tariff impacts, key segments, regional nuances, and actionable recommendations, reach out to Ketan Rohom, Associate Director of Sales & Marketing, to secure your copy. Ketan will guide you through the comprehensive findings and customized insights that will empower your strategic decisions and identify growth opportunities in an evolving market landscape.

- How big is the Power Generator Market?

- What is the Power Generator Market growth?

- When do I get the report?

- In what format does this report get delivered to me?

- How long has 360iResearch been around?

- What if I have a question about your reports?

- Can I share this report with my team?

- Can I use your research in my presentation?